1955:

120:

128:

402:. According to Jack A. Ablin, chief investment officer at Harris Private Bank, one reason for this unprecedented move of having a range, rather than a specific rate, was because a rate of 0% could have had problematic implications for money market funds, whose fees could then outpace yields. In October 2019 the target range for the Federal Funds Rate was 1.50–1.75%. On March 15, 2020, the target range for Federal Funds Rate was 0.00–0.25%, a full percentage point drop less than two weeks after being lowered to 1.00–1.25%.

416:

87:

333:

22:

409:, the Federal Reserve has raised the FFR aggressively. In the latter half of 2022, the FOMC had hiked the FFR by 0.75 percentage points on 4 different consecutive occasions, and in its final meeting of 2022, hiked the FFR a further 0.5 percentage points. The FFR sat around 4.4% in 2022, and at the time the Fed foreshadowed that the rate would not be lowered until 2024 at the earliest.

221:. An institution that is below its desired level of liquidity can address this temporarily by borrowing from institutions that have Federal Reserve deposits in excess of their requirement. The interest rate that a borrowing bank pays to a lending bank to borrow the funds is negotiated between the two banks, and the weighted average of this rate across all such transactions is the

431:. When additional supply is added and everything else remains constant, the price of borrowed funds – the federal funds rate – falls. Conversely, when the Committee wishes to increase the federal funds rate, they will instruct the Desk Manager to sell government securities, thereby taking the money they earn on the proceeds of those sales out of circulation and reducing the

593:

higher rate in the end of 2015 investments in the United States became more attractive and the rate of investment in developing countries began to fall. The rate also affects the value of currency, a higher rate slowing the decrease of the U.S. dollar and decreasing the value of currencies such as the

393:

The last full cycle of rate increases occurred between June 2004 and June 2006 as rates steadily rose from 1.00% to 5.25%. The target rate remained at 5.25% for over a year, until the

Federal Reserve began lowering rates in September 2007. The last cycle of easing monetary policy through the rate was

258:

Raising the federal funds rate will dissuade banks from taking out such inter-bank loans, which in turn will make cash that much harder to procure. Conversely, dropping the interest rates will encourage banks to borrow money and therefore invest more freely. This interest rate is used as a regulatory

254:

is essentially a way for banks to quickly raise money. For example, a bank may want to finance a major industrial effort but may not have the time to wait for deposits or interest (on loan payments) to come in. In such cases the bank will quickly raise this amount from other banks at an interest rate

228:

The

Federal Open Market Committee regularly sets a target range for the federal funds rate according to its policy goals and the economic conditions of the United States. It directs the Federal Reserve Banks to influence the rate toward that range with adjustments to their own deposit interest rates.

592:

such as China or Mexico more attractive. A high federal funds rate makes investments outside the United States less attractive. The long period of a very low federal funds rate from 2009 forward resulted in an increase in investment in developing countries. As the United States began to return to a

442:

and other periods of lower growth. In fact, the committee's lowering has recently predated recessions, in order to stimulate the economy and cushion the fall. Reducing the federal funds rate makes money cheaper, allowing an influx of credit into the economy through all types of loans.

192:

The

Federal Reserve adjusts its administratively set interest rates, mainly the interest on reserve balances (IORB), to bring the effective rate into the target range. The target range is chosen to influence market interest rates generally and in turn ultimately the level of activity,

305:

Considering the wide impact a change in the federal funds rate can have on the value of the dollar and the amount of lending going to new economic activity, the

Federal Reserve is closely watched by the market. The prices of Option contracts on fed funds futures (traded on the

394:

conducted from

September 2007 to December 2008 as the target rate fell from 5.25% to a range of 0.00–0.25%. Between December 2008 and December 2015 the target rate remained at 0.00–0.25%, the lowest rate in the Federal Reserve's history, as a reaction to the

310:) can be used to infer the market's expectations of future Fed policy changes. Based on CME Group 30-Day Fed Fund futures prices, which have long been used to express the market's views on the likelihood of changes in U.S. monetary policy, the

229:

Although this is commonly referred to as "setting interest rates," the effect is not immediate and depends on the banks' response to money market conditions. Separately, the

Federal Reserve lends directly to institutions through its

289:

The (effective) federal funds rate is achieved through open market operations at the

Domestic Trading Desk at the Federal Reserve Bank of New York which deals primarily in domestic securities (U.S. Treasury and federal agencies'

159:. Institutions with surplus balances in their accounts lend those balances to institutions in need of larger balances. The federal funds rate is an important benchmark in financial markets and central to the conduct of

178:) is calculated as the effective median interest rate of overnight federal funds transactions during the previous business day. It is published daily by the Federal Reserve Bank of New York.

2332:

2242:

189:(FOMC) which normally occurs eight times a year about seven weeks apart. The committee may also hold additional meetings and implement target rate changes outside of its normal schedule.

2291:

1844:

2315:

2248:

2208:

2309:

217:

assets that can be used to cover sustained net cash outflows. Among these assets are the deposits that the institutions maintain, directly or indirectly, with a

1084:

1811:

Rising interest rates in the United States are driving money out of many developing countries, straining governments and pinching consumers around the globe.

2215:

262:

By setting a higher discount rate the

Federal Reserve discourages banks from requisitioning funds from Federal Reserve Banks, yet positions itself as a

1304:

2260:

2142:

1881:

495:

327:

2692:

2039:

1110:

947:

2699:

1849:

282:(SOFR) and the federal funds rate are concerned with the same action, i.e. interbank loans, they are distinct from one another, as follows:

2266:

867:

2298:

1240:

1226:

1212:

1198:

1184:

1170:

1156:

1142:

1128:

1058:

929:

2303:

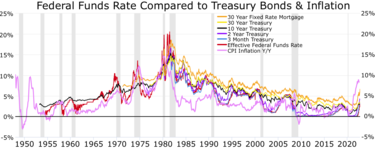

455:

296:

LIBOR may or may not be used to derive business terms. It is not fixed beforehand and is not meant to have macroeconomic ramifications.

