199:

He says that since homes are relatively infrequent purchases, people tend to remember the purchase price of a home from long ago and are surprised at the difference between then and now. However, most of the difference in the prices can be explained by inflation. He also discusses how people consistently overestimate the appreciation in the value of their homes. The US Census, since 1940, has asked home owners to estimate the value of their homes. The home-owners' estimates reflect an appreciation of 2% per year in real terms, which is significantly more than the 0.7% actual increase over the same interval as reflected in Case-Shiller index.

1174:. According to Shiller, one of the main purposes of futures and options trading in the Case-Shiller indices is to allow people to hedge the real estate market. The problem, however, is that the volume of trading in these markets is small enough as to make them relatively illiquid which creates a risk for the investor in these securities. Shiller himself has said that “there has been a disappointing volume of trade in these futures markets.” The volume traded in the CME S&P Case-Shiller Index for the full year 2007 was 2,995 contracts. That number declined over the following years, and throughout 2017 only 136 contracts traded.

858:

916:

62:

928:

20:

70:

308:

100:. There are multiple Case–Shiller home price indices: A national home price index, a 20-city composite index, a 10-city composite index, and twenty individual metro area indices. These indices were first produced commercially by Case Shiller Weiss. They are now calculated and kept monthly by Standard & Poor's, with data calculated for January 1987 to present. The indices kept by Standard & Poor are normalized to a value of 100 in January 2000. They are based on original work by economists

28:

108:, whose team calculated the home price index back to 1990. Case and Shiller's index is normalized to a value of 100 in 1990. The Case-Shiller index on Shiller's website is updated quarterly. The two datasets can greatly differ due to different reference points and calculations. For example, in the 4th quarter of 2013, the Standard and Poor 20 city index point was in the 160's, while the index point for 4th quarter on the Shiller data was in the 130's. Shiller claims in his book

2512:

78:

2538:

909:

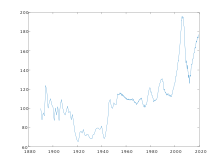

has mostly fluctuated between 100 and 120, with peaks (followed by precipitous falls) in 1Q 1979 (which peaked at 122), 3Q 1989 (at 126), and 1Q 2006 (at 198). After the 2000s housing bubble, the low point of the index was in 1Q 2012, at 114. By 4Q 2013 the index had rebounded to 134. As of

December 2019 (as per: "fred.stlouisfed.org") the S&P/Case‑Shiller U. S. National Home Price Index was at 213.789.

2525:

195:. Contrary to popular belief, there has been no continuous uptrend in home prices in the US and the home prices show a strong tendency to return to their 1890 level in real terms. Moreover, he illustrates how the pattern of changes in home prices bears no relation to changes in construction costs, interest rates or population.

165:

a bubble, after all the period after World War II had seen a substantial rise in real prices without any subsequent drop as apparent in the chart. The prices peaked in the first quarter of 2006, when the index kept by

Shiller recorded a level of 198.01, but fell rapidly after that to 113.89 in the first quarter of 2012.

908:

Using Case and

Shiller's original methods, the national index attained its all-time high of 198.01 in 2006 Q1. The S&P index attained an all-time high in July 2006, at a value of 206.52. On December 30, 2008, the index recorded its largest year-to-year drop. Since World War II, the original index

164:

book in 2005, when, according to him, the data looked like "a rocket taking off". In his book he expresses skepticism over "the long-run stability of home prices", given that the rise in home prices was much higher than the rise in income. However, he refrains from explicitly stating that this may be

198:

Shiller notes that there is a strong perception across the globe that home prices are continuously increasing, and that this kind of sentiment and paradigm may be fueling bubbles in real estate markets. He points to some psychological heuristics that may be responsible for creating this perception.

126:

who served as the CEO of Case

Shiller Weiss from the company's 1991 inception until its sale to Fiserv in 2002. Case developed a method for comparing repeat sales of the same homes in an effort to study home pricing trends. He was using data from house sales in Boston in the early 1980s, which was

139:

and economic bubbles, and together formed a repeat-sales index using home sales prices data from other cities across the country. In 1991, while Weiss was in graduate school he formed an informal working relationship with

Shiller. Weiss proposed to Case and Shiller to form a company, Case Shiller

260:

Prices remained consistently higher than the 1890 level during this period, though they gradually declined. Shiller cites the end of World War II, beginning of the Baby Boom and the GI Bill of Rights (1944) that subsidized home purchases. He also claims that the scars of the Great

Depression

315:

The S&P index family includes 20 metropolitan area indices and two composite indices as aggregates of the metropolitan areas. These indices are three-month moving averages. The composite and city indices are normalized to have a value of 100 in

January 2000.

339:

using a modified version of the weighted-repeat sales methodology. This method is able to adjust for the quality of the homes sold, unlike simple indices based on averages. The CSXR is a three-month moving average as are the indices that compose it.

