396:

However, its impact is limited to the worst-case order amplification when the demand is unpredictable. Having said that, dynamic analysis reveals that order smoothing can degrade performance in the presence of demand shocks. The opposite bias (i.e., over-reaction to mismatches), on the other hand, degrades the stationary performance but can increase dynamic performance; controlled over-reaction can aid the system reach its new goals quickly. The system, nevertheless, is considerably sensitive to that behaviour; extreme over-reaction significantly reduces performance. Overall, unbiased policies offer in general good results under a large range of demand types. Although these policies do not result in the best performance under certain criteria. It is always possible to find a biased policy that outperforms an unbiased policy for any one performance metric.

225:

studies abandoning the human factors. Previous control-theoretic models have identified as causes the tradeoff between stationary and dynamic performance as well as the use of independent controllers. In accordance with

Dellaert et al. (2017), one of the main behavioral causes that contribute to the bullwhip effect is the under-estimation of the pipeline. In addition, the complementary bias, over-estimation of the pipeline, also has a negative effect under such conditions. Nevertheless, it has been shown that when the demand stream is stationary, the system is relatively robust to this bias. In such situations, it has been found that biased policies (both under-estimating and over-estimating the pipeline) perform just as well as unbiased policies.

25:

281:. In order to minimize the cost and to simplify the logistics of a firm, most of the company prefers to accumulate the demand before doing the order. That way, they can benefit from a bigger sale on their order (economy of scale) and they have possibility to order a full truck or container which reduce greatly the transport cost. The more centralized are the orders, the more erratic the demand chart will be, it create an artificial variability in the demand, and it can influence the neighbors' industries which is likely to increase the bullwhip effect.

288:

This increase the variability by having spikes of demand and then a flatten line the time that the exceeding stock is sold by the customer. It leads to more uncertainty by the different players and a prediction of the moment when the demand will increase. All this is leading to the bullwhip effect. If it can appear as easy to counter by stopping the important sales, a competitor would take the place by offering better prices.

82:

138:

246:. Following the logic of the example of Buffa and Miller, after several weeks of producing at the classical rate, the producer will receive the information of the demand drop. As the drop was 10%, during the delay of the information's circulation the producer had a surplus of 11% per day, accumulated since day 1. He is thus more inclined to cut more than the necessary production.

122:. Suffering a glut in green cars, sales and marketing developed a program to sell the excess inventory. While successful in generating the desired market pull, manufacturing did not know about the promotional plans. Instead, they read the increase in sales as an indication of growing demand for green cars and ramped up production.

464:

Many studies demonstrate the bullwhip effect in a supply chain from different perspectives, including information sharing (Lee et al., 2000), information distortion (Lee et al., 2004), bankruptcy events (Lee et al., 2004, Mizgier et al., 2012) and systematic risk (Osadchiy et al., 2015). Most of them

294:

is when a retailer tries to limit order quantities by providing only a percentage of the order placed by the buyer. As the buyer knows that the retailer is delivering only a fraction of the order placed, he attempts to "game" the system by making an upward adjustment to the order quantity. Rationing

287:

as a result of inflationary factors, quantity discounts, or sales tend to stimulate customers to buy larger quantities than they require. The game of sales and discount push, in the case where the sales economy is higher than the stocking expenses, the firm to buy greater amount that what they need.

472:

Evolving from the notion of a stock derived bullwhip effect, there exists a similar, "financial bullwhip effect", explored in (Chen et al., 2013), on bondholders' wealth along a supply chain by examining whether the internal liquidity risk effect on bond yield spreads becomes greater upwardly along

395:

Another recommended strategy to limit the bullwhip effect is order smoothing. Previous research has demonstrated that order smoothing and the bullwhip effect are concurrent in industry. It has been proved that order smoothing is beneficial for the system's performance when the demand is stationary.

235:

Mis-perceptions of feedback and time delays. In 1979, Buffa and Miller highlighted that in their example. If a retailer sees a permanent drop of 10% of the demand on day 1, he will not place a new order until day 10. That way, the wholesaler is going to notice the 10% drop at day 10 and will place

266:

A seminal Lee et al. (1997) study found that the bullwhip effect did not solely result from irrational decision making: it found that under some circumstances it is rational for a firm to order with greater variability than variability of demand, i.e., distort demand and cause the bullwhip effect.

485:

modelling to study cascade failures as a consequence of financial bullwhips. Specifically, they create an agent-based supply network simulation model capturing the behaviours of companies with asymmetric power dynamics with their partners. To remain operational, they maximise their liquidity by

363:

In spite of having safety stocks there is still the hazard of stock-outs which result in poor customer service and lost sales. In addition to the (financially) hard measurable consequences of poor customer services and the damage to public image and loyalty, an organization has to cope with the

274:

is accomplished individually by all members of a supply chain. When a player of the chain is ordering, he will automatically add to the stock he needs a safety stock to answer to an unexpected event. When the first player supplier is going to order to its own supplier, he will also add a safety

224:

The first theories focusing onto the bullwhip effect were mainly focusing on the irrational behavior of the human in the supply chain, highlighting them as the main cause of the bullwhip effect. Since the 90's, the studies evolved, placing the supply chain's misfunctioning at the heart of their

101:

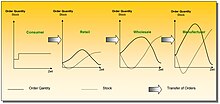

phenomenon where orders to suppliers tend to have a larger variability than sales to buyers, which results in an amplified demand variability upstream. In part, this results in increasing swings in inventory in response to shifts in consumer demand as one moves further up the supply chain. The

173:

supplier, each supply chain participant has greater observed variation in demand and thus greater need for safety stock. In periods of rising demand, down-stream participants increase orders. In periods of falling demand, orders fall or stop, thereby not reducing inventory. The effect is that

391:

back to corporate headquarters several times a day. This demand information is used to queue shipments from the Wal-Mart distribution center to the store and from the supplier to the Wal-Mart distribution center. The result is near-perfect visibility of customer demand and inventory movement

808:

359:

In addition to greater safety stocks, the described effect can lead to either inefficient production or excessive inventory, as each producer needs to fulfill the demand of its customers in the supply chain. This also leads to a low utilization of the distribution channel.

465:

devote themselves to exploring the bullwhip effect from the perspectives of inventory flow risk and information flow risk rather than that of cash flow risk. For a firm's internal liquidity risk (Chen et al., 2011), it is an appropriate proxy for a firm's

267:

They established a list of four major factors which cause the bullwhip effect: demand signal processing, rationing game, order batching, and price variations. This list has become a standard and is used as a framework to identify bullwhip effect.

253:

influencing the behavior in supply chains are largely unexplored. However, studies suggest that people with increased need for safety and security seem to perform worse than risk-takers in a simulated supply chain environment. People with high

364:

ramifications of failed fulfillment which may include contractual penalties. Moreover, repeated hiring and dismissal of employees to manage the demand variability induces further costs due to training and possible lay-offs.

114:. It has been described as "the observed propensity for material orders to be more variable than demand signals and for this variability to increase the further upstream a company is in a supply chain". Research at

1183:

Chen, Y. F., Z. Drezner, J. K. Ryan and D. Simchi-Levi (2000), Quantifying the

Bullwhip Effect in a Simple Supply Chain: The Impact of Forecasting, Lead Times and Information. Management Science, 46, 436–443.

371:, when sudden spikes in demand for everything from medical supplies such as masks or ventilators to consumer items such as toilet paper or eggs created feedback loops of panic buying, hoarding, and rationing.

153:

must forecast demand to properly position inventory and other resources. Forecasts are based on statistics, and they are rarely perfectly accurate. Because forecast errors are given, companies often carry an

1189:

Chen, Y. F., Z. Drezner, J. K. Ryan and D. Simchi-Levi (1998), The

Bullwhip Effect: Managerial Insights on the Impact of Forecasting and Information on Variability in a Supply Chain. Quantitative Models

1209:

Selwyn, B. (2008) Bringing Social

Relations Back In: (re)Conceptualising the 'Bullwhip Effect' in global commodity chains. International Journal of Management Concepts and Philosophy, 3 (2)156-175.

236:

his order on day 20. The longer the supply chain is, the bigger this delay will be and the player at the end of the supply chain will discover the decline of the demand after several weeks.

125:

Research indicates a fluctuation in point-of-sale demand of five percent will be interpreted by supply chain participants as a change in demand of up to forty percent. Much like cracking a

1180:

Cannella S., and

Ciancimino E. (2010). On the bullwhip avoidance phase: supply chain collaboration and order smoothing. International Journal of Production Research, 48 (22), 6739-6776

1193:

Disney, S.M., and Towill, D.R. (2003). On the bullwhip and inventory variance produced by an ordering policy. Omega, the

International Journal of Management Science, 31 (3), 157–167.

486:

negotiating longer repayment terms and cheaper financing, thus distributing risk onto weaker companies and propagating financial stress. This results in network-wide breakdown.

1032:

Chen, Tsung Kang; Liao, Hsien Hsing; Kuo, Hui Ju (2013). "Internal liquidity risk, financial bullwhip effects, and corporate bond yield spreads: Supply chain perspectives".

275:

stock, based on the total order of the first player. The more player there is in the chain, the safety stock will be made, resulting in an artificial raise of the demand.

85:

Illustration of the bullwhip effect: the final customer places an order (whip), which increasingly distorts interpretations of demand as one proceeds upstream along the

781:

Brauner P., Runge S., Groten M., Schuh M., Ziefle M. (2013). Human

Factors in Supply Chain Management. Lecture Notes in Computer Science Volume 8018, 2013, pp 423-432

1005:

Chen, Minjia; Guariglia, Alessandra (2013). "Internal financial constraints and firm productivity in China: Do liquidity and export behavior make a difference?".

599:"Bullwhip effect. The bullwhip effect is a distribution channel phenomenon in which forecasts yield supply chain inefficiencies. It refers to increasing swings i"

1186:

Chen, Y. F., J. K. Ryan and D. Simchi-Levi (2000), The Impact of

Exponential Smoothing Forecasts on the Bullwhip Effect. Naval Research Logistics, 47, 269–286.

1170:

Bray, Robert L., and Haim

Mendelson. "Information transmission and the bullwhip effect: An empirical investigation." Management Science 58.5 (2012): 860–875.

379:

Information sharing across the supply chain is an effective strategy to mitigate the bullwhip effect. For example, it has been successfully implemented in

1196:

Lee, H.L., Padmanabhan, V., and Whang, S. (1997). Information distortion in a supply chain: the bullwhip effect. Management

Science, 43 (4), 546–558.

174:

variations are amplified as one moves upstream in the supply chain (further from the customer). This sequence of events is well simulated by the

846:

129:, a small flick of the wrist - a shift in point of sale demand - can cause a large motion at the end of the whip - manufacturers' responses.

951:

Mizgier, Kamil J.; Wagner, Stephan M.; Holyst, Janusz A. (2012). "Modeling defaults of companies in multi-stage supply chain networks".

1230:

392:

throughout the supply chain. Better information leads to better inventory positioning and lower costs throughout the supply chain.

1117:

Mason-Jones, Rachel; Towill, Dennis R. (2000). "Coping with Uncertainty: Reducing "Bullwhip" Behaviour in Global Supply Chains".

415:

306:

1212:

Tempelmeier, H. (2006). Inventory Management in Supply Networks—Problems, Models, Solutions, Norderstedt:Books on Demand.

639:

Hoberg, K.; Thonemann, U. (2014). "Modeling and analyzing information delays in supply chains using transfer functions".

745:

Sterman, J. (1989). "Modeling managerial behavior: Misperceptions of feedback in a dynamic decision making experiment".

1261:

1217:

68:

46:

1097:

924:

Hau L. Lee; V. Padmanabhan; Seungjin Whang (2004). "Information Distortion in a Supply Chain: The Bullwhip Effect".

822:

39:

1271:

897:

Hau L. Lee; Kut C. So; Christopher S. Tang (2000). "The Value of Information Sharing in a Two-Level Supply Chain".