1835:

Federal

Reserve Web Site: Federal Funds Rate Historical Data (including the current rate), Monetary Policy, and Open Market Operations

2737:

2196:

846:

825:

80:

1979:

1795:

657:

293:

LIBOR is based on a questionnaire where a selection of banks guess the rates at which they could borrow money from other banks.

251:

1834:

1088:

2640:

2272:

2130:

2034:

2687:

2550:

1874:

160:

1845:

Historical data (since 1954) comparing the US GDP growth rate versus the US Fed Funds Rate - in the form of a chart/graph

1255:

2836:

2620:

2610:

1974:

1033:

286:

The target federal funds rate is a target interest rate that is set by the FOMC for implementing U.S. monetary policies.

2453:

2184:

1911:

380:

72:

2600:

2560:

2487:

2477:

2325:

2278:

2202:

1906:

1829:

395:

243:(CBOT), and the financial press refer to these contracts when estimating the probabilities of upcoming FOMC actions.

93:

interest rates compared to

Federal Funds Rate. The Federal Funds Rate pushes up shorter term treasuries to cause an

2901:

2662:

2570:

2540:

2483:

2236:

803:

716:

482:

suggested that in the prior 15 years ending in 2007, in each instance where the fed funds rate was higher than the

2954:

2590:

2580:

1867:

428:

90:

1766:

1741:

1716:

1691:

1666:

1641:

1616:

1591:

1566:

1541:

1516:

1502:

1488:

1474:

1460:

1446:

1432:

1418:

1404:

1390:

1376:

1362:

1348:

993:

979:

965:

2861:

2630:

2530:

2284:

2254:

607:

2856:

2730:

1921:

637:

406:

275:

186:

438:

The Federal Reserve has responded to a potential slow-down by lowering the target federal funds rate during

2536:

2526:

2467:

2344:

2190:

2172:

2166:

2054:

1901:

202:

1308:

1323:

1276:

951:

769:

632:

435:. When supply is taken away and everything else remains constant, the interest rate will normally rise.

311:

2178:

1008:

893:

2846:

2364:

1944:

1114:

692:

412:

In Sept. 2024, the Fed lowered its benchmark rate for the first time since 2020 by 50 basis points.

2770:

2723:

2400:

2376:

2136:

2048:

908:

2959:

2765:

314:

allows market participants to view the probability of an upcoming Fed Rate hike. One set of such

147:(banks and credit unions) lend reserve balances to other depository institutions overnight on an

2775:

2125:

1290:

647:

483:

427:

When the FOMC wishes to reduce interest rates they will increase the supply of money by buying

307:

240:

144:

933:

2896:

2682:

2358:

2352:

2160:

2090:

1854:

465:

263:

712:

415:

2148:

2119:

1939:

1916:

642:

627:

342:

218:

164:

148:

119:

94:

798:

127:

8:

2382:

2223:

2114:

2060:

2498:

2388:

2084:

2078:

1825:

672:

667:

662:

589:

2556:

2546:

2412:

1034:"Federal Reserve boosts interest rates — again. Here's what it means for your wallet"

617:

1111:"Historical Changes of the Target Federal Funds and Discount Rates, 1971 to present"

2949:

2473:

2394:

2319:

2108:

2102:

1791:

214:

2596:

2586:

2493:

2406:

1995:

1890:

739:

652:

399:

371:

236:

230:

156:

98:

1855:

Federal Funds Rate Data including Daily effective overnight rate and Target rate

1839:

2780:

2746:

2626:

2616:

2576:

2508:

2424:

2024:

2017:

1790:

86:

2943:

2606:

2566:

2463:

2442:

2230:

2007:

475:

152:

140:

39:

30:

2657:

2636:

2503:

2436:

2430:

2418:

2370:

2096:

594:

432:

2154:

2066:

1859:

687:

2926:

2906:

1969:

1449:. Board of Governors of The Federal Reserve System. September 18, 2019.

1407:. Board of Governors of The Federal Reserve System. September 26, 2018.

968:. Board of Governors of The Federal Reserve System. September 18, 2019.

447:

362:

194:

1840:

MoneyCafe.com page with Fed Funds Rate and historical chart and graph

1421:. Board of Governors of The Federal Reserve System. December 19, 2018.

1365:. Board of Governors of The Federal Reserve System. December 13, 2017.

1293:. Board of Governors of The Federal Reserve System. December 16, 2015.

1279:. Board of Governors of The Federal Reserve System. December 16, 2008.

2760:

2704:

2667:

2000:

1463:. Board of Governors of The Federal Reserve System. October 30, 2019.

1009:"Fed raises interest rates half a point to highest level in 15 years"

747:. Washington, D.C.: Federal Reserve Board. August 24, 2011. p. 4

612:

439:

352:

198:

106:

16:

Interest rates to maintain banks' Federal Reserve balance in the U.S.

1113:. New York Federal Reserve Branch. February 19, 2010. Archived from

2811:

2672:

2072:

1931:

1505:. Board of Governors of The Federal Reserve System. March 16, 2022.

1491:. Board of Governors of The Federal Reserve System. March 15, 2020.

1379:. Board of Governors of The Federal Reserve System. March 21, 2018.

2715:

1796:"The Fed Acts. Workers in Mexico and Merchants in Malaysia Suffer"

1477:. Board of Governors of The Federal Reserve System. March 3, 2020.

1435:. Board of Governors of The Federal Reserve System. July 31, 2019.

1393:. Board of Governors of The Federal Reserve System. June 13, 2018.

1351:. Board of Governors of The Federal Reserve System. June 14, 2017.

1307:. Board of Governors of The Federal Reserve System. Archived from

332:

21:

2866:

2826:

2816:

2801:

2677:

868:"How Does the Fed Influence Interest Rates Using Its New Tools?"

233:, at a rate that is usually higher than the federal funds rate.

2881:

2871:

102:

932:. British Bankers' Association. March 21, 2006. Archived from

422:

2921:

2911:

2886:

2876:

2851:

2841:

2831:

2806:

2796:

682:

677:

622:

479:

1850:

Federal Reserve Bank of Cleveland: Fed Fund Rate Predictions

489:

2916:

2891:

279:

336:

Prime Rate floats about 3% above the Federal funds rate

1059:"Yun: Fed Rate Cut May Have Little Impact on Mortgages"

446:

The charts referenced below show the relation between

259:

tool to control how freely the U.S. economy operates.

