45:

2409:, being 'short' means having the legal obligation to deliver something at the expiration of the contract, although the holder of the short position may alternately buy back the contract prior to expiration instead of making delivery. Short futures transactions are often used by producers of a commodity to fix the future price of goods they have not yet produced. Shorting a futures contract is sometimes also used by those holding the underlying asset (i.e. those with a long position) as a temporary hedge against price declines. Shorting futures may also be used for speculative trades, in which case the investor is looking to profit from any decline in the price of the futures contract prior to expiration.

2598:; others may be forced to cover, subject to the terms under which they borrowed the stock, if the person who lent the stock wishes to sell and take a profit. Since covering their positions involves buying shares, the short squeeze causes an ever further rise in the stock's price, which in turn may trigger additional covering. Because of this, most short sellers restrict their activities to heavily traded stocks, and they keep an eye on the "short interest" levels of their short investments. Short interest is defined as the total number of shares that have been

1887:, who is usually holding the securities for another investor who owns the securities; the broker himself seldom purchases the securities to lend to the short seller. The lender does not lose the right to sell the securities while they have been lent, as the broker usually holds a large pool of such securities for a number of investors which, as such securities are fungible, can instead be transferred to any buyer. In most market conditions there is a ready supply of securities to be borrowed, held by pension funds, mutual funds and other investors.

612:

6246:

6236:

6226:

1556:. An investor therefore "borrows" securities in the same sense as one borrows a $ 10 bill, where the legal ownership of the money is transferred to the borrower and it can be freely disposed of, and different bank notes or coins can be returned to the lender. This can be contrasted with the sense in which one borrows a bicycle, where the ownership of the bicycle does not change and the same bicycle must be returned, not merely one that is the same model.

22:

1484:

502:) and quickly selling it. The short seller must later buy the same amount of the asset to return it to the lender. If the market value of the asset has fallen in the meantime, the short seller will have made a profit equal to the difference. Conversely, if the price has risen then the short seller will bear a loss. The short seller usually must pay a handling fee to borrow the asset (charged at a particular rate over time, similar to an

2661:

2458:

2336:

2212:

1831:

6256:

5933:

1472:

1913:, meaning they have borrowed from the account. SEC Rule 15c3-3 imposes such severe restrictions on the lending of shares from cash accounts or excess margin (fully paid for) shares from margin accounts that most brokerage firms do not bother except in rare circumstances. (These restrictions include that the broker must have the express permission of the customer and provide collateral or a letter of credit.)

2862:

state pension bodies to refrain from lending stock for shorting purposes. An assessment of the effect of the temporary ban on short-selling in the United States and other countries in the wake of the financial crisis showed that it had only "little impact" on the movements of stocks, with stock prices moving in the same way as they would have moved anyhow, but the ban reduced volume and liquidity.

2886:, made clear in public statements and a letter to the FSA that he believed it ought to be extended. Between 19 and 21 September 2008, Australia temporarily banned short selling, and later placed an indefinite ban on naked short selling. Australia's ban on short selling was further extended for another 28 days on 21 October 2008. Also during September 2008, Germany, Ireland,

525:, by which the short seller assumes an obligation or right to sell an asset at a future date at a price stated in the contract. If the price of the asset falls below the contract price, the short seller can buy it at the lower market value and immediately sell it at the higher price specified in the contract. A short position can also be achieved through certain types of

2279:. If short shares continue to rise in price, and the holder does not have sufficient funds in the cash account to cover the position, the holder begins to borrow on margin for this purpose, thereby accruing margin interest charges. These are computed and charged just as for any other margin debit. Therefore, only margin accounts can be used to open a short position.

1905:

holds the securities for the institution. In an institutional stock loan, the borrower puts up cash collateral, typically 102% of the value of the stock. The cash collateral is then invested by the lender, who often rebates part of the interest to the borrower. The interest that is kept by the lender is the compensation to the lender for the stock loan.

2797:

U.S. investors considering entering into a "short against the box" transaction should be aware of the tax consequences of this transaction. Unless certain conditions are met, the IRS deems a "short against the box" position to be a "constructive sale" of the long position, which is a taxable event.

2606:

Another risk is that a given stock may become "hard to borrow". As defined by the SEC and based on lack of availability, a broker may charge a hard to borrow fee daily, without notice, for any day that the SEC declares a share is hard to borrow. Additionally, a broker may be required to cover a short

1904:

The vast majority of stocks borrowed by U.S. brokers come from loans made by the leading custody banks and fund management companies (see list below). Institutions often lend out their shares to earn extra money on their investments. These institutional loans are usually arranged by the custodian who

2436:

currencies. Assume that the current market rate is US$ 1 to Rs. 50 and the trader borrows Rs. 100. With this, he buys US$ 2. If the next day, the conversion rate becomes US$ 1 to Rs. 51, then the trader sells his US$ 2 and gets Rs. 102. He returns Rs. 100 and keeps the Rs. 2 profit (minus fees).

2046:

relates the number of shares in a given equity that have been legally shorted divided by the total shares outstanding for the company, usually expressed as a percent. For example, if there are ten million shares of XYZ Inc. that are currently legally short-sold, and the total number of shares issued

1947:

sold short as a multiple of the average daily volume. These can be useful tools to spot trends in stock price movements but for them to be reliable, investors must also ascertain the number of shares brought into existence by naked shorters. Speculators are cautioned to remember that for every share

1908:

Brokerage firms can also borrow stocks from the accounts of their own customers. Typical margin account agreements give brokerage firms the right to borrow customer shares without notifying the customer. In general, brokerage accounts are only allowed to lend shares from accounts for which customers

1780:

is the practice of short-selling a tradable asset without first borrowing the security or ensuring that the security can be borrowed – it was this practice that was commonly restricted. Investors argued that it was the weakness of financial institutions, not short-selling, that drove stocks to fall.

2635:

Short sellers tend to temper overvaluation by selling into exuberance. Likewise, short sellers are said to provide price support by buying when negative sentiment is exacerbated after a significant price decline. Short selling can have negative implications if it causes a premature or unjustified

1781:

In

September 2008, the Securities Exchange Commission in the United States abruptly banned short sales, primarily in financial stocks, to protect companies under siege in the stock market. That ban expired several weeks later as regulators determined the ban was not stabilizing the price of stocks.

1659:

or VOC in Dutch). Short selling can exert downward pressure on the underlying stock, driving down the price of shares of that security. This, combined with the seemingly complex and hard-to-follow tactics of the practice, has made short selling a historical target for criticism. At various times in

1639:. These contracts are typically cash-settled, meaning that no buying or selling of the asset in question is actually involved in the contract, although typically one side of the contract will be a broker that will effect a back-to-back sale of the asset in question in order to hedge their position.