159:

The years 2006–2012 saw the largest crash in global real estate markets in recent history; whether this could have been predicted using the Case–Shiller index is up for dispute. Shiller did see some early signs. He released the second edition of his

231:, is that real home prices show a remarkable tendency to return to their 1890 level. However, there have been some key periods where the prices have departed from this level. Shiller offers some explanations for these episodes in his book:

206:

Mobility: Shiller argues that "people and business will, if home prices are high enough, move far away, even leaving an area completely". Land may be scarce locally, but urban land area is only 2.6% of the total land area in the United

1458:

Allan Weiss, who did graduate work informally advised by

Shiller. He then persuaded the professors to form a company to produce the indexes commercially in 1991. In 2002 they sold Case Shiller Weiss to electronic data giant Fiserv

218:

Thus, real home prices are essentially trend-less and do not show any continuous uptrend or downtrend in the long-run. This is not limited to the US as it is also observed in the real home price indices of

Netherlands and Norway.

210:

Easing land restrictions: Increasing prices put pressure on the government to ease restrictions on land in terms of how much can be built on a particular amount of land and also the amount of land available for

927:

2564:

1348:

784:

458:

1171:

1273:

634:

503:

531:

using a modified version of the weighted-repeat sales methodology. This method is able to adjust for the quality of the homes sold, unlike simple indices based on averages.

1476:

214:

Technology

Improvements: Construction technology has improved considerably making home building cheaper and faster, which puts downward pressure on home prices.

292:

divisions. It is calculated monthly, using a three-month moving average. The S&P national index is normalized to have a value of 100 in the January 2000.

238:: This was the only period where prices were considerably below their 1890 level throughout. The start of the decline roughly corresponds with the start of

1706:

1497:

1303:

739:

694:

383:

1446:

1721:

1288:

814:

649:

443:

915:

2496:

1213:

574:

428:

664:

2451:

679:

1814:

1243:

1228:

604:

589:

488:

473:

122:

The indices are calculated from data on repeat sales of single-family homes, an approach developed by economists Case, Shiller and

288:

The S&P CoreLogic Case–Shiller U.S. National Home Price Index is a composite of single-family home price indices for the nine

1957:

1819:

2466:

1685:

1856:

1669:

1644:

1585:

1555:

1530:

1420:

1790:

2456:

1318:

844:

799:

709:

559:

368:

2481:

1751:

724:

2279:

1962:

754:

152:, developed tradable indices based on the data for the markets which are now commonly called the Case-Shiller index.

900:(REIT). REIT's track commercial real estate most closely, rather than home prices, explaining the low correlation.

180:

1472:

1283:

1253:

1186:

829:

824:

644:

614:

438:

393:

1504:

2436:

2416:

1881:

1333:

1328:

769:

764:

413:

408:

2542:

1208:

569:

520:

423:

328:

2569:

2446:

2390:

1995:

1268:

1223:

897:

629:

584:

498:

468:

110:

202:

Shiller also offers some explanations as to why a continuous uptrend is not observed in real home prices:

135:, a commonly used term to describe similar market trends. Case sat down with Shiller, who was researching

2395:

2385:

1952:

749:

169:

140:

Weiss, to produce the index periodically with the intent of selling the information to the markets. The

2052:

1942:

1343:

809:

779:

453:

243:

2000:

1897:

1849:

1298:

839:

689:

674:

554:

378:

1912:

2528:

2194:

2083:

1932:

524:

332:

149:

86:

857:

2294:

2254:

2020:

734:

114:

that such a long series of home prices does not appear to have been published for any country.

131:. While Case argued that such a boom was ultimately unsustainable, he had not considered it a

2355:

2335:

2309:

2299:

2259:

2127:

2088:

1990:

1947:

1937:

1922:

1902:

1367:

1258:

619:

398:

2516:

2269:

2199:

2062:

2005:

1927:

1917:

1907:

1842:

289:

141:

8:

2426:

2249:

2244:

2078:

1983:

1978:

1372:

2476:

2350:

2304:

2284:

2117:

2098:

2040:

2015:

191:

Shiller draws some key insights from his analysis of long term home prices in his book

136:

54:

1768:

61:

2380:

2189:

2172:

2132:

2057:

2047:

2025:

2010:

1747:

1700:

1665:

1640:

1581:

1551:

1526:

1416:

1362:

794:

528:

336:

105:

93:

183:, both of which are included in profit/loss considerations for investment purposes.

2400:

2375:

2274:

2216:

2177:

2137:

1610:

247:

1170:

Case–Shiller indexes are available for trading as futures and futures options.

2264:

2211:

132:

19:

307:

2491:

2471:

2431:

2370:

2152:

2122:

1313:

933:

Comparison the percentage change for the housing correction beginning in 2006 (

889:

704:

659:

363:

2558:

2289:

2221:

2206:

2035:

1829:

1392:

1238:

861:

719:

599:

483:

296:

128:

97:

69:

81:

Case–Shiller home price indices, absolute and inflation adjusted, 2000–2016.

2461:

2360:

2345:

2319:

2142:

2108:

251:

176:

101:

44:

534:

The following indexes are combined to create the SPCS20R composite index:

299:) is updated quarterly, and is normalized to have a value of 100 in 1890.

27:

2486:

2340:

2162:

2157:

2030:

1865:

893:

881:

254:

all of which, Shiller argues, could have affected home prices negatively.

