150:

tend to decrease with the increase in the total production output. The reason is that the actual product of the enterprise as it continues to expand, the original fixed costs are gradually diluted. This is particularly evident in companies with significant fixed-cost investments. Natural monopolies arise where the largest supplier in an industry, often the first supplier in a market, has an overwhelming cost advantage over other actual or potential competitors; this tends to be the case in industries where fixed costs predominate, creating economies of scale that are large in relation to the size of the market, as is the case in water and electricity services. The fixed cost of constructing a competing transmission network is so high, and the marginal cost of transmission for the incumbent so low, that it effectively bars potential competitors from the monopolist's market, acting as a nearly insurmountable barrier to entry into the market place.

127:. The marginal cost is the cost to the company of serving one more customer. In an industry where a natural monopoly does not exist, the vast majority of industries, the marginal cost decreases with economies of scale, then increases as the company has growing pains (overworking its employees, bureaucracy, inefficiencies, etc.). Along with this, the average cost of its products decreases and increases. A natural monopoly has a very different cost structure. A natural monopoly has a high fixed cost for a product that does not depend on output, but its marginal cost of producing one more good is roughly constant, and small.

20:

1556:

162:

the unit product price of a company that produces a specific product alone is higher than the corresponding unit product price of a joint production company, the companies that make it separately will lose money. These companies will either withdraw from the production field or be merged, forming a monopoly. Therefore, well-known

American economists Samuelson and Nordhaus pointed out that economies of scope can also produce natural monopolies.

1849:

part of the government, either to subject the business to reasonable conditions for the general advantage or to retain such power over it, that the profits of the monopoly may at least be obtained for the public." So, a legal prohibition against non-government competitors is often advocated. Whereby the rates are not left to the market but are regulated by the government; maximising profits, and subsequently societal reinvestment.

134:

1828:

The superiority of reward is not here the consequence of competition, but of its absence: not a compensation for disadvantages inherent in the employment, but an extra advantage; a kind of monopoly price, the effect not of a legal, but of what has been termed a natural monopoly... independently of...

1534:

The costs of building telecommunication poles and growing a cell network would just be too exhausting for other competitors to exist. Electricity requires grids and cables whilst water services and gas both require pipelines whose costs are just too high to be able to have existing competitors in the

153:

A firm with high fixed costs requires a large number of customers in order to have a meaningful return on investment. This is where economies of scale become important. Since each firm has large initial costs, as the firm gains market share and increases its output the fixed cost (what they initially

165:

Companies that take advantage of economies of scale often run into problems of bureaucracy; these factors interact to produce an "ideal" size for a company, at which the company's average cost of production is minimized. If that ideal size is large enough to supply the whole market, then that market

149:

reduces the number of possible entrants into the industry regardless of the earning of the corporations within. The production cost of an enterprise is not fixed, except for the effect of technology and other factors; even under the same conditions, the unit production cost of an enterprise can also

1860:

As with all monopolies, a monopolist that has gained its position through natural monopoly effects may engage in behaviour that abuses its market position. In cases where exploitation occurs, it often leads to calls from consumers for government regulation. Government regulation may also come about

169:

Once a natural monopoly has been established because of the large initial cost and that, according to the rule of economies of scale, the larger corporation (to a point) has a lower average cost and therefore an advantage over its competitors. With this knowledge, no firms will attempt to enter the

1843:

above the general level. A trade may also, from the nature of the case, be confined to so few hands, that profits may admit of being kept up by a combination among the dealers. It is well known that even among so numerous a body as the London booksellers, this sort of combination long continued to

161:

In real life, companies produce or provide single goods and services but often diversify their operations. Suppose the cost of having multiple products by one enterprise is lower than making them separately by several enterprises. In that case, it indicates that there is an economy of scope. Since

1848:

Mill also applied the term to land, which can manifest a natural monopoly by virtue of it being the only land with a particular mineral, etc. Furthermore, Mill referred to network industries, such as electricity and water supply, roads, rail and canals, as "practical monopolies", where "it is the

1922:

is an

American co-op that provides the majority of clearing and financial settlement across the securities industry ensuring they cannot abuse their market position to raise costs. In recent years a combined cooperative and open-source alternative to emergent web monopolies has been proposed, a

1838:

All the natural monopolies (meaning thereby those which are created by circumstances, and not by law) which produce or aggravate the disparities in the remuneration of different kinds of labour, operate similarly between different employments of capital. If a business can only be advantageously

1521:

The costs of laying tracks and building networks coupled with that of buying or leasing the trains prohibits or deters the entry of any competitor. Rail transport also fits other characteristics of a natural monopoly because it is assumed to be an industry with significant long run economies of

1864:

Common arguments in favour of regulation include the desire to limit a company's potentially abusive or unfair market power, facilitate competition, promote investment or system expansion, or stabilise markets. This is especially true in the case of essential utilities like electricity where a

1833:

Mill's initial use of the term concerned natural abilities. In contrast, common contemporary usage refers solely to market failure in a particular type of industry such as rail, post or electricity. Mill's development of the idea that 'what is true of labour, is true of capital'. He continues;

1507:, with all x being non-negative. In other words, if all companies have the same production cost function, the one with the better technology should monopolize the entire market such that the total cost is minimized, thus causing natural monopoly due to its technological advantage or condition.

564:

1889:

in each of these areas, many of which operate internationally bidding on utility contracts in other countries. However, this approach can raise its own problems. In the past, some governments have used the state-provided utility services as a source of cash flow for funding other government

1873:. In some countries an early solution to this perceived problem was government provision of, for example, a utility service. Enabling a monopolistic company with the ability to change prices without regulation can have devastating effects in society. For example, in Bolivia’s

185:(1977) provides the current formal definition of a natural monopoly. He defines a natural monopoly as "n industry in which multi-firm production is more costly than production by a monopoly" (p. 810). Baumol linked the definition to the mathematical concept of

1823:

Mill criticised Smith's neglect of an area that could explain wage disparity (the term itself was already in use in Smith's times, but with a slightly different meaning). Taking up the examples of professionals such as jewellers, physicians and lawyers, he said,

1451:

1829:

artificial monopolies , there is a natural monopoly in favour of skilled labourers against the unskilled, which makes the difference of reward exceed, sometimes in a manifold proportion, what is sufficient merely to equalize their advantages.

63:. Specifically, an industry is a natural monopoly if the total cost of one firm, producing the total output, is lower than the total cost of two or more firms producing the entire production. In that case, it is very probable that a company (

816:

1021:

Proposition: Global scale economies are sufficient but not necessary for (strict) ray subadditivity, the condition for natural monopoly in the production of a single product or in any bundle of outputs produced in fixed proportions.

384:

1917:

management where a monopoly's users or workers own the monopoly. For instance, the web's open-source architecture has both stimulated massive growth and avoided a single company controlling the entire market. The

375:

193:. Baumol also noted that for a firm producing a single product, scale economies were a sufficient condition but not a necessary condition to prove subadditivity, the argument can be illustrated as follows:

1206:

1340:

638:

1869:

for a product few can refuse. In general, though, regulation occurs when the government believes that the operator, left to his own devices, would behave in a way that is contrary to the

1297:

1004:

871:

1505:

268:

2028:, Book IV 'Influence of the progress of society on production and distribution', Chapter 2 'Influence of the Progress of Industry and Population on Values and Prices', para. 2

1894:. As a result, governments seeking funding began to seek other solutions, namely regulation and providing services on a commercial basis, often through private participation.

702:

1333:

1116:

1076:

1618:

1839:

carried on by a large capital, this in most countries limits so narrowly the class of persons who can enter into the employment, that they are enabled to keep their

952:

925:

898:

2306:

708:

137:

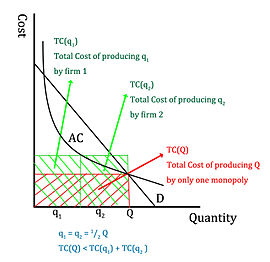

A graphical explanation of the inefficiencies of having several competitors in a naturally monopolistic market. AC = average cost (per customer), D = demand.

2163:

Saidu, Balkisu (8 May 2009). "Regulating the Abuse of the

Natural Monopoly of Pipelines in the Gas Industry vis-à-vis the Provision of Third Party Access".

59:

relative to the size of the market give the largest supplier in an industry, often the first supplier in a market, an overwhelming advantage over potential

559:{\displaystyle {\frac {C(\sum v_{j}y)}{\sum v_{j}}}<\sum {\frac {v_{i}}{\sum v_{j}}}{\frac {C(v_{i}y)}{v_{i}}}={\frac {\sum C(v_{i}y)}{\sum v_{j}}}}

1877:, a firm with a monopoly on the supply of water excessively increased water rates to fund a dam, leaving many unable to afford the essential good.

1535:

public market. However, natural monopolies are usually regulated and they face increasing competition from private networks and specialty carriers.

1897:

In recent years, bodies of information have observed the correlation between utility subsidies and welfare improvements. Today, across the world,

2277:

274:

130:

It is generally believed that there are two reasons for natural monopolies: one is economies of scale, and the other is economies of scope.

2375:

1919:

1796:

2236:

1122:

154:

invested) is divided among a larger number of customers. Therefore, in industries with large initial investment requirements,

2432:

2409:

2363:

2340:

2261:

2218:

1901:

are widely used to provide state-run water, electricity, gas, telecommunications, mass-transportation and postal services.

40:

1030:

On the other hand if firms produce many products scale economies are neither sufficient nor necessary for subadditivity:

651:

Proposition: Neither ray concavity nor ray average costs that decline everywhere are necessary for strict subadditivity.

2302:

196:

Proposition: Strict economies of scale are sufficient but not necessary for ray average cost to be strictly declining.

573:

2455:

1765:

2125:

2094:

2080:

2066:

2052:

2024:

1819:

1817:) believed that prices would reflect the costs of production in absence of an artificial or natural monopoly. In

1213:

71:) will form, providing all or most relevant products and/or services. This frequently occurs in industries where

1603:

960:

141:

All industries have costs associated with entering them. Often, a large portion of these costs is required for

2479:

1789:

1708:

823:

1456:

142:

88:

2373:

Filippini, Massimo (June 1998). "Are

Municipal Electricity Distribution Utilities Natural Monopolies?".

2197:

1637:

1572:

215:

2001:

Baumol, William J., 1977. "On the Proper Cost Tests for

Natural Monopoly in a Multiproduct Industry",

1446:{\displaystyle {\displaystyle {\begin{aligned}c(x)&=c(x^{1})+c(x^{2})+...+c(x^{k})\end{aligned}}}}

732:

667:

1874:

1782:

1081:

28:

2281:

2014:

W. J. Baumol, 1976. "Scale

Economies, Average Cost and the Profitability of Marginal-Cost Pricing"

2474:

1960:

1861:

at the request of a business hoping to enter a market otherwise dominated by a natural monopoly.

1049:

84:

1886:

1814:

1682:

1033:

Proposition: Strict concavity of a cost function is not sufficient to guarantee subadditivity.

75:

predominate, creating large economies of scale about the size of the market; examples include

2233:

1770:

1955:

1924:

1725:

1720:

1608:

930:

903:

876:

811:{\displaystyle C(y)={\begin{cases}c_{1},&y<y_{B}\\c_{2},&y>y_{B}\end{cases}}}

8:

1910:

19:

2098:, Book V, 'Of the Grounds and Limits of the Laisser-faire or Non-Interference Principle'

2444:

2421:

2352:

2180:

2145:

2126:"On the origins of the concept of natural monopoly: Economies of scale and competition"

2056:

Book II, Chapter XIV 'Of the

Differences of Wages in different Employments', para. 13-4

1989:

1744:

1666:

1525:

155:

36:

2451:

2428:

2405:

2398:

2359:

2336:

2257:

2214:

2184:

2149:

2038:

1852:

For a discussion of the historical origins of the term 'natural monopoly' see Mosca.

1730:

1715:

1598:

1586:

1310:

Proposition: Scale economies are neither necessary nor sufficient for subadditivity.

56:

2303:"What might a Coop Uber look like? (or should we be thinking bigger)? - Hello Ideas"

2384:

2172:

2137:

1898:

1810:

1739:

1693:

1689:

199:

Proposition: Strictly declining ray average cost implies strict ray subadditivity.

146:

100:

145:. Larger industries, like utilities, require an enormous initial investment. This

2240:

1970:

1931:

could be a driver-owned cooperative developing and sharing open-source software.

1870:

1698:

1677:

1623:

1547:

39:, one seller can serve the entire market at the downward-sloping section of its

1940:

1866:

1840:

1646:

1628:

182:

116:

104:

96:

80:

76:

2141:

2468:

1914:

1735:

1703:

186:

120:

2388:

1950:

1749:

1662:

1613:

72:

43:, meaning that it will have lower average costs than any potential entrant.

1909:

Alternatives to a state-owned response to natural monopolies include both

1809:

The development of the concept of natural monopoly is often attributed to

2176:

1672:

24:

1844:

exist. I have already mentioned the case of the gas and water companies.

158:

declines as output increases over a much larger range of output levels.

1965:

190:

124:

60:

32:

2254:

Water, Electricity, and the Poor: Who

Benefits from Utility Subsidies?

370:{\displaystyle C(\sum v_{j}y)/\sum v_{j}<C(\sum v_{i}y)/\sum v_{i}}

1651:

1581:

1555:

1529:

171:

68:

1891:

1885:

A wave of nationalisation across Europe after World War II created

1577:

1516:

133:

64:

52:

95:, etc. Natural monopolies were recognized as potential sources of

873:. The cost function is not concave, average cost increases after

2349:

1945:

1657:

55:

in an industry in which high infrastructural costs and other

2423:

Optimal regulation: the economic theory of natural monopoly

1992:, 2012. Microeconomics, Pearson Education, England, p. 394.

1928:

804:

92:

2350:

Baumol, William J.; Panzar, J. C.; Willig, R. D. (1982).

1313:

2354:

Contestable

Markets and the Theory of Industry Structure

1201:{\displaystyle C=y_{1}^{a}+y_{1}^{k}y_{2}^{k}+y_{2}^{a}}

2130:

The

European Journal of the History of Economic Thought

1009:

Therefore the cost function is strictly subadditivite.

642:

Therefore the cost function is strictly subadditivite.

103:

advocated government regulation to make them serve the

2333:

Natural Monopoly Regulation: Principles and Practices

1459:

1338:

1336:

1216:

1125:

1084:

1052:

963:

933:

906:

879:

826:

711:

670:

576:

387:

277:

218:

2330:

2443:

2420:

2397:

2351:

1499:

1445:

1291:

1200:

1110:

1070:

998:

946:

919:

892:

865:

810:

696:

632:

558:

369:

262:

2084:, Book II, Chapter XVI, "Of Rent", para. 2 and 16

270:, when ray average costs are strictly declining:

2466:

2278:"Publication: Platform Cooperativism Conference"

633:{\displaystyle C(\sum v_{j}y)<\sum C(v_{i}y)}

1006:total cost of production by more than one firm

2234:Body of Knowledge on Infrastructure Regulation

1790:

115:Two different types of cost are important in

1890:activities, or as a means of obtaining hard

957:total cost of any output y by a single firm

2446:Regulation of the Firm and Natural Monopoly

1292:{\displaystyle C(1,1)=3>C(1,0)+C(0,1)=2}

1210:C is strictly concave and not subbaditive:

2376:Annals of Public and Cooperative Economics

2070:Book II, Chapter XV, 'Of Profits', para. 9

1797:

1783:

2372:

2108:

1920:Depository Trust and Clearing Corporation

1904:

1758:Enforcement authorities and organizations

999:{\displaystyle \leq c_{2}<2c_{1}\leq }

2441:

132:

18:

2395:

2358:. New York: Harcourt Brace Jovanovich.

2331:Berg, Sanford; John Tschirhart (1988).

2211:Cochabamba! : water war in Bolivia

2208:

866:{\displaystyle y_{r}<y_{b}<y_{s}}

704:in the piecewise-linear cost function:

31:is a natural monopoly. Due to enormous

2467:

2111:Economics: A Contemporary Introduction

1500:{\displaystyle \sum _{i=1}^{k}x^{i}=x}

1314:Mathematical Notation of Subadditivity

1118:in the cost function for two outputs:

2418:

2227:

2213:. Cambridge, Mass.: South End Press.

2162:

2123:

2113:. Thomson South-Western. p. 319.

189:; specifically, subadditivity of the

2256:. Washington, DC: World Bank. 2005.

1025:

177:

900:and ray average cost is greater at

13:

2324:

1554:

1018:Combining all propositions gives:

67:) or minimal number of companies (

14:

2491:

2427:. Cambridge, MA, USA: MIT Press.

2243:"General Concepts: Introduction."

2165:The Journal of Structured Finance

1766:International Competition Network

263:{\displaystyle v_{1}y,...,v_{n}y}

2450:. New York, NY, USA: Blackwell.

2309:from the original on 2016-02-05

2295:

2270:

2246:

2202:

2191:

2156:

2117:

2101:

2095:Principles of Political Economy

2081:Principles of Political Economy

2067:Principles of Political Economy

2053:Principles of Political Economy

2025:Principles of Political Economy

1820:Principles of Political Economy

2404:. Cambridge University Press.

2400:The Theory of Natural Monopoly

2335:. Cambridge University Press.

2087:

2073:

2059:

2045:

2031:

2017:

2008:

1995:

1983:

1771:List of competition regulators

1434:

1421:

1400:

1387:

1378:

1365:

1352:

1346:

1280:

1268:

1259:

1247:

1232:

1220:

721:

715:

697:{\displaystyle c_{1}<c_{2}}

627:

611:

599:

580:

535:

519:

491:

475:

413:

394:

346:

327:

300:

281:

99:as early as the 19th century;

1:

2109:McEachern, Willam A. (2005).

1976:

1855:

1111:{\displaystyle 0<k<1/2}

110:

1880:

1037:

655:

203:

7:

1934:

1510:

1071:{\displaystyle 0<a<1}

10:

2496:

2442:Waterson, Michael (1988).

2419:Train, Kenneth E. (1991).

1813:, who (writing before the

1638:Anti-competitive practices

1604:Herfindahl–Hirschman index

1573:History of competition law

1539:

212:Consider n output vectors

2142:10.1080/09672560802037623

2042:(1776) Book I, Chapter 10

2003:American Economic Review

1913:licensed technology and

1875:2000 Cochabamba protests

29:electricity transmission

23:In small countries like

2389:10.1111/1467-8292.00077

2209:Olivera, Oscar (2004).

2124:Mosca, Manuela (2008).

1927:, where, for instance,

166:is a natural monopoly.

2107:On subways, see also,

1905:Alternative regulation

1846:

1831:

1815:marginalist revolution

1683:Occupational licensing

1559:

1501:

1480:

1447:

1293:

1202:

1112:

1072:

1000:

948:

921:

894:

867:

812:

698:

634:

560:

371:

264:

174:or monopoly develops.

138:

44:

1887:state-owned companies

1836:

1826:

1558:

1502:

1460:

1448:

1294:

1203:

1113:

1073:

1001:

949:

947:{\displaystyle y_{r}}

922:

920:{\displaystyle y_{s}}

895:

893:{\displaystyle y_{b}}

868:

813:

699:

635:

561:

372:

265:

136:

22:

2480:Monopoly (economics)

2396:Sharkey, W. (1982).

2177:10.3905/jsf.13.4.105

1956:Price-cap regulation

1925:platform cooperative

1726:Occupational closure

1721:Dividing territories

1709:Essential facilities

1609:Market concentration

1457:

1334:

1214:

1123:

1082:

1050:

961:

931:

904:

877:

824:

709:

668:

574:

385:

275:

216:

16:Concept in economics

1865:monopoly creates a

1197:

1179:

1164:

1146:

2239:2013-10-03 at the

1745:Regulatory capture

1560:

1526:Telecommunications

1497:

1443:

1441:

1439:

1289:

1198:

1183:

1165:

1150:

1132:

1108:

1068:

996:

944:

917:

890:

863:

808:

803:

694:

630:

556:

367:

260:

156:average total cost

139:

89:telecommunications

45:

41:average cost curve

2434:978-0-262-20084-4

2411:978-0-521-27194-3

2365:978-0-15-513910-7

2342:978-0-521-33893-6

2263:978-0-8213-6342-3

2220:978-0-896-08702-6

2039:Wealth of Nations

1807:

1806:

1736:Misuse of patents

1731:Predatory pricing

1716:Exclusive dealing

1599:Barriers to entry

1587:Coercive monopoly

1303:

1302:

1026:Multiproduct case

1014:

1013:

647:

646:

554:

505:

467:

432:

178:Formal definition

57:barriers to entry

2487:

2461:

2449:

2438:

2426:

2415:

2403:

2392:

2369:

2357:

2346:

2318:

2317:

2315:

2314:

2299:

2293:

2292:

2290:

2289:

2280:. Archived from

2274:

2268:

2267:

2250:

2244:

2231:

2225:

2224:

2206:

2200:

2198:Natural Monopoly

2195:

2189:

2188:

2160:

2154:

2153:

2121:

2115:

2114:

2105:

2099:

2091:

2085:

2077:

2071:

2063:

2057:

2049:

2043:

2035:

2029:

2021:

2015:

2012:

2006:

1999:

1993:

1987:

1899:public utilities

1811:John Stuart Mill

1799:

1792:

1785:

1690:Product bundling

1592:Natural monopoly

1544:

1543:

1506:

1504:

1503:

1498:

1490:

1489:

1479:

1474:

1452:

1450:

1449:

1444:

1442:

1440:

1433:

1432:

1399:

1398:

1377:

1376:

1318:A cost function

1298:

1296:

1295:

1290:

1207:

1205:

1204:

1199:

1196:

1191:

1178:

1173:

1163:

1158:

1145:

1140:

1117:

1115:

1114:

1109:

1104:

1077:

1075:

1074:

1069:

1038:

1005:

1003:

1002:

997:

992:

991:

976:

975:

953:

951:

950:

945:

943:

942:

926:

924:

923:

918:

916:

915:

899:

897:

896:

891:

889:

888:

872:

870:

869:

864:

862:

861:

849:

848:

836:

835:

817:

815:

814:

809:

807:

806:

800:

799:

779:

778:

765:

764:

744:

743:

703:

701:

700:

695:

693:

692:

680:

679:

656:

639:

637:

636:

631:

623:

622:

595:

594:

565:

563:

562:

557:

555:

553:

552:

551:

538:

531:

530:

511:

506:

504:

503:

494:

487:

486:

470:

468:

466:

465:

464:

451:

450:

441:

433:

431:

430:

429:

416:

409:

408:

389:

376:

374:

373:

368:

366:

365:

353:

342:

341:

320:

319:

307:

296:

295:

269:

267:

266:

261:

256:

255:

228:

227:

204:

170:industry and an

147:barrier to entry

101:John Stuart Mill

77:public utilities

49:natural monopoly

2495:

2494:

2490:

2489:

2488:

2486:

2485:

2484:

2465:

2464:

2458:

2435:

2412:

2366:

2343:

2327:

2325:Further reading

2322:

2321:

2312:

2310:

2301:

2300:

2296:

2287:

2285:

2276:

2275:

2271:

2264:

2252:

2251:

2247:

2241:Wayback Machine

2232:

2228:

2221:

2207:

2203:

2196:

2192:

2161:

2157:

2122:

2118:

2106:

2102:

2092:

2088:

2078:

2074:

2064:

2060:

2050:

2046:

2036:

2032:

2022:

2018:

2013:

2009:

2000:

1996:

1988:

1984:

1979:

1971:Standardization

1937:

1907:

1883:

1871:public interest

1858:

1803:

1699:Refusal to deal

1678:Tacit collusion

1624:Relevant market

1548:Competition law

1542:

1533:

1520:

1513:

1485:

1481:

1475:

1464:

1458:

1455:

1454:

1438:

1437:

1428:

1424:

1394:

1390:

1372:

1368:

1355:

1339:

1337:

1335:

1332:

1331:

1316:

1215:

1212:

1211:

1192:

1187:

1174:

1169:

1159:

1154:

1141:

1136:

1124:

1121:

1120:

1100:

1083:

1080:

1079:

1051:

1048:

1047:

1028:

987:

983:

971:

967:

962:

959:

958:

938:

934:

932:

929:

928:

911:

907:

905:

902:

901:

884:

880:

878:

875:

874:

857:

853:

844:

840:

831:

827:

825:

822:

821:

802:

801:

795:

791:

783:

774:

770:

767:

766:

760:

756:

748:

739:

735:

728:

727:

710:

707:

706:

688:

684:

675:

671:

669:

666:

665:

618:

614:

590:

586:

575:

572:

571:

547:

543:

539:

526:

522:

512:

510:

499:

495:

482:

478:

471:

469:

460:

456:

452:

446:

442:

440:

425:

421:

417:

404:

400:

390:

388:

386:

383:

382:

361:

357:

349:

337:

333:

315:

311:

303:

291:

287:

276:

273:

272:

251:

247:

223:

219:

217:

214:

213:

180:

113:

17:

12:

11:

5:

2493:

2483:

2482:

2477:

2475:Market failure

2463:

2462:

2456:

2439:

2433:

2416:

2410:

2393:

2370:

2364:

2347:

2341:

2326:

2323:

2320:

2319:

2294:

2269:

2262:

2245:

2226:

2219:

2201:

2190:

2171:(4): 105–112.

2155:

2136:(2): 317–353.

2116:

2100:

2086:

2072:

2058:

2044:

2030:

2016:

2007:

1994:

1981:

1980:

1978:

1975:

1974:

1973:

1968:

1963:

1958:

1953:

1948:

1943:

1941:Network effect

1936:

1933:

1906:

1903:

1882:

1879:

1867:captive market

1857:

1854:

1841:rate of profit

1805:

1804:

1802:

1801:

1794:

1787:

1779:

1776:

1775:

1774:

1773:

1768:

1760:

1759:

1755:

1754:

1753:

1752:

1747:

1742:

1733:

1728:

1723:

1718:

1713:

1712:

1711:

1706:

1696:

1687:

1686:

1685:

1680:

1675:

1670:

1660:

1649:

1647:Monopolization

1641:

1640:

1634:

1633:

1632:

1631:

1629:Merger control

1626:

1621:

1616:

1611:

1606:

1601:

1596:

1595:

1594:

1589:

1575:

1567:

1566:

1565:Basic concepts

1562:

1561:

1551:

1550:

1541:

1538:

1537:

1536:

1523:

1512:

1509:

1496:

1493:

1488:

1484:

1478:

1473:

1470:

1467:

1463:

1436:

1431:

1427:

1423:

1420:

1417:

1414:

1411:

1408:

1405:

1402:

1397:

1393:

1389:

1386:

1383:

1380:

1375:

1371:

1367:

1364:

1361:

1358:

1356:

1354:

1351:

1348:

1345:

1342:

1341:

1315:

1312:

1305:

1304:

1301:

1300:

1288:

1285:

1282:

1279:

1276:

1273:

1270:

1267:

1264:

1261:

1258:

1255:

1252:

1249:

1246:

1243:

1240:

1237:

1234:

1231:

1228:

1225:

1222:

1219:

1195:

1190:

1186:

1182:

1177:

1172:

1168:

1162:

1157:

1153:

1149:

1144:

1139:

1135:

1131:

1128:

1107:

1103:

1099:

1096:

1093:

1090:

1087:

1067:

1064:

1061:

1058:

1055:

1043:

1042:

1027:

1024:

1016:

1015:

1012:

1011:

995:

990:

986:

982:

979:

974:

970:

966:

941:

937:

914:

910:

887:

883:

860:

856:

852:

847:

843:

839:

834:

830:

805:

798:

794:

790:

787:

784:

782:

777:

773:

769:

768:

763:

759:

755:

752:

749:

747:

742:

738:

734:

733:

731:

726:

723:

720:

717:

714:

691:

687:

683:

678:

674:

661:

660:

649:

648:

645:

644:

629:

626:

621:

617:

613:

610:

607:

604:

601:

598:

593:

589:

585:

582:

579:

550:

546:

542:

537:

534:

529:

525:

521:

518:

515:

509:

502:

498:

493:

490:

485:

481:

477:

474:

463:

459:

455:

449:

445:

439:

436:

428:

424:

420:

415:

412:

407:

403:

399:

396:

393:

364:

360:

356:

352:

348:

345:

340:

336:

332:

329:

326:

323:

318:

314:

310:

306:

302:

299:

294:

290:

286:

283:

280:

259:

254:

250:

246:

243:

240:

237:

234:

231:

226:

222:

209:

208:

183:William Baumol

179:

176:

117:microeconomics

112:

109:

97:market failure

81:water services

15:

9:

6:

4:

3:

2:

2492:

2481:

2478:

2476:

2473:

2472:

2470:

2459:

2457:0-631-14007-7

2453:

2448:

2447:

2440:

2436:

2430:

2425:

2424:

2417:

2413:

2407:

2402:

2401:

2394:

2390:

2386:

2382:

2378:

2377:

2371:

2367:

2361:

2356:

2355:

2348:

2344:

2338:

2334:

2329:

2328:

2308:

2304:

2298:

2284:on 2016-02-05

2283:

2279:

2273:

2265:

2259:

2255:

2249:

2242:

2238:

2235:

2230:

2222:

2216:

2212:

2205:

2199:

2194:

2186:

2182:

2178:

2174:

2170:

2166:

2159:

2151:

2147:

2143:

2139:

2135:

2131:

2127:

2120:

2112:

2104:

2097:

2096:

2090:

2083:

2082:

2076:

2069:

2068:

2062:

2055:

2054:

2048:

2041:

2040:

2034:

2027:

2026:

2020:

2011:

2004:

1998:

1991:

1986:

1982:

1972:

1969:

1967:

1964:

1962:

1959:

1957:

1954:

1952:

1949:

1947:

1944:

1942:

1939:

1938:

1932:

1930:

1926:

1921:

1916:

1915:co-operatives

1912:

1902:

1900:

1895:

1893:

1888:

1878:

1876:

1872:

1868:

1862:

1853:

1850:

1845:

1842:

1835:

1830:

1825:

1822:

1821:

1816:

1812:

1800:

1795:

1793:

1788:

1786:

1781:

1780:

1778:

1777:

1772:

1769:

1767:

1764:

1763:

1762:

1761:

1757:

1756:

1751:

1748:

1746:

1743:

1741:

1737:

1734:

1732:

1729:

1727:

1724:

1722:

1719:

1717:

1714:

1710:

1707:

1705:

1704:Group boycott

1702:

1701:

1700:

1697:

1695:

1691:

1688:

1684:

1681:

1679:

1676:

1674:

1671:

1668:

1664:

1661:

1659:

1656:Formation of

1655:

1654:

1653:

1650:

1648:

1645:

1644:

1643:

1642:

1639:

1636:

1635:

1630:

1627:

1625:

1622:

1620:

1617:

1615:

1612:

1610:

1607:

1605:

1602:

1600:

1597:

1593:

1590:

1588:

1585:

1584:

1583:

1579:

1576:

1574:

1571:

1570:

1569:

1568:

1564:

1563:

1557:

1553:

1552:

1549:

1546:

1545:

1531:

1527:

1524:

1518:

1515:

1514:

1508:

1494:

1491:

1486:

1482:

1476:

1471:

1468:

1465:

1461:

1429:

1425:

1418:

1415:

1412:

1409:

1406:

1403:

1395:

1391:

1384:

1381:

1373:

1369:

1362:

1359:

1357:

1349:

1343:

1329:

1326:at an output

1325:

1321:

1311:

1308:

1299:

1286:

1283:

1277:

1274:

1271:

1265:

1262:

1256:

1253:

1250:

1244:

1241:

1238:

1235:

1229:

1226:

1223:

1217:

1208:

1193:

1188:

1184:

1180:

1175:

1170:

1166:

1160:

1155:

1151:

1147:

1142:

1137:

1133:

1129:

1126:

1105:

1101:

1097:

1094:

1091:

1088:

1085:

1065:

1062:

1059:

1056:

1053:

1045:

1044:

1040:

1039:

1036:

1035:

1034:

1031:

1023:

1019:

1010:

1007:

993:

988:

984:

980:

977:

972:

968:

964:

955:

939:

935:

912:

908:

885:

881:

858:

854:

850:

845:

841:

837:

832:

828:

818:

796:

792:

788:

785:

780:

775:

771:

761:

757:

753:

750:

745:

740:

736:

729:

724:

718:

712:

689:

685:

681:

676:

672:

663:

662:

658:

657:

654:

653:

652:

643:

640:

624:

619:

615:

608:

605:

602:

596:

591:

587:

583:

577:

569:

568:Which gives:

566:

548:

544:

540:

532:

527:

523:

516:

513:

507:

500:

496:

488:

483:

479:

472:

461:

457:

453:

447:

443:

437:

434:

426:

422:

418:

410:

405:

401:

397:

391:

380:

377:

362:

358:

354:

350:

343:

338:

334:

330:

324:

321:

316:

312:

308:

304:

297:

292:

288:

284:

278:

257:

252:

248:

244:

241:

238:

235:

232:

229:

224:

220:

211:

210:

206:

205:

202:

201:

200:

197:

194:

192:

191:cost function

188:

187:subadditivity

184:

175:

173:

167:

163:

159:

157:

151:

148:

144:

135:

131:

128:

126:

122:

121:marginal cost

118:

108:

106:

102:

98:

94:

90:

86:

82:

78:

74:

73:capital costs

70:

66:

62:

58:

54:

50:

42:

38:

34:

30:

26:

21:

2445:

2422:

2399:

2380:

2374:

2353:

2332:

2311:. Retrieved

2297:

2286:. Retrieved

2282:the original

2272:

2253:

2248:

2229:

2210:

2204:

2193:

2168:

2164:

2158:

2133:

2129:

2119:

2110:

2103:

2093:

2089:

2079:

2075:

2065:

2061:

2051:

2047:

2037:

2033:

2023:

2019:

2010:

2002:

1997:

1985:

1951:Market forms

1908:

1896:

1884:

1863:

1859:

1851:

1847:

1837:

1832:

1827:

1818:

1808:

1750:Rent-seeking

1663:Price fixing

1614:Market power

1591:

1327:

1323:

1319:

1317:

1309:

1306:

1209:

1119:

1032:

1029:

1020:

1017:

1008:

956:

819:

705:

650:

641:

570:

567:

381:

378:

271:

198:

195:

181:

168:

164:

160:

152:

140:

129:

114:

48:

46:

2005:67, 809–22.

1961:Public good

1911:open source

1673:Bid rigging

1453:such that

1324:subadditive

1307:Therefore:

379:Therefore:

105:public good

85:electricity

61:competitors

37:market size

33:fixed costs

25:New Zealand

2469:Categories

2383:(2): 157.

2313:2016-01-30

2288:2016-01-30

1990:Perloff, J

1977:References

1966:Quasi-rent

1856:Regulation

1740:copyrights

1619:SSNIP test

143:investment

125:fixed cost

111:Definition

35:and small

2185:153866300

2150:154480729

1652:Collusion

1582:oligopoly

1530:Utilities

1462:∑

994:≤

965:≤

606:∑

584:∑

541:∑

514:∑

454:∑

438:∑

419:∑

398:∑

355:∑

331:∑

309:∑

285:∑

172:oligopoly

69:oligopoly

2307:Archived

2237:Archived

1935:See also

1892:currency

1578:Monopoly

1517:Railways

1511:Examples

954:. Also:

79:such as

65:monopoly

53:monopoly

1881:History

1658:cartels

1540:History

2454:

2431:

2408:

2362:

2339:

2260:

2217:

2183:

2148:

1946:LoopCo

1522:scale.

1041:Proof

659:Proof

207:Proof

2181:S2CID

2146:S2CID

1694:tying

1667:cases

927:than

51:is a

2452:ISBN

2429:ISBN

2406:ISBN

2360:ISBN

2337:ISBN

2258:ISBN

2215:ISBN

1929:Uber

1738:and

1692:and

1580:and

1528:and

1242:>

1095:<

1089:<

1078:and

1063:<

1057:<

1046:Let

978:<

851:<

838:<

820:Let

789:>

754:<

682:<

664:Let

603:<

435:<

322:<

123:and

93:mail

2385:doi

2173:doi

2138:doi

1330:if

1322:is

2471::

2381:69

2379:.

2305:.

2179:.

2169:13

2167:.

2144:.

2134:15

2132:.

2128:.

119::

107:.

91:,

87:,

83:,

47:A

27:,

2460:.

2437:.

2414:.

2391:.

2387::

2368:.

2345:.

2316:.

2291:.

2266:.

2223:.

2187:.

2175::

2152:.

2140::

1798:e

1791:t

1784:v

1669:)

1665:(

1532::

1519::

1495:x

1492:=

1487:i

1483:x

1477:k

1472:1

1469:=

1466:i

1435:)

1430:k

1426:x

1422:(

1419:c

1416:+

1413:.

1410:.

1407:.

1404:+

1401:)

1396:2

1392:x

1388:(

1385:c

1382:+

1379:)

1374:1

1370:x

1366:(

1363:c

1360:=

1353:)

1350:x

1347:(

1344:c

1328:x

1320:c

1287:2

1284:=

1281:)

1278:1

1275:,

1272:0

1269:(

1266:C

1263:+

1260:)

1257:0

1254:,

1251:1

1248:(

1245:C

1239:3

1236:=

1233:)

1230:1

1227:,

1224:1

1221:(

1218:C

1194:a

1189:2

1185:y

1181:+

1176:k

1171:2

1167:y

1161:k

1156:1

1152:y

1148:+

1143:a

1138:1

1134:y

1130:=

1127:C

1106:2

1102:/

1098:1

1092:k

1086:0

1066:1

1060:a

1054:0

989:1

985:c

981:2

973:2

969:c

940:r

936:y

913:s

909:y

886:b

882:y

859:s

855:y

846:b

842:y

833:r

829:y

797:B

793:y

786:y

781:,

776:2

772:c

762:B

758:y

751:y

746:,

741:1

737:c

730:{

725:=

722:)

719:y

716:(

713:C

690:2

686:c

677:1

673:c

628:)

625:y

620:i

616:v

612:(

609:C

600:)

597:y

592:j

588:v

581:(

578:C

549:j

545:v

536:)

533:y

528:i

524:v

520:(

517:C

508:=

501:i

497:v

492:)

489:y

484:i

480:v

476:(

473:C

462:j

458:v

448:i

444:v

427:j

423:v

414:)

411:y

406:j

402:v

395:(

392:C

363:i

359:v

351:/

347:)

344:y

339:i

335:v

328:(

325:C

317:j

313:v

305:/

301:)

298:y

293:j

289:v

282:(

279:C

258:y

253:n

249:v

245:,

242:.

239:.

236:.

233:,

230:y

225:1

221:v

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.