1536:

and sell it, expecting that it will be cheaper to repurchase in the future. When the seller decides that the time is right (or when the lender recalls the securities), the seller buys the same number of equivalent securities and returns them to the lender. The act of buying back the securities that

2861:

The

Securities and Exchange Commission initiated a temporary ban on short selling of 799 financial stocks from 19 September 2008 until 2 October 2008. Greater penalties for naked shorting, by mandating delivery of stocks at clearing time, were also introduced. Some state governors have been urging

2058:

stock reached an annualized 55%, indicating that a short seller would need to pay the lender more than half the price of the stock over the course of the year, essentially as interest for borrowing a stock in limited supply. This has important implications for derivatives pricing and strategy, for

2898:

banned naked short selling of leading financial stocks. By contrast with the approach taken by other countries, Chinese regulators responded by allowing short selling, along with a package of other market reforms. Short selling was completely allowed on 31 March 2010, limited to " for large blue

2793:

was used to store (long) shares. The purpose of this technique is to lock in paper profits on the long position without having to sell that position (and possibly incur taxes if said position has appreciated). Once the short position has been entered, it serves to balance the long position taken

2736:

is constantly trading bonds when clients want to buy or sell. This can create substantial bond positions. The largest risk is that interest rates overall move. The trader can hedge this risk by selling government bonds short against his long positions in corporate bonds. In this way, the risk

2586:

with their stockbroker after selling a stock short—an order to the brokerage to cover the position if the price of the stock should rise to a certain level. This is to limit the loss and avoid the problem of unlimited liability described above. In some cases, if the stock's price skyrockets, the

2318:

A similar issue comes up with the voting rights attached to the shorted shares. Unlike a dividend, voting rights cannot legally be synthesized and so the buyer of the shorted share, as the holder of record, controls the voting rights. The owner of a margin account from which the shares were lent

2053:

is the fee paid to a securities lender for borrowing the stock or other security. The cost of borrowing the stock is usually negligible compared to fees paid and interest accrued on the margin account – in 2002, 91% of stocks could be shorted for less than a 1% fee per annum, generally lower than

2039:

short-sold and the number of days of typical trading that it would require to 'cover' all legal short positions outstanding. For example, if there are ten million shares of XYZ Inc. that are currently legally short-sold and the average daily volume of XYZ shares traded each day is one million, it

2572:

are not, as there is no limit, in theory, on how high the price can go. On the other hand, the short seller's possible gains are limited to the original price of the stock, which can only go down to zero, whereas the loss potential, again in theory, has no limit. For this reason, short selling

2160:

A naked short sale occurs when a security is sold short without borrowing the security within a set time (for example, three days in the US.) This means that the buyer of such a short is buying the short-seller's promise to deliver a share, rather than buying the share itself. The short-seller's

2602:

sold short, but not covered. A short squeeze can be deliberately induced. This can happen when large investors (such as companies or wealthy individuals) notice significant short positions, and buy many shares, with the intent of selling the position at a profit to the short sellers, who may be

2594:. When the price of a stock rises significantly, some people who are shorting the stock cover their positions to limit their losses (this may occur in an automated way if the short sellers had stop-loss orders in place with their brokers); others may be forced to close their position to meet a

2396:

Transactions in financial derivatives such as options and futures have the same name but have different overlaps, one notable overlap is having an equal "negative" amount in the position. However, the practice of a short position in derivatives is completely different. Derivatives are contracts

2310:

and is unlikely to be aware that these particular shares are being lent out for shorting, also expects to receive a dividend. The short seller therefore pays the lender an amount equal to the dividend to compensate—though technically, as this payment does not come from the company, it is not a

2412:

An investor can also purchase a put option, giving that investor the right (but not the obligation) to sell the underlying asset (such as shares of stock) at a fixed price. In the event of a market decline, the option holder may exercise these put options, obliging the counterparty to buy the

2289:

For some brokers, the short seller may not earn interest on the proceeds of the short sale or use it to reduce outstanding margin debt. These brokers may not pass this benefit on to the retail client unless the client is very large. The interest is often split with the lender of the security.

1800:

and other

European countries in 2008 to minimal effect. Australia moved to ban naked short selling entirely in September 2008. Germany placed a ban on naked short selling of certain euro zone securities in 2010. Spain, Portugal and Italy introduced short selling bans in 2011 and again in 2012.

2943:. Chanos responds to critics of short-selling by pointing to the critical role they played in identifying problems at Enron, Boston Market and other "financial disasters" over the years. In 2011, research oriented short sellers were widely acknowledged for exposing the China stock frauds.

2631:

that froze the values of shorted stocks at artificially high values. Reportedly in some instances, brokers charged short sellers excessively large amounts of interest based on these high values as the shorts were forced to continue their borrowings at least until the halts were lifted.

1549:. A short position can be covered at any time before the securities are due to be returned. Once the position is covered, the short seller is not affected by subsequent rises or falls in the price of the securities, for it already holds the securities that it will return to the lender.

2798:

These conditions include a requirement that the short position be closed out within 30 days of the end of the year and that the investor must hold their long position, without entering into any hedging strategies, for a minimum of 60 days after the short position has been closed.

2794:

earlier. Thus, from that point in time, the profit is locked in (less brokerage fees and short financing costs), regardless of further fluctuations in the underlying share price. For example, one can ensure a profit in this way, while delaying sale until the subsequent tax year.

2823:) that a short sale could only be made when the price of a particular stock was higher than the previous trade price. The uptick rule aimed to prevent short sales from causing or exacerbating market price declines. In January 2005, The Securities and Exchange Commission enacted

2931:

have said that short sellers help the market. Klarman argued that short sellers are a useful counterweight to the widespread bullishness on Wall Street, while

Buffett believes that short sellers are useful in uncovering fraudulent accounting and other problems at companies.

2023:

and SunGard

Financial Systems) believe that stock lending data provides a good proxy for short interest levels (excluding any naked short interest). SunGard provides daily data on short interest by tracking the proxy variables based on borrowing and lending data it collects.

2054:

interest rates earned on the margin account. However, certain stocks become "hard to borrow" as stockholders willing to lend their stock become more difficult to locate. The cost of borrowing these stocks can become significant – in

February 2001, the cost to borrow (short)

1752:, shorting a start-up company could backfire since it could be taken over at a price higher than the price at which speculators shorted; short-sellers were forced to cover their positions at acquisition prices, while in many cases the firm often overpaid for the start-up.

2559:

Short selling is sometimes referred to as a "negative income investment strategy" because there is no potential for dividend income or interest income. Stock is held only long enough to be sold pursuant to the contract, and one's return is therefore limited to short term

1627:"Shorting" or "going short" (and sometimes also "short selling") also refer more broadly to any transaction used by an investor to profit from the decline in price of a borrowed asset or financial instrument. Derivatives contracts that can be used in this way include

2421:

Selling short on the currency markets is different from selling short on the stock markets. Currencies are traded in pairs, each currency being priced in terms of another. In this way, selling short on the currency markets is identical to going long on stocks.

1948:

that has been shorted (owned by a new owner), a 'shadow owner' exists (i.e., the original owner) who also is part of the universe of owners of that stock, i.e., despite having no voting rights, he has not relinquished his interest and some rights in that stock.

2198:, intended to prevent speculators from selling some stocks short before doing a locate. More stringent rules were put in place in September 2008, ostensibly to prevent the practice from exacerbating market declines. These rules were made permanent in 2009.

1667:

collapsed in June 1772, precipitating a major crisis that included the collapse of almost every private bank in

Scotland, and a liquidity crisis in the two major banking centres of the world, London and Amsterdam. The bank had been speculating by shorting

2047:

by the company is one hundred million, the Short

Interest is 10% (10 million / 100 million). If, however, shares are being created through naked short selling, "fails" data must be accessed to assess accurately the true level of short interest.

4820:

Lobanova O, Hamid S. S. and

Prakash A. J. (2010) "The impact of short-sale restrictions on volatility, liquidity, and market efficiency: the evidence from the short-sale ban in the u.s." Technical report, Florida International University – Department of

1962:

When a security is sold, the seller is contractually obliged to deliver it to the buyer. If a seller sells a security short without owning it first, the seller must borrow the security from a third party to fulfill its obligation. Otherwise, the seller

2784:

One variant of selling short involves a long position. "Selling short against the box" consists of holding a long position on which the shares have already risen, whereupon one then enters a short sell order for an equal number of shares. The term

1714:. Regulations governing short selling were implemented in the United States in 1929 and in 1940. Political fallout from the 1929 crash led Congress to enact a law banning short sellers from selling shares during a downtick; this was known as the

2919:

mechanism. Financial researchers at Duke

University said in a study that short interest is an indicator of poor future stock performance (the self-fulfilling aspect) and that short sellers exploit market mistakes about firms' fundamentals.