239:

123:

2441:

2314:

343:

The following indexes are combined to create the CXSR composite index:

175:

The index is a simplification of home values and does not account for

77:

153:

156:

acquired the Case Shiller Weiss business from Fiserv in April 2013.

2421:

2365:

2167:

2093:

1876:

1615:

1602:

168:

Options and futures based on Case-Shiller index are traded on the

73:

Case–Shiller home price index data, inflation adjusted, 1890–2018.

1603:"Understanding recent trends in house prices and home ownership"

273:: Reflects regional bubbles on West Coast as well as East Coast.

2226:

145:

1834:

880:

Macromarkets.com reports the US index has a slightly negative

2182:

1498:"S&P/Case-Shiller Home Price Indices Futures and Options"

885:

1791:"Home prices off record 18% in past year, Case–Shiller says"

1464:

2147:

1824:

1820:

CoreLogic Acquisition and Overview of Case–Shiller Indexes

519:

is a composite index of the home price index for 20 major

327:

is a composite index of the home price index for 10 major

2565:

United States Department of Housing and Urban Development

1722:"Can you invest in real estate using home price indexes?"

523:

in the United States. The index is published monthly by

331:

in the United States. The index is published monthly by

295:

The index kept by Shiller (available on his website at

148:

bought Case Shiller Weiss in 2002 and, together with

1200:

A composite index of the top 10 MSAs in the country

31:

S&P/Case-Shiller U.S. National Home Price Index

1440:

1438:

1436:

1434:

1432:

227:Shiller's key observation, as outlined in his book

1630:

1628:

1626:

1470:

1349:New York–Northern New Jersey–Long Island, NY–NJ–PA

785:New York–Northern New Jersey–Long Island, NY–NJ–PA

459:New York–Northern New Jersey–Long Island, NY–NJ–PA

1571:

1569:

1567:

1406:

1404:

1402:

302:

2556:

1705:: CS1 maint: bot: original URL status unknown (

1429:

1623:

921:Case–Shiller home-price index from 1890 to 2012

1737:

1735:

1688:. Archived from the original on March 28, 2007

1564:

1399:

2497:List of housing markets by real estate prices

1850:

1473:"CoreLogic acquires Case–Shiller from Fiserv"

267:: Reflects the regional bubble in California.

1447:"Bob Shiller didn't kill the housing market"

1444:

1274:Washington–Arlington–Alexandria, DC–VA–MD–WV

875: Case-Shiller National Home Price Index

635:Washington–Arlington–Alexandria, DC–VA–MD–WV

504:Washington–Arlington–Alexandria, DC–VA–MD–WV

1746:. Princeton University Press. p. 392.

1732:

2537:

1857:

1843:

1664:. Princeton University Press. p. 15.

1639:. Princeton University Press. p. 16.

1580:. Princeton University Press. p. 22.

1550:. Princeton University Press. p. 19.

1525:. Princeton University Press. p. 14.

1415:. Princeton University Press. p. 13.

892:, but slightly positive correlation with

527:and uses the Case and Shiller method of a

335:and uses the Case and Shiller method of a

297:http://www.econ.yale.edu/~shiller/data.htm

222:

117:

1614:

90:CoreLogic Case–Shiller Home Price Indices

47:money supply increases % change Y/Y

856:

306:

186:

76:

68:

60:

26:

18:

1815:S&P/Case–Shiller Home Price Indices

1788:

1741:

1659:

1634:

1600:

1575:

1545:

1520:

1410:

1289:Miami–Fort Lauderdale–Pompano Beach, FL

740:Minneapolis–St. Paul–Bloomington, MN–WI

650:Miami–Fort Lauderdale–Pompano Beach, FL

444:Miami–Fort Lauderdale–Pompano Beach, FL

283:

2557:

1719:

951:(from original data set back to 1890)

279:: Global boom and bust in real estate.

1838:

1766:

511:

319:

261:deflected any speculative tendencies.

2524:

1825:S&P's Blog on the Housing Market

1214:Los Angeles–Long Beach–Santa Ana, CA

903:

869: Deposits, All Commercial Banks

575:Los Angeles–Long Beach–Santa Ana, CA

429:Los Angeles–Long Beach–Santa Ana, CA

1304:Chicago–Naperville–Joliet, IL–IN–WI

949:Selected Case–Shiller index values

815:Portland–Vancouver–Beaverton, OR–WA

695:Chicago–Naperville–Joliet, IL–IN–WI

665:Tampa–St. Petersburg–Clearwater, FL

384:Chicago–Naperville–Joliet, IL–IN–WI

13:

2482:Undergraduate real estate programs

680:Atlanta–Sandy Springs–Marietta, GA

65:Median housing price by metro area

14:

2581:

2280:Investment rating for real estate

1808:

1744:Irrational Exuberance 3rd edition

1503:. CME Group. 2008. Archived from

1471:Margaret Chadbourn (2013-04-25).

1244:San Francisco–Oakland–Fremont, CA

1229:San Diego–Carlsbad–San Marcos, CA

1172:Quotes are available from the CME

755:Charlotte-Gastonia-Concord, NC-SC

605:San Francisco–Oakland–Fremont, CA

590:San Diego–Carlsbad–San Marcos, CA

489:San Francisco–Oakland–Fremont, CA

474:San Diego–Carlsbad–San Marcos, CA

16:United States house price indices

2536:

2523:

2511:

2510:

1601:Shiller, Robert (October 2007).