950:. Associated Press. December 16, 2008. Archived from

486:

growth rate, assets such as stocks and housing fell.

123:

Inflation (blue) compared to federal funds rate (red)

1305:"Decisions Regarding Monetary Policy Implementation"

1085:"An Explanation of How The Fed Moves Interest Rates"

741:

The Federal Reserve System: Purposes & Functions

213:

Financial institutions are obligated by law to hold

2310:

Public–Private Investment Program for Legacy Assets

847:"12 CFR 249.20: High-quality liquid asset criteria"

454:July 13, 1990 – Sept 4, 1992: 8.00–3.00% (Includes

1794:, Keith Bradsher and Neil Gough (March 16, 2017).

1256:"The Bond Yield Curve as an Economic Crystal Ball"

464:May 16, 2000 – June 25, 2003: 6.50–1.00 (Includes

906:

779:. Federal Reserve System Publication. August 2021

185:is determined by a meeting of the members of the

2941:

1771:Board of Governors of the Federal Reserve System

1746:Board of Governors of the Federal Reserve System

1721:Board of Governors of the Federal Reserve System

1696:Board of Governors of the Federal Reserve System

1671:Board of Governors of the Federal Reserve System

1646:Board of Governors of the Federal Reserve System

1621:Board of Governors of the Federal Reserve System

1596:Board of Governors of the Federal Reserve System

1571:Board of Governors of the Federal Reserve System

1546:Board of Governors of the Federal Reserve System

1521:Board of Governors of the Federal Reserve System

496:History of Federal Open Market Committee actions

328:History of Federal Open Market Committee actions

255:equal to or higher than the Federal funds rate.

1241:"$ SPX 2006-06-29 2008-06-01 (rate drop chart)"

1227:"$ SPX 2003-06-25 2006-06-29 (rate rise chart)"

1213:"$ SPX 2002-01-01 2003-07-25 (rate drop chart)"

1199:"$ SPX 2000-04-16 2002-01-01 (rate drop chart)"

1185:"$ SPX 1998-09-17 2000-06-16 (rate rise chart)"

1171:"$ SPX 1996-12-01 1998-10-17 (rate drop chart)"

1157:"$ SPX 1995-01-01 1997-01-01 (rate drop chart)"

1143:"$ SPX 1992-08-04 1995-03-01 (rate rise chart)"

1129:"$ SPX 1990-06-12 1992-10-04 (rate drop chart)"

770:"The Fed Explained: What the Central Bank Does"

588:A low federal funds rate makes investments in

2731:

2700:Personal consumption expenditures price index

1875:

1826:Historical Data: Effective Federal Funds Rate

1082:

300:

2299:2009 Supervisory Capital Assessment Program

2216:Federal Reserve v. Investment Co. Institute

423:Explanation of federal funds rate decisions

2738:

2724:

2304:Term Asset-Backed Securities Loan Facility

1889:

1882:

1868:

1784:

826:"12 CFR 249.10: Liquidity coverage ratio"

738:"The Implementation of Monetary Policy".

490:Rates since 2008 global economic downturn

930:"BBA LIBOR - Frequently asked questions"

583:

331:

269:

126:

118:

85:

20:

1767:"Federal Reserve issues FOMC statement"

1742:"Federal Reserve issues FOMC statement"

1717:"Federal Reserve issues FOMC statement"

1692:"Federal Reserve issues FOMC statement"

1667:"Federal Reserve issues FOMC statement"

1642:"Federal Reserve issues FOMC statement"

1617:"Federal Reserve issues FOMC statement"

1592:"Federal Reserve issues FOMC statement"

1567:"Federal Reserve issues FOMC statement"

1542:"Federal Reserve issues FOMC statement"

1517:"Federal Reserve issues FOMC statement"

1503:"Federal Reserve issues FOMC statement"

1489:"Federal Reserve issues FOMC statement"

1475:"Federal Reserve issues FOMC statement"

1461:"Federal Reserve issues FOMC statement"

1447:"Federal Reserve issues FOMC statement"

1433:"Federal Reserve issues FOMC statement"

1419:"Federal Reserve issues FOMC statement"

1405:"Federal Reserve issues FOMC statement"

1391:"Federal Reserve issues FOMC statement"

1377:"Federal Reserve issues FOMC statement"

1363:"Federal Reserve issues FOMC statement"

1349:"Federal Reserve issues FOMC statement"

966:"Federal Reserve issues FOMC statement"

471:June 29, 2006 – Oct 29, 2008: 5.25–1.00

239:in the federal funds rate trade on the

131:Federal funds rate vs unemployment rate

2942:

1980:Monetary Policy Report to the Congress

658:Mortgage industry of the United States

461:Feb 1, 1995 – Nov 17, 1998: 6.00–4.75

2719:

2273:Unfair or Deceptive Acts or Practices

1863:

909:"Open Market Operations in the 1990s"

764:

762:

2688:Monetary policy of the United States

2267:Emergency Economic Stabilization Act

2224:Northeast Bancorp v. Federal Reserve

2197:Humphrey–Hawkins Full Employment Act

1253:

1103:

1087:. InformedTrades.com. Archived from

161:monetary policy in the United States

2745:

1975:Federal Reserve Statistical Release

1324:"Fed raises rates at March meeting"

1321:

907:Cheryl L. Edwards (November 1997).

321:

318:is published by the Cleveland Fed.

65: Effective Federal Funds Rate

13:

2261:Subprime mortgage crisis responses

1411:

1083:David Waring (February 19, 2008).

958:

759:

414:

381:United States Consumer Price Index

14:

2971:

2326:Commercial Paper Funding Facility

2279:Commercial Paper Funding Facility

1830:Federal Reserve Bank of St. Louis

1819:

1254:Shaw, Richard (January 7, 2007).

355:interest rate 48 months new autos

163:as it influences a wide range of

2663:Criticism of the Federal Reserve

2237:Expedited Funds Availability Act

1953:

804:Federal Reserve Bank of New York

717:Federal Reserve Bank of New York

407:2021–2022 global inflation surge

280:Secured Overnight Financing Rate

2131:U.S. Treasury Department Accord

1759:

1734:

1709:

1684:

1659:

1634:

1609:

1584:

1559:

1534:

1509:

1495:

1481:

1467:

1453:

1439:

1425:

1397:

1383:

1369:

1355:

1341:

1315:

1297:

1283:

1269:

1247:

1233:

1219:

1205:

1191:

1177:

1163:

1149:

1135:

1121:

1076:

1051:

1026:

1006:

1000:

994:"Federal reserve press release"

986:

980:"Federal reserve press release"

972:

940:

922:

246:

2333:Corner Post v. Federal Reserve

2285:Primary Dealer Credit Facility

900:

886:

860:

839:

818:

799:"Effective Federal Funds Rate"

791:

731:

705:

608:Austrian Business Cycle Theory

1:

1922:Federal Open Market Committee

1828:(interactive graph) from the

948:"4:56 p.m. US-Closing Stocks"

699:

638:Federal Reserve Economic Data

396:Financial crisis of 2007–2008

276:London Interbank Offered Rate

187:Federal Open Market Committee

2292:Bloomberg v. Federal Reserve

2191:Electronic Fund Transfer Act

2173:Home Mortgage Disclosure Act

2167:Equal Credit Opportunity Act

2055:National Monetary Commission

1322:Cox, Jeff (March 15, 2017).

896:. Bankrate, Inc. March 2016.

208:

172:effective federal funds rate

59: 3 month Treasury Bond

47: 10 Year Treasury Bond

7:

633:Euro Interbank Offered Rate

600:

53: 2 Year Treasury Bond

10:

2976:

2488:Vice Chair for Supervision

2185:Federal Reserve Reform Act

2179:Community Reinvestment Act

713:"Fedpoints: Federal Funds"

493:

325:

183:federal funds target range

135:In the United States, the

2789:

2753:

2650:

2517:

2452:

2343:

2203:International Banking Act

2033:

1988:

1962:

1951:

1945:Federal Reserve Bank Note

1930:

1897:

693:Zero interest rate policy

388: Federal funds rate

301:Predictions by the market

2771:Interbank lending market

2137:Bank Holding Company Act

1291:"Open Market Operations"

916:Federal Reserve Bulletin

155:are amounts held at the

114: Federal Funds Rate

31:30 year mortgage average

2766:Effective interest rate

579:Sep 18, 2024: 4.75–5.00

576:Jul 26, 2023: 5.25–5.50

570:Mar 22, 2023: 4.75–5.00

564:Dec 14, 2022: 4.25–4.50

558:Sep 21, 2022: 3.00–3.25

555:Jul 27, 2022: 2.25–2.50

552:Jun 15, 2022: 1.50–1.75

546:Mar 16, 2022: 0.25–0.50

543:Mar 15, 2020: 0.00–0.25

537:Oct 30, 2019: 1.50–1.75

534:Sep 18, 2019: 1.75–2.00

531:Jul 31, 2019: 2.00–2.25

528:Dec 19, 2018: 2.25–2.50

525:Sep 26, 2018: 2.00–2.25

522:Jun 13, 2018: 1.75–2.00

519:Mar 21, 2018: 1.50–1.75

516:Dec 13, 2017: 1.25–1.50

513:Jun 14, 2017: 1.00–1.25

510:Mar 15, 2017: 0.75–1.00

507:Dec 14, 2016: 0.50–0.75

504:Dec 16, 2015: 0.25–0.50

312:CME Group FedWatch tool

145:depository institutions

2955:Federal Reserve System

2776:Overnight indexed swap

2255:Gramm–Leach–Bliley Act

2126:Employment Act of 1946

1891:Federal Reserve System

918:(PDF). Gerard Sinzdak.

777:www.federalreserve.gov

648:Modern Monetary Theory

573:May 3, 2023: 5.00–5.25

567:Feb 1, 2023: 4.50–4.75

561:Nov 2, 2022: 3.75–4.00

549:May 4, 2022: 0.75–1.00

540:Mar 3, 2020: 1.00–1.25

501:Dec 16, 2008: 0.0–0.25

419:

390:

308:Chicago Board of Trade

241:Chicago Board of Trade

132:

124:

116:

83:

2683:Lender of last resort

2359:William P. G. Harding

2161:Smithsonian Agreement

2091:Emergency Banking Act

1917:Federal Reserve Banks

1311:on December 15, 2016.

1117:on December 21, 2008.

936:on February 16, 2007.

584:International effects

429:government securities

418:

372:10 year Treasury bond

335:

316:implied probabilities

270:Comparison with LIBOR

264:lender of last resort

165:market interest rates

130:

122:

89:

40:30 Year Treasury Bond

24:

2365:Daniel R. Crissinger

2249:FDIC Improvement Act

2149:Truth in Lending Act

2120:Bretton Woods system

2049:Aldrich–Vreeland Act

1940:Federal Reserve Note

643:Inverted yield curve

628:Equation of exchange

590:developing countries

450:and interest rates.

343:Credit card interest

225:federal funds rate.

219:Federal Reserve Bank

95:inverted yield curve

2115:Banking Act of 1935

2061:Federal Reserve Act

456:1990–1991 recession

252:Interbank borrowing

2822:Federal funds rate

2518:Current presidents

2499:Christopher Waller

2389:Marriner S. Eccles

2103:Glass–Steagall Act

2013:Federal funds rate

1800:The New York Times

1243:. StockCharts.com.

1229:. StockCharts.com.

1215:. StockCharts.com.

1201:. StockCharts.com.

1187:. StockCharts.com.

1173:. StockCharts.com.

1159:. StockCharts.com.

1145:. StockCharts.com.

1131:. StockCharts.com.

872:www.stlouisfed.org

673:Real interest rate

668:Official bank rate

663:Official cash rate

420:

391:

137:federal funds rate

133:

125:

117:

84:

2937:

2936:

2887:Singaporean SIBOR

2713:

2712:

2557:Loretta J. Mester

2547:Patrick T. Harker

2413:G. William Miller

2401:William M. Martin

2353:Charles S. Hamlin

954:on July 18, 2012.

618:Demand Management

2967:

2740:

2733:

2726:

2717:

2716:

2474:Philip Jefferson

2395:Thomas B. McCabe

2320:Durbin amendment

2109:Gold Reserve Act

1957:

1956:

1884:

1877:

1870:

1861:

1860:

1814:

1813:

1808:

1806:

1792:Peter S. Goodman

1788:

1782:

1781:

1779:

1777:

1763:

1757:

1756:

1754:

1752:

1738:

1732:

1731:

1729:

1727:

1713:

1707:

1706:

1704:

1702:

1688:

1682:

1681:

1679:

1677:

1663:

1657:

1656:

1654:

1652:

1638:

1632:

1631:

1629:

1627:

1613:

1607:

1606:

1604:

1602:

1588:

1582:

1581:

1579:

1577:

1563:

1557:

1556:

1554:

1552:

1538:

1532:

1531:

1529:

1527:

1513:

1507:

1506:

1499:

1493:

1492:

1485:

1479:

1478:

1471:

1465:

1464:

1457:

1451:

1450:

1443:

1437:

1436:

1429:

1423:

1422:

1415:

1409:

1408:

1401:

1395:

1394:

1387:

1381:

1380:

1373:

1367:

1366:

1359:

1353:

1352:

1345:

1339:

1338:

1336:

1334:

1319:

1313:

1312:

1301:

1295:

1294:

1287:

1281:

1280:

1273:

1267:

1266:

1264:

1262:

1251:

1245:

1244:

1237:

1231:

1230:

1223:

1217:

1216:

1209:

1203:

1202:

1195:

1189:

1188:

1181:

1175:

1174:

1167:

1161:

1160:

1153:

1147:

1146:

1139:

1133:

1132:

1125:

1119:

1118:

1107:

1101:

1100:

1098:

1096:

1080:

1074:

1073:

1071:

1069:

1055:

1049:

1048:

1046:

1044:

1030:

1024:

1023:

1021:

1019:

1004:

998:

997:

990:

984:

983:

976:

970:

969:

962:

956:

955:

944:

938:

937:

926:

920:

919:

913:

904:

898:

897:

894:"Fed funds rate"

890:

884:

883:

881:

879:

874:. August 5, 2020

864:

858:

857:

855:

853:

843:

837:

836:

834:

832:

822:

816:

815:

813:

811:

795:

789:

788:

786:

784:

774:

766:

757:

756:

754:

752:

746:

735:

729:

728:

726:

724:

709:

405:In light of the

387:

378:

369:

360:

350:

340:

322:Historical rates

237:Future contracts

153:Reserve balances

149:uncollateralized

113:

79:

70:

64:

58:

52:

46:

37:

28:

2975:

2974:

2970:

2969:

2968:

2966:

2965:

2964:

2940:

2939:

2938:

2933:

2847:Ukrainian KIBOR

2842:Pakistani KIBOR

2785:

2749:

2747:Reference rates

2744:

2714:

2709:

2646:

2597:Alberto Musalem

2587:Austan Goolsbee

2519:

2513:

2494:Michelle Bowman

2455:

2448:

2407:Arthur F. Burns

2383:Eugene R. Black

2339:

2037:

2029:

1996:Discount window

1984:

1958:

1954:

1949:

1926:

1893:

1888:

1822:

1817:

1804:

1802:

1789:

1785:

1775:

1773:

1765:

1764:

1760:

1750:

1748:

1740:

1739:

1735:

1725:

1723:

1715:

1714:

1710:

1700:

1698:

1690:

1689:

1685:

1675:

1673:

1665:

1664:

1660:

1650:

1648:

1640:

1639:

1635:

1625:

1623:

1615:

1614:

1610:

1600:

1598:

1590:

1589:

1585:

1575:

1573:

1565:

1564:

1560:

1550:

1548:

1540:

1539:

1535:

1525:

1523:

1515:

1514:

1510:

1501:

1500:

1496:

1487:

1486:

1482:

1473:

1472:

1468:

1459:

1458:

1454:

1445:

1444:

1440:

1431:

1430:

1426:

1417:

1416:

1412:

1403:

1402:

1398:

1389:

1388:

1384:

1375:

1374:

1370:

1361:

1360:

1356:

1347:

1346:

1342:

1332:

1330:

1320:

1316:

1303:

1302:

1298:

1289:

1288:

1284:

1277:"Press Release"

1275:

1274:

1270:

1260:

1258:

1252:

1248:

1239:

1238:

1234:

1225:

1224:

1220:

1211:

1210:

1206:

1197:

1196:

1192:

1183:

1182:

1178:

1169:

1168:

1164:

1155:

1154:

1150:

1141:

1140:

1136:

1127:

1126:

1122:

1109:

1108:

1104:

1094:

1092:

1081:

1077:

1067:

1065:

1063:www.nar.realtor

1057:

1056:

1052:

1042:

1040:

1038:www.cbsnews.com

1032:

1031:

1027:

1017:

1015:

1005:

1001:

992:

991:

987:

978:

977:

973:

964:

963:

959:

946:

945:

941:

928:

927:

923:

911:

905:

901:

892:

891:

887:

877:

875:

866:

865:

861:

851:

849:

845:

844:

840:

830:

828:

824:

823:

819:

809:

807:

797:

796:

792:

782:

780:

772:

768:

767:

760:

750:

748:

744:

737:

736:

732:

722:

720:

711:

710:

706:

702:

697:

653:Monetary policy

603:

586:

498:

492:

425:

389:

385:

383:

376:

374:

367:

365:

358:

356:

348:

346:

338:

330:

324:

303:

272:

249:

231:discount window

211:

157:Federal Reserve

115:

111:

99:Federal Reserve

77:

76:

68:

66:

62:

60:

56:

54:

50:

48:

44:

42:

35:

33:

26:

17:

12:

11:

5:

2973:

2963:

2962:

2960:Interest rates

2957:

2952:

2935:

2934:

2932:

2931:

2930:

2929:

2919:

2914:

2909:

2904:

2899:

2894:

2889:

2884:

2879:

2874:

2869:

2864:

2859:

2854:

2849:

2844:

2839:

2834:

2829:

2824:

2819:

2814:

2809:

2804:

2799:

2793:

2791:

2787:

2786:

2784:

2783:

2781:Overnight rate

2778:

2773:

2768:

2763:

2757:

2755:

2751:

2750:

2743:

2742:

2735:

2728:

2720:

2711:

2710:

2708:

2707:

2702:

2697:

2696:

2695:

2685:

2680:

2675:

2670:

2665:

2660:

2654:

2652:

2648:

2647:

2645:

2644:

2634:

2624:

2614:

2604:

2594:

2584:

2577:Raphael Bostic

2574:

2564:

2554:

2544:

2534:

2523:

2521:

2515:

2514:

2512:

2511:

2509:Adriana Kugler

2506:

2501:

2496:

2491:

2481:

2471:

2460:

2458:

2450:

2449:

2447:

2446:

2445:(2018–present)

2440:

2434:

2428:

2425:Alan Greenspan

2422:

2416:

2410:

2404:

2398:

2392:

2386:

2380:

2374:

2368:

2362:

2356:

2349:

2347:

2341:

2340:

2338:

2337:

2329:

2323:

2316:Dodd–Frank Act

2313:

2307:

2301:

2296:

2288:

2282:

2276:

2270:

2264:

2258:

2252:

2246:

2240:

2234:

2228:

2220:

2212:

2206:

2200:

2194:

2188:

2182:

2176:

2170:

2164:

2158:

2152:

2146:

2145:(1961–present)

2140:

2134:

2128:

2123:

2117:

2112:

2106:

2100:

2094:

2088:

2082:

2076:

2070:

2064:

2058:

2052:

2045:

2043:

2031:

2030:

2028:

2027:

2025:Primary dealer

2022:

2021:

2020:

2018:Overnight rate

2010:

2005:

2004:

2003:

1992:

1990:

1986:

1985:

1983:

1982:

1977:

1972:

1966:

1964:

1960:

1959:

1952:

1950:

1948:

1947:

1942:

1936:

1934:

1928:

1927:

1925:

1924:

1919:

1914:

1909:

1904:

1898:

1895:

1894:

1887:

1886:

1879:

1872:

1864:

1858:

1857:

1852:

1847:

1842:

1837:

1832:

1821:

1820:External links

1818:

1816:

1815:

1783:

1758:

1733:

1708:

1683:

1658:

1633:

1608:

1583:

1558:

1533:

1508:

1494:

1480:

1466:

1452:

1438:

1424:

1410:

1396:

1382:

1368:

1354:

1340:

1314:

1296:

1282:

1268:

1246:

1232:

1218:

1204:

1190:

1176:

1162:

1148:

1134:

1120:

1102:

1091:on May 5, 2015

1075:

1050:

1025:

999:

985:

971:

957:

939:

921:

899:

885:

859:

838:

817:

790:

758:

730:

703:

701:

698:

696:

695:

690:

685:

680:

675:

670:

665:

660:

655:

650:

645:

640:

635:

630:

625:

620:

615:

610:

604:

602:

599:

585:

582:

581:

580:

577:

574:

571:

568:

565:

562:

559:

556:

553:

550:

547:

544:

541:

538:

535:

532:

529:

526:

523:

520:

517:

514:

511:

508:

505:

502:

494:Main article:

491:

488:

473:

472:

469:

466:2001 recession

462:

459:

424:

421:

384:

375:

366:

357:

347:

337:

323:

320:

302:

299:

298:

297:

294:

291:

287:

271:

268:

248:

245:

210:

207:

110:

101:wants to tame

67:

61:

55:

49:

43:

34:

25:

15:

9:

6:

4:

3:

2:

2972:

2961:

2958:

2956:

2953:

2951:

2948:

2947:

2945:

2928:

2925:

2924:

2923:

2920:

2918:

2915:

2913:

2910:

2908:

2905:

2903:

2900:

2898:

2895:

2893:

2890:

2888:

2885:

2883:

2880:

2878:

2875:

2873:

2870:

2868:

2865:

2863:

2862:Russian MIBOR

2860:

2858:

2855:

2853:

2850:

2848:

2845:

2843:

2840:

2838:

2835:

2833:

2830:

2828:

2825:

2823:

2820:

2818:

2815:

2813:

2810:

2808:

2805:

2803:

2800:

2798:

2795:

2794:

2792:

2788:

2782:

2779:

2777:

2774:

2772:

2769:

2767:

2764:

2762:

2759:

2758:

2756:

2752:

2748:

2741:

2736:

2734:

2729:

2727:

2722:

2721:

2718:

2706:

2703:

2701:

2698:

2694:

2691:

2690:

2689:

2686:

2684:

2681:

2679:

2676:

2674:

2671:

2669:

2666:

2664:

2661:

2659:

2656:

2655:

2653:

2649:

2642:

2641:San Francisco

2638:

2635:

2632:

2628:

2625:

2622:

2618:

2615:

2612:

2608:

2607:Neel Kashkari

2605:

2602:

2598:

2595:

2592:

2588:

2585:

2582:

2578:

2575:

2572:

2568:

2567:Thomas Barkin

2565:

2562:

2558:

2555:

2552:

2548:

2545:

2542:

2538:

2537:John Williams

2535:

2532:

2528:

2527:Susan Collins

2525:

2524:

2522:

2520:(by district)

2516:

2510:

2507:

2505:

2502:

2500:

2497:

2495:

2492:

2489:

2485:

2482:

2479:

2475:

2472:

2469:

2465:

2464:Jerome Powell

2462:

2461:

2459:

2457:

2451:

2444:

2443:Jerome Powell

2441:

2438:

2435:

2432:

2429:

2426:

2423:

2420:

2417:

2414:

2411:

2408:

2405:

2402:

2399:

2396:

2393:

2390:

2387:

2384:

2381:

2378:

2375:

2372:

2369:

2366:

2363:

2360:

2357:

2354:

2351:

2350:

2348:

2346:

2342:

2335:

2334:

2330:

2327:

2324:

2321:

2317:

2314:

2311:

2308:

2305:

2302:

2300:

2297:

2294:

2293:

2289:

2286:

2283:

2280:

2277:

2274:

2271:

2268:

2265:

2262:

2259:

2256:

2253:

2250:

2247:

2244:

2241:

2238:

2235:

2232:

2231:Greenspan put

2229:

2226:

2225:

2221:

2218:

2217:

2213:

2210:

2207:

2204:

2201:

2198:

2195:

2192:

2189:

2186:

2183:

2180:

2177:

2174:

2171:

2168:

2165:

2162:

2159:

2156:

2153:

2150:

2147:

2144:

2141:

2138:

2135:

2132:

2129:

2127:

2124:

2121:

2118:

2116:

2113:

2110:

2107:

2104:

2101:

2098:

2095:

2092:

2089:

2086:

2083:

2080:

2077:

2074:

2071:

2068:

2065:

2062:

2059:

2056:

2053:

2050:

2047:

2046:

2044:

2041:

2036:

2032:

2026:

2023:

2019:

2016:

2015:

2014:

2011:

2009:

2008:Federal funds

2006:

2002:

1999:

1998:

1997:

1994:

1993:

1991:

1989:Federal funds

1987:

1981:

1978:

1976:

1973:

1971:

1968:

1967:

1965:

1961:

1946:

1943:

1941:

1938:

1937:

1935:

1933:

1929:

1923:

1920:

1918:

1915:

1913:

1910:

1908:

1905:

1903:

1900:

1899:

1896:

1892:

1885:

1880:

1878:

1873:

1871:

1866:

1865:

1862:

1856:

1853:

1851:

1848:

1846:

1843:

1841:

1838:

1836:

1833:

1831:

1827:

1824:

1823:

1812:

1801:

1797:

1793:

1787:

1776:September 18,

1772:

1768:

1762:

1747:

1743:

1737:

1722:

1718:

1712:

1697:

1693:

1687:

1672:

1668:

1662:

1647:

1643:

1637:

1622:

1618:

1612:

1601:September 21,

1597:

1593:

1587:

1572:

1568:

1562:

1547:

1543:

1537:

1522:

1518:

1512:

1504:

1498:

1490:

1484:

1476:

1470:

1462:

1456:

1448:

1442:

1434:

1428:

1420:

1414:

1406:

1400:

1392:

1386:

1378:

1372:

1364:

1358:

1350:

1344:

1329:

1325:

1318:

1310:

1306:

1300:

1292:

1286:

1278:

1272:

1257:

1250:

1242:

1236:

1228:

1222:

1214:

1208:

1200:

1194:

1186:

1180:

1172:

1166:

1158:

1152:

1144:

1138:

1130:

1124:

1116:

1112:

1106:

1090:

1086:

1079:

1068:September 18,

1064:

1060:

1054:

1039:

1035:

1029:

1014:

1010:

1003:

995:

989:

981:

975:

967:

961:

953:

949:

943:

935:

931:

925:

917:

910:

903:

895:

889:

873:

869:

863:

848:

842:

827:

821:

806:

805:

800:

794:

778:

771:

765:

763:

743:

742:

734:

719:. August 2007

718:

714:

708:

704:

694:

691:

689:

686:

684:

681:

679:

676:

674:

671:

669:

666:

664:

661:

659:

656:

654:

651:

649:

646:

644:

641:

639:

636:

634:

631:

629:

626:

624:

621:

619:

616:

614:

611:

609:

606:

605:

598:

596:

591:

578:

575:

572:

569:

566:

563:

560:

557:

554:

551:

548:

545:

542:

539:

536:

533:

530:

527:

524:

521:

518:

515:

512:

509:

506:

503:

500:

499:

497:

487:

485:

481:

477:

470:

467:

463:

460:

457:

453:

452:

451:

449:

444:

441:

436:

434:

430:

417:

413:

410:

408:

403:

401:

397:

382:

373:

364:

354:

344:

334:

329:

319:

317:

313:

309:

295:

292:

288:

285:

284:

283:

281:

278:(LIBOR), the

277:

267:

265:

260:

256:

253:

244:

242:

238:

234:

232:

226:

224:

220:

216:

206:

204:

200:

196:

190:

188:

184:

179:

177:

173:

168:

166:

162:

158:

154:

150:

146:

142:

141:interest rate

138:

129:

121:

108:

104:

100:

96:

92:

88:

82:

74:

73:CPI inflation

41:

32:

23:

19:

2857:Indian MIBOR

2821:

2658:Central bank

2637:Mary C. Daly

2551:Philadelphia

2504:Lisa D. Cook

2484:Michael Barr

2437:Janet Yellen

2431:Ben Bernanke

2419:Paul Volcker

2377:Eugene Meyer

2371:Roy A. Young

2331:

2290:

2222:

2214:

2143:FOMC actions

2097:Regulation Q

2085:Regulation D

2012:

1810:

1803:. Retrieved

1799:

1786:

1774:. Retrieved

1770:

1761:

1749:. Retrieved

1745:

1736:

1724:. Retrieved

1720:

1711:

1699:. Retrieved

1695:

1686:

1674:. Retrieved

1670:

1661:

1651:December 14,

1649:. Retrieved

1645:

1636:

1624:. Retrieved

1620:

1611:

1599:. Retrieved

1595:

1586:

1574:. Retrieved

1570:

1561:

1549:. Retrieved

1545:

1536:

1524:. Retrieved

1520:

1511:

1497:

1483:

1469:

1455:

1441:

1427:

1413:

1399:

1385:

1371:

1357:

1343:

1331:. Retrieved

1327:

1317:

1309:the original

1299:

1285:

1271:

1259:. Retrieved

1249:

1235:

1221:

1207:

1193:

1179:

1165:

1151:

1137:

1123:

1115:the original

1105:

1093:. Retrieved

1089:the original

1078:

1066:. Retrieved

1062:

1053:

1043:December 15,

1041:. Retrieved

1037:

1028:

1018:December 15,

1016:. Retrieved

1012:

1002:

988:

974:

960:

952:the original

942:

934:the original

924:

915:

902:

888:

876:. Retrieved

871:

862:

850:. Retrieved

841:

829:. Retrieved

820:

808:. Retrieved

802:

793:

781:. Retrieved

776:

749:. Retrieved

740:

733:

721:. Retrieved

707:

595:Mexican peso

587:

474:

445:

437:

433:money supply

426:

411:

404:

392:

315:

304:

290:securities).

273:

261:

257:

250:

247:Applications

235:

227:

222:

212:

203:U.S. economy

191:

182:

180:

175:

171:

169:

136:

134:

18:

2754:Terminology

2627:Lorie Logan

2621:Kansas City

2617:Jeff Schmid

2611:Minneapolis

2439:(2014–2018)

2433:(2006–2014)

2427:(1987–2006)

2421:(1979–1987)

2415:(1978–1979)

2409:(1970–1978)

2403:(1951–1970)

2397:(1948–1951)

2391:(1934–1948)

2385:(1933–1934)

2379:(1930–1933)

2373:(1927–1930)

2367:(1923–1927)

2361:(1916–1922)

2355:(1914–1916)

2328:(2020–2021)

2306:(2009–2010)

2287:(2008–2010)

2281:(2008–2010)

2263:(2007–2010)

2155:Nixon shock

2122:(1944–1971)

2067:Pittman Act

2057:(1909–1912)

2040:Antecedents

1676:February 1,

1626:November 2,

1007:Cox, Jeff.

688:Taylor rule

484:nominal GDP

448:S&P 500

274:Though the

91:US Treasury

2944:Categories

2927:Mutan rate

2907:TED spread

2478:Vice Chair

2079:Phelan Act

1970:Beige Book

1907:Vice Chair

751:October 2,

723:October 2,

700:References

476:Bill Gross

440:recessions

363:Prime Rate

326:See also:

195:employment

81:Recessions

2761:Bank rate

2705:Sahm rule

2668:Fed model

2601:St. Louis

2561:Cleveland

2456:governors

2243:FIRRE Act

2209:DIDMC Act

2087:(c. 1930)

2001:Bank rate

1932:Banknotes

1912:Governors

1805:March 18,

1701:March 22,

1333:March 15,

878:August 4,

783:August 3,

613:Bank Rate

400:aftermath

353:Auto loan

223:effective

209:Mechanism

199:inflation

143:at which

107:inflation

97:when the

75:year/year

2673:Fedspeak

2571:Richmond

2541:New York

2073:Edge Act

1751:July 26,

1576:July 27,

1551:June 15,

1261:April 3,

1095:July 20,

852:July 29,

831:July 29,

601:See also

398:and its

2950:Banking

2867:RIGIBOR

2827:Helibor

2817:EURONIA

2802:Euribor

2693:History

2678:Fed put

2651:Related

2591:Chicago

2581:Atlanta

2454:Current

2318:(2010;

2312:(2009–)

2035:History

1963:Reports

201:in the

151:basis.

139:is the

71:

2902:STIBOR

2882:Shibor

2872:SAIBOR

2631:Dallas

2531:Boston

2345:Chairs

2336:(2024)

2295:(2009)

2275:(2008)

2269:(2008)

2257:(1999)

2251:(1991)

2245:(1989)

2239:(1987)

2233:(1987)

2227:(1985)

2219:(1981)

2211:(1980)

2205:(1978)

2199:(1978)

2193:(1978)

2187:(1977)

2181:(1977)

2175:(1975)

2169:(1974)

2163:(1971)

2157:(1971)

2151:(1968)

2139:(1956)

2133:(1951)

2111:(1934)

2105:(1933)

2099:(1933)

2093:(1933)

2081:(1920)

2075:(1919)

2069:(1918)

2063:(1913)

2051:(1908)

1726:May 3,

1526:May 4,

810:May 1,

386:

379:

377:

370:

368:

361:

359:

351:

349:

341:

339:

215:liquid

112:

103:demand

78:

69:

63:

57:

51:

45:

38:

36:

29:

27:

2922:TONAR

2912:TIBOR

2897:SONIA

2877:SARON

2852:Libor

2837:JIBAR

2832:HIBOR

2807:EONIA

2797:EIBOR

2790:Rates

2468:Chair

1902:Chair

912:(PDF)

773:(PDF)

745:(PDF)

683:SONIA

678:SARON

623:Eonia

480:PIMCO

345:rates

2917:TIIE

2892:SOFR

2812:€STR

1807:2017

1778:2024

1753:2023

1728:2023

1703:2023

1678:2023

1653:2022

1628:2022

1603:2022

1578:2022

1553:2022

1528:2022

1335:2017

1328:CNBC

1263:2011

1097:2009

1070:2024

1045:2022

1020:2022

1013:CNBC

880:2023

854:2022

833:2022

812:2021

785:2023

753:2011

725:2011

197:and

181:The

176:EFFR

170:The

105:and

478:of

109:.

2946::

1809:.

1798:.

1769:.

1744:.

1719:.

1694:.

1669:.

1644:.

1619:.

1594:.

1569:.

1544:.

1519:.

1326:.

1061:.

1036:.

1011:.

914:.

870:.

801:.

775:.

761:^

715:.

597:.

266:.

205:.

167:.

2739:e

2732:t

2725:v

2643:)

2639:(

2633:)

2629:(

2623:)

2619:(

2613:)

2609:(

2603:)

2599:(

2593:)

2589:(

2583:)

2579:(

2573:)

2569:(

2563:)

2559:(

2553:)

2549:(

2543:)

2539:(

2533:)

2529:(

2490:)

2486:(

2480:)

2476:(

2470:)

2466:(

2322:)

2042:)

2038:(

1883:e

1876:t

1869:v

1780:.

1755:.

1730:.

1705:.

1680:.

1655:.

1630:.

1605:.

1580:.

1555:.

1530:.

1337:.

1265:.

1099:.

1072:.

1047:.

1022:.

996:.

982:.

882:.

856:.

835:.

814:.

787:.

755:.

727:.

468:)

458:)

174:(

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.