3268:

forecasted only to peak at 126% in 2015 and subsequently decline to 105% in 2020, and thus considered to remain within sustainable territory. The €10bn bailout comprise €4.1bn spend on debt liabilities (refinancing and amortization), 3.4bn to cover fiscal deficits, and €2.5bn for the bank recapitalization. These amounts will be paid to Cyprus through regular tranches from 13 May 2013 until 31 March 2016. According to the programme this will be sufficient, as Cyprus during the programme period in addition will: Receive €1.0bn extraordinary revenue from privatization of government assets, ensure an automatic roll-over of €1.0bn maturing

Treasury Bills and €1.0bn of maturing bonds held by domestic creditors, bring down the funding need for bank recapitalization with €8.7bn — of which 0.4bn is reinjection of future profit earned by the Cyprus Central Bank (injected in advance at the short term by selling its gold reserve) and €8.3bn origin from the bail-in of creditors in Laiki bank and Bank of Cyprus. The forced automatic rollover of maturing bonds held by domestic creditors were conducted in 2013, and equaled according to some credit rating agencies a "selective default" or "restrictive default", mainly because the fixed yields of the new bonds did not reflect the market rates — while maturities at the same time automatically were extended. Cyprus successfully concluded its three-year financial assistance programme at the end of March 2016, having borrowed a total of €6.3 billion from the

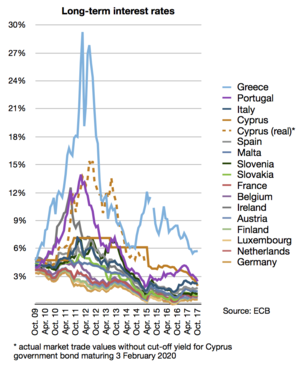

3949:(MoU) agreement. Countries receiving a precautionary programme rather than a sovereign bailout will, by definition, have complete market access and thus qualify for OMT support if also suffering from stressed interest rates on its government bonds. In regards of countries receiving a sovereign bailout (Ireland, Portugal and Greece), they will on the other hand not qualify for OMT support before they have regained complete market access, which will normally only happen after having received the last scheduled bailout disbursement. Despite none OMT programmes were ready to start in September/October, the financial markets straight away took notice of the additionally planned OMT packages from ECB, and started slowly to price-in a decline of both short-term and long-term interest rates in all European countries previously suffering from stressed and elevated interest levels (as OMTs were regarded as an extra potential back-stop to counter the frozen liquidity and highly stressed rates; and just the knowledge about their potential existence in the very near future helped to calm the markets).

617:(reductions in the value of the national currency) due to having the Euro as a shared currency. Debt accumulation in some eurozone members was in part due to macroeconomic differences among eurozone member states prior to the adoption of the euro. It also involved a process of debt market contagion. The European Central Bank adopted an interest rate that incentivized investors in Northern eurozone members to lend to the South, whereas the South was incentivized to borrow because interest rates were very low. Over time, this led to the accumulation of deficits in the South, primarily by private economic actors. A lack of fiscal policy coordination among eurozone member states contributed to imbalanced capital flows in the eurozone, while a lack of financial regulatory centralization or harmonization among eurozone states, coupled with a lack of credible commitments to provide bailouts to banks, incentivized risky financial transactions by banks. The detailed causes of the crisis varied from country to country. In several countries, private debts arising from a property

4675:

they're carrying out structural reforms that may take two or three or five years to fully accomplish. So countries like Spain and Italy, for example, have embarked on some smart structural reforms that everybody thinks are necessary—everything from tax collection to labour markets to a whole host of different issues. But they've got to have the time and the space for those steps to succeed. And if they are just cutting and cutting and cutting, and their unemployment rate is going up and up and up, and people are pulling back further from spending money because they're feeling a lot of pressure—ironically, that can actually make it harder for them to carry out some of these reforms over the long term ... n addition to sensible ways to deal with debt and government finances, there's a parallel discussion that's taking place among

European leaders to figure out how do we also encourage growth and show some flexibility to allow some of these reforms to really take root".

5541:

structural changes are essential in addition to the immediate steps needed to arrest the crisis. The changes he recommends include even greater economic integration of the

European Union. Soros writes that a treaty is needed to transform the European Financial Stability Fund into a full-fledged European Treasury. Following the formation of the Treasury, the European Council could then authorise the ECB to "step into the breach", with risks to the ECB's solvency being indemnified. Soros acknowledges that converting the EFSF into a European Treasury will necessitate "a radical change of heart". In particular, he cautions, Germans will be wary of any such move, not least because many continue to believe that they have a choice between saving the Euro and abandoning it. Soros writes that a collapse of the European Union would precipitate an uncontrollable financial meltdown and thus "the only way" to avert "another Great Depression" is the formation of a European Treasury.

2145:

banks, but be transferred to a government-owned

Spanish fund responsible to conduct the needed bank recapitalisations (FROB), and thus it will be counted for as additional sovereign debt in Spain's national account. An economic forecast in June 2012 highlighted the need for the arranged bank recapitalisation support package, as the outlook promised a negative growth rate of 1.7%, unemployment rising to 25%, and a continued declining trend for housing prices. In September 2012 the ECB removed some of the pressure from Spain on financial markets, when it announced its "unlimited bond-buying plan", to be initiated if Spain would sign a new sovereign bailout package with EFSF/ESM. Strictly speaking, Spain was not hit by a sovereign debt-crisis in 2012, as the financial support package that they received from the ESM was earmarked for a bank recapitalization fund and did not include financial support for the government itself.

1672:'s Hellenic Observatory argue that the billions of taxpayer euros are not saving Greece but financial institutions. Of all €252bn in bailouts between 2010 and 2015, just 10% has found its way into financing continued public deficit spending on the Greek government accounts. Much of the rest went straight into refinancing the old stock of Greek government debt (originating mainly from the high general government deficits being run in previous years), which was mainly held by private banks and hedge funds by the end of 2009. According to LSE, "more than 80% of the rescue package" is going to refinance the expensive old maturing Greek government debt towards private creditors (mainly private banks outside Greece), replacing it with new debt to public creditors on more favourable terms, that is to say paying out their private creditors with new debt issued by its new group of public creditors known as the Troika.

3293:

frozen programme to 30 June 2015, paving the way within this new deadline for the possibility of transfer terms first to be renegotiated and then finally complied with to ensure completion of the programme. As Greece withdrew unilaterally from the process of settling renegotiated terms and time extension for the completion of the programme, it expired uncompleted on 30 June 2015. Hereby, Greece lost the possibility to extract €13.7bn of remaining funds from the EFSF (€1.0bn unused PSI and Bond

Interest facilities, €10.9bn unused bank recapitalization funds and a €1.8bn frozen tranche of macroeconomic support), and also lost the remaining SDR 13.561bn of IMF funds (being equal to €16.0bn as per the SDR exchange rate on 5 Jan 2012), although those lost IMF funds might be recouped if Greece settles an agreement for a new third bailout programme with ESM — and passes the first review of such programme.

3395:) on 11 December 2012. A second tranch for "category 2" banks on €1.86n was approved by the Commission on 20 December, and finally transferred by ESM on 5 February 2013. "Category 3" banks were also subject for a possible third tranch in June 2013, in case they failed before then to acquire sufficient additional capital funding from private markets. During January 2013, all "category 3" banks however managed to fully recapitalise through private markets and thus will not be in need for any State aid. The remaining €58.7bn of the initial support package is thus not expected to be activated, but will stay available as a fund with precautionary capital reserves to possibly draw upon if unexpected things happen — until 31 December 2013. In total €41.3bn out of the available €100bn was transferred. Upon the scheduled exit of the programme, no follow-up assistance was requested.