926:

914:

244:Great Influenza Pandemic of 1918

181:home mortgage interest deduction

1864:

1760:

1713:

1678:

1653:

1479:from the original on 2013-04-30

1284:South Florida metropolitan area

1254:Denver-Aurora Metropolitan Area

864:compared to Case-Shiller Index

852:

830:Dallas–Fort Worth–Arlington, TX

645:South Florida metropolitan area

615:Denver-Aurora Metropolitan Area

439:South Florida metropolitan area

394:Denver-Aurora Metropolitan Area

2437:Graduate real estate education

1882:Tertiary sector of the economy

1594:

1539:

1514:

1490:

1393:"Online Data - Robert Shiller"

1385:

521:Metropolitan Statistical Areas

329:Metropolitan Statistical Areas

303:The composite and city indices

1:

1830:Shiller's online data website

1378:

1165:

898:Real Estate Investment Trusts

23:Case-Shiller Home Price Index

2391:Real estate investment trust

1996:Extraterrestrial real estate

1789:Mantell, Ruth (2008-12-30).

1767:Dolan, John (22 June 2018).

1607:NBER Working Paper No. 13553

1269:Washington Metropolitan Area

1224:San Diego County, California

1183:Home Price Index description

630:Washington Metropolitan Area

585:San Diego County, California

543:Home Price Index description

499:Washington Metropolitan Area

469:San Diego County, California

352:Home Price Index description

311:20 metropolitan area indices

242:, which was followed by the

7:

2396:Real property administrator

2386:Real estate investment club

1720:Krantz, Matt (2011-05-26).

1445:Katie Benner (2009-07-07).

1356:

1329:Las Vegas metropolitan area

1319:Boston–Cambridge–Quincy, MA

845:Seattle–Tacoma–Bellevue, WA

825:Dallas–Fort Worth metroplex

800:Cleveland–Elyria–Mentor, OH

765:Las Vegas metropolitan area

750:Charlotte metropolitan area

710:Boston–Cambridge–Quincy, MA

560:Phoenix–Mesa–Scottsdale, AZ

409:Las Vegas metropolitan area

369:Boston–Cambridge–Quincy, MA

170:Chicago Mercantile Exchange

10:

2586:

2053:Private equity real estate

1344:New York metropolitan area

1334:Las Vegas–Paradise, NV MSA

810:Portland metropolitan area

780:New York metropolitan area

770:Las Vegas–Paradise, NV MSA

725:Detroit–Warren–Livonia, MI

454:New York metropolitan area

414:Las Vegas–Paradise, NV MSA

2505:

2409:

2328:

2235:

2107:

2071:

2001:International real estate

1971:

1890:

1872:

1299:Chicago metropolitan area

948:

840:Seattle metropolitan area

690:Chicago metropolitan area

675:Atlanta metropolitan area

555:Phoenix metropolitan area

379:Chicago metropolitan area

1742:Shiller, Robert (2015).

1660:Shiller, Robert (2005).

1635:Shiller, Robert (2005).

1576:Shiller, Robert (2005).

1546:Shiller, Robert (2005).

1521:Shiller, Robert (2005).

1411:Shiller, Robert (2005).

2195:Real estate transaction

2084:Real estate development

937:) and the correction (

223:Key events and episodes

118:History and methodology

37: Home Price Index

2295:Real estate derivative

2255:Effective gross income

2021:Healthcare real estate

1771:. homepricefutures.com

877:

735:Minneapolis-Saint Paul

312:

82:

74:

66:

58:

24:

2452:Industry trade groups

2356:Exclusive buyer agent

2310:Real estate valuation

2300:Real estate economics

2260:Gross rent multiplier

2089:Real estate investing

1991:Corporate Real Estate

1662:Irrational Exuberance

1637:Irrational Exuberance

1578:Irrational Exuberance

1548:Irrational Exuberance

1523:Irrational Exuberance

1413:Irrational Exuberance

1368:Real estate appraisal

860:

525:Standard & Poor's

333:Standard & Poor's

310:

229:Irrational Exuberance

193:Irrational Exuberance

187:Economic implications

162:Irrational Exuberance

150:Standard & Poor's

111:Irrational Exuberance

87:Standard & Poor's

80:

72:

64:

30:

22:

2270:Highest and best use

2236:Economics, financing

2200:Real estate contract

2094:Real estate flipping

2063:Residential property

2006:Lease administration

1958:United Arab Emirates

284:The national indices

2570:Real estate indices

2250:Capitalization rate

2245:Asset-based lending

2079:Property management

1984:Commercial building

1979:Commercial property

1373:Real estate pricing

1209:Greater Los Angeles

941:) beginning in 1989

570:Greater Los Angeles

424:Greater Los Angeles

94:house price indices

2477:Real estate trends

2381:Real estate broker

2351:Chartered Surveyor

2305:Real estate bubble

2285:Mortgage insurance

2118:Adverse possession

2041:Luxury real estate

2016:Garden real estate

878:

512:Composite 20 index

320:Composite 10 index

313:

137:behavioral finance

129:housing price boom

83:

75:

67:

59:

55:Federal funds rate

25:

2552:

2551:

2190:Property abstract

2173:Land registration

2133:Concurrent estate

2058:Real estate owned

2048:Off-plan property

2026:Vacation property

2011:Niche real estate

1671:978-0-691-12335-6

1646:978-0-691-12335-6

1587:978-0-691-12335-6

1557:978-0-691-12335-6

1532:978-0-691-12335-6

1422:978-0-691-12335-6

1363:House price index

1354:

1353:

1259:Denver–Aurora, CO

1163:

1162:

904:Historical values

850:

849:

795:Greater Cleveland

620:Denver–Aurora, CO

529:house price index

509:

508:

399:Denver–Aurora, CO

337:house price index

92:are repeat-sales

2577:

2540:

2539:

2527:

2526:

2514:

2513:

2457:Investment firms

2376:Property manager

2275:Home equity loan

2178:Leasehold estate

2138:Conditional sale

1859:

1852:

1845:

1836:

1835:

1804:

1802:

1801:

1781:

1780:

1778:

1776:

1764:

1758:

1757:

1739:

1730:

1729:

1717:

1711:

1710:

1704:

1696:

1694:

1693:

1682:

1676:

1675:

1657:

1651:

1650:

1632:

1621:

1620:

1618:

1598:

1592:

1591:

1573:

1562:

1561:

1543:

1537:

1536:

1518:

1512:

1511:

1509:

1502:

1494:

1488:

1487:

1485:

1484:

1468:

1462:

1461:

1455:

1454:

1442:

1427:

1426:

1408:

1397:

1396:

1389:

1177:

1176:

946:

945:

940:

936:

930:

918:

874:

868:

546:MSA designation

537:

536:

355:MSA designation

346:

345:

248:Great Depression

127:going through a

52:

42:

36:

2585:

2584:

2580:

2579:

2578:

2576:

2575:

2574:

2555:

2554:

2553:

2548:

2501:

2405:

2324:

2265:Hard money loan

2237:

2231:

2212:Rent regulation

2103:

2067:

1967:

1886:

1868:

1863:

1811:

1799:

1797:

1785:

1784:

1774:

1772:

1769:"CME CS Volume"

1765:

1761:

1754:

1740:

1733:

1718:

1714:

1698:

1697:

1691:

1689:

1684:

1683:

1679:

1672:

1658:

1654:

1647:

1633:

1624:

1599:

1595:

1588:

1574:

1565:

1558:

1544:

1540:

1533:

1519:

1515:

1510:on 8 July 2011.

1507:

1500:

1496:

1495:

1491:

1482:

1480:

1475:. Reuters.com.

1469:

1465:

1452:

1450:

1443:

1430:

1423:

1409:

1400:

1391:

1390:

1386:

1381:

1359:

1168:

950:

942:

938:

934:

931:

922:

919:

906:

876:

872:

870:

866:

855:

514:

322:

305:

286:

225:

189:

120:

57:

50:

48:

40:

38:

34:

32:

17:

12:

11:

5:

2583:

2573:

2572:

2567:

2550:

2549:

2547:

2546:

2543:List of topics

2533:

2520:

2506:

2503:

2502:

2500:

2499:

2494:

2492:Urban planning

2489:

2484:

2479:

2474:

2472:Property cycle

2469:

2464:

2459:

2454:

2449:

2444:

2439:

2434:

2432:Gentrification

2429:

2424:

2419:

2413:

2411:

2407:

2406:

2404:

2403:

2398:

2393:

2388:

2383:

2378:

2373:

2371:Moving company

2368:

2363:

2358:

2353:

2348:

2343:

2338:

2332:

2330:

2326:

2325:

2323:

2322:

2317:

2312:

2307:

2302:

2297:

2292:

2287:

2282:

2277:

2272:

2267:

2262:

2257:

2252:

2247:

2241:

2239:

2233:

2232:

2230:

2229:

2224:

2219:

2214:

2209:

2204:

2203:

2202:

2192:

2187:

2186:

2185:

2175:

2170:

2165:

2160:

2155:

2153:Eminent domain

2150:

2145:

2140:

2135:

2130:

2125:

2123:Chain of title

2120:

2114:

2112:

2111:and regulation

2105:

2104:

2102:

2101:

2096:

2091:

2086:

2081:

2075:

2073:

2069:

2068:

2066:

2065:

2060:

2055:

2050:

2045:

2044:

2043:

2038:

2033:

2028:

2023:

2018:

2008:

2003:

1998:

1993:

1988:

1987:

1986:

1975:

1973:

1969:

1968:

1966:

1965:

1963:United Kingdom

1960:

1955:

1950:

1945:

1940:

1935:

1930:

1925:

1920:

1915:

1910:

1905:

1900:

1894:

1892:

1888:

1887:

1885:

1884:

1879:

1873:

1870:

1869:

1862:

1861:

1854:

1847:

1839:

1833:

1832:

1827:

1822:

1817:

1810:

1809:External links

1807:

1806:

1805:

1783:

1782:

1759:

1753:978-1469640662

1752:

1731:

1712:

1686:"MacroMarkets"

1677:

1670:

1652:

1645:

1622:

1616:10.3386/w13553

1593:

1586:

1563:

1556:

1538:

1531:

1513:

1489:

1463:

1449:. CNNMoney.com

1428:

1421:

1398:

1383:

1382:

1380:

1377:

1376:

1375:

1370:

1365:

1358:

1355:

1352:

1351:

1346:

1341:

1337:

1336:

1331:

1326:

1322:

1321:

1316:

1314:Greater Boston

1311:

1307:

1306:

1301:

1296:

1292:

1291:

1286:

1281:

1277:

1276:

1271:

1266:

1262:

1261:

1256:

1251:

1247:

1246:

1241:

1236:

1232:

1231:

1226:

1221:

1217:

1216:

1211:

1206:

1202:

1201:

1198:

1195:

1191:

1190:

1184:

1181:

1167:

1164:

1161:

1160:

1157:

1153:

1152:

1149:

1145:

1144:

1141:

1137:

1136:

1133:

1129:

1128:

1125:

1121:

1120:

1117:

1113:

1112:

1109:

1105:

1104:

1101:

1097:

1096:

1093:

1089:

1088:

1085:

1081:

1080:

1077:

1073:

1072:

1069:

1065:

1064:

1061:

1057:

1056:

1053:

1049:

1048:

1045:

1041:

1040:

1037:

1033:

1032:

1029:

1025:

1024:

1021:

1017:

1016:

1013:

1009:

1008:

1005:

1001:

1000:

997:

993:

992:

989:

985:

984:

981:

977:

976:

973:

969:

968:

965:

961:

960:

957:

953:

952:

944:

943:

932:

925:

923:

920:

913:

905:

902:

871:

865:

854:

851:

848:

847:

842:

837:

833:

832:

827:

822:

818:

817:

812:

807:

803:

802:

797:

792:

788:

787:

782:

777:

773:

772:

767:

762:

758:

757:

752:

747:

743:

742:

737:

732:

728:

727:

722:

717:

713:

712:

707:

705:Greater Boston

702:

698:

697:

692:

687:

683:

682:

677:

672:

668:

667:

662:

660:Tampa Bay Area

657:

653:

652:

647:

642:

638:

637:

632:

627:

623:

622:

617:

612:

608:

607:

602:

597:

593:

592:

587:

582:

578:

577:

572:

567:

563:

562:

557:

552:

548:

547:

544:

541:

513:

510:

507:

506:

501:

496:

492:

491:

486:

481:

477:

476:

471:

466:

462:

461:

456:

451:

447:

446:

441:

436:

432:

431:

426:

421:

417:

416:

411:

406:

402:

401:

396:

391:

387:

386:

381:

376:

372:

371:

366:

364:Greater Boston

361:

357:

356:

353:

350:

321:

318:

304:

301:

285:

282:

281:

280:

274:

268:

262:

255:

224:

221:

216:

215:

212:

208:

188:

185:

119:

116:

106:Robert Shiller

49:

39:

33:

15:

9:

6:

4:

3:

2:

2582:

2571:

2568:

2566:

2563:

2562:

2560:

2545:

2544:

2534:

2532:

2531:

2521:

2519:

2518:

2508:

2507:

2504:

2498:

2495:

2493:

2490:

2488:

2485:

2483:

2480:

2478:

2475:

2473:

2470:

2468:

2465:

2463:

2460:

2458:

2455:

2453:

2450:

2448:

2445:

2443:

2440:

2438:

2435:

2433:

2430:

2428:

2425:

2423:

2420:

2418:

2415:

2414:

2412:

2408:

2402:

2399:

2397:

2394:

2392:

2389:

2387:

2384:

2382:

2379:

2377:

2374:

2372:

2369:

2367:

2364:

2362:

2359:

2357:

2354:

2352:

2349:

2347:

2344:

2342:

2339:

2337:

2334:

2333:

2331:

2327:

2321:

2318:

2316:

2313:

2311:

2308:

2306:

2303:

2301:

2298:

2296:

2293:

2291:

2290:Mortgage loan

2288:

2286:

2283:

2281:

2278:

2276:

2273:

2271:

2268:

2266:

2263:

2261:

2258:

2256:

2253:

2251:

2248:

2246:

2243:

2242:

2240:

2238:and valuation

2234:

2228:

2225:

2223:

2222:Torrens title

2220:

2218:

2215:

2213:

2210:

2208:

2207:Real property

2205:

2201:

2198:

2197:

2196:

2193:

2191:

2188:

2184:

2181:

2180:

2179:

2176:

2174:

2171:

2169:

2166:

2164:

2161:

2159:

2156:

2154:

2151:

2149:

2146:

2144:

2141:

2139:

2136:

2134:

2131:

2129:

2126:

2124:

2121:

2119:

2116:

2115:

2113:

2110:

2106:

2100:

2097:

2095:

2092:

2090:

2087:

2085:

2082:

2080:

2077:

2076:

2074:

2070:

2064:

2061:

2059:

2056:

2054:

2051:

2049:

2046:

2042:

2039:

2037:

2036:Golf property

2034:

2032:

2029:

2027:

2024:

2022:

2019:

2017:

2014:

2013:

2012:

2009:

2007:

2004:

2002:

1999:

1997:

1994:

1992:

1989:

1985:

1982:

1981:

1980:

1977:

1976:

1974:

1970:

1964:

1961:

1959:

1956:

1954:

1951:

1949:

1946:

1944:

1941:

1939:

1936:

1934:

1931:

1929:

1926:

1924:

1921:

1919:

1916:

1914:

1911:

1909:

1906:

1904:

1901:

1899:

1896:

1895:

1893:

1889:

1883:

1880:

1878:

1875:

1874:

1871:

1867:

1860:

1855:

1853:

1848:

1846:

1841:

1840:

1837:

1831:

1828:

1826:

1823:

1821:

1818:

1816:

1813:

1812:

1796:

1792:

1787:

1786:

1770:

1763:

1755:

1749:

1745:

1738:

1736:

1727:

1723:

1716:

1708:

1702:

1687:

1681:

1673:

1667:

1663:

1656:

1648:

1642:

1638:

1631:

1629:

1627:

1617:

1612:

1608:

1604:

1597:

1589:

1583:

1579:

1572:

1570:

1568:

1559:

1553:

1549:

1542:

1534:

1528:

1524:

1517:

1506:

1499:

1493:

1478:

1474:

1467:

1460:

1448:

1441:

1439:

1437:

1435:

1433:

1424:

1418:

1414:

1407:

1405:

1403:

1394:

1388:

1384:

1374:

1371:

1369:

1366:

1364:

1361:

1360:

1350:

1347:

1345:

1342:

1339:

1338:

1335:

1332:

1330:

1327:

1324:

1323:

1320:

1317:

1315:

1312:

1309:

1308:

1305:

1302:

1300:

1297:

1294:

1293:

1290:

1287:

1285:

1282:

1279:

1278:

1275:

1272:

1270:

1267:

1264:

1263:

1260:

1257:

1255:

1252:

1249:

1248:

1245:

1242:

1240:

1239:San Francisco

1237:

1234:

1233:

1230:

1227:

1225:

1222:

1219:

1218:

1215:

1212:

1210:

1207:

1204:

1203:

1199:

1196:

1193:

1192:

1188:

1185:

1182:

1179:

1178:

1175:

1173:

1158:

1155:

1154:

1150:

1147:

1146:

1142:

1139:

1138:

1134:

1131:

1130:

1126:

1123:

1122:

1118:

1115:

1114:

1110:

1107:

1106:

1102:

1099:

1098:

1094:

1091:

1090:

1086:

1083:

1082:

1078:

1075:

1074:

1070:

1067:

1066:

1062:

1059:

1058:

1054:

1051:

1050:

1046:

1043:

1042:

1038:

1035:

1034:

1030:

1027:

1026:

1022:

1019:

1018:

1014:

1011:

1010:

1006:

1003:

1002:

998:

995:

994:

990:

987:

986:

982:

979:

978:

974:

971:

970:

966:

963:

962:

958:

955:

954:

947:

929:

924:

917:

912:

911:

910:

901:

899:

895:

891:

887:

883:

863:

862:Bank deposits

859:

846:

843:

841:

838:

835:

834:

831:

828:

826:

823:

820:

819:

816:

813:

811:

808:

805:

804:

801:

798:

796:

793:

790:

789:

786:

783:

781:

778:

775:

774:

771:

768:

766:

763:

760:

759:

756:

753:

751:

748:

745:

744:

741:

738:

736:

733:

730:

729:

726:

723:

721:

720:Metro Detroit

718:

715:

714:

711:

708:

706:

703:

700:

699:

696:

693:

691:

688:

685:

684:

681:

678:

676:

673:

670:

669:

666:

663:

661:

658:

655:

654:

651:

648:

646:

643:

640:

639:

636:

633:

631:

628:

625:

624:

621:

618:

616:

613:

610:

609:

606:

603:

601:

600:San Francisco

598:

595:

594:

591:

588:

586:

583:

580:

579:

576:

573:

571:

568:

565:

564:

561:

558:

556:

553:

550:

549:

545:

542:

539:

538:

535:

532:

530:

526:

522:

518:

505:

502:

500:

497:

494:

493:

490:

487:

485:

484:San Francisco

482:

479:

478:

475:

472:

470:

467:

464:

463:

460:

457:

455:

452:

449:

448:

445:

442:

440:

437:

434:

433:

430:

427:

425:

422:

419:

418:

415:

412:

410:

407:

404:

403:

400:

397:

395:

392:

389:

388:

385:

382:

380:

377:

374:

373:

370:

367:

365:

362:

359:

358:

354:

351:

348:

347:

344:

341:

338:

334:

330:

326:

317:

309:

300:

298:

293:

291:

278:

275:

272:

269:

266:

263:

259:

256:

253:

249:

245:

241:

237:

234:

233:

232:

230:

220:

213:

209:

205:

204:

203:

200:

196:

194:

184:

182:

178:

173:

171:

166:

163:

157:

155:

151:

147:

143:

138:

134:

130:

125:

115:

113:

112:

107:

103:

99:

98:United States

95:

91:

88:

79:

71:

63:

56:

46:

29:

21:

2541:

2529:

2515:

2462:Land banking

2361:Land banking

2346:Buyer broker

2320:Rental value

2143:Conveyancing

1953:Saudi Arabia

1798:. Retrieved

1794:

1773:. Retrieved

1762:

1743:

1725:

1715:

1690:. Retrieved

1680:

1661:

1655:

1636:

1606:

1596:

1577:

1547:

1541:

1522:

1516:

1505:the original

1492:

1481:. Retrieved

1466:

1457:

1451:. Retrieved

1412:

1387:

1189:designation

1169:

907:

879:

853:Correlations

533:

516:

515:

342:

324:

323:

314:

294:

287:

276:

270:

264:

257:

252:World War II

250:and finally

235:

228:

226:

217:

211:development.

201:

197:

192:

190:

177:imputed rent

174:

167:

161:

158:

121:

109:

89:

84:

2487:Urban decay

2341:Buyer agent

2163:Foreclosure

2158:Encumbrance

2031:Arable land

1943:Puerto Rico

1891:By location

1866:Real estate

1795:MarketWatch

894:commodities

882:correlation

290:U.S. Census

240:World War I

124:Allan Weiss

2559:Categories

2442:Green belt

2315:Remortgage

2099:Relocation

1898:Bangladesh

1800:2012-12-02

1692:2007-12-26

1483:2013-05-07

1453:2009-07-07

1379:References

1166:Securities

959:Annual/4Q

258:1953–1977:

2427:Filtering

2417:Companies

2336:Appraiser

2217:Severance

1913:Indonesia

1726:USA Today

1197:Composite

277:1997–2012

271:1985–1989

265:1976–1982

236:1921–1942

154:CoreLogic

102:Karl Case

2517:Category

2422:Eviction

2366:Landlord

2168:Land law

1933:Pakistan

1877:Property

1701:cite web

1477:Archived

1357:See also

96:for the

2530:Commons

2447:Indices

2329:Parties

2128:Closing

2072:Sectors

1775:14 July

1159:134.02

1151:121.58

1143:115.84

1135:124.56

1127:130.93

1119:133.97

1111:170.09

1103:192.29

1095:195.35

1087:123.30

1079:106.73

1071:108.33

1063:124.89

1055:105.44

1047:118.82

1039:103.46

1031:109.56

1023:109.65

1015:105.89

975:101.57

517:SPCS20R

207:States.

142:FinTech

53:

2535:

2522:

2509:

2467:People

2401:Tenant

2227:Zoning

1948:Russia

1938:Panama

1923:Turkey

1903:Canada

1750:

1668:

1643:

1584:

1554:

1529:

1419:

1180:Ticker

1007:81.73

999:69.49

991:66.07

983:93.11

886:stocks

873:

867:

246:, the

146:Fiserv

144:giant

133:bubble

51:

43:

41:

35:

2410:Other

2183:Lease

1972:Types

1928:Kenya

1918:Italy

1908:China

1508:(PDF)

1501:(PDF)

890:bonds

884:with

540:Index

349:Index

2148:Deed

1777:2018

1748:ISBN

1707:link

1666:ISBN

1641:ISBN

1582:ISBN

1552:ISBN

1527:ISBN

1417:ISBN

1156:2013

1148:2012

1140:2011

1132:2010

1124:2009

1116:2008

1108:2007

1100:2006

1092:2005

1084:2000

1076:1996

1068:1994

1060:1989

1052:1984

1044:1979

1036:1975

1028:1970

1020:1960

1012:1950

1004:1940

996:1930

988:1920

980:1910

972:1900

967:100

964:1890

956:YEAR

939:blue

896:and

888:and

836:SEXR

821:DAXR

806:POXR

791:CEXR

776:NYXR

761:LVXR

746:CRXR

731:MNXR

716:DEXR

701:BOXR

686:CHXR

671:ATXR

656:TPXR

641:MIXR

626:WDXR

611:DNXR

596:SFXR

581:SDXR

566:LXXR

551:PHXR

495:WDXR

480:SFXR

465:SDXR

450:NYXR

435:MIXR

420:LXXR

405:LVXR

390:DNXR

375:CHXR

360:BOXR

325:CSXR

179:and

104:and

85:The

2109:Law

1611:doi

1340:NYM

1325:LAV

1310:BOS

1295:CHI

1280:MIA

1265:WDC

1250:DEN

1235:SFR

1220:SDG

1205:LAX

1194:CUS

1187:MSA

935:red

2561::

1793:.

1734:^

1724:.

1703:}}

1699:{{

1625:^

1609:.

1605:.

1566:^

1456:.

1431:^

1401:^

172:.

45:M2

1858:e

1851:t

1844:v

1803:.

1779:.

1756:.

1728:.

1709:)

1695:.

1674:.

1649:.

1619:.

1613::

1590:.

1560:.

1535:.

1486:.

1425:.

1395:.

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.