179:

1059:

Yaniv Proselkov; Jie Zhang; Liming Xu; Erik Hofmann; Thomas Y. Choi; Dale Rogers; Alexandra Brintrup (2023).

555:

Lee, H.; Padmanabhan, V.; Whang, S. (1997). "Information distortion in a supply chain: The bullwhip effect".

1276:

1234:

409:

978:

Nikolay Osadchiy; Vishal Gaur; Sridhar Seshadri (2015). "Systematic Risk in Supply Chain Networks".

669:

Disney, S. (2008). "Supply chain aperiodicity, bullwhip and stability analysis with Jury's inners".

367:

The impact of the bullwhip effect has been especially acute at the beginning stages of the COVID-19

1266:

598:

500:

403:

33:

791:

622:

1242:

510:

482:

1199:

Lee, H.L. (2010). Taming the bullwhip. Journal of Supply Chain Management 46 (1), pp. 7–7.

495:

175:

50:

420:

103:

8:

243:

115:

1134:

1078:

727:

445:

295:

and gaming generate inconsistencies in the ordering information that is being received.

1213:

1151:

1082:

719:

696:

Udenio, Maximiliano; Vatamidou, Eleni; Fransoo, Jan C.; Dellaert, Nico (2017-10-03).

368:

950:

731:

1138:

1130:

1126:

1068:

1061:"Financial ripple effect in complex adaptive supply networks: an agent-based model"

1045:

1041:

1014:

987:

960:

933:

906:

879:

762:

754:

709:

698:"Behavioral causes of the bullwhip effect: An analysis using linear control theory"

678:

648:

564:

1073:

1060:

870:

Bray, R.L.; Mendelson, H. (2015). "Production smoothing and the bullwhip effect".

714:

697:

823:"How health systems are responding as COVID-19 squeezes the medical supply chain"

910:

453:

Order allocation based on past sales instead of current size in case of shortage

118:

helped incorporate the concept into supply chain vernacular using a story about

964:

652:

505:

466:

1018:

1255:

1203:

1058:

723:

582:

Chain reaction: Managing a supply chain is becoming a bit like rocket science

515:

388:

384:

255:

250:

1031:

682:

348:

Lean and JIT style management of inventories and a chase production strategy

991:

977:

937:

883:

170:

166:

159:

98:

86:

758:

568:

258:

experience less trouble handling the bullwhip-effect in the supply chain.

1246:

213:

481:

This is more generally modelled in (Proselkov et al., 2023), which uses

1238:

767:

581:

311:

Adjustment of inventory control parameters with each demand observation

209:

923:

896:

316:

155:

847:"What procurement managers should expect from a 'bullwhip on crack'"

399:

Methods intended to reduce uncertainty, variability, and lead time:

380:

150:

146:

126:

81:

1152:"Bullwhips and Beer: Why Supply Chain Management is so Difficult"

1095:

1004:

137:

554:

1206:, R. Ganeshan and M. Magazine, eds., Kluwer, pp. 417–439.

695:

119:

1231:

What the "beer game" can teach about supply chain challenges

1116:

383:'s distribution system. Individual Wal-Mart stores transmit

319:

variability (forecast error during replenishment lead time)

1175:

Production-Inventory Systems : Planning and Control

869:

638:

1096:

Lee, Hau L; Padmanabhan, V.; Whang, Seungjin (1997).

431:

Coordinate with retailers to spread deliveries evenly

228:Some others behavioral causes can be highlighted:

872:Manufacturing & Service Operations Management

1253:

1173:Buffa Elwood S and Jeffrey G Miller. 1979.

953:International Journal of Production Economics

641:International Journal of Production Economics

1065:International Journal of Production Research

744:

239:Panic ordering reactions after unmet demand

668:

476:

1233:segment from the Jun 29, 2021 episode of

1177:. 3d ed. Homewood Ill: Richard D. Irwin.

1072:

766:

713:

534:

69:Learn how and when to remove this message

450:Restrict returns and order cancellations

437:Smaller and more frequent replenishments

136:

110:(1961) and thus it is also known as the

80:

32:This article includes a list of general

208:The causes can further be divided into

1254:

1098:"The Bullwhip Effect in Supply Chains"

671:IMA Journal of Management Mathematics

550:

548:

546:

459:

261:

1149:

664:

662:

219:

18:

204:Simply human greed and exaggeration

149:demand is rarely perfectly stable,

13:

543:

442:Eliminate pathological incentives

374:

336:Trade promotion and forward buying

299:Other operational causes include:

38:it lacks sufficient corresponding

14:

1288:

1224:

659:

575:

473:the supply chain counterparties.

322:Lot-sizing/order synchronization

242:Perceived risk of other players'

1007:Journal of Comparative Economics

23:

1052:

1025:

998:

971:

944:

917:

890:

863:

839:

815:

801:

784:

775:

354:

1131:10.1080/16258312.2000.11517070

1046:10.1016/j.jbankfin.2013.02.011

1034:Journal of Banking and Finance

738:

689:

632:

615:

591:

535:Forrester, Jay Wright (1961).

528:

180:MIT Sloan School of Management

16:Form of distribution marketing

1:

1164:

1074:10.1080/00207543.2023.2173509

715:10.1080/24725854.2017.1325026

521:

232:Misuse of base-stock policies

428:Smooth the flow of products

342:Allocation rule of suppliers

303:Dependent demand processing

7:

911:10.1287/mnsc.46.5.626.12047

489:

10:

1293:

965:10.1016/j.ijpe.2010.09.022

653:10.1016/j.ijpe.2014.05.019

446:Every day low price policy

434:Reduce minimum batch sizes

339:Anticipation of shortages

102:concept first appeared in

1202:Supply Chain Management,

1019:10.1016/j.jce.2013.05.003

132:

1262:Distribution (marketing)

501:Forrester effect mapping

483:complex adaptive systems

404:Vendor-managed inventory

325:Consolidation of demands

272:Demand forecast updating

1272:Supply chain management

1243:Harvard Business School

1102:Sloan Management Review

511:Supply chain management

477:Financial ripple effect

178:which was developed by

53:more precise citations.

1150:Bean, Michael (2006).

992:10.1287/mnsc.2015.2187

938:10.1287/mnsc.1040.0266

884:10.1287/msom.2014.0513

496:Beer distribution game

176:beer distribution game

142:

90:

759:10.1287/mnsc.35.3.321

683:10.1093/imaman/dpm033

603:ww.en.freejournal.org

569:10.1287/mnsc.43.4.546

421:Strategic partnership

189:Lack of communication

169:from end-consumer to

140:

84:

1239:Professor Willy Shih

792:"Faculty of Science"

623:"Faculty of Science"

387:(POS) data from the

292:Rationing and gaming

192:Free return policies

537:Industrial Dynamics

425:Information sharing

412:replenishment (JIT)

244:bounded rationality

116:Stanford University

108:Industrial Dynamics

1277:Consumer behaviour

1119:Supply Chain Forum

980:Management Science

926:Management Science

899:Management Science

747:Management Science

557:Management Science

460:Financial bullwhip

331:Quantity discounts

328:Transaction motive

285:Price fluctuations

262:Operational causes

201:Demand information

143:

91:

932:(12): 1875–1886.

851:Supply Chain Dive

827:Supply Chain Dive

702:IISE Transactions

588:, 31 January 2002

416:Demand-driven MRP

220:Behavioral causes

79:

78:

71:

1284:

1159:

1142:

1109:

1087:

1086:

1076:

1056:

1050:

1049:

1040:(7): 2434–2456.

1029:

1023:

1022:

1013:(4): 1123–1140.

1002:

996:

995:

986:(6): 1755–1777.

975:

969:

968:

948:

942:

941:

921:

915:

914:

894:

888:

887:

867:

861:

860:

858:

857:

843:

837:

836:

834:

833:

819:

813:

812:

805:

799:

798:

796:

788:

782:

779:

773:

772:

770:

742:

736:

735:

717:

708:(10): 980–1000.

693:

687:

686:

666:

657:

656:

636:

630:

629:

627:

619:

613:

612:

610:

609:

595:

589:

579:

573:

572:

552:

541:

540:

532:

198:Price variations

112:Forrester effect

74:

67:

63:

60:

54:

49:this article by

40:inline citations

27:

26:

19:

1292:

1291:

1287:

1286:

1285:

1283:

1282:

1281:

1267:Demand response

1252:

1251:

1245:interviewed by

1227:

1167:

1162:

1145:

1112:

1091:

1090:

1057:

1053:

1030:

1026:

1003:

999:

976:

972:

949:

945:

922:

918:

895:

891:

868:

864:

855:

853:

845:

844:

840:

831:

829:

821:

820:

816:

809:"Opentextbooks"

807:

806:

802:

794:

790:

789:

785:

780:

776:

743:

739:

694:

690:

667:

660:

637:

633:

625:

621:

620:

616:

607:

605:

597:

596:

592:

580:

576:

553:

544:

533:

529:

524:

492:

479:

462:

377:

375:Countermeasures

357:

345:Shortage gaming

307:Forecast errors

264:

222:

186:Disorganisation

158:buffer called "

141:Bullwhip effect

135:

95:bullwhip effect

75:

64:

58:

55:

45:Please help to

44:

28:

24:

17:

12:

11:

5:

1290:

1280:

1279:

1274:

1269:

1264:

1250:

1249:

1226:

1225:External links

1223:

1222:

1221:

1210:

1207:

1200:

1197:

1194:

1191:

1187:

1184:

1181:

1178:

1171:

1166:

1163:

1161:

1160:

1146:

1144:

1143:

1113:

1111:

1110:

1092:

1089:

1088:

1051:

1024:

997:

970:

943:

916:

905:(5): 626–643.

889:

878:(2): 208–220.

862:

838:

814:

800:

783:

774:

753:(3): 321–339.

737:

688:

677:(2): 101–116.

658:

631:

614:

590:

574:

563:(4): 546–558.

542:

526:

525:

523:

520:

519:

518:

513:

508:

506:PID controller

503:

498:

491:

488:

478:

475:

467:financial risk

461:

458:

457:

456:

455:

454:

451:

448:

440:

439:

438:

435:

432:

426:

423:

418:

413:

407:

376:

373:

356:

353:

352:

351:

350:

349:

346:

343:

337:

334:

333:

332:

329:

326:

320:

314:

313:

312:

309:

297:

296:

289:

282:

279:Order batching

276:

263:

260:

248:

247:

240:

237:

233:

221:

218:

206:

205:

202:

199:

196:

195:Order batching

193:

190:

187:

182:in the 1960s.

165:Moving up the

134:

131:

77:

76:

31:

29:

22:

15:

9:

6:

4:

3:

2:

1289:

1278:

1275:

1273:

1270:

1268:

1265:

1263:

1260:

1259:

1257:

1248:

1244:

1240:

1236:

1232:

1229:

1228:

1219:

1218:3-8334-5373-7

1215:

1211:

1208:

1205:

1201:

1198:

1195:

1192:

1188:

1185:

1182:

1179:

1176:

1172:

1169:

1168:

1157:

1153:

1148:

1147:

1140:

1136:

1132:

1128:

1124:

1120:

1115:

1114:

1107:

1103:

1099:

1094:

1093:

1084:

1080:

1075:

1070:

1066:

1062:

1055:

1047:

1043:

1039:

1035:

1028:

1020:

1016:

1012:

1008:

1001:

993:

989:

985:

981:

974:

966:

962:

958:

954:

947:

939:

935:

931:

927:

920:

912:

908:

904:

900:

893:

885:

881:

877:

873:

866:

852:

848:

842:

828:

824:

818:

810:

804:

793:

787:

778:

769:

764:

760:

756:

752:

748:

741:

733:

729:

725:

721:

716:

711:

707:

703:

699:

692:

684:

680:

676:

672:

665:

663:

654:

650:

646:

642:

635:

624:

618:

604:

600:

594:

587:

586:The Economist

583:

578:

570:

566:

562:

558:

551:

549:

547:

538:

531:

527:

517:

516:Damping ratio

514:

512:

509:

507:

504:

502:

499:

497:

494:

493:

487:

484:

474:

470:

468:

452:

449:

447:

444:

443:

441:

436:

433:

430:

429:

427:

424:

422:

419:

417:

414:

411:

408:

405:

402:

401:

400:

397:

393:

390:

389:cash register

386:

385:point-of-sale

382:

372:

370:

365:

361:

347:

344:

341:

340:

338:

335:

330:

327:

324:

323:

321:

318:

315:

310:

308:

305:

304:

302:

301:

300:

293:

290:

286:

283:

280:

277:

273:

270:

269:

268:

259:

257:

256:self-efficacy

252:

251:Human factors

245:

241:

238:

234:

231:

230:

229:

226:

217:

215:

211:

203:

200:

197:

194:

191:

188:

185:

184:

183:

181:

177:

172:

171:raw materials

168:

163:

161:

157:

152:

148:

139:

130:

128:

123:

121:

117:

113:

109:

105:

104:Jay Forrester

100:

96:

88:

83:

73:

70:

62:

52:

48:

42:

41:

35:

30:

21:

20:

1174:

1155:

1122:

1118:

1108:(3): 93–102.

1105:

1101:

1064:

1054:

1037:

1033:

1027:

1010:

1006:

1000:

983:

979:

973:

959:(1): 14–23.

956:

952:

946:

929:

925:

919:

902:

898:

892:

875:

871:

865:

854:. Retrieved

850:

841:

830:. Retrieved

826:

817:

803:

786:

777:

750:

746:

740:

705:

701:

691:

674:

670:

644:

640:

634:

617:

606:. Retrieved

602:

593:

585:

577:

560:

556:

539:. MIT Press.

536:

530:

480:

471:

463:

410:Just in time

398:

394:

378:

366:

362:

358:

355:Consequences

298:

291:

284:

278:

271:

265:

249:

227:

223:

207:

167:supply chain

164:

160:safety stock

144:

124:

111:

107:

99:supply chain

94:

92:

87:supply chain

65:

56:

37:

1247:Kai Ryssdal

1235:Marketplace

768:1721.1/2184

647:: 132–145.

214:operational

51:introducing

1256:Categories

1165:Literature

856:2020-07-21

832:2020-07-21

608:2021-06-02

522:References

210:behavioral

151:businesses

34:references

1125:: 40–44.

1083:257149106

724:2472-5854

317:Lead time

156:inventory

59:July 2013

1204:S. Tayur

1067:: 1–23.

732:53692411

490:See also

381:Wal-Mart

369:pandemic

216:causes.

147:customer

145:Because

1241:of the

1158:(blog).

1139:7920876

47:improve

1216:

1156:/forio

1137:

1081:

730:

722:

133:Causes

36:, but

1237:with

1135:S2CID

1079:S2CID

795:(PDF)

728:S2CID

626:(PDF)

406:(VMI)

120:Volvo

97:is a

1214:ISBN

720:ISSN

212:and

127:whip

93:The

1190:for

1127:doi

1069:doi

1042:doi

1015:doi

988:doi

961:doi

957:135

934:doi

907:doi

880:doi

763:hdl

755:doi

710:doi

679:doi

649:doi

645:156

565:doi

162:".

106:'s

1258::

1154:.

1133:.

1121:.

1106:38

1104:.

1100:.

1077:.

1063:.

1038:37

1036:.

1011:41

1009:.

984:62

982:.

955:.

930:50

928:.

903:46

901:.

876:17

874:.

849:.

825:.

761:.

751:35

749:.

726:.

718:.

706:49

704:.

700:.

675:19

673:.

661:^

643:.

601:.

584:,

561:43

559:.

545:^

469:.

1220:.

1141:.

1129::

1123:1

1085:.

1071::

1048:.

1044::

1021:.

1017::

994:.

990::

967:.

963::

940:.

936::

913:.

909::

886:.

882::

859:.

835:.

811:.

797:.

771:.

765::

757::

734:.

712::

685:.

681::

655:.

651::

628:.

611:.

571:.

567::

89:.

72:)

66:(

61:)

57:(

43:.

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.