544:

to its broker as collateral to ensure that any such liabilities can be met, and to post additional margin if losses begin to accrue. For analogous reasons, short positions in derivatives also usually involve the posting of margin with the

2007:

shorted shares) is available in a number of countries, including the US, the UK, Hong Kong, and Spain. The number of stocks being shorted on a global basis has increased in recent years for various structural reasons (e.g., the growth of

2610:

Because short sellers must eventually deliver the shorted securities to their broker, and need money to buy them, there is a credit risk for the broker. The penalties for failure to deliver on a short selling contract inspired financier

2626:

on North American equity markets brought a related risk to light for the short seller. The efforts of research-oriented short sellers to expose these frauds eventually prompted NASDAQ, NYSE and other exchanges to impose sudden, lengthy

1591:

Short seller keeps as its profit the $ 200 difference between the price at which the short seller sold the borrowed shares and the lower price at which the short seller purchased the equivalent shares (minus borrowing fees paid to the

2428:

When the exchange rate has changed, the trader buys the first currency again; this time he gets more of it, and pays back the loan. Since he got more money than he had borrowed initially, he makes money. The reverse can also occur.

4806:

Marsh I and Niemer N (2008) "The impact of short sales restrictions". Technical report, commissioned and funded by the International Securities Lending Association (ISLA) the Alternative Investment Management Association (AIMA) and

1617:

Short seller incurs as a loss the $ 1,500 difference between the price at which they sold the borrowed shares and the higher price at which the short seller had to purchase the equivalent shares (plus any borrowing

582:

Research indicates that banning short selling is ineffective and has negative effects on markets. Nevertheless, short selling is subject to criticism and periodically faces hostility from society and policymakers.

1808:, shorting was severely restricted or temporarily banned, with European market watchdogs tightening the rules on short selling "in an effort to stem the historic losses arising from the coronavirus pandemic".

1987:. The lender receives a fee for this service. Similarly, retail investors can sometimes make an extra fee when their broker wants to borrow their securities. This is only possible when the investor has full

533:. This is an agreements between two parties to pay each other the difference if the price of an asset rises or falls, under which the party that will benefit if the price falls will have a short position.

4830:

Beber A. and Pagano M. (2009) "Short-selling bans around the world: Evidence from the 2007–09 crisis". CSEF Working Papers 241, Centre for Studies in Economics and Finance (CSEF), University of Naples,

3646:

3707:

4701:

2834:

securities by requiring a broker possess or have arranged to possess borrowed shares. The close out component requires that a broker be able to deliver the shares that are to be shorted. In the US,

1776:

created instability in the stock market and placed additional downward pressure on prices. In response, a number of countries introduced restrictive regulations on short-selling in 2008 and 2009.

2275:

If the short position begins to move against the holder of the short position (i.e., the price of the security begins to rise), money is removed from the holder's cash balance and moved to their

3395:

1811:

Worldwide, economic regulators seem inclined to restrict short selling to decrease potential downward price cascades. Investors continue to argue this only contributes to market inefficiency.

2272:

When a broker facilitates the delivery of a client's short sale, the client is charged a fee for this service, usually a standard commission similar to that of purchasing a similar security.

3828:

3734:

2838:(IPOs) cannot be sold short for a month after they start trading. This mechanism is in place to ensure a degree of price stability during a company's initial trading period. However, some

4299:

2298:

Where shares have been shorted and the company that issues the shares distributes a dividend, the question arises as to who receives the dividend. The new buyer of the shares, who is the

575:

investors or speculators hope to profit from a rise in the price of an instrument that appears undervalued. Alternatively, traders or fund managers may use offsetting short positions to

1695:

was in use from at least the mid-nineteenth century. It is commonly understood that the word "short" (i.e. 'lacking') is used because the short seller is in a deficit position with his

1588:

Short seller returns the shares to the lender, who must accept the return of the same number of shares as was lent despite the fact that the market value of the shares has decreased.

4923:

4359:

3294:

3121:

2425:

Novice traders or stock traders can be confused by the failure to recognize and understand this point: a contract is always long in terms of one medium and short another.

4390:

4326:

2725:

A farmer who has just planted their wheat wants to lock in the price at which they can sell after the harvest. The farmer would take a short position in wheat futures.

2587:

stockbroker may decide to cover the short seller's position immediately and without his consent to guarantee that the short seller can make good on his debt of shares.

4277:

3917:

4618:

29:

and immediately sells them. The short seller then expects the price to decrease, after which the seller can profit by purchasing the shares to return to the lender.

3677:

2607:

seller's position at any time ("buy in"). The short seller receives a warning from the broker that he is "failing to deliver" stock, which leads to the buy-in.

4961:

3185:

1895:

To sell stocks short in the U.S., the seller must arrange for a broker-dealer to confirm that it can deliver the shorted securities. This is referred to as a

4480:

3699:

3085:

1920:. Brokers go through the "locate" process outside their own firm to obtain borrowed shares from other brokers only for their large institutional customers.

6229:

4705:

3638:

3210:

1745:

Negative news, such as litigation against a company, may also entice professional traders to sell the stock short in hope of the stock price going down.

3385:

2322:

As noted earlier, victims of naked shorting sometimes report that the number of votes cast is greater than the number of shares issued by the company.

4671:

3605:

4728:

4502:

3957:

3821:

2615:

to warn: "He who sells what isn't his'n, Must buy it back or go to pris'n." To manage its own risk, the broker requires the short seller to keep a

1402:

3808:

3730:

4303:

2987:

Several studies of the effectiveness of short selling bans indicate that short selling bans do not contribute to more moderate market dynamics.

3890:

2827:

to target abusive naked short selling. Regulation SHO was the SEC's first update to short selling restrictions since the uptick rule in 1938.

4644:

3103:

2904:

1431:

4367:

2819:

the power to regulate short sales. The first official restriction on short selling came in 1938, when the SEC adopted a rule (known as the

2763:

A short seller may be trying to benefit from market inefficiencies arising from the mispricing of certain products. Examples of this are

6206:

3860:

3417:

1718:

and was in effect until 3 July 2007, when it was removed by the Securities and Exchange Commission (SEC Release No. 34-55970). President

1392:

1357:

4449:

6110:

4954:

3992:

3169:

2176:

475:, where the investor will profit if the market value of the asset rises. An investor that sells an asset short is, as to that asset, a

4593:

3579:

4018:

2413:

underlying asset at the agreed upon (or "strike") price, which would then be higher than the current quoted spot price of the asset.

1514:

3483:

3318:"The Panic Effect: Possible Unintended Consequences of the Temporary Bans on Short Selling Enacted During the 2008 Financial Crisis"

1916:

Most brokers allow retail customers to borrow shares to short a stock only if one of their own customers has purchased the stock on

3286:

1170:

536:

Because a short seller can incur a liability to the lender if the price rises, and because a short sale is normally done through a

3118:

1559:

Because the price of a share is theoretically unlimited, the potential losses of a short-seller are also theoretically unlimited.

4777:

2191:

4263:

4382:

2883:

2444:

or options; the preceding method is used to bet on the spot price, which is more directly analogous to selling a stock short.

2397:

between two parties, a buyer and seller. Each trade results in a "long" (buyer's position) and a "short" (seller's position).

5810:

5752:

4947:

4910:

4895:

4880:

4808:

4336:

4241:

2879:

4285:

2903:." However, in 2015, short selling was effectively banned due to legislative restrictions on borrowing stocks following the

2522:

1901:. Brokers have a variety of means to borrow stocks to facilitate locates and make good on delivery of the shorted security.

5192:

3978:

The Theory and Practice of Short Selling, Chapter 9, Conclusions and Implications for Investors by Frank J. Fabozzi, editor

435:

327:

4134:

3449:

2494:

3363:

2302:

and holds the shares outright, receives the dividend from the company. However, the lender, who may hold its shares in a

2164:

When the holder of the underlying stock receives a dividend, the holder of the hypothecated share would receive an equal

1183:

322:

2568:

profile from selling short. Furthermore, a "long's" losses are limited because the price can only go down to zero, but

2286:

passes, the dividend is deducted from the shortholder's account and paid to the person from whom the stock is borrowed.

44:

4211:

4194:

4167:

4113:

4086:

3551:

3521:

3270:

3243:

3137:

2816:

2721:

Hedging often represents a means of minimizing the risk from a more complex set of transactions. Examples of this are:

1342:

347:

3913:

3669:

2830:

The regulation contains two key components: the "locate" and the "close-out". The locate component attempts to reduce

1672:

stock on a massive scale, and apparently using customer deposits to cover losses. In another well-referenced example,

6295:

4631:

4047:

3986:

2708:

2541:

2501:

2383:

2259:

2040:

would require ten days of average trading for all legal short positions to be covered (10 million / 1 million).

1870:

1734:

founded a fund (that was unregulated) that bought stocks while selling other stocks short, hence hedging some of the

1656:

2690:

2365:

2241:

5217:

3182:

2682:

2475:

2357:

2233:

2183:" or simply "fail." While many fails are settled in a short time, some have been allowed to linger in the system.

1848:

1064:

4888:

Don't Blame the Shorts: Why Short Sellers Are Always Blamed for Market Crashes and Why History Is Repeating Itself

4540:

4472:

3337:

3082:

3058:

2812:

1761:

3202:

2564:, which are taxed as ordinary income. For this reason, buying shares (called "going long") has a very different

1579:

A short seller borrows from a lender 100 shares of ACME Inc., and immediately sells them for a total of $ 1,000.

4750:

3053:

2686:

2508:

2479:

2361:

2237:

2076:

1852:

1614:

Short seller returns the shares to the lender, who accepts the return of the same number of shares as was lent.

824:

734:

342:

337:

6290:

5211:

4844:

3756:

3043:

2966:

suggest Cramer exaggerated the costs of short selling and underestimated the benefits, which may include the

1664:

1507:

1476:

720:

3614:

2984:, for example, engaged in a lengthy legal battle with the pharmaceutical manufacturer Hemispherx Biopharma.

6249:

6084:

5694:

5634:

5430:

5336:

4679:

3008:

2871:

1611:

Short seller is required to return the shares, and is compelled to buy 100 shares of ACME Inc. for $ 2,500.

2490:

2016:

member firms to report data on the 15th of each month, and then publishes a compilation eight days later.

2012:

type strategies, short or bear ETFs). The data is typically delayed; for example, the NASDAQ requires its

6072:

5420:

5388:

5292:

5246:

5229:

5182:

6285:

5783:

5205:

5199:

3939:

2950:

has expressed concern about short selling and started a petition calling for the reintroduction of the

2847:

2603:

panicked by the initial uptick or who are forced to cover their short positions to avoid margin calls.

1286:

1000:

690:

121:

6211:

6155:

5874:

5801:

5745:

4300:"Australian Securities and Investments Commission – 08-210 ASIC extends ban on covered short selling"

3795:

1711:

1347:

1232:

1010:

784:

549:. Any failure to post margin promptly would prompt the broker or counterparty to close the position.

4572:

2748:

so that they are not exposed to risk from price movements in the stocks that underlie their options.

6048:

5918:

5594:

5269:

4331:

3886:

2671:

2346:

2222:

2088:

1652:

1500:

1036:

428:

317:

4648:

3100:

1931:

typically report the "short interest" of a stock, which gives the number of shares that have been

6150:

6058:

6053:

6017:

5914:

5878:

5548:

5409:

5304:

5187:

3033:

2855:

2835:

2675:

2468:

2350:

2226:

2130:

1841:

679:

669:

530:

232:

111:

4078:

The Hedge Fund Handbook: A Definitive Guide for Analyzing and Evaluating Alternative Investments

3513:

The Hedge Fund Handbook: A Definitive Guide for Analyzing and Evaluating Alternative Investments

2432:

An example of this is as follows: Let us say a trader wants to trade with the US dollar and the

1764:, critics argued that investors taking large short positions in struggling financial firms like

6280:

6160:

5957:

5830:

5806:

5791:

5436:

3119:

http://scholarlycommons.law.northwestern.edu/cgi/viewcontent.cgi?article=1704&context=njilb

838:

749:

154:

4184:

4157:

4103:

3853:

3541:

1552:

The process relies on the fact that the securities (or the other assets being sold short) are

6185:

5843:

5815:

5796:

5574:

5383:

4559:

4536:

4413:

4076:

3233:

2319:

agreed in advance to relinquish voting rights to shares during the period of any short sale.

1980:

1178:

789:

312:

3976:

3511:

3260:

571:

may sell short hoping to realize a profit on an instrument that appears overvalued, just as

6239:

6090:

6002:

5838:

5820:

5738:

5709:

5629:

5394:

5378:

5341:

5223:

5166:

5134:

4586:

3571:

3038:

2900:

2515:

1968:

1940:

1731:

1374:

1291:

995:

920:

854:

806:

649:

370:

267:

76:

4014:

3809:

SunGard Launches Borrow Indices; First Proxy for Measuring Short Interest on a Daily Basis

16:

Practice of selling securities or other financial instruments that are not currently owned

8:

6259:

6165:

6145:

5972:

5947:

5639:

5584:

5508:

5368:

5298:

5127:

5100:

2974:

2939:

received widespread publicity when he was an early critic of the accounting practices of

2636:

share price collapse when the fear of cancellation due to bankruptcy becomes contagious.

2171:

Naked shorting has been made illegal except where allowed under limited circumstances by

2155:

2068:

1777:

1451:

1441:

1161:

1118:

1070:

1015:

829:

421:

4159:

The Complete Guide to Selling Stocks Short: Everything You Need to Know Explained Simply

3475:

6170:

6115:

6027:

5679:

5654:

5614:

5599:

5518:

5488:

5457:

5415:

5159:

5069:

5059:

4785:

4496:

4441:

2831:

2180:

2072:

1984:

1957:

1820:

1669:

1533:

1464:

1446:

1296:

1251:

1200:

1041:

930:

664:

491:

472:

352:

295:

149:

54:

36:

26:

4842:"Regulatory Medicine Against Financial Market Instability: What Helps And What Hurts?"

2874:

had a moratorium on short selling of 29 leading financial stocks, effective from 2300

2619:

account, and charges interest of between 2% and 8% depending on the amounts involved.

1605:

A short seller borrows 100 shares of ACME Inc., and sells them for a total of $ 1,000.

5893:

5869:

5853:

5543:

5528:

5280:

4906:

4891:

4876:

4627:

4532:

4445:

4433:

4190:

4163:

4109:

4082:

3982:

3547:

3517:

3266:

3239:

3163:

3028:

2981:

2772:

2768:

2569:

2060:

1805:

1352:

1228:

1123:

990:

985:

980:

954:

915:

739:

639:

482:

There are a number of ways of achieving a short position. The most basic is physical

402:

397:

4934:

4130:

3442:

6062:

5997:

5644:

5564:

5360:

5241:

5117:

5036:

4992:

4970:

4524:

4425:

3782:

3329:

3023:

2963:

2790:

2623:

2616:

2406:

2283:

2112:

1988:

1917:

1897:

1727:

1632:

1628:

1568:

1424:

1217:

1191:

1109:

1102:

1085:

1031:

1005:

892:

874:

859:

779:

770:

674:

659:

621:

595:

561:

553:

541:

522:

518:

514:

387:

382:

377:

215:

169:

164:

116:

106:

94:

4233:

25:

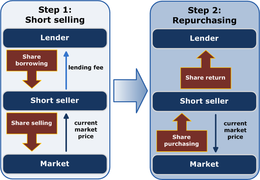

Schematic representation of physical short selling in two steps. The short seller

6201:

6095:

6076:

6043:

5967:

5962:

5898:

5719:

5714:

5624:

5559:

5533:

5513:

5472:

5467:

5462:

5447:

5442:

5330:

5264:

5256:

5144:

5031:

4928:

4848:

3189:

3125:

3107:

3089:

2996:

2916:

2650:

2574:

2441:

2307:

2100:

2035:

is the relationship between the number of shares in a given equity that has been

1936:

1765:

1723:

1685:

1681:

1677:

1572:

1407:

1332:

1323:

1281:

1246:

1238:

1046:

935:

849:

630:

576:

495:

407:

307:

282:

262:

250:

227:

192:

144:

3183:

https://www.newyorkfed.org/medialibrary/media/research/current_issues/ci18-5.pdf

2858:. Canada and other countries do allow selling IPOs (including U.S. IPOs) short.

611:

6100:

6080:

5848:

5674:

5669:

5569:

5554:

5315:

5310:

5275:

5074:

5041:

4987:

4979:

3731:"Short-selling bans sweep Europe in the hope of stemming stock market bleeding"

2928:

2915:

Advocates of short selling argue that the practice is an essential part of the

2839:

2824:

2733:

2303:

2276:

2195:

2106:

2020:

1983:

firm, often lend out these securities to gain extra income, a process known as

1976:

1884:

1785:

1773:

1749:

1719:

1696:

1648:

1647:

The practice of short selling was likely invented in 1609 by Dutch businessman

1636:

1314:

1152:

844:

814:

729:

696:

572:

526:

499:

469:

392:

357:

302:

197:

187:

159:

66:

3359:

3083:

https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr518.pdf

6274:

6175:

6140:

6066:

5538:

5523:

5498:

5452:

5404:

5107:

5064:

5051:

5002:

4437:

3048:

3018:

3002:

2980:

Individual short sellers have been subject to criticism and even litigation.

2890:

and Canada banned short selling of leading financial stocks, and France, the

2851:

2745:

2591:

2094:

2013:

1992:

1381:

1337:

1113:

1075:

1055:

940:

901:

654:

4729:"B. Alpert "Even Short Sellers Burned by Chinese Shares" (Barrons 20110618)"

4587:"Do Short Sellers Convey Information About Changes in Fundamentals or Risk?"

3144:

6180:

6135:

6022:

6007:

5888:

5699:

5619:

5589:

5579:

5399:

5373:

5122:

5112:

5095:

5026:

5021:

4997:

4623:

4040:

3013:

2936:

2924:

2729:

2628:

2595:

2561:

2433:

2172:

2055:

1972:

1700:

1673:

1488:

1306:

1276:

1136:

834:

711:

684:

546:

465:

101:

3639:"Germany to Temporarily Ban Naked Short Selling, Some Swaps of Euro Bonds"

2186:

In the US, arranging to borrow a security before a short sale is called a

2075:

feature of American call options on non-dividend paying stocks can become

6012:

5952:

5704:

5684:

5664:

5659:

5604:

5493:

5425:

2951:

2891:

2887:

2843:

2820:

2738:

2612:

1735:

1726:

said he would investigate short sellers for their role in prolonging the

1715:

1553:

1532:

To profit from a decrease in the price of a security, a short seller can

896:

761:

706:

701:

644:

557:

537:

257:

126:

4528:

5761:

5689:

5609:

5286:

5149:

4518:"Short Sale Constraints And Stock Returns by C.M Jones and O.A. Lamont"

4517:

4429:

3317:

2947:

2582:

1855: in this section. Unsourced material may be challenged and removed.

1739:

1131:

970:

906:

568:

277:

272:

202:

3572:"A Debate as a Ban on Short-Selling Ends: Did It Make Any Difference?"

3333:

2878:

on 19 September 2008 until 16 January 2009. After the ban was lifted,

5778:

5325:

5320:

5235:

5154:

2758:

2190:. In 2005, to prevent widespread failure to deliver securities, the

1436:

1397:

1080:

869:

864:

461:

71:

5932:

4939:

4903:

Fubarnomics: A Lighthearted, Serious Look at America's Economic Ills

4868:

4754:

4645:"2006 Berkshire Hathaway Annual Meeting Q&A with Warren Buffett"

2660:

2457:

2335:

2211:

1830:

5503:

5139:

4237:

3063:

2165:

2142:

2124:

2118:

2064:

884:

744:

507:

503:

61:

4841:

4015:"United States IRS Publication 550 Investment Income and Expenses"

3760:

21:

5347:

3390:

3360:"Scripophily – PSTA – Professional Scripophily Trade Association"

2967:

2895:

1789:

1684:

of 1992, when he sold short more than $ 10 billion worth of

603:

449:

332:

4131:"Division of Market Regulation: Key Points about Regulation SHO"

5090:

4414:"Short selling, margin buying and stock return in China market"

3418:"What Kinds of Restrictions Does the SEC Put on Short Selling?"

3101:

http://people.stern.nyu.edu/mbrenner/research/short_selling.pdf

2136:

2009:

1928:

1793:

1471:

756:

5730:

4327:"Australian short selling ban goes further than other bourses"

1660:

history, governments have restricted or banned short selling.

1608:

Subsequently, the price of the shares rises to $ 25 per share.

5013:

3235:

Trading and Exchange: Market Microstructure for Practitioners

2971:

2940:

1797:

1596:

1582:

Subsequently, the price of the shares falls to $ 8 per share.

1527:

975:

925:

457:

222:

81:

3667:

2899:

chip stocks with good earnings performance and little price

1562:

579:

certain risks that exist in a long position or a portfolio.

468:

of the asset falls. This is the opposite of the more common

4383:"UPDATE 2-China to launch stocks margin trade, short sales"

2850:) have used the lack of short selling during this month to

2565:

1924:

1769:

1301:

1268:

879:

819:

4473:"China stock exchanges step up crackdown on short-selling"

4186:

Security Analysis with Investment and Portfolio Management

3258:

506:) and reimburse the lender for any cash return (such as a

2875:

1784:

Temporary short-selling bans were also introduced in the

1212:

4516:

Jones, Charles M.; Lamont, Owen A. (20 September 2001).

1991:

of the security, so it cannot be used as collateral for

1585:

Short seller now buys 100 shares of ACME Inc. for $ 800.

4929:"Short-Selling Bans Dampen 130/30 Strategies Worldwide"

4212:"Short Sellers under Fire in U.S., U.K. After AIG Fall"

3670:"Spain, Portugal and Italy reinstate short-selling ban"

3315:

2440:

One may also take a short position in a currency using

1601:

Shares in ACME Inc. currently trade at $ 10 per share.

4672:"Balance Sheet : The silly season isn't over yet"

4471:

Chatterjee, Nathaniel Taplin, Saikat (4 August 2015).

2555:

Note: this section does not apply to currency markets.

1707:, began shorting stocks in the United States in 1822.

1622:

490:, by which the short seller borrows an asset (often a

3700:"The AMF announces a short selling ban for one month"

1939:. Alternatively, these can also be expressed as the

4412:

Li, Rui; Li, Nan; Li, Jiahui; Wu, Chongfeng (2018).

3476:"New York Magazine – The Creation of the Hedge Fund"

2767:

An arbitrageur who buys long futures contracts on a

1971:, and the seller may be subject to a claim from its

4162:. Atlantic Publishing Group Inc. pp. 178–179.

3386:"Short sellers have been the villain for 400 years"

2590:Short sellers must be aware of the potential for a

2482:. Unsourced material may be challenged and removed.

2311:dividend. The short seller is therefore said to be

1755:

464:in such a way that the investor will profit if the

4702:"Contrarian Investor Sees Economic Crash in China"

3814:

3613:

3262:An Introduction to Derivatives and Risk Management

2577:strategy to manage the risks of long investments.

3546:. South-Western College Publishing. p. 308.

1998:

1975:. Certain large holders of securities, such as a

6272:

4108:. Discovery Publishing House. pp. 122–123.

3378:

2400:

2059:the borrow cost itself can become a significant

554:public securities, futures, and currency markets

4861:

4324:

3668:Tracy Rucinski; Stephen Jewkes (23 July 2012).

3259:Don M. Chance; Robert Brooks (11 August 2009).

567:A short sale may have a variety of objectives.

540:, a short seller is typically required to post

513:A short position can also be created through a

4931:, Global Investment Technology, Sept. 29, 2008

4769:

4360:"Europe Spooked By Revenge of the Commodities"

3287:"'Naakt short gaan', een oud-Hollands kunstje"

2865:

2293:

5746:

4955:

4182:

3958:"Even Short-Sellers Burned by Chinese Shares"

2882:, chairman of the Treasury Select Committee,

2744:An options trader may short shares to remain

2063:for holding the stock (similar to additional

1890:

1508:

510:) that was paid on the asset while borrowed.

429:

4890:(New York: McGraw-Hill Professional, 2009).

4663:

4501:: CS1 maint: multiple names: authors list (

4046:. Securities and Exchange Commission. 1934.

3846:

3231:

6230:Alternative investment management companies

6207:Standards Board for Alternative Investments

4873:The Oxford Handbook of Financial Regulation

4515:

4070:

4068:

2689:. Unsourced material may be challenged and

2364:. Unsourced material may be challenged and

2240:. Unsourced material may be challenged and

2177:Depository Trust & Clearing Corporation

2079:, which otherwise would not be economical.

1883:A short seller typically borrows through a

1393:International Financial Reporting Standards

1358:Separation of investment and retail banking

6255:

6111:Taxation of private equity and hedge funds

5753:

5739:

4962:

4948:

4642:

4470:

4101:

3505:

3503:

3501:

2161:promise is known as a hypothecated share.

1597:Worked example of a loss-making short sale

1528:Physical shorting with borrowed securities

1515:

1501:

436:

422:

4875:(Oxford: Oxford University Press, 2015).

4834:

4318:

3884:

3749:

3599:

3597:

3535:

3533:

2910:

2709:Learn how and when to remove this message

2542:Learn how and when to remove this message

2384:Learn how and when to remove this message

2260:Learn how and when to remove this message

2121:(Amsterdam, Netherlands, formerly Fortis)

1871:Learn how and when to remove this message

1563:Worked example of a profitable short sale

4669:

4411:

4278:"ASX ban on short selling is indefinite"

4128:

4065:

3914:"Knowing the Rules of the Shorting Game"

3757:"Understanding Short Selling – A Primer"

3661:

3636:

3565:

3563:

3473:

3203:"Short Sale Constraints and Overpricing"

20:

4074:

3974:

3854:"Lecture 13: Hard to Borrow Securities"

3509:

3498:

3238:. Oxford University Press. p. 41.

2192:U.S. Securities and Exchange Commission

6273:

4775:

4726:

3975:Fabozzi, Frank J. (17 November 2004).

3911:

3606:"Short-selling ban has minimal effect"

3603:

3594:

3569:

3539:

3530:

3200:

3168:: CS1 maint: archived copy as title (

2149:

2027:

2003:Time delayed short interest data (for

552:Short selling is a common practice in

5811:fixed-income relative-value investing

5734:

4969:

4943:

4935:SEC Discussion of Naked Short Selling

4809:London Investment Banking Association

4599:from the original on 22 February 2012

4325:McDonald, Sarah (22 September 2008).

4209:

4155:

4149:

4095:

3728:

3560:

3252:

3225:

2622:In 2011, the eruption of the massive

2133:Corporation (New York, United States)

2115:(Amsterdam, Netherlands, now defunct)

1951:

1935:sold short as a percent of the total

4380:

4244:from the original on 22 January 2009

4210:Tsang, Michael (19 September 2008).

4137:from the original on 3 February 2023

4053:from the original on 14 January 2012

4021:from the original on 26 October 2018

3995:from the original on 3 February 2023

3920:from the original on 3 February 2023

3710:from the original on 3 February 2023

3680:from the original on 3 February 2023

3649:from the original on 3 February 2023

3582:from the original on 3 February 2023

3486:from the original on 3 February 2023

3398:from the original on 3 February 2023

3366:from the original on 3 February 2023

3340:from the original on 3 February 2023

3322:Entrepreneurial Business Law Journal

3297:from the original on 3 February 2023

3265:. South-Western College. p. 6.

3213:from the original on 28 January 2021

2687:adding citations to reliable sources

2654:

2480:adding citations to reliable sources

2451:

2362:adding citations to reliable sources

2329:

2238:adding citations to reliable sources

2205:

1853:adding citations to reliable sources

1824:

328:Residential mortgage-backed security

4905:(Buffalo, N.Y.: Prometheus, 2010).

4357:

1676:became notorious for "breaking the

1623:Synthetic shorting with derivatives

323:Commercial mortgage-backed security

13:

4776:Nelson, Brett (26 November 2001).

4234:"FSA clamps down on short-selling"

3737:from the original on 31 March 2020

3604:Oakley, David (18 December 2008).

3543:Financial Markets and Institutions

2817:Securities and Exchange Commission

2779:

1710:Short sellers were blamed for the

1432:Private equity and venture capital

1343:Bank for International Settlements

348:Collateralized mortgage obligation

14:

6307:

4917:

4041:"Securities Exchange Act of 1934"

3912:Arnold, Roger (14 January 2000).

3516:. McGraw-Hill. pp. 442–443.

3455:from the original on 15 July 2012

2771:, and sells short the underlying

2573:probably is most often used as a

2071:relationships are broken and the

2019:Some market data providers (like

1722:condemned short sellers and even

1657:Vereenigde Oostindische Compagnie

1571:Inc. currently trade at $ 10 per

1477:Business and Economics portal

6254:

6245:

6244:

6235:

6234:

6225:

6224:

5931:

5218:Electronic communication network

4643:Casterline, Rick (1 June 2006).

4546:from the original on 2 June 2018

4483:from the original on 27 May 2021

4452:from the original on 5 June 2021

4393:from the original on 5 June 2021

4358:Ram, Vidya (22 September 2008).

4284:. 3 October 2008. Archived from

3893:from the original on 10 May 2018

3866:from the original on 18 May 2013

3834:from the original on 3 June 2013

3822:"The market for borrowing stock"

3570:Harris, Larry (7 October 2008).

3316:Stanley, Christopher A. (2009).

2905:stock market crash the same year

2806:

2659:

2456:

2334:

2210:

2082:

1943:, which is the number of shares

1829:

1756:Naked short selling restrictions

1651:, a sizeable shareholder of the

1482:

1470:

1065:Base erosion and profit shifting

610:

43:

5760:

4924:Porsche VW Shortselling Scandal

4824:

4814:

4800:

4743:

4720:

4694:

4636:

4611:

4579:

4509:

4464:

4405:

4381:Shen, Samuel (5 October 2008).

4374:

4351:

4292:

4270:

4256:

4226:

4203:

4176:

4122:

4081:. McGraw-Hill. pp. 85–95.

4033:

4007:

3968:

3950:

3940:"margin account rates schedule"

3932:

3905:

3878:

3801:

3788:

3775:

3759:. Langasset.com. Archived from

3729:Smith, Elliot (17 March 2020).

3722:

3692:

3630:

3474:Lindgren, Hugo (9 April 2007).

3467:

3435:

3410:

3352:

3309:

3059:Special settlement (securities)

2813:Securities Exchange Act of 1934

2467:needs additional citations for

1840:needs additional citations for

3887:"Over-voting at Taser in 2005"

3637:Crawford, Alan (18 May 2010).

3279:

3194:

3176:

3130:

3112:

3094:

3076:

3054:Socially responsible investing

2801:

1999:Sources of short interest data

1730:. A few years later, in 1949,

825:Collateralised debt obligation

735:Bull (stock market speculator)

343:Collateralized fund obligation

338:Collateralized debt obligation

1:

5212:Multilateral trading facility

4727:Alpert, Bill (18 June 2011).

4670:Peterson, Jim (6 July 2002).

4302:. Asic.gov.au. Archived from

3783:About the Short Interest Page

3201:Lamont, Owen (1 March 2005).

3044:Sharia and securities trading

2846:(referred to colloquially as

2639:

2401:Futures and options contracts

1705:The Great Bear of Wall Street

1665:Neal, James, Fordyce and Down

1171:Final consumption expenditure

233:Initial public offering (IPO)

122:Over-the-counter market (OTC)

6085:security characteristic line

5635:Returns-based style analysis

5431:Post-modern portfolio theory

5337:Security characteristic line

4869:Regulating Trading Practices

4862:General and cited references

3069:

3009:Inverse exchange-traded fund

2872:Financial Services Authority

2752:

1923:Stock exchanges such as the

1814:

1663:The London banking house of

7:

6073:Capital asset pricing model

5792:Capital structure arbitrage

5389:Efficient-market hypothesis

5293:Capital asset pricing model

5230:Straight-through processing

4753:. TheStreet. Archived from

4189:. Gyan Books. p. 233.

2990:

2866:Europe, Australia and China

2789:alludes to the days when a

2580:Many short sellers place a

2416:

2294:Dividends and voting rights

2097:(New Jersey, United States)

10:

6312:

5875:Commodity trading advisors

5206:Alternative Trading System

4647:. Fool.com. Archived from

4156:Young, Matthew G. (2010).

4129:U.S. SEC (11 April 2005).

3443:"SEC Release No. 34-55970"

2756:

2648:

2644:

2325:

2153:

2077:rational to exercise early

1955:

1891:Shorting stock in the U.S.

1818:

1642:

1537:were sold short is called

1403:Professional certification

1001:Enterprise risk management

785:Offshore financial centres

586:

268:Exchange-traded fund (ETF)

6220:

6212:Managed Funds Association

6194:

6156:High-net-worth individual

6128:

6036:

5990:

5981:

5940:

5929:

5907:

5862:

5829:

5777:

5768:

5481:

5356:

5255:

5175:

5083:

5050:

5011:

4977:

4282:The Sydney Morning Herald

4075:Lavinio, Stefano (1999).

3981:. John Wiley & Sons.

3885:Greg Land (15 May 2009).

3510:Lavinio, Stefano (1999).

2175:. It is detected by the

2127:(New York, United States)

2103:(New York, United States)

1967:the transaction does not

1712:Wall Street Crash of 1929

1348:Financial Stability Board

6296:Stock market terminology

6049:Arbitrage pricing theory

5270:Arbitrage pricing theory

4418:Accounting & Finance

4332:National Business Review

3106:14 February 2017 at the

3088:24 December 2016 at the

2923:Such noted investors as

2447:

2145:(London, United Kingdom)

2109:(Chicago, United States)

2089:State Street Corporation

1653:Dutch East India Company

1037:Mergers and acquisitions

318:Mortgage-backed security

6161:Institutional investors

6054:Assets under management

5879:managed futures account

5549:Initial public offering

5410:Modern portfolio theory

5305:Dividend discount model

5188:List of stock exchanges

2741:of the corporate bonds.

2201:

2168:from the short seller.

2131:Bank of New York Mellon

2091:(Boston, United States)

531:contract for difference

112:Foreign exchange market

6186:Sovereign wealth funds

5958:High-frequency trading

5807:Fixed income arbitrage

5437:Random walk hypothesis

4867:Fleckner, Andreas M. "

4847:3 January 2018 at the

4567:Cite journal requires

4183:Mahipal Singh (2011).

3798:discusses the product.

3188:18 August 2016 at the

3124:18 August 2016 at the

2956:Don't Blame the Shorts

2911:Views of short selling

839:certificate of deposit

155:Inflation-indexed bond

30:

6028:Structured securities

5844:Distressed securities

5816:Statistical arbitrage

5802:Equity market neutral

5797:Convertible arbitrage

5575:Market capitalization

5384:Dollar cost averaging

4370:on 22 September 2008.

4240:. 18 September 2008.

3540:Madura, Jeff (2009).

3394:. 26 September 2008.

3232:Larry Harris (2002).

2836:initial public offers

2757:Further information:

2649:Further information:

2139:(Zurich, Switzerland)

1981:investment management

1762:2008 financial crisis

1543:covering the position

790:Conduit and sink OFCs

313:Asset-backed security

24:

6291:Financial regulation

6146:Financial endowments

6091:Fundamental analysis

5839:Shareholder activism

5821:Volatility arbitrage

5395:Fundamental analysis

5379:Contrarian investing

5342:Security market line

5247:Liquidity aggregator

5224:Direct market access

5135:Quantitative analyst

4731:. Online.barrons.com

4339:on 27 September 2011

3362:. Encyberpedia.com.

3039:Repurchase agreement

2958:by Robert Sloan and

2773:US Treasury security

2769:US Treasury security

2683:improve this section

2491:"Short" finance

2476:improve this article

2358:improve this section

2234:improve this section

1941:short interest ratio

1849:improve this article

1732:Alfred Winslow Jones

1016:Financial statements

996:Credit rating agency

921:Repurchase agreement

6260:List of hedge funds

6250:Hedge fund managers

6166:Insurance companies

6151:Fund of hedge funds

6059:Black–Scholes model

5973:Proprietary trading

5948:Algorithmic trading

5915:Fund of hedge funds

5640:Reverse stock split

5585:Market manipulation

5509:Dual-listed company

5369:Algorithmic trading

5299:Capital market line

5101:Inter-dealer broker

4529:10.2139/ssrn.281514

4102:S.K. Singh (2009).

3618:on 10 December 2022

2842:that specialize in

2194:(SEC) put in place

2156:Naked short selling

2150:Naked short selling

2033:Days to Cover (DTC)

2028:Short selling terms

1778:Naked short selling

1534:borrow the security

1452:Accounting scandals

1442:Stock market bubble

1162:Government spending

1119:Employment contract

1071:Corporate tax haven

830:Credit default swap

6116:Technical analysis

5680:Stock market index

5519:Efficient frontier

5458:Technical analysis

5416:Momentum investing

5238:(private exchange)

5128:Proprietary trader

5070:Shares outstanding

5060:Authorised capital

4901:Wright, Robert E.

4708:on 12 January 2010

4676:The New York Times

4430:10.1111/acfi.12229

4288:on 5 October 2008.

3576:The New York Times

2970:identification of

2832:failure to deliver

2624:China stock frauds

2313:short the dividend

2282:When a security's

2181:failure to deliver

2179:(in the US) as a "

2067:) – for instance,

1985:securities lending

1958:Securities lending

1952:Securities lending

1821:Securities lending

1670:East India Company

1539:covering the short

1447:Stock market crash

1297:Investment banking

1287:Fractional-reserve

1252:Warrant of payment

1201:Government revenue

1124:Financial planning

1042:Structured finance

353:Credit-linked note

296:Structured finance

150:Floating rate note

31:

6286:Financial markets

6268:

6267:

6124:

6123:

5927:

5926:

5894:Long/short equity

5870:Convergence trade

5854:Special situation

5728:

5727:

5529:Flight-to-quality

5281:Buffett indicator

4971:Financial markets

4911:978-1-61614-191-2

4896:978-0-07-163686-5

4881:978-0-19-968720-6

4788:on 10 August 2009

4266:. 2 October 2008.

3763:on 19 August 2011

3029:Manuel P. Asensio

2982:Manuel P. Asensio

2719:

2718:

2711:

2552:

2551:

2544:

2526:

2407:futures contracts

2394:

2393:

2386:

2270:

2269:

2262:

2061:convenience yield

1965:fails to deliver,

1881:

1880:

1873:

1806:COVID-19 pandemic

1525:

1524:

1415:

1414:

1365:

1364:

1353:Deposit insurance

1259:

1258:

1093:

1092:

991:Corporate finance

986:Capital structure

981:Capital budgeting

916:Performance bonds

797:

796:

780:Financial centres

740:Financial planner

640:Asset (economics)

446:

445:

403:Credit derivative

216:Equities (stocks)

6303:

6258:

6257:

6248:

6247:

6238:

6237:

6228:

6227:

6171:Investment banks

6018:Foreign exchange

5988:

5987:

5935:

5775:

5774:

5755:

5748:

5741:

5732:

5731:

5645:Share repurchase

5357:Trading theories

5242:Crossing network

5200:Over-the-counter

5037:Restricted stock

4993:Secondary market

4964:

4957:

4950:

4941:

4940:

4855:

4838:

4832:

4828:

4822:

4818:

4812:

4804:

4798:

4797:

4795:

4793:

4784:. Archived from

4773:

4767:

4766:

4764:

4762:

4757:on 15 March 2012

4747:

4741:

4740:

4738:

4736:

4724:

4718:

4717:

4715:

4713:

4704:. Archived from

4698:

4692:

4691:

4689:

4687:

4678:. Archived from

4667:

4661:

4660:

4658:

4656:

4640:

4634:

4619:Margin of safety

4615:

4609:

4608:

4606:

4604:

4598:

4591:

4583:

4577:

4576:

4570:

4565:

4563:

4555:

4553:

4551:

4545:

4522:

4513:

4507:

4506:

4500:

4492:

4490:

4488:

4468:

4462:

4461:

4459:

4457:

4409:

4403:

4402:

4400:

4398:

4378:

4372:

4371:

4366:. Archived from

4355:

4349:

4348:

4346:

4344:

4335:. Archived from

4322:

4316:

4315:

4313:

4311:

4306:on 20 March 2012

4296:

4290:

4289:

4274:

4268:

4267:

4264:"The Australian"

4260:

4254:

4253:

4251:

4249:

4230:

4224:

4223:

4221:

4219:

4207:

4201:

4200:

4180:

4174:

4173:

4153:

4147:

4146:

4144:

4142:

4126:

4120:

4119:

4105:Bank Regulations

4099:

4093:

4092:

4072:

4063:

4062:

4060:

4058:

4052:

4045:

4037:

4031:

4030:

4028:

4026:

4011:

4005:

4004:

4002:

4000:

3972:

3966:

3965:

3954:

3948:

3947:

3936:

3930:

3929:

3927:

3925:

3909:

3903:

3902:

3900:

3898:

3882:

3876:

3875:

3873:

3871:

3865:

3858:

3850:

3844:

3843:

3841:

3839:

3833:

3826:

3818:

3812:

3811:. Business Wire.

3805:

3799:

3792:

3786:

3779:

3773:

3772:

3770:

3768:

3753:

3747:

3746:

3744:

3742:

3726:

3720:

3719:

3717:

3715:

3696:

3690:

3689:

3687:

3685:

3665:

3659:

3658:

3656:

3654:

3634:

3628:

3627:

3625:

3623:

3617:

3612:. Archived from

3601:

3592:

3591:

3589:

3587:

3567:

3558:

3557:

3537:

3528:

3527:

3507:

3496:

3495:

3493:

3491:

3471:

3465:

3464:

3462:

3460:

3454:

3447:

3439:

3433:

3432:

3430:

3428:

3414:

3408:

3407:

3405:

3403:

3382:

3376:

3375:

3373:

3371:

3356:

3350:

3349:

3347:

3345:

3313:

3307:

3306:

3304:

3302:

3293:. 25 July 2008.

3283:

3277:

3276:

3256:

3250:

3249:

3229:

3223:

3222:

3220:

3218:

3198:

3192:

3180:

3174:

3173:

3167:

3159:

3157:

3155:

3149:

3143:. Archived from

3142:

3134:

3128:

3116:

3110:

3098:

3092:

3080:

3024:Magnetar Capital

2964:Robert E. Wright

2884:House of Commons

2791:safe deposit box

2737:that remains is

2714:

2707:

2703:

2700:

2694:

2663:

2655:

2547:

2540:

2536:

2533:

2527:

2525:

2484:

2460:

2452:

2389:

2382:

2378:

2375:

2369:

2338:

2330:

2300:holder of record

2284:ex-dividend date

2265:

2258:

2254:

2251:

2245:

2214:

2206:

1876:

1869:

1865:

1862:

1856:

1833:

1825:

1517:

1510:

1503:

1489:Money portal

1487:

1486:

1485:

1475:

1474:

1425:Economic history

1387:

1386:

1320:

1319:

1218:Deficit spending

1192:Transfer payment

1158:

1157:

1086:Transfer pricing

1032:Leveraged buyout

1006:Enterprise value

960:

959:

875:Letter of credit

860:Futures contract

693:

691:Over-the-counter

680:Foreign exchange

627:

626:

614:

591:

590:

519:forward contract

515:futures contract

504:interest payment

438:

431:

424:

251:Investment funds

170:Commercial paper

165:Zero-coupon bond

117:Futures exchange

107:Commodity market

47:

33:

32:

6311:

6310:

6306:

6305:

6304:

6302:

6301:

6300:

6271:

6270:

6269:

6264:

6216:

6202:Fund governance

6190:

6120:

6044:Absolute return

6032:

5983:

5977:

5968:Program trading

5963:Prime brokerage

5936:

5923:

5903:

5899:Trend following

5884:Dedicated short

5858:

5825:

5782:

5770:

5764:

5759:

5729:

5724:

5715:Voting interest

5625:Public offering

5560:Mandatory offer

5534:Government bond

5514:DuPont analysis

5477:

5473:Value investing

5468:Value averaging

5463:Trend following

5448:Style investing

5443:Sector rotation

5358:

5352:

5331:Net asset value

5257:Stock valuation

5251:

5171:

5079:

5046:

5032:Preferred stock

5007:

4973:

4968:

4920:

4886:Sloan, Robert.

4864:

4859:

4858:

4849:Wayback Machine

4840:Kerbl S (2010)

4839:

4835:

4829:

4825:

4819:

4815:

4805:

4801:

4791:

4789:

4774:

4770:

4760:

4758:

4749:

4748:

4744:

4734:

4732:

4725:

4721:

4711:

4709:

4700:

4699:

4695:

4685:

4683:

4668:

4664:

4654:

4652:

4651:on 13 June 2006

4641:

4637:

4616:

4612:

4602:

4600:

4596:

4589:

4585:

4584:

4580:

4568:

4566:

4557:

4556:

4549:

4547:

4543:

4520:

4514:

4510:

4494:

4493:

4486:

4484:

4469:

4465:

4455:

4453:

4410:

4406:

4396:

4394:

4379:

4375:

4356:

4352:

4342:

4340:

4323:

4319:

4309:

4307:

4298:

4297:

4293:

4276:

4275:

4271:

4262:

4261:

4257:

4247:

4245:

4232:

4231:

4227:

4217:

4215:

4214:. Bloomberg L.P

4208:

4204:

4197:

4181:

4177:

4170:

4154:

4150:

4140:

4138:

4127:

4123:

4116:

4100:

4096:

4089:

4073:

4066:

4056:

4054:

4050:

4043:

4039:

4038:

4034:

4024:

4022:

4013:

4012:

4008:

3998:

3996:

3989:

3973:

3969:

3964:. 18 June 2011.

3956:

3955:

3951:

3946:. 18 June 2011.

3938:

3937:

3933:

3923:

3921:

3910:

3906:

3896:

3894:

3883:

3879:

3869:

3867:

3863:

3856:

3852:

3851:

3847:

3837:

3835:

3831:

3824: