272:, pinched myself a couple of times and took stock and inventory, I thought of the old adage, "Fools rush in where angels fear to tread," and some of you now who look upon me as the Tax Collector of the Province, probably use language in speaking of my methods of collection which I couldn't repeat before this august and important assembly. That is my responsibility, to meet the obligations of the Province of Ontario, to protect the interests of the Province of Ontario: That is what I am trying to do.

241:

1469:

1452:

1442:

1420:

1402:

1385:

1375:

1360:

1350:

1331:

1314:

1297:

1287:

1272:

1251:

1234:

1217:

1207:

1184:

1174:

1155:

1136:

1121:

1111:

1091:

1081:

1061:

1051:

1034:

756:

731:

721:

701:

691:

671:

661:

586:

576:

566:

551:

541:

531:

521:

511:

501:

491:

481:

471:

456:

446:

436:

426:

416:

406:

396:

386:

376:

979:

to hard work and initiative. It is reasonable and just that one should be able to provide something for his wife and children, and others, after his death. It is also reasonable and just, however, that the state should share in what one leaves, at a rate dependent upon the amount of wealth being transferred. Indeed, I find this view so generally held in this country that it is not necessary to do more than call it to mind.

948:

230:

1501:

would otherwise be applicable. It is particularly expedient to introduce this measure at this time in view of the higher rates of taxation provided for in the new surtax on investment income. Not only should this tax put our income tax structure on a more secure foundation but it should operate in a like manner with regard to succession and inheritance taxes levied by the provinces.

931:

921:

911:

901:

891:

881:

871:

861:

851:

836:

826:

816:

806:

796:

786:

776:

766:

741:

711:

681:

646:

636:

626:

616:

606:

596:

268:? Bless his heart, he is a great fellow! He is a very astute man. You know he was the luckiest Premier this Province ever had. He blamed the debts which he inherited on his predecessors, he added to them and then handed them on to me. I have to meet the obligations which were handed down to me, and after I sat in his chair in

978:

Death duties, in general, are a very good type of tax, second only to income tax in their essential fairness and the possibilities of adjusting them progressively to ability to pay. They are even better than income tax in so far as they do not have as much tendency to reduce an individual's incentive

263:

That right of succession duties was conferred upon the provinces, and the drive today, emanating from the other provinces is to get control of succession duties and place all collections under the jurisdiction of the

Federal Government. If that were to happen, I can tell you, Gentlemen, I would have

298:

Duty cannot be charged where property is left outside the province to beneficiaries who are neither resident nor domiciled in the province. Taken as a whole, chargeability to succession duty depended upon whether the donor's domicile, the donee's residence, as well as the donee's status at the date

1597:

by parliamentary committees, he announced that, as "it is no longer possible to establish a uniform national system of death duties through federal legislation," the federal government would vacate the estate and gift tax field on

December 31, 1971. At that time, only British Columbia, Ontario and

282:

within the duty's scope. Hepburn consequently ordered that all files relating to estates worth $ 500,000 or more, together with those of smaller estates where evasion was suspected, were to be reopened, with the expectation of raising further duties anywhere from $ 70 million to $ 100 million. The

1500:

This form of tax, adopted by many countries, is being imposed primarily to operate as a deterrent to transfers of property as a gift, chiefly within family groups which would have the effect of reducing personal income to lower brackets and thus securing income tax assessments at rates lower than

44:

where the deceased person was at the time of his death domiciled in the

Province, and where the property of the deceased comprises any personal property situate without the Province in respect of which any beneficial interest passes under the law of the Province to a person who is domiciled or

1028:

every succession, being every past or future disposition of property by which another person obtains the beneficial interest in property or the income thereof, either immediately or after any interval, certainly or contingently, originally or by way of substantive limitation, including those

2199:

in addition to the requirement to pay a deposit on tax that was already in place in order to receive an estate certificate, an estate representative must file an estate information return within 90 days of the date the certificate was issued, together with any balance of tax still

2193:. The provincial 2011 budget speech stated that there was still a compliance problem with respect to the Estate Administration Tax, and it accordingly passed amending legislation that year, coming into effect on January 1, 2015, which provided for the following changes:

1524:

several classes of gifts or donations were exempt from tax: those in any year that totalled $ 4000 or less; those taking effect upon death; those made to charitable or educational institutions, Canada or any province, and certain ones not recognized for income tax

283:

collection tactics employed included the seizure of books and records without a warrant, different methods for valuing assets, and the assessment of penalties that could amount to double or triple the amount of the duty involved.

1566:

In

Ontario and Quebec, the federal government collected estate taxes at only 50% of the full rate, and remitted 50% of such collections to such provinces, and the provinces continued to levy their own succession

1557:

In

Newfoundland, Prince Edward Island, Nova Scotia, New Brunswick and Manitoba, the federal government collected estate taxes at full rates, but remitted 75% of the revenues derived from each of those provinces;

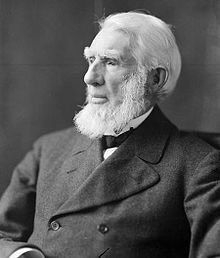

259:, adopted a more aggressive approach in their collection on large estates, which resulted in millions of dollars in extra government revenues. He made no apologies for doing so, as he noted in a speech in 1938:

1412:

that is the subject matter of a transfer, agreement or settlement made at any time in consideration of marriage, where any interest for life or otherwise is reserved either expressly or by implication to the

41:

property of a deceased situate outside the

Province at the time of the death of the deceased, and the beneficiary of any of the property of the deceased was a resident at the time of the death of the deceased

1521:

it applied "whether the transfer is in trust or otherwise, or direct or indirect, or whether the property is real or personal, tangible or intangible, and shall extend to gifts made by personal corporations"

2415:

Canadian gift tax guide: a commentary on taxability of gifts under the Income tax act, Estate tax act, the

Succession duty acts of British Columbia, Ontario and Quebec, and Sales and Use tax statutes

1560:

In

Alberta and Saskatchewan, the federal government collected estate taxes at full rates, but remitted 75% of the revenues derived from each of those provinces, which was rebated back to the estate;

38:

property of a deceased person, whether he was at the time of his death domiciled in the

Province or domiciled elsewhere, situate within the Province passing to any person for any beneficial interest

290:, who had died in 1925. Although succession duties of $ 4.28 million were paid in 1927, Hepburn subsequently claimed more in 1937. Booth's heirs eventually paid another $ 3 million in 1939.

1982:, which included liability arising from the "deemed disposition" of assets. Liability will arise from gifts from, and the death of, the taxpayer, as well in the following circumstances:

2207:

discloses any property that was not previously disclosed on the estate information return, the estate representative must file an amended return within 30 days of the statement date

1395:

agreed to be transferred to or settled upon any person, within three years preceding death, in consideration of marriage, to the extent that it was actually transferred or settled

1244:

disposed under an arrangement with another person (other than a financial institution) to purchase an annuity, whether for life or for any other period in reference to death

2701:

2222:

The changes have been viewed as "put undue pressure on executors—often family members—faced with balancing their grief with trying to make the

Finance Ministry happy."

1598:

Quebec were still levying duties of their own. Most of the other provinces revived their succession duties, and also started levying gift taxes, on January 1, 1972.

276:

In 1937, legislation was passed that allowed for reexamination of estates for deaths that had occurred back to the beginning of 1916, and also included many gifts

2645:

1324:

disposed of by any person on or after death of the deceased, whether voluntarily in recognition of employment service, or otherwise under any other agreement

2729:

2673:

1563:

In British Columbia, the federal government collected estate taxes at only 25% of the full rate, and the province continued to levy its own succession duty;

958:

Death taxes, which were not subject to the territorial limitations that affected provincial taxation, were first introduced at the federal level under the

1528:

where a gift is made to a minor aged 13 to 18 years, liability for tax will not arise until the 19th birthday, provided that the donor has supplied a

221:

arose from liability to duty in different provinces, as well as other jurisdictions abroad, which were dealt with inconsistently among the provinces.

3166:

3220:

105:

89:

2078:

An Act to Amend Chapter 104 of the Revised Statutes, 1989, the Costs and Fees Act, and Chapter 359 of the Revised Statutes, 1989, the Probate Act

2125:

998:

The succession duty focused on the succession being transferred, as opposed to the estate itself, which made it similar in scope to the UK's

2021:

declared that the method by which it was introduced was unconstitutional, as its basis had not been the subject of appropriate legislation.

299:

of the deceased's death and the date of the disposition of the estate. In 1967, Ontario published a table outlining the various effects:

1282:

any annuity or other interest, to the extent that the beneficial interest passes by survivorship or otherwise upon death of the deceased

2784:

2764:

2017:

to ones based on the value of the estate. In 1992, Ontario introduced fees at a level higher than in any other province. The

1581:

on tax reform was issued in 1969, his original intention was to retain estate and gift taxes in conjunction with introducing

1978:

Upon the repeal of the federal estate and gift taxes on January 1, 1972, the income tax régime was altered to provide for a

3280:

3275:

2558:

2331:

1954:

3255:

2216:

there is no procedure for the estate to receive a clearance certificate with respect to closing off any further liability

1345:, whether held (either alone, jointly or in common) by the deceased, or a trust or corporation controlled by the deceased

1994:

a trust for a taxpayer's spouse or common-law partner, when that beneficiary dies, or on the 21st anniversary of a trust

2375:

2403:

1877:

1462:

any disposition within three years preceding death in consideration of the release of any right in dower or curtesy

34:

duties have been held to be valid "direct taxation within the province," and can apply in the following scenarios:

1820:

1641:

2256:

1005:

2528:

2273:

121:

2882:

2828:

1535:

the donor is liable to pay the tax, otherwise there is joint and several liability by both the donor and donee

3148:

3135:

2959:

2493:

2109:

2044:

1518:

it applied to any property (whether situated inside or outside Canada) transferred by way of gift or donation

3270:

1370:

transferred to or settled upon any person, within three years preceding death, in consideration of marriage

1551:

From 1947 to 1971, there was a complicated set of federal-provincial revenue-sharing arrangements, where:

3245:

2371:

2287:

167:

1941:

1719:

2311:

1930:

141:

73:

2809:

2627:

2391:

2093:

2905:

2851:

2172:

2010:

269:

3087:

2350:

1703:

3260:

2563:

2336:

1855:

1844:

1831:

1657:

1000:

3105:

1011:

At the introduction of each tax, the property that was subject to each was identified as follows:

3250:

3069:

3051:

3033:

2497:

2302:

2018:

2077:

2189:

Ontario already had the highest rates relating to probate taxes, but is still faced with large

1759:

These taxes were seen to have died out because of their relative unattractiveness, as noted by

20:

3265:

2606:

2141:

1673:

1342:

207:

1773:

the taxes lead to an avoidance industry, often including shifting assets out of the province

1505:

As a consequence, it was imposed by the Parliament of Canada later that year as part of the

1073:

971:

951:

287:

256:

244:

2945:

2543:

2210:

the Minister of Finance has similar powers to examine the information as he has under the

1307:

any superannuation, pension or death benefit that arises on or after death of the deceased

183:

8:

2780:

2760:

1590:

1493:

1199:

2142:

An Act to Amend the Personal Property Security Act, the Probate Act and the Registry Act

2024:

As a result, the provinces passed legislation to legitimate the fees already in effect:

3110:

3092:

3074:

3056:

3038:

2910:

2856:

2814:

2678:

2584:

2061:

1973:

1166:

2419:

2399:

2239:

1979:

1582:

1262:

49:

Succession duties came into effect in the various provinces at the following times:

3225:

2706:

1770:

its complexity makes the taxes costly to administer, relative to the amounts raised

1749:

1642:

An Act to Amend Chapter 17 of the Acts of 1972, An Act respecting Succession Duties

264:

to impose some new taxes upon you, because I inherited a debt. You know my friend,

252:

233:

2000:

1919:

An Act to Amend The Gift Tax Act (Manitoba) and The Succession Duty Act (Manitoba)

2413:

2234:

1586:

988:

963:

265:

218:

3202:

2600:

1492:'s New Deal in 1935. It was framed as an antiavoidance measure, as explained by

2734:

2650:

2190:

2156:

1546:

1046:

all of which the deceased was competent to dispose, immediately prior to death

3239:

3186:

2423:

2005:

The provinces have moved in recent years to convert fees for the granting of

1832:

An Act to Amend Chapter 9 of the Acts of 1972, An Act to Provide for Gift Tax

1733:

1594:

1195:

23:. They are beginning to see a return to prominence in the provincial sphere.

2777:

The Provincial Treasurer of Alberta and another v Clara E. Kerr and another

2269:

2252:

1574:

1489:

1148:

disposed within three years preceding death, either to a trust or as a gift

974:

explained why the federal government was entering in this area of revenue:

1578:

1529:

1103:

1004:. The estate tax, in comparison, was modelled more along the line of the

278:

31:

947:

1760:

240:

90:

An Act respecting duties on successions and on transfers of real estate

2014:

1227:

disposed within three years preceding death for partial consideration

286:

One estate of particular focus in this campaign was that of the late

2559:"International and Interprovincial Death Duty and Gift Tax Problems"

2161:, S.N.B. c. P-17.1, s. 75.1, as inserted by S.N.B. 1999, c. 29, s. 5

1974:

Conversion to deemed dispositions for capital gains tax (after 1971)

751:

Personal property outside Ontario (disposition made outside Ontario)

1485:

2890:

2836:

2827:

James Lorimer Ilsley, Minister of Finance (April 29, 1941).

2006:

1435:

2881:

Edgar Nelson Rhodes, Minister of Finance (March 22, 1935).

2471:

a term that covers letters probate and letters of administration

229:

2490:

Attorney General of British Columbia v. Canada Trust Co. et al.

2288:"Death Taxes in Canada, in the Past and in the Possible Future"

2001:

Recent conversion of provincial probate fees into probate taxes

970:) in 1941, In his Budget speech that year, Minister of Finance

656:

Personal property outside Ontario (disposition made in Ontario)

561:

Personal property in Ontario (disposition made outside Ontario)

1431:

2925:

1601:

1131:

taken as a gift, whenever made, with reservation of benefits

2966:

2763:, AC 176; (1913), 15 DLR 283 (PC) (11 November 1913),

2462:

with the exception of Quebec, which never had such a regime

2389:

1547:

Federal-provincial revenue-sharing arrangements (1947-1971)

466:

Personal property in Ontario (disposition made in Ontario)

2510:

2508:

2506:

1965:

An Act to amend various fiscal laws and other legislation

1750:

An Act to amend various fiscal laws and other legislation

251:

Ontario was especially notable in its pursuit of duties.

3014:

3002:

2418:(2nd ed.). Don Mills: CCH Canadian Limited. 1968.

2184:

1606:

Succession duties continued until the following dates:

2503:

1198:

with one or more other persons, to the extent of the

2978:

2826:

2790:

2496: at pp. 485–486, 2 SCR 466 (27 June 1980),

293:

2990:

2880:

2862:

2444:

the last class of exempt gifts was repealed in 1941

1777:

1734:

Ontario Tax Plan for More Jobs and Growth Act, 2009

1541:

2351:"28. The Taxation of Wealth: Death and Gift Taxes"

1782:Gift taxes were levied until the following dates:

995:) in 1958, which was repealed at the end of 1971.

3221:"Ontario government wants estate tax paid sooner"

3203:Information required under section 4.1 of the Act

3167:"Changes for Ontario's Estate Administration Tax"

2639:

2637:

2173:The Administration of Estates Amendment Act, 1999

3237:

2598:

2582:"Mitchell F. Hepburn, Ontario ex-premier dies".

2922:IWTA, s. 88 (as inserted by the 1935 amendment)

2840:. Canada: House of Commons. pp. 2349–2350.

993:Loi de l'impôt sur les biens transmis par décès

236:, Premier and Treasurer of Ontario in the 1930s

26:

3214:

3212:

2783:, AC 710; 4 DLR 81 (PC) (27 July 1933),

2730:"Ottawa Estates Pay Additional Duties to Govt"

2634:

2398:. Toronto: Queen's Printer. pp. 360–393.

3160:

3158:

247:, whose estate was Hepburn's principal target

3149:Tax Credits and Revenue Protection Act, 1998

1729:Succession Duty Legislation Repeal Act, 2009

3209:

2960:Dominion Succession Duty (1957) Regulations

2355:Report of the Ontario Committee on Taxation

2145:, S.P.E.I. 1999 (2nd session), c. 17, s. 2

1767:effective legislation is difficult to draft

323:At date of death and at date of disposition

318:Deceased not domiciled in Ontario at death

3155:

2383:Report of the Royal Commission on Taxation

139:, S.M. 1893, c. 31, later consolidated as

2894:. Canada: House of Commons. p. 1986.

2643:

1602:Provincial succession duties (after 1971)

2757:Charles S. Cotton and another v The King

2312:"Eurig Estate: Another Day, Another Tax"

2062:The Law Fees Amendment and Consequential

968:Loi fédérale sur les droits successoraux

946:

239:

228:

224:

3219:Brennan, Richard (September 24, 2015).

3218:

3020:

3008:

2931:

2628:The Succession Duty Amendment Act, 1937

2556:

2514:

2309:

2285:

942:

3238:

3164:

2984:

2972:

2906:An Act to amend the Income War Tax Act

2599:Mitchell Hepburn (December 15, 1938).

2370:

2275:Summary of 1971 Tax Reform Legislation

2268:

2251:

2126:Government Fees and Charges Review Act

1658:The Succession Duty (Repeal) Act, 1974

187:, N.W.T.Ord. 1903 (2nd Session), c. 5

19:have a complex history dating back to

2868:

2796:

2348:

2329:

2281:. Ottawa: Queen's Printer for Canada.

2264:. Ottawa: Queen's Printer for Canada.

317:

3095:1985 (5th Supp.), c. 1, s. 128.1(1)

2996:

2644:McEachern, R.A. (January 22, 1938).

2390:Ontario Fair Tax Commission (1993).

2232:

2185:Expansion of scope in Ontario (2015)

1720:The Succession Duty Repeal Act, 1979

1689:The Succession Duty Repeal Act, 1977

303:Treatment of dispositions under the

17:Inheritance and gift taxes in Canada

2376:"17: Gifts, including inheritances"

2046:Estate Administration Tax Act, 1998

1585:, with appropriate relief to avoid

13:

3138:, 2 SCR 565 (22 October 1998)

3113:1985 (5th Supp.), c. 1, s. 104(4)

2702:"Ontario Assembly Prorogues Today"

2646:"Ontario's Death Duty Inquisition"

2363:

2357:. Vol. III. pp. 131–208.

2203:where a later statement under the

2081:, S.N.S. 1999 (2nd session), c. 1

1991:the taxpayer emigrates from Canada

14:

3292:

3077:1985 (5th Supp.), c. 1, s. 45(1)

3059:1985 (5th Supp.), c. 1, s. 70(5)

3041:1985 (5th Supp.), c. 1, s. 69(1)

2588:. January 5, 1953. pp. 1, 3.

2396:Fair taxation in a changing world

1988:the use of a property has changed

366:Not resident in Ontario at death

360:Resident in Ontario at both dates

351:Resident in Ontario at both dates

342:Resident in Ontario at both dates

294:Where succession duty could apply

211:, S.N. 1914 (war session), c. 11

3165:Dollar, Stuart L. (April 2014).

2810:The Dominion Succession Duty Act

2385:. Vol. 3. pp. 465–519.

1921:, S.M. 1977 (2nd session), c. 2

1778:Provincial gift tax (after 1971)

1542:Post-war involvement in revenues

1467:

1450:

1440:

1418:

1400:

1383:

1373:

1358:

1348:

1329:

1312:

1295:

1285:

1270:

1249:

1232:

1215:

1205:

1182:

1172:

1153:

1134:

1119:

1109:

1089:

1079:

1059:

1049:

1032:

929:

919:

909:

899:

889:

879:

869:

859:

849:

834:

824:

814:

804:

794:

784:

774:

764:

754:

739:

729:

719:

709:

699:

689:

679:

669:

659:

644:

634:

624:

614:

604:

594:

584:

574:

564:

549:

539:

529:

519:

509:

499:

489:

479:

469:

454:

444:

434:

424:

414:

404:

394:

384:

374:

357:Not resident in Ontario at death

348:Not resident in Ontario at death

3195:

3188:Better Tomorrow for Ontario Act

3180:

3141:

3125:

3116:

3098:

3080:

3062:

3044:

3026:

2952:

2937:

2916:

2898:

2891:Parliamentary Debates (Hansard)

2874:

2844:

2837:Parliamentary Debates (Hansard)

2820:

2802:

2770:

2750:

2722:

2694:

2666:

2465:

2456:

2447:

2438:

1856:The Gift Tax (Repeal) Act, 1974

1704:The Regulatory Reform Act, 1992

1532:securing the payment of the tax

1512:The tax was wide in its scope:

3192:, S.O. 2011, c. 9, Schedule 14

2620:

2592:

2575:

2550:

2535:

2520:

2483:

1958:, S.Q. 1972, c. 23, Part VIII

1821:An Act to Provide for Gift Tax

1496:in that year's Budget speech:

1101:disposed as an immediate gift

1029:operating by devolution of law

363:Resident at date of death only

354:Resident at date of death only

345:Resident at date of death only

1:

2787: (on appeal from Alberta)

2477:

2148:Whenever the charge was made

2132:Whenever the charge was made

2116:Whenever the charge was made

2113:, S.N. 1998, c. S-13.2, s. 6

1942:The Gift Tax Repeal Act, 1979

1899:The Gift Tax Repeal Act, 1977

1878:The Gift Tax Repeal Act, 1972

1677:, S.M. 1988-89, c. 42, s. 78

983:It was later replaced by the

954:, Minister of Finance in 1941

846:Real property outside Ontario

315:Deceased domiciled in Ontario

122:The Succession Duty Act, 1892

106:The Succession Duty Act, 1892

74:The Succession Duty Act, 1892

2767: (on appeal from Canada)

2049:, S.O. 1998, c. 34, Schedule

960:Dominion Succession Duty Act

27:Provincial succession duties

7:

3281:Financial history of Canada

3276:Taxation and redistribution

3152:, S.O. 1998, c. 34, Part V

2349:Smith, Lancelot J. (1967).

2235:"Wills and Estate Planning"

1967:, S.Q. 1986, c. 15, s. 208

1737:, S.O. 2009, c. 34, Sch. T

1480:

1341:any amount payable under a

10:

3297:

3256:Wills and trusts in Canada

2674:"Claims Booth Duties Paid"

2557:Goodman, Wolfe D. (1974).

2286:Goodman, Wolfe D. (1995).

2225:

1488:was introduced as part of

2946:The Estate Tax Rebate Act

2129:, S.A. 1999, c. G8, s. 2

2033:Retrospective legislation

2011:letters of administration

1787:

1753:, S.Q. 1986, c. 15, s. 4

1714:

1711:

336:

333:

330:

325:

322:

314:

312:Property at date of death

311:

217:Many incidents involving

184:Succession Duty Ordinance

181:

168:Succession Duty Act, 1894

142:The Succession Duties Act

137:The Succession Duties Act

2564:Osgoode Hall Law Journal

2432:

2392:"19: Taxation of Wealth"

2337:Osgoode Hall Law Journal

2258:Proposals for tax reform

1001:Succession Duty Act 1853

371:Real property in Ontario

45:resident in the Province

3190:(Budget Measures), 2011

2529:The Succession Duty Act

2303:Canadian Tax Foundation

2019:Supreme Court of Canada

1674:The Succession Duty Act

2781:[1933] UKPC 57

2761:[1913] UKPC 56

2541:until replaced by the

2526:until consolidated as

2310:LeBreux, Paul (1999).

1931:The Gift Tax Act, 1972

1890:The Gift Tax Act, 1972

1881:, S.S. 1976-77, c. 27

1868:The Gift Tax Act, 1972

1845:The Gift Tax Act, 1972

1503:

1261:disposed at less than

992:

981:

967:

955:

326:At date of death only

274:

248:

237:

145:, R.S.M. 1902, c. 161

21:Canadian Confederation

3176:. Sun Life Financial.

2934:, pp. 1365–1366.

2607:Empire Club of Canada

2544:Succession Duties Act

2532:, R.S.S. 1909, c. 38

2330:Pozer, David (1959).

2233:Bale, Gordon (1972).

1691:, S.B.C. 1977, c. 20

1645:, S.N.S. 1974, c. 30

1498:

1343:life insurance policy

976:

950:

261:

255:, in his capacity as

243:

232:

225:Collection in Ontario

171:, S.B.C. 1894, c. 47

150:Prince Edward Island

2943:in Alberta, through

2738:. September 23, 1939

2682:. September 18, 1937

2602:Present Day Problems

2332:"The New Estate Tax"

2319:Canadian Tax Journal

2295:Canadian Tax Journal

2212:Retail Sales Tax Act

2137:Prince Edward Island

2110:Services Charges Act

2097:, S.B.C. 1999, c. 4

1901:, S.B.C. 1977 c. 15

1824:, S.N.S. 1972, c. 9

1731:, as enacted by the

1591:public consultations

1074:donatio mortis causa

972:James Lorimer Ilsley

952:James Lorimer Ilsley

943:Federal estate taxes

288:John Rudolphus Booth

257:Treasurer of Ontario

245:John Rudolphus Booth

125:, S.N.S. 1892, c. 6

109:, S.N.B. 1892, c. 6

3271:History of taxation

2949:, S.A. 1967, c. 18

2913:1935, c. 40, s. 14

2065:, S.M. 1999, c. 11

1945:, S.O. 1979, c. 21

1934:, S.O. 1972, c. 12

1912:, S.M. 1972, c. 10

1892:, S.B.C. 1972 c. 23

1859:, S.N. 1974, c. 75

1848:, S.N. 1972, c. 39

1835:, S.N. 1974, c. 75

1723:, S.O. 1979, c. 20

1707:, S.S. 1992, c. 11

1661:, S.N. 1974, c. 76

1494:Edgar Nelson Rhodes

1200:beneficial interest

308:

305:Succession Duty Act

93:, S.Q. 1892, c. 18

3246:Taxation in Canada

2710:. December 3, 1937

2679:Regina Leader-Post

2631:, S.O. 1937, c. 3

2585:Toronto Daily Star

2547:, S.A. 1914, c. 5

2176:, S.S. 1999, c. 2

1805:, S.N.B. 1972, c.9

1803:Gift Tax Act, 1972

1593:were held through

1507:Income War Tax Act

956:

302:

249:

238:

77:, S.O. 1892, c. 6

3206:, O. Reg. 310/14

2240:Ottawa Law Review

2182:

2181:

2158:Probate Court Act

1980:capital gains tax

1971:

1970:

1870:, S.S. 1972 c. 48

1811:S.N.B. 1991, c.5

1757:

1756:

1682:British Columbia

1629:S.N.B. 1991, c.6

1583:capital gains tax

1478:

1477:

1263:fair market value

940:

939:

215:

214:

160:British Columbia

61:Introductory Act

3288:

3231:

3230:

3226:The Toronto Star

3216:

3207:

3199:

3193:

3184:

3178:

3177:

3171:

3162:

3153:

3145:

3139:

3129:

3123:

3120:

3114:

3102:

3096:

3084:

3078:

3066:

3060:

3048:

3042:

3030:

3024:

3018:

3012:

3006:

3000:

2994:

2988:

2982:

2976:

2970:

2964:

2956:

2950:

2941:

2935:

2929:

2923:

2920:

2914:

2902:

2896:

2895:

2887:

2878:

2872:

2866:

2860:

2848:

2842:

2841:

2833:

2824:

2818:

2806:

2800:

2794:

2788:

2774:

2768:

2754:

2748:

2747:

2745:

2743:

2726:

2720:

2719:

2717:

2715:

2707:Montreal Gazette

2698:

2692:

2691:

2689:

2687:

2670:

2664:

2663:

2661:

2659:

2654:. pp. 11–12

2641:

2632:

2624:

2618:

2617:

2615:

2613:

2596:

2590:

2589:

2579:

2573:

2572:

2554:

2548:

2539:

2533:

2524:

2518:

2512:

2501:

2487:

2472:

2469:

2463:

2460:

2454:

2453:repealed in 1941

2451:

2445:

2442:

2427:

2409:

2386:

2380:

2358:

2345:

2326:

2316:

2306:

2292:

2282:

2280:

2265:

2263:

2248:

2089:British Columbia

2084:October 1, 1982

2027:

2026:

1915:October 11, 1977

1910:The Gift Tax Act

1895:January 24, 1977

1886:British Columbia

1785:

1784:

1609:

1608:

1474:

1471:

1470:

1457:

1454:

1453:

1447:

1444:

1443:

1425:

1422:

1421:

1407:

1404:

1403:

1390:

1387:

1386:

1380:

1377:

1376:

1365:

1362:

1361:

1355:

1352:

1351:

1336:

1333:

1332:

1319:

1316:

1315:

1302:

1299:

1298:

1292:

1289:

1288:

1277:

1274:

1273:

1256:

1253:

1252:

1239:

1236:

1235:

1222:

1219:

1218:

1212:

1209:

1208:

1189:

1186:

1185:

1179:

1176:

1175:

1160:

1157:

1156:

1141:

1138:

1137:

1126:

1123:

1122:

1116:

1113:

1112:

1096:

1093:

1092:

1086:

1083:

1082:

1066:

1063:

1062:

1056:

1053:

1052:

1039:

1036:

1035:

1014:

1013:

962:passed in 1941.(

936:

933:

932:

926:

923:

922:

916:

913:

912:

906:

903:

902:

896:

893:

892:

886:

883:

882:

876:

873:

872:

866:

863:

862:

856:

853:

852:

841:

838:

837:

831:

828:

827:

821:

818:

817:

811:

808:

807:

801:

798:

797:

791:

788:

787:

781:

778:

777:

771:

768:

767:

761:

758:

757:

746:

743:

742:

736:

733:

732:

726:

723:

722:

716:

713:

712:

706:

703:

702:

696:

693:

692:

686:

683:

682:

676:

673:

672:

666:

663:

662:

651:

648:

647:

641:

638:

637:

631:

628:

627:

621:

618:

617:

611:

608:

607:

601:

598:

597:

591:

588:

587:

581:

578:

577:

571:

568:

567:

556:

553:

552:

546:

543:

542:

536:

533:

532:

526:

523:

522:

516:

513:

512:

506:

503:

502:

496:

493:

492:

486:

483:

482:

476:

473:

472:

461:

458:

457:

451:

448:

447:

441:

438:

437:

431:

428:

427:

421:

418:

417:

411:

408:

407:

401:

398:

397:

391:

388:

387:

381:

378:

377:

309:

301:

253:Mitchell Hepburn

234:Mitchell Hepburn

208:Death Duties Act

52:

51:

3296:

3295:

3291:

3290:

3289:

3287:

3286:

3285:

3261:Inheritance tax

3236:

3235:

3234:

3217:

3210:

3200:

3196:

3185:

3181:

3169:

3163:

3156:

3146:

3142:

3136:1998 CanLII 801

3132:Re Eurig Estate

3130:

3126:

3121:

3117:

3103:

3099:

3085:

3081:

3067:

3063:

3049:

3045:

3031:

3027:

3023:, p. 1162.

3019:

3015:

3011:, p. 1370.

3007:

3003:

2995:

2991:

2983:

2979:

2971:

2967:

2957:

2953:

2942:

2938:

2930:

2926:

2921:

2917:

2903:

2899:

2885:

2879:

2875:

2867:

2863:

2849:

2845:

2831:

2825:

2821:

2817:1940-41, c. 14

2807:

2803:

2795:

2791:

2775:

2771:

2755:

2751:

2741:

2739:

2728:

2727:

2723:

2713:

2711:

2700:

2699:

2695:

2685:

2683:

2672:

2671:

2667:

2657:

2655:

2642:

2635:

2625:

2621:

2611:

2609:

2597:

2593:

2581:

2580:

2576:

2555:

2551:

2540:

2536:

2525:

2521:

2517:, p. 1362.

2513:

2504:

2494:1980 CanLII 221

2488:

2484:

2480:

2475:

2470:

2466:

2461:

2457:

2452:

2448:

2443:

2439:

2435:

2430:

2412:

2406:

2378:

2372:Carter, K. LeM.

2366:

2364:Further reading

2361:

2325:(5): 1126–1163.

2314:

2290:

2278:

2261:

2228:

2191:budget deficits

2187:

2094:Probate Fee Act

2068:August 6, 1959

2036:Retroactive to

2007:letters probate

2003:

1976:

1873:January 1, 1977

1808:January 1, 1974

1780:

1604:

1587:double taxation

1549:

1544:

1483:

1472:

1468:

1455:

1451:

1445:

1441:

1423:

1419:

1405:

1401:

1388:

1384:

1378:

1374:

1363:

1359:

1353:

1349:

1334:

1330:

1317:

1313:

1300:

1296:

1290:

1286:

1275:

1271:

1254:

1250:

1237:

1233:

1220:

1216:

1210:

1206:

1187:

1183:

1177:

1173:

1169:, whenever made

1165:comprised in a

1158:

1154:

1139:

1135:

1124:

1120:

1114:

1110:

1094:

1090:

1084:

1080:

1064:

1060:

1054:

1050:

1037:

1033:

1020:Succession duty

945:

934:

930:

924:

920:

914:

910:

904:

900:

894:

890:

884:

880:

874:

870:

864:

860:

854:

850:

839:

835:

829:

825:

819:

815:

809:

805:

799:

795:

789:

785:

779:

775:

769:

765:

759:

755:

744:

740:

734:

730:

724:

720:

714:

710:

704:

700:

694:

690:

684:

680:

674:

670:

664:

660:

649:

645:

639:

635:

629:

625:

619:

615:

609:

605:

599:

595:

589:

585:

579:

575:

569:

565:

554:

550:

544:

540:

534:

530:

524:

520:

514:

510:

504:

500:

494:

490:

484:

480:

474:

470:

459:

455:

449:

445:

439:

435:

429:

425:

419:

415:

409:

405:

399:

395:

389:

385:

379:

375:

296:

266:Howard Ferguson

227:

219:double taxation

29:

12:

11:

5:

3294:

3284:

3283:

3278:

3273:

3268:

3263:

3258:

3253:

3251:Personal taxes

3248:

3233:

3232:

3208:

3194:

3179:

3154:

3140:

3124:

3115:

3106:Income Tax Act

3097:

3088:Income Tax Act

3079:

3070:Income Tax Act

3061:

3052:Income Tax Act

3043:

3034:Income Tax Act

3025:

3013:

3001:

2999:, p. 555.

2989:

2977:

2965:

2951:

2936:

2924:

2915:

2897:

2873:

2861:

2852:Estate Tax Act

2843:

2819:

2801:

2799:, p. 168.

2789:

2769:

2749:

2735:Ottawa Citizen

2721:

2693:

2665:

2651:Financial Post

2633:

2619:

2591:

2574:

2549:

2534:

2519:

2502:

2481:

2479:

2476:

2474:

2473:

2464:

2455:

2446:

2436:

2434:

2431:

2429:

2428:

2410:

2404:

2387:

2367:

2365:

2362:

2360:

2359:

2346:

2327:

2307:

2283:

2266:

2249:

2229:

2227:

2224:

2220:

2219:

2218:

2217:

2214:

2208:

2201:

2186:

2183:

2180:

2179:

2177:

2169:

2165:

2164:

2162:

2154:

2150:

2149:

2146:

2138:

2134:

2133:

2130:

2122:

2118:

2117:

2114:

2106:

2102:

2101:

2100:April 1, 1988

2098:

2090:

2086:

2085:

2082:

2074:

2070:

2069:

2066:

2058:

2054:

2053:

2050:

2042:

2038:

2037:

2034:

2031:

2002:

1999:

1998:

1997:

1996:

1995:

1992:

1989:

1975:

1972:

1969:

1968:

1962:

1961:April 23, 1985

1959:

1951:

1947:

1946:

1938:

1937:April 11, 1979

1935:

1927:

1923:

1922:

1916:

1913:

1907:

1903:

1902:

1896:

1893:

1887:

1883:

1882:

1874:

1871:

1865:

1861:

1860:

1852:

1849:

1841:

1837:

1836:

1828:

1825:

1817:

1813:

1812:

1809:

1806:

1800:

1796:

1795:

1794:Repealing Act

1792:

1789:

1779:

1776:

1775:

1774:

1771:

1768:

1755:

1754:

1746:

1743:

1739:

1738:

1725:

1724:

1716:

1713:

1709:

1708:

1700:

1697:

1693:

1692:

1686:

1683:

1679:

1678:

1670:

1667:

1663:

1662:

1654:

1651:

1647:

1646:

1638:

1635:

1631:

1630:

1627:

1624:

1623:New Brunswick

1620:

1619:

1618:Repealing Act

1616:

1613:

1603:

1600:

1571:

1570:

1569:

1568:

1564:

1561:

1558:

1548:

1545:

1543:

1540:

1539:

1538:

1537:

1536:

1533:

1526:

1522:

1519:

1482:

1479:

1476:

1475:

1465:

1463:

1459:

1458:

1448:

1438:

1430:any estate in

1427:

1426:

1416:

1414:

1409:

1408:

1398:

1396:

1392:

1391:

1381:

1371:

1367:

1366:

1356:

1346:

1338:

1337:

1327:

1325:

1321:

1320:

1310:

1308:

1304:

1303:

1293:

1283:

1279:

1278:

1268:

1266:

1258:

1257:

1247:

1245:

1241:

1240:

1230:

1228:

1224:

1223:

1213:

1203:

1191:

1190:

1180:

1170:

1162:

1161:

1151:

1149:

1145:

1144:

1142:

1132:

1128:

1127:

1117:

1107:

1098:

1097:

1087:

1077:

1071:disposed as a

1068:

1067:

1057:

1047:

1043:

1042:

1040:

1030:

1025:

1024:

1021:

1018:

985:Estate Tax Act

944:

941:

938:

937:

927:

917:

907:

897:

887:

877:

867:

857:

847:

843:

842:

832:

822:

812:

802:

792:

782:

772:

762:

752:

748:

747:

737:

727:

717:

707:

697:

687:

677:

667:

657:

653:

652:

642:

632:

622:

612:

602:

592:

582:

572:

562:

558:

557:

547:

537:

527:

517:

507:

497:

487:

477:

467:

463:

462:

452:

442:

432:

422:

412:

402:

392:

382:

372:

368:

367:

364:

361:

358:

355:

352:

349:

346:

343:

339:

338:

335:

332:

328:

327:

324:

320:

319:

316:

313:

295:

292:

226:

223:

213:

212:

204:

201:

197:

196:

193:

189:

188:

180:

177:

173:

172:

164:

161:

157:

156:

154:

151:

147:

146:

134:

131:

127:

126:

118:

115:

111:

110:

102:

99:

98:New Brunswick

95:

94:

86:

83:

79:

78:

70:

67:

63:

62:

59:

56:

47:

46:

42:

39:

28:

25:

9:

6:

4:

3:

2:

3293:

3282:

3279:

3277:

3274:

3272:

3269:

3267:

3264:

3262:

3259:

3257:

3254:

3252:

3249:

3247:

3244:

3243:

3241:

3228:

3227:

3222:

3215:

3213:

3205:

3204:

3198:

3191:

3189:

3183:

3175:

3168:

3161:

3159:

3151:

3150:

3144:

3137:

3133:

3128:

3122:O.Reg. 293/92

3119:

3112:

3108:

3107:

3101:

3094:

3090:

3089:

3083:

3076:

3072:

3071:

3065:

3058:

3054:

3053:

3047:

3040:

3036:

3035:

3029:

3022:

3017:

3010:

3005:

2998:

2993:

2987:, p. 33.

2986:

2981:

2974:

2969:

2963:, SOR/57-216

2962:

2961:

2955:

2948:

2947:

2940:

2933:

2928:

2919:

2912:

2908:

2907:

2901:

2893:

2892:

2884:

2877:

2871:, p. 90.

2870:

2865:

2858:

2854:

2853:

2847:

2839:

2838:

2830:

2823:

2816:

2812:

2811:

2805:

2798:

2793:

2786:

2782:

2778:

2773:

2766:

2762:

2758:

2753:

2742:September 24,

2737:

2736:

2731:

2725:

2714:September 24,

2709:

2708:

2703:

2697:

2686:September 24,

2681:

2680:

2675:

2669:

2658:September 24,

2653:

2652:

2647:

2640:

2638:

2630:

2629:

2623:

2608:

2604:

2603:

2595:

2587:

2586:

2578:

2571:(1): 191–205.

2570:

2566:

2565:

2560:

2553:

2546:

2545:

2538:

2531:

2530:

2523:

2516:

2511:

2509:

2507:

2499:

2498:Supreme Court

2495:

2491:

2486:

2482:

2468:

2459:

2450:

2441:

2437:

2425:

2421:

2417:

2416:

2411:

2407:

2405:0-8020-7572-X

2401:

2397:

2393:

2388:

2384:

2377:

2373:

2369:

2368:

2356:

2352:

2347:

2343:

2339:

2338:

2333:

2328:

2324:

2320:

2313:

2308:

2304:

2300:

2296:

2289:

2284:

2277:

2276:

2271:

2267:

2260:

2259:

2254:

2250:

2247:(2): 555–582.

2246:

2242:

2241:

2236:

2231:

2230:

2223:

2215:

2213:

2209:

2206:

2202:

2198:

2197:

2196:

2195:

2194:

2192:

2178:

2175:

2174:

2170:

2167:

2166:

2163:

2160:

2159:

2155:

2153:New Brunswick

2152:

2151:

2147:

2144:

2143:

2139:

2136:

2135:

2131:

2128:

2127:

2123:

2120:

2119:

2115:

2112:

2111:

2107:

2104:

2103:

2099:

2096:

2095:

2091:

2088:

2087:

2083:

2080:

2079:

2075:

2072:

2071:

2067:

2064:

2063:

2059:

2056:

2055:

2052:May 15, 1950

2051:

2048:

2047:

2043:

2040:

2039:

2035:

2032:

2029:

2028:

2025:

2022:

2020:

2016:

2012:

2008:

1993:

1990:

1987:

1986:

1985:

1984:

1983:

1981:

1966:

1963:

1960:

1957:

1956:

1952:

1949:

1948:

1944:

1943:

1939:

1936:

1933:

1932:

1928:

1925:

1924:

1920:

1917:

1914:

1911:

1908:

1905:

1904:

1900:

1897:

1894:

1891:

1888:

1885:

1884:

1880:

1879:

1875:

1872:

1869:

1866:

1863:

1862:

1858:

1857:

1853:

1851:April 9, 1974

1850:

1847:

1846:

1842:

1839:

1838:

1834:

1833:

1829:

1827:April 1, 1974

1826:

1823:

1822:

1818:

1815:

1814:

1810:

1807:

1804:

1801:

1799:New Brunswick

1798:

1797:

1793:

1790:

1786:

1783:

1772:

1769:

1766:

1765:

1764:

1762:

1752:

1751:

1747:

1744:

1741:

1740:

1736:

1735:

1730:

1727:

1726:

1722:

1721:

1717:

1710:

1706:

1705:

1701:

1698:

1696:Saskatchewan

1695:

1694:

1690:

1687:

1684:

1681:

1680:

1676:

1675:

1671:

1668:

1665:

1664:

1660:

1659:

1655:

1652:

1650:Newfoundland

1649:

1648:

1644:

1643:

1639:

1636:

1633:

1632:

1628:

1625:

1622:

1621:

1617:

1614:

1611:

1610:

1607:

1599:

1596:

1592:

1588:

1584:

1580:

1576:

1565:

1562:

1559:

1556:

1555:

1554:

1553:

1552:

1534:

1531:

1527:

1523:

1520:

1517:

1516:

1515:

1514:

1513:

1510:

1508:

1502:

1497:

1495:

1491:

1487:

1466:

1464:

1461:

1460:

1449:

1439:

1437:

1433:

1429:

1428:

1417:

1415:

1411:

1410:

1399:

1397:

1394:

1393:

1382:

1372:

1369:

1368:

1357:

1347:

1344:

1340:

1339:

1328:

1326:

1323:

1322:

1311:

1309:

1306:

1305:

1294:

1284:

1281:

1280:

1269:

1267:

1264:

1260:

1259:

1248:

1246:

1243:

1242:

1231:

1229:

1226:

1225:

1214:

1204:

1201:

1197:

1193:

1192:

1181:

1171:

1168:

1164:

1163:

1152:

1150:

1147:

1146:

1143:

1133:

1130:

1129:

1118:

1108:

1106:

1105:

1100:

1099:

1088:

1078:

1076:

1075:

1070:

1069:

1058:

1048:

1045:

1044:

1041:

1031:

1027:

1026:

1022:

1019:

1016:

1015:

1012:

1009:

1007:

1006:US estate tax

1003:

1002:

996:

994:

990:

986:

980:

975:

973:

969:

965:

961:

953:

949:

928:

918:

908:

898:

888:

878:

868:

858:

848:

845:

844:

833:

823:

813:

803:

793:

783:

773:

763:

753:

750:

749:

738:

728:

718:

708:

698:

688:

678:

668:

658:

655:

654:

643:

633:

623:

613:

603:

593:

583:

573:

563:

560:

559:

548:

538:

528:

518:

508:

498:

488:

478:

468:

465:

464:

453:

443:

433:

423:

413:

403:

393:

383:

373:

370:

369:

365:

362:

359:

356:

353:

350:

347:

344:

341:

340:

329:

321:

310:

306:

300:

291:

289:

284:

281:

280:

273:

271:

267:

260:

258:

254:

246:

242:

235:

231:

222:

220:

210:

209:

205:

202:

200:Newfoundland

199:

198:

194:

191:

190:

186:

185:

178:

176:Saskatchewan

175:

174:

170:

169:

165:

162:

159:

158:

155:

152:

149:

148:

144:

143:

138:

135:

132:

129:

128:

124:

123:

119:

116:

113:

112:

108:

107:

103:

100:

97:

96:

92:

91:

87:

84:

81:

80:

76:

75:

71:

68:

65:

64:

60:

57:

54:

53:

50:

43:

40:

37:

36:

35:

33:

24:

22:

18:

3266:Transfer tax

3224:

3201:

3197:

3187:

3182:

3173:

3147:

3143:

3131:

3127:

3118:

3104:

3100:

3086:

3082:

3068:

3064:

3050:

3046:

3032:

3028:

3021:LeBreux 1999

3016:

3009:Goodman 1995

3004:

2992:

2980:

2975:, par. 3.42.

2968:

2958:

2954:

2944:

2939:

2932:Goodman 1995

2927:

2918:

2904:

2900:

2889:

2883:"The Budget"

2876:

2864:

2859:1958, c. 29

2850:

2846:

2835:

2829:"The Budget"

2822:

2808:

2804:

2792:

2776:

2772:

2756:

2752:

2740:. Retrieved

2733:

2724:

2712:. Retrieved

2705:

2696:

2684:. Retrieved

2677:

2668:

2656:. Retrieved

2649:

2626:

2622:

2610:. Retrieved

2601:

2594:

2583:

2577:

2568:

2562:

2552:

2542:

2537:

2527:

2522:

2515:Goodman 1995

2489:

2485:

2467:

2458:

2449:

2440:

2414:

2395:

2382:

2354:

2341:

2335:

2322:

2318:

2305:: 1360–1376.

2298:

2294:

2274:

2270:Benson, E.J.

2257:

2253:Benson, E.J.

2244:

2238:

2221:

2211:

2204:

2188:

2171:

2168:Saskatchewan

2157:

2140:

2124:

2108:

2105:Newfoundland

2092:

2076:

2060:

2045:

2023:

2004:

1977:

1964:

1955:Taxation Act

1953:

1940:

1929:

1918:

1909:

1898:

1889:

1876:

1867:

1864:Saskatchewan

1854:

1843:

1840:Newfoundland

1830:

1819:

1802:

1781:

1758:

1748:

1732:

1728:

1718:

1702:

1688:

1672:

1656:

1640:

1634:Nova Scotia

1605:

1575:Edgar Benson

1572:

1550:

1511:

1506:

1504:

1499:

1490:R.B. Bennett

1484:

1102:

1072:

1010:

999:

997:

984:

982:

977:

959:

957:

304:

297:

285:

277:

275:

270:Queen's Park

262:

250:

216:

206:

182:

166:

140:

136:

120:

114:Nova Scotia

104:

88:

72:

48:

30:

16:

15:

3174:sunlife.com

2985:Benson 1971

2973:Benson 1969

2344:(2): 90–94.

2205:Estates Act

2073:Nova Scotia

1816:Nova Scotia

1579:white paper

1265:at any time

1104:inter vivos

1023:Estate tax

279:inter vivos

3240:Categories

2869:Pozer 1959

2797:Smith 1967

2612:October 6,

2605:(Speech).

2478:References

2015:flat rates

1761:Peter Hogg

1167:settlement

307:(Ontario)

58:Introduced

32:Succession

2997:Bale 1972

2424:461607604

1666:Manitoba

130:Manitoba

2500:(Canada)

2374:(1966).

2272:(1971).

2255:(1969).

2057:Manitoba

2030:Province

1906:Manitoba

1788:Province

1712:Ontario

1612:Province

1595:hearings

1589:. After

1525:purposes

1486:Gift tax

1481:Gift tax

1413:deceased

1017:Property

192:Alberta

66:Ontario

55:Province

3134:,

2492:,

2226:Sources

2121:Alberta

2041:Ontario

1926:Ontario

1742:Quebec

1567:duties.

1436:curtesy

1202:therein

1196:jointly

82:Quebec

3111:R.S.C.

3093:R.S.C.

3075:R.S.C.

3057:R.S.C.

3039:R.S.C.

2422:

2402:

1950:Quebec

1791:Repeal

1615:Repeal

989:French

964:French

337:Donee

3170:(PDF)

2886:(PDF)

2832:(PDF)

2779:

2759:

2433:Notes

2379:(PDF)

2315:(PDF)

2301:(5).

2291:(PDF)

2279:(PDF)

2262:(PDF)

2200:owing

2013:from

1715:1979

1573:When

1432:dower

1194:held

334:Donee

331:Donee

195:1905

2911:S.C.

2857:S.C.

2815:S.C.

2785:P.C.

2765:P.C.

2744:2013

2716:2013

2688:2013

2660:2013

2614:2013

2420:OCLC

2400:ISBN

2009:and

1745:1985

1699:1977

1685:1977

1669:1977

1653:1974

1637:1974

1626:1974

1530:bond

203:1914

179:1905

163:1894

153:1894

133:1893

117:1892

101:1892

85:1892

69:1892

1577:'s

1434:or

3242::

3223:.

3211:^

3172:.

3157:^

3109:,

3091:,

3073:,

3055:,

3037:,

2909:,

2888:.

2855:,

2834:.

2813:,

2732:.

2704:.

2676:.

2648:.

2636:^

2569:12

2567:.

2561:.

2505:^

2394:.

2381:.

2353:.

2340:.

2334:.

2323:47

2321:.

2317:.

2299:43

2297:.

2293:.

2243:.

2237:.

1763::

1509:.

1008:.

991::

966::

3229:.

2746:.

2718:.

2690:.

2662:.

2616:.

2426:.

2408:.

2342:1

2245:5

1473:Y

1456:Y

1446:Y

1424:Y

1406:Y

1389:Y

1379:Y

1364:Y

1354:Y

1335:Y

1318:Y

1301:Y

1291:Y

1276:Y

1255:Y

1238:Y

1221:Y

1211:Y

1188:Y

1178:Y

1159:Y

1140:Y

1125:Y

1115:Y

1095:Y

1085:Y

1065:Y

1055:Y

1038:Y

987:(

935:N

925:N

915:N

905:N

895:N

885:N

875:N

865:N

855:N

840:N

830:N

820:N

810:N

800:N

790:N

780:N

770:N

760:Y

745:N

735:Y

725:Y

715:N

705:Y

695:Y

685:N

675:Y

665:Y

650:N

640:N

630:N

620:N

610:N

600:N

590:Y

580:Y

570:Y

555:Y

545:Y

535:Y

525:Y

515:Y

505:Y

495:Y

485:Y

475:Y

460:Y

450:Y

440:Y

430:Y

420:Y

410:Y

400:Y

390:Y

380:Y

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.