1223:

1214:

651:

earmarked for a bank recapitalisation fund and did not include financial support for the government itself. The crisis had significant adverse economic effects and labour market effects, with unemployment rates in Greece and Spain reaching 27%, and was blamed for subdued economic growth, not only for the entire eurozone but for the entire

European Union. The austerity policies implemented as a result of the crisis also produced a sharp rise in poverty levels and a significant increase in income inequality across Southern Europe. It had a major political impact on the ruling governments in 10 out of 19 eurozone countries, contributing to power shifts in Greece, Ireland, France, Italy, Portugal, Spain, Slovenia, Slovakia, Belgium, and the Netherlands as well as outside of the eurozone in the United Kingdom.

1445:, which led the budget deficits of several Western nations to reach or exceed 10% of GDP. In the case of Greece, the high budget deficit (which, after several corrections, had been allowed to reach 10.2% and 15.1% of GDP in 2008 and 2009, respectively) was coupled with a high public debt to GDP ratio (which, until then, was relatively stable for several years, at just above 100% of GDP, as calculated after all corrections). Thus, the country appeared to lose control of its public debt to GDP ratio, which already reached 127% of GDP in 2009. In contrast, Italy was able (despite the crisis) to keep its 2009 budget deficit at 5.1% of GDP, which was crucial, given that it had a public debt to GDP ratio comparable to Greece's. In addition, being a member of the Eurozone, Greece had essentially no autonomous

7706:

5674:

7674:

4014:

5596:, under which they pledged to limit their deficit spending and debt levels. Some EU member states, including Greece and Italy, were able to circumvent these rules and mask their deficit and debt levels through the use of complex currency and credit derivatives structures. The structures were designed by prominent US investment banks, who received substantial fees in return for their services and who took on little credit risk themselves thanks to special legal protections for derivatives counterparties. Financial reforms within the U.S. since the financial crisis have only served to reinforce special protections for derivatives—including greater access to government guarantees—while minimising disclosure to broader financial markets.

4358:(IMF) also found, that tax hikes and spending cuts during the most recent decade had indeed damaged the GDP growth more severely, compared to what had been expected and forecasted in advance (based on the "GDP damage ratios" previously recorded in earlier decades and under different economic scenarios). Already a half-year earlier, several European countries as a response to the problem with subdued GDP growth in the eurozone, likewise had called for the implementation of a new reinforced growth strategy based on additional public investments, to be financed by growth-friendly taxes on property, land, wealth, and financial institutions. In June 2012, EU leaders agreed as a first step to moderately increase the funds of the

1240:

3285:

implemented in

December 2012), the total amount of bailout funds sums up to €245.6bn. The first bailout resulted in a payout of €20.1bn from IMF and €52.9bn from GLF, during the course of May 2010 until December 2011, and then it was technically replaced by a second bailout package for 2012-2016, which had a size of €172.6bn (€28bn from IMF and €144.6bn from EFSF), as it included the remaining committed amounts from the first bailout package. All committed IMF amounts were made available to the Greek government for financing its continued operation of public budget deficits and to refinance maturing public debt held by private creditors and IMF. The payments from EFSF were earmarked to finance €35.6bn of

4934:(BCG) adds that if the overall debt load continues to grow faster than the economy, then large-scale debt restructuring becomes inevitable. To prevent a vicious upward debt spiral from gaining momentum the authors urge policymakers to "act quickly and decisively" and aim for an overall debt level well below 180% for the private and government sector. This number is based on the assumption that governments, non-financial corporations, and private households can each sustain a debt load of 60% of GDP, at an interest rate of five per cent and a nominal economic growth rate of three per cent per year. Lower interest rates and/or higher growth would help reduce the debt burden further.

4772:

legislation would give member states the power to impose losses, resulting from a bank failure, on the bondholders to minimise costs for taxpayers. The proposal is part of a new scheme in which banks will be compelled to "bail-in" their creditors whenever they fail, the basic aim being to prevent taxpayer-funded bailouts in the future. The public authorities would also be given powers to replace the management teams in banks even before the lender fails. Each institution would also be obliged to set aside at least one per cent of the deposits covered by their national guarantees for a special fund to finance the resolution of banking crisis starting in 2018.

2224:

measures, including cuts in civil service salaries, social benefits, allowances and pensions and increases in VAT, tobacco, alcohol and fuel taxes, taxes on lottery winnings, property, and higher public health care charges. At the insistence of the

Commission negotiators, at first the proposal also included an unprecedented one-off levy of 6.7% for deposits up to €100,000 and 9.9% for higher deposits on all domestic bank accounts. Following public outcry, the eurozone finance ministers were forced to change the levy, excluding deposits of less than €100,000, and introducing a higher 15.6% levy on deposits of above €100,000 ($ 129,600)—in line with the

3302:

19 August 2015. IMF's transfer of the "remainder of its frozen I+II programme" and their new commitment also to contribute with a part of the funds for the third bailout, depends on a successful prior completion of the first review of the new third programme in

October 2015. Due to a matter of urgency, EFSM immediately conducted a temporary €7.16bn emergency transfer to Greece on 20 July 2015, which was fully overtaken by ESM when the first tranche of the third program was conducted 20 August 2015. Due to being temporary bridge financing and not part of an official bailout programme, the table do not display this special type of EFSM transfer.

1815:-led government refusing to accept respecting the terms of its current bailout agreement. The rising political uncertainty of what would follow caused the Troika to suspend all scheduled remaining aid to Greece under its second programme, until such time as the Greek government either accepted the previously negotiated conditional payment terms or alternatively could reach a mutually accepted agreement of some new updated terms with its public creditors. This rift caused a renewed increasingly growing liquidity crisis (both for the Greek government and Greek financial system), resulting in plummeting stock prices at the

2271:

yield. A continued selling of bonds with a ten-year maturity, which would equal a regain of complete access to the private lending market (and mark the end of the era with need for bailout support), is expected to happen sometime in 2015. The

Cypriot minister of finance recently confirmed, that the government plan to issue two new European Medium Term Note (EMTN) bonds in 2015, likely shortly ahead of the expiry of another €1.1bn bond on 1 July and a second expiry of a €0.9bn bond on 1 November. As announced in advance, the Cypriot government issued €1bn of seven-year bonds with a 4.0% yield by the end of April 2015.

2063:

the situation was described as fully sustainable and progressing well. As a result, from the slightly worse economic circumstances, the country has been given one more year to reduce the budget deficit to a level below 3% of GDP, moving the target year from 2013 to 2014. The budget deficit for 2012 has been forecast to end at 5%. The recession in the economy is now also projected to last until 2013, with GDP declining 3% in 2012 and 1% in 2013; followed by a return to positive real growth in 2014. Unemployment rate increased to over 17% by end of 2012 but it has since decreased gradually to 10,5% as of November 2016.

4565:

2335:(marked with yellow in the table) have no access to the funds provided by EFSF/ESM, but can be covered with rescue loans from EU's Balance of Payments programme (BoP), IMF and bilateral loans (with an extra possible assistance from the Worldbank/EIB/EBRD if classified as a development country). Since October 2012, the ESM as a permanent new financial stability fund to cover any future potential bailout packages within the eurozone, has effectively replaced the now defunct GLF + EFSM + EFSF funds. Whenever pledged funds in a scheduled bailout program were not transferred in full, the table has noted this by writing

4216:

2071:), aiming to bring governmental interest rates down to sustainable levels. A peak for the Portuguese 10-year governmental interest rates happened on 30 January 2012, where it reached 17.3% after the rating agencies had cut the governments credit rating to "non-investment grade" (also referred to as "junk"). As of December 2012, it has been more than halved to only 7%. A successful return to the long-term lending market was made by the issuing of a 5-year maturity bond series in January 2013, and the state regained complete lending access when it successfully issued a 10-year maturity bond series on 7 May 2013.

134:

3249:

2012. In December 2012 a preliminary estimate indicated, that the needed overall bailout package should have a size of €17.5bn, comprising €10bn for bank recapitalisation and €6.0bn for refinancing maturing debt plus €1.5bn to cover budget deficits in 2013+2014+2015, which in total would have increased the Cypriot debt-to-GDP ratio to around 140%. The final agreed package however only entailed a €10bn support package, financed partly by IMF (€1bn) and ESM (€9bn), because it was possible to reach a fund saving agreement with the Cypriot authorities, featuring a direct closure of the most troubled

4573:

3352:

amounts had been transferred, except for the last tranche of €2.6bn (1.7bn from EFSM and 0.9bn from IMF), which the Portuguese government declined to receive. The reason why the IMF transfers still mounted to slightly more than the initially committed €26bn, was due to its payment with SDR's instead of euro — and some favorable developments in the EUR-SDR exchange rate compared to the beginning of the programme. In November 2014, Portugal received its last delayed €0.4bn tranche from EFSM (post programme), hereby bringing its total drawn bailout amount up at €76.8bn out of €79.0bn.

4885:

3813:

interest rate to 0.15%, and set the deposit rate at −0.10%. The latter move in particular was seen as "a bold and unusual move", as a negative interest rate had never been tried on a wide-scale before. Additionally, the ECB announced it would offer long-term four-year loans at the cheap rate (normally the rate is primarily for overnight lending), but only if the borrowing banks met strict conditions designed to ensure the funds ended up in the hands of businesses instead of, for example, being used to buy low risk government bonds. Collectively, the moves are aimed at avoiding

1232:

4386:, the European commissioner for economic and monetary affairs in Brussels, "enthusiastically announced to EU parliamentarians in mid-April that 'there was a breakthrough before Easter'. He said the European heads of state had given the green light to pilot projects worth billions, such as building highways in Greece". Other growth initiatives include "project bonds" wherein the EIB would "provide guarantees that safeguard private investors. In the pilot phase until 2013, EU funds amounting to €230 million are expected to mobilise investments of up to €4.6 billion".

3290:

available to cover continued operation of public budget deficits. The combined programme was scheduled to expire in March 2016, after IMF had extended their programme period with extra loan tranches from January 2015 to March 2016 (as a mean to help Greece service the total sum of interests accruing during the lifespan of already issued IMF loans), while the Eurogroup at the same time opted to conduct their reimbursement and deferral of interests outside their bailout programme framework — with the EFSF programme still being planned to end in December 2014.

1968:

749:

4540:

5111:

2194:

2111:

5142:—have also played a central and controversial role in the current European bond market crisis. On one hand, the agencies have been accused of giving overly generous ratings due to conflicts of interest. On the other hand, ratings agencies have a tendency to act conservatively, and to take some time to adjust when a firm or country is in trouble. In the case of Greece, the market responded to the crisis before the downgrades, with Greek bonds trading at junk levels several weeks before the ratings agencies began to describe them as such.

4375:

1567:—i.e., fiscal deficit before interest payments—from €24.7bn (10.6% of GDP) in 2009 to just €5.2bn (2.4% of GDP) in 2011, but as a side-effect they also contributed to a worsening of the Greek recession, which began in October 2008 and only became worse in 2010 and 2011. The Greek GDP had its worst decline in 2011 with −6.9%, a year where the seasonal adjusted industrial output ended 28.4% lower than in 2005, and with 111,000 Greek companies going bankrupt (27% higher than in 2010). As a result, Greeks have lost about 40% of their

1858:

1386:

5471:

effects and instability would spread into the system. Having that the exit of Greece would trigger the breakdown of the eurozone, this is not welcomed by many politicians, economists and journalists. According to Steven Erlanger from The New York Times, a "Greek departure is likely to be seen as the beginning of the end for the whole euro zone project, a major accomplishment, whatever its faults, in the post-War construction of a Europe "whole and at peace". Likewise, the two big leaders of the Euro zone, German Chancellor

4820:(ESBies), i.e. bundled European government bonds (70% senior bonds, 30% junior bonds) in the form of a "union-wide safe asset without joint liability". According to the authors, ESBies "would be at least as safe as German bonds and approximately double the supply of euro safe assets when protected by a 30%-thick junior tranche". ESBies could be issued by public or private-sector entities and would "weaken the diabolic loop and its diffusion across countries". It requires "no significant change in treaties or legislation.“

5496:

tells the rest of Europe how to behave, it risks fostering destructive nationalist resentment against Germany and ... it would strengthen the camp in Britain arguing for an exit—a problem not just for Britons but for all economically liberal Europeans. Solutions which involve greater integration of European banking and fiscal management and supervision of national decisions by European umbrella institutions can be criticised as Germanic domination of European political and economic life. According to US author

15151:

678:

3703:

1414:

4444:

4617:

example, if a country's citizens saved more instead of consuming imports, this would reduce its trade deficit. It has therefore been suggested that countries with large trade deficits (e.g., Greece) consume less and improve their exporting industries. On the other hand, export driven countries with a large trade surplus, such as Germany, Austria and the Netherlands would need to shift their economies more towards domestic services and increase wages to support domestic consumption.

18540:

925:

1949:

financial life support, Ireland finally left the EU/IMF bailout programme, although it retained a debt of €22.5 billion to the IMF; in August 2014, early repayment of €15 billion was being considered, which would save the country €375 million in surcharges. Despite the end of the bailout the country's unemployment rate remains high and public sector wages are still around 20% lower than at the beginning of the crisis. Government debt reached 123.7% of GDP in 2013.

5012:). According to this agreement, West Germany had to make repayments only when it was running a trade surplus, that is "when it had earned the money to pay up, rather than having to borrow more, or dip into its foreign currency reserves. Its repayments were also limited to 3% of export earnings". As LSE researchers note, this had the effect that, Germany's creditors had an incentive to buy the country's goods, so that it would be able to afford to pay them.

3378:

Development Policy Loan with a deferred drawdown option valid from January 2013 through December 2015. The World Bank will throughout the period also continue providing earlier committed development programme support of €0.891bn, but this extra transfer is not accounted for as "bailout support" in the third programme due to being "earlier committed amounts". In April 2014, the World Bank increased their support by adding the transfer of a first €0.75bn

4691:(with euro-wide deposit insurance, bank oversight and joint means for the recapitalisation or resolution of failing banks); and embracing a limited form of debt mutualisation to create a joint safe asset and allow peripheral economies the room gradually to reduce their debt burdens. This is the refrain from Washington, Beijing, London, and indeed most of the capitals of the euro zone. Why hasn't the continent's canniest politician sprung into action?"

4710:

R&D, etc., i.e. all institutional subsystems, crucial for firms’ success. In economies of the south special attention should be given to creating less labour-intensive industries to avoid price competition pressure from emerging low-cost countries (such as China) via an exchange rate channel, and providing a smooth transition of workers from old unsustainable industries to new ones based on the so-called Nordic-style ‘flexicurity’ market model.

1661:

666:

961:

23781:

23769:

23757:

3309:), and also include establishment of a new privatization fund to conduct sale of Greek public assets — of which the first generated €25bn will be used for early repayment of the bailout loans earmarked for bank recapitalizations. Potential debt relief for Greece, in the form of longer grace and payment periods, will be considered by the European public creditors after the first review of the new programme, by October/November 2015.

881:

5901:

1342:). By July 2012 also the Netherlands, Austria, and Finland benefited from zero or negative interest rates. Looking at short-term government bonds with a maturity of less than one year the list of beneficiaries also includes Belgium and France. While Switzerland (and Denmark) equally benefited from lower interest rates, the crisis also harmed its export sector due to a substantial influx of foreign capital and the resulting rise of the

1245:

1243:

1241:

4552:

to get there over the course of 2013. Portugal and Italy are expected to progress to the turnaround stage in spring 2013, possibly followed by Spain in autumn, while the fate of Greece continues to hang in the balance. Overall, the authors suggest that if the eurozone gets through the current acute crisis and stays on the reform path "it could eventually emerge from the crisis as the most dynamic of the major Western economies".

1866:

1244:

1697:

bailout package for 2015–16 worth €32.6bn of extra loans. On 11 November 2012, facing a default by the end of November, the Greek parliament passed a new austerity package worth €18.8bn, including a "labour market reform" and "mid term fiscal plan 2013–16". In return, the Eurogroup agreed on the following day to lower interest rates and prolong debt maturities and to provide Greece with additional funds of around €10bn for a

996:

1976:

1394:

5915:

831:

1719:

though businesses have reacted positively. The opening of product and service markets is proving tough because interest groups are slowing reforms. The biggest challenge for Greece is to overhaul the tax administration with a significant part of annually assessed taxes not paid. Poul Thomsen, the IMF official who heads the bailout mission in Greece, stated that "in structural terms, Greece is more than halfway there".

2084:, the Portuguese government has "made progress in reforming labour legislation, cutting previously generous redundancy payments by more than half and freeing smaller employers from collective bargaining obligations, all components of Portugal's €78 billion bailout program". Additionally, unit labour costs have fallen since 2009, working practices are liberalizing, and industrial licensing is being streamlined.

5419:

currency devaluations, a politically easier option than the economically equivalent but politically impossible method of lowering wages by political enactment. Sweden's floating rate currency gives it a short-term advantage, structural reforms and constraints account for longer-term prosperity. Labour concessions, a minimal reliance on public debt, and tax reform helped to further a pro-growth policy.

38:

77:

1790:, while the Troika calculations were less optimistic and returned a not covered financing gap at €2.5bn (being required to be covered by additional austerity measures). As the Greek government insisted their calculations were more accurate than those presented by the Troika, they submitted an unchanged fiscal budget bill on 21 November, to be voted for by the parliament on 7 December. The

1803:. The ECCL instrument is often used as a follow-up precautionary measure, when a state has exited its sovereign bailout programme, with transfers only taking place if adverse financial/economic circumstances materialize, but with the positive effect that it help calm down financial markets as the presence of this extra backup guarantee mechanism makes the environment safer for investors.

15125:

4901:

surpluses exceeding 2 per cent of gross domestic product—starting now—just to bring the debt-to-GDP ratio back to its pre-crisis level". The same authors found in a previous study that increased financial burden imposed by ageing populations and lower growth makes it unlikely that indebted economies can grow out of their debt problem if only one of the following three conditions is met:

4578:

4577:

4574:

4579:

5259:, setting up a new ratings agency would cost €300 million. On 30 January 2012, the company said it was already collecting funds from financial institutions and business intelligence agencies to set up an independent non-profit ratings agency by mid-2012, which could provide its first country ratings by the end of the year. In April 2012, in a similar attempt, the

4600:. In other words, a country that imports more than it exports must either decrease its savings reserves or borrow to pay for those imports. Conversely, Germany's large trade surplus (net export position) means that it must either increase its savings reserves or be a net exporter of capital, lending money to other countries to allow them to buy German goods.

1657:, and caused the Greek debt level to temporarily fall from roughly €350bn to €240bn in March 2012 (it would subsequently rise again, due to the resulting bank recapitalization needs), with improved predictions about the debt burden. In December 2012, the Greek government bought back €21 billion ($ 27 billion) of their bonds for 33 cents on the euro.

5199:, said: "Standard and Poor's must stop playing politics. Why doesn't it act on the highly indebted United States or highly indebted Britain?", adding that the latter's collective private and public sector debts are the largest in Europe. He further added: "If the agency downgrades France, it should also downgrade Britain in order to be consistent".

4613:

exporting country's currency used to purchase the goods. Alternatively, trade imbalances can be reduced if a country encouraged domestic saving by restricting or penalising the flow of capital across borders, or by raising interest rates, although this benefit is likely offset by slowing down the economy and increasing government interest payments.

4576:

1734:. The new forecast financing gaps will need either to be covered by the government's additional lending from private capital markets, or to be countered by additional fiscal improvements through expenditure reductions, revenue hikes or increased amount of privatizations. Due to an improved outlook for the Greek economy, with return of a government

14871:

4737:, former president of the European Central Bank. Control, including requirements that taxes be raised or budgets cut, would be exercised only when fiscal imbalances developed. This proposal is similar to contemporary calls by Angela Merkel for increased political and fiscal union which would "allow Europe oversight possibilities".

1583:

estimated to have risen sharply above 33%. In February 2012, an IMF official negotiating Greek austerity measures admitted that excessive spending cuts were harming Greece. The IMF predicted the Greek economy to contract by 5.5% by 2014. Harsh austerity measures led to an actual contraction after six years of recession of 17%.

5102:, which contains the same requirements for budget deficit and debt limitation but with a much stricter regime. In the past, many European countries have substantially exceeded these criteria over a long period of time. Around 2005 most eurozone members violated the pact, resulting in no action taken against violators.

2003:), Portugal had the characteristic that the 2000s were not marked by economic growth, but were already a period of economic crisis, marked by stagnation, two recessions (in 2002–03 and 2008–09) and government-sponsored fiscal austerity in order to reduce the budget deficit to the limits allowed by the European Union's

5091:

2067:

maturity. Once Portugal regains complete market access, measured as the moment it successfully manages to sell a bond series with a full 10-year maturity, it is expected to benefit from interventions by the ECB, which announced readiness to implement extended support in the form of some yield-lowering bond purchases (

2137:

Ireland combined) the condition of Spain's economy is of particular concern to international observers. Under pressure from the United States, the IMF, other European countries and the European Commission the Spanish governments eventually succeeded in trimming the deficit from 11.2% of GDP in 2009 to 7.1% in 2013.

5628:

the bailout. The main point of contention was that the collateral is aimed to be a cash deposit, a collateral the Greeks can only give by recycling part of the funds loaned by Finland for the bailout, which means Finland and the other eurozone countries guarantee the Finnish loans in the event of a Greek default.

4858:(EMF), which could provide governments with fixed interest rate Eurobonds at a rate slightly below medium-term economic growth (in nominal terms). These bonds would not be tradable but could be held by investors with the EMF and liquidated at any time. Given the backing of all eurozone countries and the ECB, "the

4054:. By the end of the day, 26 countries had agreed to the plan, leaving the United Kingdom as the only country not willing to join. Cameron subsequently conceded that his action had failed to secure any safeguards for the UK. Britain's refusal to be part of the fiscal compact to safeguard the eurozone constituted a

4401:

cheaper for banks to borrow from the ECB, with the aim that lower cost of money would be passed on to businesses taking out loans, boosting investment in the economy. The lowered borrowing rates caused the euro to fall in relation to other currencies, which it was hoped would boost exports from the eurozone.

1676:

and September 2011, while the combined exposure of foreign banks to (public and private) Greek entities was reduced from well over €200bn in 2009 to around €80bn (−€120bn) by mid-February 2012. As of 2015, 78% of Greek debt is owed to public sector institutions, primarily the EU. According to a study by the

1128:

Harmonization or centralization in financial regulations could have alleviated the problem of risky loans. Another factor that incentivized risky financial transaction was that national governments could not credibly commit not to bailout financial institutions who had undertaken risky loans, thus causing a

13244:

outlook on the long-term ratings on France and Austria is negative, indicating that we believe that there is at least a one-in-three chance that we will lower the ratings again in 2012 or 2013. We affirmed the ratings on the other 'AAA' rated EFSF members: Finland, Germany, Luxembourg, and The Netherlands.

1062:

inflation) and low in Southern eurozone member states. This incentivized investors in Germany to lend to the South, whereas the South was incentivized to borrow (because interest rates were very low). Over time, this led to the accumulation of deficits in the South, primarily by private economic actors.

3945:. A eurozone country can benefit from the program if -and for as long as- it is found to suffer from stressed bond yields at excessive levels; but only at the point of time where the country possesses/regains a complete market access -and only if the country still complies with all terms in the signed

19238:

But while Europe is better prepared for a Greek restructuring of its debt – writing down what is currently held by states and the European bailout funds – a Greek departure is likely to be seen as the beginning of the end for the whole euro zone project, a major accomplishment, whatever its

5836:

announced his resignation in favour of a national unity government between three parties, of which only two currently remain in the coalition. Following the vote in the Greek parliament on the austerity and bailout measures, which both leading parties supported but many MPs of these two parties voted

5430:

and not "Euroland" for its 2011 expansion into Ireland because, CEO Jim McCarthy said, "'Eurozone' ... is usually reported in association with bad news — job losses, debts and increased taxes". His company planned to use Dealz in continental Europe; McCarthy stated that "There is less certainty about

5356:

reported that "Goldman was reportedly the most heavily involved of a dozen or so Wall Street banks" that assisted the Greek government in the early 2000s "to structure complex derivatives deals early in the decade and 'borrow' billions of dollars in exchange rate swaps, which did not officially count

4645:

According to the Euro Plus Monitor Report 2013, the collective current account of Greece, Ireland, Italy, Portugal, and Spain is improving rapidly and is expected to balance by mid 2013. Thereafter these countries as a group would no longer need to import capital. In 2014, the current account surplus

4603:

The 2009 trade deficits for Italy, Spain, Greece, and Portugal were estimated to be $ 42.96bn, $ 75.31bn and $ 35.97bn, and $ 25.6bn respectively, while Germany's trade surplus was $ 188.6bn. A similar imbalance exists in the US, which runs a large trade deficit (net import position) and therefore is

4471:

Other economists argue that no matter how much Greece and Portugal drive down their wages, they could never compete with low-cost developing countries such as China or India. Instead weak European countries must shift their economies to higher quality products and services, though this is a long-term

4463:

noted in 2012 that Ireland was the only country that had implemented relative wage moderation in the last five years, which helped decrease its relative price/wage levels by 16%. Greece would need to bring this figure down by 31%, effectively reaching the level of Turkey. By 2012, wages in Greece had

4288:

Apart from arguments over whether or not austerity, rather than increased or frozen spending, is a macroeconomic solution, union leaders have also argued that the working population is being unjustly held responsible for the economic mismanagement errors of economists, investors, and bankers. Over 23

4182:

and most European finance ministers that "budget consolidation" revives confidence in financial markets over the longer haul. In a 2003 study that analysed 133 IMF austerity programmes, the IMF's independent evaluation office found that policy makers consistently underestimated the disastrous effects

4089:

On 28 June 2012, eurozone leaders agreed to permit loans by the European Stability Mechanism to be made directly to stressed banks rather than through eurozone states, to avoid adding to sovereign debt. The reform was linked to plans for banking regulation by the European Central Bank. The reform was

3903:

of their own maturing debts in the first three months of 2012, and at the same time keep operating and loaning to businesses so that a credit crunch does not choke off economic growth. It also hoped that banks would use some of the money to buy government bonds, effectively easing the debt crisis. On

3334:

and the remaining €7.5bn paid by "domestic cash resources", which helped increase the program total to €85bn. As this extra amount by technical terms is an internal bail-in, it has not been added to the bailout total. As of 31 March 2014 all committed funds had been transferred, with EFSF even paying

2127:

The bank bailouts and the economic downturn increased the country's deficit and debt levels and led to a substantial downgrading of its credit rating. To build up trust in the financial markets, the government began to introduce austerity measures and in 2011 it passed a law in congress to approve an

1822:

Faced by the threat of a sovereign default and potential resulting exit of the eurozone, some final attempts were made by the Greek government in May 2015 to settle an agreement with the Troika about some adjusted terms for Greece to comply with in order to activate the transfer of the frozen bailout

1785:

During the second half of 2014, the Greek government again negotiated with the Troika. The negotiations were this time about how to comply with the programme requirements, to ensure activation of the payment of its last scheduled eurozone bailout tranche in December 2014, and about a potential update

1675:

The shift in liabilities from European banks to European taxpayers has been staggering. One study found that the public debt of Greece to foreign governments, including debt to the EU/IMF loan facility and debt through the Eurosystem, increased from €47.8bn to €180.5bn (+132,7bn) between January 2010

1582:

Overall the share of the population living at "risk of poverty or social exclusion" did not increase notably during the first two years of the crisis. The figure was measured to 27.6% in 2009 and 27.7% in 2010 (only being slightly worse than the EU27-average at 23.4%), but for 2011 the figure was now

1366:

taken by EU leaders and the ECB (see below), financial stability in the eurozone improved significantly and interest rates fell steadily. This also greatly diminished contagion risk for other eurozone countries. As of October 2012 only 3 out of 17 eurozone countries, namely Greece, Portugal, and

1354:

Despite sovereign debt having risen substantially in only a few eurozone countries, with the three most affected countries Greece, Ireland and Portugal collectively only accounting for 6% of the eurozone's gross domestic product (GDP), it became a perceived problem for the area as a whole, leading to

1261:

and accelerating debt levels. When, as a negative repercussion of the Great Recession, the relatively fragile banking sector had suffered large capital losses, most states in Europe had to bail out several of their most affected banks with some supporting recapitalization loans, because of the strong

1061:

Macroeconomic divergence among eurozone member states led to imbalanced capital flows between the member states. Despite different macroeconomic conditions, the European Central Bank could only adopt one interest rate, choosing one that meant that real interest rates in Germany were high (relative to

14543:

We affirm that it is imperative to break the vicious circle between banks and sovereigns. The Commission will present Proposals on the basis of Article 127(6) for a single supervisory mechanism shortly. We ask the Council to consider these Proposals as a matter of urgency by the end of 2012. When an

5610:

The focus has naturally remained on Greece due to its debt crisis. There have been reports about manipulated statistics by EU and other nations aiming, as was the case for Greece, to mask the sizes of public debts and deficits. These have included analyses of examples in several countries the United

5599:

The revision of Greece's 2009 budget deficit from a forecast of "6–8% of GDP" to 12.7% by the new Pasok Government in late 2009 (a number which, after reclassification of expenses under IMF/EU supervision was further raised to 15.4% in 2010) has been cited as one of the issues that ignited the Greek

5202:

Credit rating agencies were also accused of bullying politicians by systematically downgrading eurozone countries just before important European Council meetings. As one EU source put it: "It is interesting to look at the downgradings and the timings of the downgradings... It is strange that we have

5055:

5044:

4941:

of between 11 and 30% for most countries, apart from the crisis countries (particularly Ireland) where a write-off would have to be substantially higher. The authors admit that such programmes would be "drastic", "unpopular" and "require broad political coordination and leadership" but they maintain

4900:

countries nearly quadrupled between 1980 and 2010, and will likely continue to grow, reaching between 250% (for Italy) and about 600% (for Japan) by 2040. A BIS study released in June 2012 warns that budgets of most advanced economies, excluding interest payments, "would need 20 consecutive years of

4866:

backs government bonds to an unlimited extent". To ensure fiscal discipline despite lack of market pressure, the EMF would operate according to strict rules, providing funds only to countries that meet fiscal and macroeconomic criteria. Governments lacking sound financial policies would be forced to

4709:

At the same time, it is vital to keep in mind that just putting emphasis on emulating LME's wage-setting system to CMEs and mixed-market economies will not work. Therefore, apart from wage issues, structural reforms should be focused on developing capacities for innovations, technologies, education,

4705:

The key policy issue that has to be addressed in the long run is how to harmonise different political-economic institutional set-ups of the north and south European economies to promote economic growth and make the currency union sustainable. The Eurozone member states must adopt structural reforms,

4551:

In its Euro Plus Monitor Report 2012, published in November 2012, the Lisbon Council finds that the eurozone has slightly improved its overall health. With the exception of Greece, all eurozone crisis countries are either close to the point where they have achieved the major adjustment or are likely

4341:

Germany has come under pressure due to not having a government budget deficit and funding it by borrowing more. As of late 2014, the government (federal and state) has spent less than it receives in revenue, for the third year in a row, despite low economic growth. The 2015 budget includes a surplus

3377:

Romania had a second €4bn precautionary credit line established jointly by IMF and EU, of which IMF accounts for SDR 1.75134bn = €2bn, which is available to draw money from if needed during the period from October 2013 to 30 September 2015. In addition the World Bank also made €1bn available under a

3301:

A new third bailout programme worth €86bn in total, jointly covered by funds from IMF and ESM, will be disbursed in tranches from August 2015 until August 2018. The programme was approved to be negotiated on 17 July 2015, and approved in full detail by the publication of an ESM facility agreement on

2123:

received a 19 billion euro bailout, on top of the previous 4.5 billion euros to prop up Bankia. Questionable accounting methods disguised bank losses. During September 2012, regulators indicated that Spanish banks required €59 billion (US$ 77 billion) in additional capital to offset losses from real

1932:

In July 2011, European leaders agreed to cut the interest rate that Ireland was paying on its EU/IMF bailout loan from around 6% to between 3.5% and 4% and to double the loan time to 15 years. The move was expected to save the country between 600 and 700 million euros per year. On 14 September 2011,

1090:

future government revenues to reduce their debts and/or deficits, sidestepping best practice and ignoring international standards. This allowed the sovereigns to mask their deficit and debt levels through a combination of techniques, including inconsistent accounting, off-balance-sheet transactions,

1069:

explains the fundamental roots of the European crisis in varieties of national institutional structures of member countries (north vs. south), which conditioned their asymmetric development trends over time and made the union susceptible to external shocks. Imperfections in the Eurozone's governance

5627:

support package for the Greek economy. Austria, the Netherlands, Slovenia, and Slovakia responded with irritation over this special guarantee for Finland and demanded equal treatment across the eurozone, or a similar deal with Greece, so as not to increase the risk level over their participation in

5402:

As the debt crisis expanded beyond Greece, these economists continued to advocate, albeit more forcefully, the disbandment of the eurozone. If this was not immediately feasible, they recommended that Greece and the other debtor nations unilaterally leave the eurozone, default on their debts, regain

4790:

would be the best way of solving a debt crisis, though their introduction matched by tight financial and budgetary co-ordination may well require changes in EU treaties. On 21 November 2011, the European Commission suggested that eurobonds issued jointly by the 17 euro nations would be an effective

4353:

policies criticised the timing and amount of austerity measures being called for in the bailout programmes, as they argued such extensive measures should not be implemented during the crisis years with an ongoing recession, but if possible delayed until the years after some positive real GDP growth

3812:

With inflation falling to 0.5% in May 2014, the ECB again took measures to stimulate the eurozone economy, which grew at just 0.2% during the first quarter of 2014. (Deflation or very low inflation encourages holding cash, causing a decrease in purchases). On 5 June, the central bank cut the prime

3694:. Furthermore, governments of Member States where central banks currently hold Greek government bonds in their investment portfolio commit to pass on to Greece an amount equal to any future income until 2020. Altogether this should bring down Greece's debt to between 117% and 120.5% of GDP by 2020.

3652:

I do not think Europeans understand the implications of a systemic banking crisis. ... When all banks are forced to raise capital at the same time, the result is going to be even weaker banks and an even longer recession—if not depression. ... Government intervention should be the first resort, not

3390:

Spain's €100bn support package has been earmarked only for recapitalisation of the financial sector. Initially an EFSF emergency account with €30bn was available, but nothing was drawn, and it was cancelled again in November 2012 after being superseded by the regular ESM recapitalisation programme.

2270:

Although the bailout support programme feature sufficient financial transfers until March 2016, Cyprus began slowly to regain its access to the private lending markets already in June 2014. At this point of time, the government sold €0.75bn of bonds with a five-year maturity, to the tune of a 4.85%

2062:

Portugal's debt was in September 2012 forecast by the Troika to peak at around 124% of GDP in 2014, followed by a firm downward trajectory after 2014. Previously the Troika had predicted it would peak at 118.5% of GDP in 2013, so the developments proved to be a bit worse than first anticipated, but

1899:

Irish banks had lost an estimated 100 billion euros, much of it related to defaulted loans to property developers and homeowners made in the midst of the property bubble, which burst around 2007. The economy collapsed during 2008. Unemployment rose from 4% in 2006 to 14% by 2010, while the national

1644:

Then, in March 2012, the Greek government did finally default on parts of its debt - as there was a new law passed by the government so that private holders of Greek government bonds (banks, insurers and investment funds) would "voluntarily" accept a bond swap with a 53.5% nominal write-off, partly

1325:

To fight the crisis some governments have focused on raising taxes and lowering expenditures, which contributed to social unrest and significant debate among economists, many of whom advocate greater deficits when economies are struggling. Especially in countries where budget deficits and sovereign

1103:

developed in the public, and the government debt of several states was downgraded. The crisis subsequently spread to Ireland and Portugal, while raising concerns about Italy, Spain, and the European banking system, and more fundamental imbalances within the eurozone. The under-reporting was exposed

13243:

Standard & Poor's Ratings Services today lowered the 'AAA' long-term issuer credit rating on the European Financial Stability Facility (EFSF) to 'AA+' from 'AAA'.... We lowered to 'AA+' the long-term ratings on two of the EFSF's previously 'AAA' rated guarantor members, France and Austria. The

5418:

Iceland, not part of the EU, is regarded as one of Europe's recovery success stories. It defaulted on its debt and drastically devalued its currency, which has effectively reduced wages by 50% making exports more competitive. Lee Harris argues that floating exchange rates allows wage reductions by

5149:

credit rating agencies have fuelled rising euro zone indebtedness by issuing more severe downgrades since the sovereign debt crisis unfolded in 2009. The authors concluded that rating agencies were not consistent in their judgments, on average rating Portugal, Ireland, and Greece 2.3 notches lower

5065:

of over-spending and lending in good times. They were also meant to protect the taxpayers of the other more prudent member states. By issuing bail-out aid guaranteed by prudent eurozone taxpayers to rule-breaking eurozone countries such as Greece, the EU and eurozone countries also encourage moral

4555:

The Euro Plus Monitor update from spring 2013 notes that the eurozone remains on the right track. According to the authors, almost all vulnerable countries in need of adjustment "are slashing their underlying fiscal deficits and improving their external competitiveness at an impressive speed", for

4324:

as part of their national law/constitution. The Fiscal Compact is a direct successor of the previous Stability and Growth Pact, but it is more strict, not only because criteria compliance will be secured through its integration into national law/constitution, but also because it starting from 2014

4223:

According to Keynesian economists "growth-friendly austerity" relies on the false argument that public cuts would be compensated for by more spending from consumers and businesses, a theoretical claim that has not materialised. The case of Greece shows that excessive levels of private indebtedness

3994:

Such a mechanism serves as a "financial firewall". Instead of a default by one country rippling through the entire interconnected financial system, the firewall mechanism can ensure that downstream nations and banking systems are protected by guaranteeing some or all of their obligations. Then the

3459:

Stocks surged worldwide after the EU announced the EFSF's creation. The facility eased fears that the Greek debt crisis would spread, and this led to some stocks rising to the highest level in a year or more. The euro made its biggest gain in 18 months, before falling to a new four-year low a week

3443:

On 29 November 2011, the member state finance ministers agreed to expand the EFSF by creating certificates that could guarantee up to 30% of new issues from troubled euro-area governments, and to create investment vehicles that would boost the EFSF's firepower to intervene in primary and secondary

1777:

Greece experienced positive economic growth in each of the three first quarters of 2014. The return of economic growth, along with the now existing underlying structural budget surplus of the general government, build the basis for the debt-to-GDP ratio to start a significant decline in the coming

1718:

special report on the future of the European Union argues that the liberalisation of labour markets has allowed Greece to narrow the cost-competitiveness gap with other southern eurozone countries by approximately 50% over the past two years. This has been achieved primary through wage reductions,

642:

and providing cheap loans of more than one trillion euro in order to maintain money flows between European banks. On 6 September 2012, the ECB calmed financial markets by announcing free unlimited support for all eurozone countries involved in a sovereign state bailout/precautionary programme from

5528:

provides detailed blue print to mutualise the current debts of all euro-zone economies above 60% of their GDP. Instead of the break-up and issuing new national governments bonds by individual euro-zone governments, "everybody, from Germany (debt: 81% of GDP) to Italy (120%) would issue only these

5254:

Germany's foreign minister Guido Westerwelle called for an "independent" European ratings agency, which could avoid the conflicts of interest that he claimed US-based agencies faced. European leaders are reportedly studying the possibility of setting up a European ratings agency in order that the

4771:

On 6 June 2012, the European Commission adopted a legislative proposal for a harmonised bank recovery and resolution mechanism. The proposed framework sets out the necessary steps and powers to ensure that bank failures across the EU are managed in a way that avoids financial instability. The new

4400:

to historical lows, reaching 0.25% in November 2013. Soon after the rates were shaved to 0.15%, then on 4 September 2014 the central bank shocked financial markets by cutting the razor-thin rates by a further two thirds from 0.15% to 0.05%, the lowest on record. The moves were designed to make it

3368:

Romania had a precautionary credit line with €5.0bn available to draw money from if needed, during the period March 2011-June 2013; but entirely avoided to draw on it. During the period, the World Bank however supported with a transfer of €0.4bn as a DPL3 development loan programme and €0.75bn as

3289:

restructured government debt (as part of a deal where private investors in return accepted a nominal haircut, lower interest rates and longer maturities for their remaining principal), €48.2bn for bank recapitalization, €11.3bn for a second PSI debt buy-back, while the remaining €49.5bn were made

3248:

When it became evident Cyprus needed an additional bailout loan to cover the government's fiscal operations throughout 2013–2015, on top of additional funding needs for recapitalization of the Cypriot financial sector, negotiations for such an extra bailout package started with the Troika in June

2223:

On 30 November the Troika (the European Commission, the International Monetary Fund, and the European Central Bank) and the Cypriot Government had agreed on the bailout terms with only the amount of money required for the bailout remaining to be agreed upon. Bailout terms include strong austerity

2144:

became a prime concern for the Euro-zone when interest on Spain's 10-year bonds reached the 7% level and it faced difficulty in accessing bond markets. This led the Eurogroup on 9 June 2012 to grant Spain a financial support package of up to €100 billion. The funds will not go directly to Spanish

2087:

On 18 May 2014, Portugal left the EU bailout mechanism without additional need for support, as it had already regained a complete access to lending markets back in May 2013, and with its latest issuing of a 10-year government bond being successfully completed with a rate as low as 3.59%. Portugal

1729:

Both of the latest bailout programme audit reports, released independently by the European Commission and IMF in June 2014, revealed that even after transfer of the scheduled bailout funds and full implementation of the agreed adjustment package in 2012, there was a new forecast financing gap of:

1305:

The states that were adversely affected by the crisis faced a strong rise in interest rate spreads for government bonds as a result of investor concerns about their future debt sustainability. Four eurozone states had to be rescued by sovereign bailout programs, which were provided jointly by the

1073:

Eurozone member states could have alleviated the imbalances in capital flows and debt accumulation in the South by coordinating national fiscal policies. Germany could have adopted more expansionary fiscal policies (to boost domestic demand and reduce the outflow of capital) and Southern eurozone

5495:

The challenges to the speculation about the break-up or salvage of the eurozone is rooted in its innate nature that the break-up or salvage of eurozone is not only an economic decision but also a critical political decision followed by complicated ramifications that "If Berlin pays the bills and

5470:

There is opposition in this view. The national exits are expected to be an expensive proposition. The breakdown of the currency would lead to insolvency of several euro zone countries, a breakdown in intrazone payments. Having instability and the public debt issue still not solved, the contagion

5290:

rebutted these "Anglo-Saxon conspiracy" claims, writing that although American and British traders overestimated the weakness of southern European public finances and the probability of the breakup of the eurozone, these sentiments were an ordinary market panic, rather than some deliberate plot.

4674:

stated in June 2012: "Right now, focus has to be on strengthening their overall banking system...making a series of decisive actions that give people confidence that the banking system is solid ... In addition, they're going to have to look at how do they achieve growth at the same time as

4637:

In its spring 2012 economic forecast, the European Commission finds "some evidence that the current-account rebalancing is underpinned by changes in relative prices and competitiveness positions as well as gains in export market shares and expenditure switching in deficit countries". In May 2012

3665:

conversion, then, one analyst "said that as banks find it more difficult to raise funds, they will move faster to cut down on loans and unload lagging assets" as they work to improve capital ratios. This latter contraction of balance sheets "could lead to a depression", the analyst said. Reduced

1794:

was scheduled to meet and discuss the updated review of the Greek bailout programme on 8 December (to be published on the same day), and the potential adjustments to the remaining programme for 2015–16. There were rumours in the press that the Greek government has proposed immediately to end the

1464:

Despite the drastic upwards revision of the forecast for the 2009 budget deficit in October 2009, Greek borrowing rates initially rose rather slowly. By April 2010 it was apparent that the country was becoming unable to borrow from the markets; on 23 April 2010, the Greek government requested an

5845:

were the first time in the history of the country, at which the bipartisanship (consisted of PASOK and New Democracy parties), which ruled the country for over 40 years, collapsed in votes as a punishment for their support to the strict measures proposed by the country's foreign lenders and the

4835:

dealing with the aftermath of the financial crisis. The European Commission has recently introduced a proposal to introduce what it calls Sovereign Bond Backed Securities (SBBS) which are essentially the same as ESBies and the European Parliament endorsed the changes in regulations necessary to

4616:

Either way, many of the countries involved in the crisis are on the euro, so devaluation, individual interest rates, and capital controls are not available. The only solution left to raise a country's level of saving is to reduce budget deficits and to change consumption and savings habits. For

4025:

was initiated, aiming at straightening the rules by adopting an automatic procedure for imposing of penalties in case of breaches of either the 3% deficit or the 60% debt rules. By the end of the year, Germany, France and some other smaller EU countries went a step further and vowed to create a

3412:

On 9 May 2010, the 27 EU member states agreed to create the European Financial Stability Facility, a legal instrument aiming at preserving financial stability in Europe, by providing financial assistance to eurozone states in difficulty. The EFSF can issue bonds or other debt instruments on the

3292:

Due to the refusal by the Greek government to comply with the agreed conditional terms for receiving a continued flow of bailout transfers, both IMF and the Eurogroup opted to freeze their programmes since August 2014. To avoid a technical expiry, the Eurogroup postponed the expiry date for its

3284:

Many sources list the first bailout was €110bn followed by the second on €130bn. When you deduct €2.7bn due to Ireland+Portugal+Slovakia opting out as creditors for the first bailout, and add the extra €8.2bn IMF has promised to pay Greece for the years in 2015-16 (through a programme extension

2170:

special report on the future of the European Union. "Madrid is reviewing its labour market and pension reforms and has promised by the end of this year to liberalize its heavily regulated professions". But Spain is benefiting from improved labour cost competitiveness. "They have not lost export

2136:

at both the national and regional level by 2020. The amendment states that public debt can not exceed 60% of GDP, though exceptions would be made in case of a natural catastrophe, economic recession or other emergencies. As one of the largest eurozone economies (larger than Greece, Portugal and

2118:

Spain had a comparatively low debt level among advanced economies prior to the crisis. Its public debt relative to GDP in 2010 was only 60%, more than 20 points less than Germany, France or the US, and more than 60 points less than Italy or Greece. Debt was largely avoided by the ballooning tax

1903:

With Ireland's credit rating falling rapidly in the face of mounting estimates of the banking losses, guaranteed depositors and bondholders cashed in during 2009–10, and especially after August 2010. (The necessary funds were borrowed from the central bank.) With yields on Irish Government debt

650:

Return to economic growth and improved structural deficits enabled Ireland and Portugal to exit their bailout programmes in July 2014. Greece and Cyprus both managed to partly regain market access in 2014. Spain never officially received a bailout programme. Its rescue package from the ESM was

5271:

financial law and regulation experts have argued that the hastily drafted, unevenly transposed in national law, and poorly enforced EU rule on ratings agencies (Regulation EC N° 1060/2009) has had little effect on the way financial analysts and economists interpret data or on the potential for

4547:

On 15 November 2011, the Lisbon Council published the Euro Plus Monitor 2011. According to the report most critical eurozone member countries are in the process of rapid reforms. The authors note that "Many of those countries most in need to adjust are now making the greatest progress towards

4034:

meeting, all 17 members of the eurozone and six countries that aspire to join agreed on a new intergovernmental treaty to put strict caps on government spending and borrowing, with penalties for those countries who violate the limits. All other non-eurozone countries apart from the UK are also

3824:

index, for example, set a record high the day the new rates were announced. Meanwhile, the euro briefly fell to a four-month low against the dollar. However, due to the unprecedented nature of the negative interest rate, the long-term effects of the stimulus measures are hard to predict. Bank

3351:

Portugal completed its support programme as scheduled in June 2014, one month later than initially planned due to awaiting a verdict by its constitutional court, but without asking for establishment of any subsequent precautionary credit line facility. By the end of the programme all committed

3267:

framework in Cypriot financial institutions, (3) Fiscal consolidation to help bring down the Cypriot governmental budget deficit, (4) Structural reforms to restore competitiveness and macroeconomic imbalances, (5) Privatization programme. The Cypriot debt-to-GDP ratio is on this background now

1920:

was to be used to support the country's failing financial sector (only about half of this was used in that way following stress tests conducted in 2011). In return the government agreed to reduce its budget deficit to below three per cent by 2015. In April 2011, despite all the measures taken,

1742:

during the course of 2014, for the purpose of fully funding its new extra financing gaps with additional private capital. A total of €6.1bn was received from the sale of three-year and five-year bonds in 2014, and the Greek government now plans to cover its forecast financing gap for 2015 with

1696:

Due to a delayed reform schedule and a worsened economic recession, the new government immediately asked the Troika to be granted an extended deadline from 2015 to 2017 before being required to restore the budget into a self-financed situation; which in effect was equal to a request of a third

4870:

The econometric analysis suggests that "If the short-term and long- term interest rates in the euro area were stabilised at 1.5% and 3%, respectively, aggregate output (GDP) in the euro area would be 5 percentage points above baseline in 2015". At the same time, sovereign debt levels would be

4612:

A country with a large trade surplus would generally see the value of its currency appreciate relative to other currencies, which would reduce the imbalance as the relative price of its exports increases. This currency appreciation occurs as the importing country sells its currency to buy the

4392:

also said: "According to sources inside the German government, instead of funding new highways, Berlin is interested in supporting innovation and programs to promote small and medium-sized businesses. To ensure that this is done as professionally as possible, the Germans would like to see the

1948:

On 26 July 2012, for the first time since September 2010, Ireland was able to return to the financial markets, selling over €5 billion in long-term government debt, with an interest rate of 5.9% for the 5-year bonds and 6.1% for the 8-year bonds at sale. In December 2013, after three years on

1680:

only €9.7bn or less than 5% of the first two bailout programs went to the Greek fiscal budget, while most of the money went to French and German banks (In June 2010, France's and Germany's foreign claims vis-a-vis Greece were $ 57bn and $ 31bn respectively. German banks owned $ 60bn of Greek,

629:

The onset of crisis was in late 2009 when the Greek government disclosed that its budget deficits were far higher than previously thought. Greece called for external help in early 2010, receiving an EU–IMF bailout package in May 2010. European nations implemented a series of financial support

2066:

As part of the bailout programme, Portugal was required to regain complete access to financial markets by September 2013. The first step towards this target was successfully taken on 3 October 2012, when the country managed to regain partial market access by selling a bond series with 3-year

1826:

On 5 July 2015, the citizens of Greece voted decisively (a 61% to 39% decision with 62.5% voter turnout) to reject a referendum that would have given Greece more bailout help from other EU members in return for increased austerity measures. As a result of this vote, Greece's finance minister

1684:

According to a leaked document, dated May 2010, the IMF was fully aware of the fact that the Greek bailout program was aimed at rescuing the private European banks – mainly from France and Germany. A number of IMF Executive Board members from India, Brazil, Argentina, Russia, and Switzerland

16366:

We need not just a currency union; we also need a so-called fiscal union, more common budget policies. And we need above all a political union. That means that we must, step by step as things go forward, give up more powers to Europe as well and allow Europe oversight possibilities. (Angela

5540:

warns in "Does the Euro have a Future?" that there is no escape from the "gloomy scenario" of a prolonged European recession and the consequent threat to the Eurozone's political cohesion so long as "the authorities persist in their current course". He argues that to save the Euro long-term

4423:

notes in November 2011 that no debt restructuring will work without growth, even more so as European countries "face pressures from three fronts: demography (an aging population), technology (which has allowed companies to do much more with fewer people) and globalisation (which has allowed

4329:

of either maximum 0.5% or 1% (depending on the debt level). Each of the eurozone countries being involved in a bailout programme (Greece, Portugal, and Ireland) was asked both to follow a programme with fiscal consolidation/austerity, and to restore competitiveness through implementation of

1421:

The Greek economy had fared well for much of the 20th century, with high growth rates and low public debt. By 2007 (i.e., before the global financial crisis of 2007–2008), it was still one of the fastest growing in the eurozone, with a public debt-to-GDP that did not exceed 104%, but it was

3920:

On 16 June 2012 the European Central Bank together with other European leaders hammered out plans for the ECB to become a bank regulator and to form a deposit insurance program to augment national programs. Other economic reforms promoting European growth and employment were also proposed.

3239:

Cyprus received in late December 2011 a €2.5bn bilateral emergency bailout loan from Russia, to cover its governmental budget deficits and a refinancing of maturing governmental debts until 31 December 2012. Initially the bailout loan was supposed to be fully repaid in 2016, but as part of

9021:"IMF Country Report No. 14/151: GREECE – Fifth Review under the Extended Arrangement under the Extended Fund Facility, and Request for Waiver of Nonobservance of Performance Criterion and Rephasing of Access; Staff Report; Press Release; and Statement by the Executive Director for Greece"

3507:

rescue package for Ireland (the rest was loaned from individual European countries, the European Commission and the IMF). In May 2011 it contributed one-third of the €78 billion package for Portugal. As part of the second bailout for Greece, the loan was shifted to the EFSF, amounting to

1127: