127:

1075:, vol. LXX, no. 16 (19 October 2023), pp. 33-35. "rivate equity firms create nothing and provide no meaningful services – on the contrary, they actively undermine functional companies." (p. 34.) "Tax law plays a critical part in making funds profitable. The 'carried interest' provision, for example, which allows most of the profits of private equity partners to be taxed at the lower capital gains rate rather than as earnings, is crucial to their self-enrichment." (p. 35.)

352:, which should earn a premium over traditional securities, such as stocks and bonds. Once invested, liquidity of invested funds may be very difficult to achieve before the manager realizes the investments in the portfolio because an investor's capital may be locked-up in long-term investments for as long as twelve years. Distributions may be made only as investments are converted to cash with limited partners typically having no right to demand that sales be made.

2571:

1731:

1721:

1701:

1681:

1671:

2579:

1711:

1691:

1863:

25:

368:

An investor's commitment to a private-equity fund is satisfied over time as the general partner makes capital calls on the investor. If a private-equity firm cannot find suitable investment opportunities, it will not draw on an investor's commitment, and an investor may potentially invest less than

138:

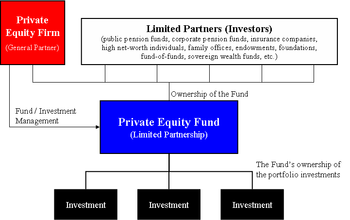

and are governed by the terms set forth in the limited partnership agreement (LPA). Such funds have a general partner, which raises capital from cash-rich institutional investors, such as pension plans, universities, insurance companies, foundations, endowments, and high-net-worth individuals, which

271:

A private-equity fund typically makes investments in companies (known as portfolio companies). These portfolio company investments are funded with the capital raised from LPs, and may be partially or substantially financed by debt. Some private equity investment transactions can be highly leveraged

183:

The fund's manager has significant discretion to make investments and control the affairs of the fund. However, the LPA does have certain restrictions and controls and is often limited in the type, size, or geographic focus of investments permitted, and how long the manager is permitted to make new

401:

For the above-mentioned reasons, private-equity fund investment is for investors who can afford to have capital locked up for long periods and who can risk losing significant amounts of money. These disadvantages are offset by the potential benefits of annual returns, which may range up to 30% per

276:—hence the acronym LBO for "leveraged buy-out". The cash flow from the portfolio company usually provides the source for the repayment of such debt. While billion dollar private equity investments make the headlines, private-equity funds also play a large role in middle market businesses.

286:

LBO funds commonly acquire most of the equity interests or assets of the portfolio company through a newly created special purpose acquisition subsidiary controlled by the fund, and sometimes as a consortium of several like-minded funds.

101:

make an unfunded commitment to the limited partnership, which is then drawn over the term of the fund. From the investors' point of view, funds can be traditional (where all the investors invest with equal terms) or

319:

of the portfolio company or a sale of the company to a strategic acquirer through a merger or acquisition, also known as a trade sale. A sale of the portfolio company to another private-equity firm, also known as a

176:

Private equity funds are not intended to be transferred or traded; however, they can be transferred to another investor. Typically, such a transfer must receive the consent of and is at the discretion of the fund's

117:

and investment advisor). Typically, a single private-equity firm will manage a series of distinct private-equity funds and will attempt to raise a new fund every 3 to 5 years as the previous fund is fully invested.

2558:

327:

In prior years, another exit strategy has been a preferred dividend by the portfolio company to the private-equity fund to repay the capital investment, sometimes financed with additional debt.

342:

With most private-equity funds requiring significant initial commitment (usually upwards of $ 1,000,000), which can be drawn at the manager's discretion over the first few years of the fund.

154:

An annual payment made by the investors in the fund to the fund's manager to pay for the private-equity firm's investment operations (typically 1 to 2% of the committed capital of the fund).

646:

296:

1601:

1122:

552:

358:

Nearly all investors in private equity are passive and rely on the manager to make investments and generate liquidity from those investments. Typically, governance rights for

1179:

397:

Consistent with the risks outlined above, private equity can provide high returns, with the best private equity managers significantly outperforming the public markets.

315:

its investments in portfolio companies for a return, known as internal rate of return (IRR) in excess of the price paid. These exit scenarios historically have been an

1133:

480:

Kaplan, Steven N., and

Antoinette Schoar. "Private equity performance: Returns, persistence, and capital flows." The Journal of Finance 60.4 (2005): 1791-1823.

162:

The process by which the returned capital will be distributed to the investor, and allocated between limited and general partner. This waterfall includes the

1994:

1674:

1127:

375:

Given the risks associated with private equity investments, an investor can lose all of its investment. The risk of loss of capital is typically higher in

1079:

1116:

362:

in private-equity funds are minimal. However, in some cases, limited partners with substantial investment enjoy special rights and terms of investment.

283:, may also provide financing. Since mid-2007, debt financing has become much more difficult to obtain for private-equity funds than in previous years.

299:. Private equity multiples are highly dependent on the portfolio company's industry, the size of the company, and the availability of LBO financing.

89:

used for making investments in various equity (and to a lesser extent debt) securities according to one of the investment strategies associated with

1103:

1172:

1050:

295:

The acquisition price of a portfolio company is usually based on a multiple of the company's historical income, most often based on the measure of

2305:

2198:

1907:

1139:

1062:

1902:

1887:

1248:

416:

2265:

1892:

1145:

662:

1734:

1165:

1767:

1646:

441:

166: : a minimum rate of return (e.g. 8%) which must be achieved before the general partner can receive any carried interest, and the

2574:

379:

funds, which invest in companies during the earliest phases of their development or in companies with high amounts of financial

139:

invest as limited partners (LPs) in the fund. Among the terms set forth in the limited partnership agreement are the following:

1096:

471:

Prowse, Stephen D. "The economics of the private equity market." Economic Review-Federal

Reserve Bank of Dallas (1998): 21-34.

1028:

1005:

979:

952:

926:

899:

872:

845:

818:

791:

744:

717:

690:

584:

531:

504:

549:

279:

Such LBO financing most often comes from commercial banks, although other financial institutions, such as hedge funds and

2191:

1468:

1463:

436:

348:

Investments in limited partnership interests (the dominant legal form of private equity investments) are referred to as

1371:

230:

1151:

462:

Metrick, Andrew, and Ayako Yasuda. "The economics of private equity funds."Review of

Financial Studies (2010): hhq020.

163:

146:

The partnership is usually a fixed-life investment vehicle that is typically 10 years plus some number of extensions.

64:

35:

1256:

1233:

321:

244:

2582:

2402:

2332:

2184:

1760:

1704:

1446:

2290:

2165:

1714:

1684:

1020:

Raising

Venture Capital Finance in Europe: A Practical Guide for Business Owners, Entrepreneurs and Investors

996:

918:

Private Equity Fund

Investments: New Insights on Alignment of Interests, Governance, Returns and Forecasting

188:

The following is an illustration of the difference between a private-equity fund and a private-equity firm:

2548:

2311:

2043:

1823:

1694:

1451:

1071:

421:

86:

2483:

1281:

1276:

1271:

1266:

1261:

2606:

2322:

1328:

431:

2270:

2239:

2089:

1753:

1538:

1488:

1426:

1386:

1333:

614:

335:

Considerations for investing in private-equity funds relative to other forms of investment include:

2478:

2392:

1724:

1641:

1636:

42:

2601:

2553:

2538:

2512:

2507:

2357:

2285:

2227:

2150:

2140:

1989:

1621:

1616:

1571:

781:

316:

205:

98:

494:

2533:

2447:

2135:

1979:

1631:

1596:

1493:

1323:

609:

411:

157:

1018:

969:

916:

889:

862:

835:

808:

707:

680:

574:

2347:

2207:

2084:

1912:

1548:

1456:

521:

2337:

2233:

2160:

2033:

1576:

1361:

1238:

135:

94:

170:, the share of the profits paid the general partner above the preferred return (e.g. 20%).

90:

8:

2611:

2300:

2074:

1928:

1651:

1513:

1503:

1421:

1412:

1366:

110:

2502:

2412:

2377:

2069:

1626:

1586:

1523:

1518:

1356:

1058:

380:

258:

109:

A private equity fund is raised and managed by investment professionals of a specific

97:

with a fixed term of 10 years (often with one- or two-year extensions). At inception,

2373:

2094:

1964:

1948:

1837:

1807:

1591:

1318:

1313:

1308:

1223:

1157:

1046:

1024:

1001:

975:

948:

922:

895:

868:

841:

814:

787:

740:

713:

686:

654:

627:

580:

527:

500:

280:

2421:

2387:

2255:

1882:

1431:

1300:

1211:

619:

167:

2462:

2452:

2442:

2437:

2417:

2215:

2145:

2114:

2038:

1974:

1833:

1776:

1611:

1533:

1381:

1343:

1218:

1192:

942:

761:

734:

556:

388:

376:

359:

251:

237:

114:

103:

600:

Metrick, Andrew; Yasuda, Ayako (2010). "The

Economics of Private Equity Funds".

41:

The references used may be made clearer with a different or consistent style of

2496:

2407:

2397:

2155:

1969:

1943:

1436:

1351:

1228:

1188:

426:

384:

273:

223:

216:

149:

46:

523:

Investing in

Private Equity Partnerships: The Role of Monitoring and Reporting

126:

2595:

2492:

2457:

2342:

2317:

2280:

2245:

2026:

1917:

1543:

1528:

1508:

1396:

658:

631:

971:

Research

Handbook on Hedge Funds, Private Equity and Alternative Investments

864:

Private Equity and

Venture Capital in Europe: Markets, Techniques, and Deals

576:

Venture

Capital and Private Equity Contracting: An International Perspective

2543:

2488:

2295:

2119:

2079:

1984:

1841:

1656:

1581:

1553:

1498:

1391:

1154:. Pensions Investment Research Consultants for the Trades Union Congress.

2517:

2275:

2021:

1897:

1441:

810:

Private Equity Exits: Divestment Process Management for Leveraged Buyouts

623:

2176:

1067:

These Are the Plunderers: How Private Equity Runs – and Wrecks – America

2382:

2352:

2260:

2250:

2059:

1877:

1848:

1797:

1606:

1376:

1119:(University of Pennsylvania, The Wharton School, Department of Finance)

1080:"A closer look: Private equity co-investment: Best practices emerging"

1802:

1862:

682:

An Introduction to Investment Banks, Hedge Funds, and Private Equity

1745:

324:, has become a common feature of developed private equity markets.

647:"Selling Your Business: Why Private Equity Can Be The Best Buyer"

560:

572:

1206:

1134:"Guide on Private Equity and Venture Capital for Entrepreneurs"

297:

earnings before interest, taxes, depreciation, and amortization

2327:

837:

Merger Arbitrage: How to Profit from Event-Driven Arbitrage

1140:"UK Venture Capital and Private Equity as an Asset Class"

1087:

330:

130:

Diagram of the structure of a generic private-equity fund

891:

How to Protect Investors: Lessons from the EC and the UK

813:. Springer Science & Business Media. pp. 184–.

779:

526:. Springer Science & Business Media. pp. 99–.

496:

Private Equity Funds: Business Structure and Operations

1187:

573:

Douglas J. Cumming; Sofia A. Johan (21 August 2013).

1152:"Private equity – a guide for pension fund trustees"

775:

773:

311:

A private-equity fund's ultimate goal is to sell or

200:

Private equity portfolio investments (partial list)

967:

545:

543:

645:Davis, Eva; Robinson, Monique; Birenbaum, Joshua.

644:

302:

106:(where different investors have different terms).

1055:Plunder: Private Equity's Plan to Pillage America

770:

709:Investment Banks, Hedge Funds, and Private Equity

387:companies tend to be riskier than investments in

2593:

732:

705:

593:

540:

2306:Qualifying investor alternative investment fund

961:

860:

833:

566:

492:

1016:

994:Michael S. Long & Thomas A. Bryant (2007)

674:

672:

2192:

1761:

1173:

914:

894:. Cambridge University Press. pp. 187–.

887:

806:

678:

599:

417:History of private equity and venture capital

2266:Labour-sponsored venture capital corporation

1675:Private equity and venture capital investors

1148:(Tuck School of Business at Dartmouth, 2003)

1136:(European Venture Capital Association, 2007)

1123:CalPERS "Private Equity Industry Dictionary"

1104:"The Economics of the Private Equity Market"

1010:

827:

759:

488:

486:

266:

134:Most private-equity funds are structured as

121:

908:

881:

854:

780:Eli Talmor; Florin Vasvari (24 June 2011).

699:

669:

2578:

2199:

2185:

1768:

1754:

1710:

1690:

1647:Taxation of private equity and hedge funds

1464:Private investment in public equity (PIPE)

1180:

1166:

974:. Edward Elgar Publishing. pp. 113–.

800:

519:

442:Taxation of private equity and hedge funds

2206:

1097:"Legal Structure of Private Equity Funds"

753:

726:

613:

513:

483:

458:

456:

65:Learn how and when to remove this message

1146:"Note on Limited Partnership Agreements"

1106:. Federal Reserve Bank of Dallas, 1998.

1023:. Kogan Page Publishers. pp. 216–.

840:. John Wiley & Sons. pp. 189–.

125:

1117:"The Economics of Private Equity Funds"

1099:. Private Equity and Hedge Funds 2007.

1049:, "Conspicuous Destruction" (review of

944:Pratt's Guide to Private Equity Sources

290:

2594:

1069:, Simon and Schuster, 2023, 383 pp.),

968:Phoebus Athanassiou (1 January 2012).

786:. John Wiley & Sons. pp. 4–.

453:

331:Investment features and considerations

2180:

1749:

1161:

1142:(British Venture Capital Association)

921:. Palgrave Macmillan. pp. 114–.

474:

93:. Private equity funds are typically

1775:

1057:, PublicAffairs, 2023, 353 pp.; and

861:Stefano Caselli (20 November 2009).

18:

1000:New York: Oxford University Press.

947:. Thomson Venture Economics. 2003.

437:Special purpose private equity fund

180:Restrictions on the general partner

173:Transfer of an interest in the fund

13:

1130:(Glossary of Private Equity Terms)

1040:

550:Private equity industry dictionary

499:. Law Journal Press. pp. 3–.

493:James M. Schell (1 January 1999).

383:. By their nature, investments in

231:Energy Future Holdings Corporation

14:

2623:

1110:

888:Niamh Moloney (21 January 2010).

867:. Academic Press. pp. 310–.

763:Merger and Acquisition Sourcebook

712:. Academic Press. pp. 205–.

685:. Academic Press. pp. 347–.

579:. Academic Press. pp. 145–.

2577:

2570:

2569:

1861:

1730:

1729:

1720:

1719:

1709:

1700:

1699:

1689:

1680:

1679:

1670:

1669:

213:($ 17.6 billion of commitments)

23:

1017:Keith Arundale (3 April 2007).

988:

935:

834:Thomas Kirchner (1 July 2009).

807:Stefan Povaly (21 March 2007).

679:David Stowell (19 March 2010).

245:Hospital Corporation of America

2403:Socially responsible investing

2333:Split capital investment trust

1447:Publicly traded private equity

638:

563:Alternative Investment Program

465:

339:Substantial entry requirements

1:

2291:Open-ended investment company

2166:Money-weighted rate of return

1715:List of venture capital firms

997:Valuing the Closely Held Firm

736:Private Equity and Its Impact

447:

2549:Returns-based style analysis

2312:Real estate investment trust

2044:Real estate investment trust

1824:Real estate investment trust

1695:List of private equity firms

1452:Business Development Company

1072:The New York Review of Books

915:Cyril Demaria (1 May 2015).

783:International Private Equity

422:List of private equity firms

402:annum for successful funds.

87:collective investment scheme

7:

2484:Efficient-market hypothesis

739:. Nova Science Publishers.

602:Review of Financial Studies

520:Kay Müller (17 June 2008).

405:

10:

2628:

2323:Short-term investment fund

1838:Mezzanine investment funds

1539:High-net-worth individuals

1329:Leveraged recapitalization

1095:Krüger Andersen, Thomas.

2567:

2526:

2471:

2430:

2366:

2271:Listed investment company

2240:Fonds commun de placement

2214:

2128:

2107:

2090:Sovereign investment fund

2052:

2014:

2007:

1957:

1936:

1926:

1870:

1859:

1816:

1790:

1783:

1665:

1562:

1481:

1427:Limited liability company

1405:

1387:Venture capital financing

1342:

1334:Dividend recapitalization

1299:

1290:

1247:

1199:

733:Spencer J. Fritz (2009).

706:David P. Stowell (2012).

303:Portfolio company sales (

267:Investments and financing

210:

204:

122:Legal structure and terms

2479:Arbitrage pricing theory

2554:Traditional investments

2539:Commodity pool operator

2513:Noisy market hypothesis

2508:Modern portfolio theory

2358:Unitised insurance fund

2286:Open-ended fund company

2228:Common contractual fund

2151:Assets under management

2141:Traditional investments

2136:Alternative investments

1494:Institutional investors

317:initial public offering

206:Kohlberg Kravis Roberts

143:Term of the partnership

99:institutional investors

16:Type of investment fund

2534:Alternative investment

2448:Institutional investor

1965:Long/short equity fund

1632:Liquidation preference

1597:Distribution waterfall

1549:Sovereign wealth funds

412:Distribution waterfall

369:expected or committed.

158:Distribution waterfall

131:

2348:Unit investment trust

2208:Investment management

2108:By measure of returns

2085:Sovereign wealth fund

1913:Asset allocation fund

1705:Venture capital firms

1457:Venture capital trust

760:Walter Jurek (2006).

129:

2338:Tax transparent fund

2234:Exchange-traded fund

2161:Time-weighted return

2034:Exchange-traded fund

1990:Managed futures fund

1834:Venture capital fund

1685:Private equity firms

1413:Private equity firms

1362:Post-money valuation

1239:Equity co-investment

651:Transaction Advisors

365:Unfunded commitments

350:illiquid investments

291:Multiples and prices

211:KKR 2006 Fund, L.P.

197:Private equity fund

194:Private equity firm

136:limited partnerships

95:limited partnerships

2393:Manager of managers

2301:Private-equity fund

2065:Private equity fund

1995:Multi-strategy fund

1970:Market neutral fund

1929:investment strategy

1829:Private equity fund

1735:Portfolio companies

1652:Undercapitalization

1504:Insurance companies

1422:Limited partnership

1367:Pre-money valuation

1128:VC Experts Glossary

1102:Prowse, Stephen D.

111:private-equity firm

79:private equity fund

2503:Martingale pricing

2413:Thematic investing

2378:passive management

2070:Pooled income fund

1587:Capital commitment

1357:Business incubator

1324:Buy–sell agreement

1059:Gretchen Morgenson

624:10.1093/rfs/hhq020

555:2008-05-05 at the

355:Investment control

259:NXP Semiconductors

132:

2607:Financial markets

2589:

2588:

2367:Investment styles

2174:

2173:

2103:

2102:

2095:Urban wealth fund

2030:

2003:

2002:

1985:Global macro fund

1980:Event-driven fund

1949:Stable value fund

1857:

1856:

1845:

1808:Money market fund

1743:

1742:

1592:Capital structure

1477:

1476:

1319:Divisional buyout

1314:Management buyout

1309:Financial sponsor

1047:Kim Phillips-Fein

1030:978-0-7494-5202-5

1006:978-0-19-530146-5

981:978-1-84980-608-4

954:978-0-914470-09-0

928:978-1-137-40039-0

901:978-0-521-88870-7

874:978-0-08-096294-8

847:978-0-470-50811-4

820:978-3-540-70954-1

793:978-1-119-97388-1

746:978-1-60692-682-6

719:978-0-12-415820-7

692:978-0-08-092289-8

586:978-0-12-409596-0

533:978-3-8349-9745-6

506:978-1-58852-088-3

345:Limited liquidity

264:

263:

75:

74:

67:

2619:

2581:

2580:

2573:

2572:

2422:growth investing

2388:Impact investing

2256:Investment trust

2201:

2194:

2187:

2178:

2177:

2024:

2012:

2011:

1934:

1933:

1883:Target date fund

1865:

1831:

1788:

1787:

1777:Investment funds

1770:

1763:

1756:

1747:

1746:

1733:

1732:

1723:

1722:

1713:

1712:

1703:

1702:

1693:

1692:

1683:

1682:

1673:

1672:

1534:Commercial banks

1524:Investment banks

1432:Carried interest

1297:

1296:

1200:Investment types

1182:

1175:

1168:

1159:

1158:

1092:

1084:

1035:

1034:

1014:

1008:

992:

986:

985:

965:

959:

958:

939:

933:

932:

912:

906:

905:

885:

879:

878:

858:

852:

851:

831:

825:

824:

804:

798:

797:

777:

768:

767:

757:

751:

750:

730:

724:

723:

703:

697:

696:

676:

667:

666:

661:. Archived from

642:

636:

635:

617:

608:(6): 2303–2341.

597:

591:

590:

570:

564:

547:

538:

537:

517:

511:

510:

490:

481:

478:

472:

469:

463:

460:

432:Real estate fund

372:Investment risks

360:limited partners

208:& Co. (KKR)

191:

190:

168:carried interest

164:preferred return

81:(abbreviated as

70:

63:

59:

56:

50:

27:

26:

19:

2627:

2626:

2622:

2621:

2620:

2618:

2617:

2616:

2592:

2591:

2590:

2585:

2563:

2522:

2467:

2463:Performance fee

2453:Net asset value

2443:Fund governance

2438:Closed-end fund

2426:

2362:

2219:

2217:

2210:

2205:

2175:

2170:

2146:Net asset value

2124:

2115:Absolute return

2099:

2048:

2039:Closed-end fund

1999:

1953:

1922:

1866:

1853:

1812:

1779:

1774:

1744:

1739:

1725:Angel investors

1661:

1612:High-yield debt

1565:financial terms

1564:

1558:

1473:

1401:

1382:Startup company

1338:

1292:

1286:

1243:

1195:

1193:venture capital

1186:

1113:

1091:. January 2015.

1082:

1078:

1043:

1041:Further reading

1038:

1031:

1015:

1011:

993:

989:

982:

966:

962:

955:

941:

940:

936:

929:

913:

909:

902:

886:

882:

875:

859:

855:

848:

832:

828:

821:

805:

801:

794:

778:

771:

758:

754:

747:

731:

727:

720:

704:

700:

693:

677:

670:

665:on Jul 1, 2017.

643:

639:

615:10.1.1.421.7270

598:

594:

587:

571:

567:

557:Wayback Machine

548:

541:

534:

518:

514:

507:

491:

484:

479:

475:

470:

466:

461:

454:

450:

408:

389:publicly traded

377:venture capital

333:

309:

293:

281:mezzanine funds

269:

252:Nielsen Company

238:First Data Corp

212:

150:Management fees

124:

115:general partner

71:

60:

54:

51:

40:

34:has an unclear

28:

24:

17:

12:

11:

5:

2625:

2615:

2614:

2609:

2604:

2602:Private equity

2587:

2586:

2568:

2565:

2564:

2562:

2561:

2556:

2551:

2546:

2541:

2536:

2530:

2528:

2527:Related topics

2524:

2523:

2521:

2520:

2515:

2510:

2505:

2500:

2486:

2481:

2475:

2473:

2469:

2468:

2466:

2465:

2460:

2455:

2450:

2445:

2440:

2434:

2432:

2428:

2427:

2425:

2424:

2415:

2410:

2408:Social trading

2405:

2400:

2398:Social finance

2395:

2390:

2385:

2380:

2370:

2368:

2364:

2363:

2361:

2360:

2355:

2350:

2345:

2340:

2335:

2330:

2325:

2320:

2315:

2309:

2303:

2298:

2293:

2288:

2283:

2278:

2273:

2268:

2263:

2258:

2253:

2248:

2243:

2237:

2231:

2224:

2222:

2212:

2211:

2204:

2203:

2196:

2189:

2181:

2172:

2171:

2169:

2168:

2163:

2158:

2156:Rate of return

2153:

2148:

2143:

2138:

2132:

2130:

2129:Related topics

2126:

2125:

2123:

2122:

2117:

2111:

2109:

2105:

2104:

2101:

2100:

2098:

2097:

2092:

2087:

2082:

2077:

2075:Endowment fund

2072:

2067:

2062:

2056:

2054:

2050:

2049:

2047:

2046:

2041:

2036:

2031:

2018:

2016:

2009:

2005:

2004:

2001:

2000:

1998:

1997:

1992:

1987:

1982:

1977:

1972:

1967:

1961:

1959:

1955:

1954:

1952:

1951:

1946:

1944:Long-only fund

1940:

1938:

1931:

1924:

1923:

1921:

1920:

1915:

1910:

1905:

1900:

1895:

1890:

1885:

1880:

1874:

1872:

1868:

1867:

1860:

1858:

1855:

1854:

1852:

1851:

1846:

1826:

1820:

1818:

1814:

1813:

1811:

1810:

1805:

1800:

1794:

1792:

1785:

1784:By asset class

1781:

1780:

1773:

1772:

1765:

1758:

1750:

1741:

1740:

1738:

1737:

1727:

1717:

1707:

1697:

1687:

1677:

1666:

1663:

1662:

1660:

1659:

1654:

1649:

1644:

1639:

1634:

1629:

1624:

1619:

1614:

1609:

1604:

1599:

1594:

1589:

1584:

1579:

1574:

1568:

1566:

1560:

1559:

1557:

1556:

1551:

1546:

1544:Family offices

1541:

1536:

1531:

1529:Merchant banks

1526:

1521:

1516:

1511:

1506:

1501:

1496:

1491:

1485:

1483:

1479:

1478:

1475:

1474:

1472:

1471:

1466:

1461:

1460:

1459:

1454:

1444:

1439:

1437:Management fee

1434:

1429:

1424:

1419:

1409:

1407:

1403:

1402:

1400:

1399:

1394:

1389:

1384:

1379:

1374:

1369:

1364:

1359:

1354:

1352:Angel investor

1348:

1346:

1340:

1339:

1337:

1336:

1331:

1326:

1321:

1316:

1311:

1305:

1303:

1294:

1288:

1287:

1285:

1284:

1279:

1274:

1269:

1264:

1259:

1253:

1251:

1245:

1244:

1242:

1241:

1236:

1231:

1226:

1221:

1216:

1215:

1214:

1203:

1201:

1197:

1196:

1189:Private equity

1185:

1184:

1177:

1170:

1162:

1156:

1155:

1149:

1143:

1137:

1131:

1125:

1120:

1112:

1111:External links

1109:

1108:

1107:

1100:

1093:

1076:

1051:Brendan Ballou

1042:

1039:

1037:

1036:

1029:

1009:

987:

980:

960:

953:

934:

927:

907:

900:

880:

873:

853:

846:

826:

819:

799:

792:

769:

766:. The Company.

752:

745:

725:

718:

698:

691:

668:

637:

592:

585:

565:

539:

532:

512:

505:

482:

473:

464:

451:

449:

446:

445:

444:

439:

434:

429:

427:Private equity

424:

419:

414:

407:

404:

399:

398:

395:

392:

385:privately held

373:

370:

366:

363:

356:

353:

346:

343:

340:

332:

329:

308:

301:

292:

289:

274:debt financing

268:

265:

262:

261:

255:

254:

248:

247:

241:

240:

234:

233:

227:

226:

224:Dollar General

220:

219:

217:Alliance Boots

214:

209:

202:

201:

198:

195:

186:

185:

181:

178:

174:

171:

160:

155:

152:

147:

144:

123:

120:

91:private equity

73:

72:

36:citation style

31:

29:

22:

15:

9:

6:

4:

3:

2:

2624:

2613:

2610:

2608:

2605:

2603:

2600:

2599:

2597:

2584:

2576:

2566:

2560:

2557:

2555:

2552:

2550:

2547:

2545:

2542:

2540:

2537:

2535:

2532:

2531:

2529:

2525:

2519:

2516:

2514:

2511:

2509:

2506:

2504:

2501:

2498:

2494:

2490:

2487:

2485:

2482:

2480:

2477:

2476:

2474:

2470:

2464:

2461:

2459:

2458:Open-end fund

2456:

2454:

2451:

2449:

2446:

2444:

2441:

2439:

2436:

2435:

2433:

2429:

2423:

2419:

2416:

2414:

2411:

2409:

2406:

2404:

2401:

2399:

2396:

2394:

2391:

2389:

2386:

2384:

2381:

2379:

2375:

2372:

2371:

2369:

2365:

2359:

2356:

2354:

2351:

2349:

2346:

2344:

2343:Umbrella fund

2341:

2339:

2336:

2334:

2331:

2329:

2326:

2324:

2321:

2319:

2318:Royalty trust

2316:

2313:

2310:

2307:

2304:

2302:

2299:

2297:

2294:

2292:

2289:

2287:

2284:

2282:

2281:Offshore fund

2279:

2277:

2274:

2272:

2269:

2267:

2264:

2262:

2259:

2257:

2254:

2252:

2249:

2247:

2246:Fund of funds

2244:

2241:

2238:

2235:

2232:

2229:

2226:

2225:

2223:

2221:

2213:

2209:

2202:

2197:

2195:

2190:

2188:

2183:

2182:

2179:

2167:

2164:

2162:

2159:

2157:

2154:

2152:

2149:

2147:

2144:

2142:

2139:

2137:

2134:

2133:

2131:

2127:

2121:

2118:

2116:

2113:

2112:

2110:

2106:

2096:

2093:

2091:

2088:

2086:

2083:

2081:

2078:

2076:

2073:

2071:

2068:

2066:

2063:

2061:

2058:

2057:

2055:

2053:Institutional

2051:

2045:

2042:

2040:

2037:

2035:

2032:

2028:

2027:Open-end fund

2023:

2020:

2019:

2017:

2013:

2010:

2008:By structures

2006:

1996:

1993:

1991:

1988:

1986:

1983:

1981:

1978:

1976:

1973:

1971:

1968:

1966:

1963:

1962:

1960:

1956:

1950:

1947:

1945:

1942:

1941:

1939:

1935:

1932:

1930:

1925:

1919:

1918:Fund of funds

1916:

1914:

1911:

1909:

1908:Balanced fund

1906:

1904:

1901:

1899:

1896:

1894:

1891:

1889:

1886:

1884:

1881:

1879:

1876:

1875:

1873:

1869:

1864:

1850:

1847:

1843:

1839:

1835:

1830:

1827:

1825:

1822:

1821:

1819:

1815:

1809:

1806:

1804:

1801:

1799:

1796:

1795:

1793:

1789:

1786:

1782:

1778:

1771:

1766:

1764:

1759:

1757:

1752:

1751:

1748:

1736:

1728:

1726:

1718:

1716:

1708:

1706:

1698:

1696:

1688:

1686:

1678:

1676:

1668:

1667:

1664:

1658:

1655:

1653:

1650:

1648:

1645:

1643:

1640:

1638:

1635:

1633:

1630:

1628:

1625:

1623:

1620:

1618:

1615:

1613:

1610:

1608:

1605:

1603:

1600:

1598:

1595:

1593:

1590:

1588:

1585:

1583:

1580:

1578:

1575:

1573:

1570:

1569:

1567:

1561:

1555:

1552:

1550:

1547:

1545:

1542:

1540:

1537:

1535:

1532:

1530:

1527:

1525:

1522:

1520:

1517:

1515:

1512:

1510:

1509:Fund of funds

1507:

1505:

1502:

1500:

1499:Pension funds

1497:

1495:

1492:

1490:

1487:

1486:

1484:

1480:

1470:

1467:

1465:

1462:

1458:

1455:

1453:

1450:

1449:

1448:

1445:

1443:

1440:

1438:

1435:

1433:

1430:

1428:

1425:

1423:

1420:

1418:

1414:

1411:

1410:

1408:

1404:

1398:

1397:Venture round

1395:

1393:

1390:

1388:

1385:

1383:

1380:

1378:

1375:

1373:

1370:

1368:

1365:

1363:

1360:

1358:

1355:

1353:

1350:

1349:

1347:

1345:

1341:

1335:

1332:

1330:

1327:

1325:

1322:

1320:

1317:

1315:

1312:

1310:

1307:

1306:

1304:

1302:

1298:

1295:

1289:

1283:

1280:

1278:

1275:

1273:

1270:

1268:

1265:

1263:

1260:

1258:

1257:Early history

1255:

1254:

1252:

1250:

1246:

1240:

1237:

1235:

1232:

1230:

1227:

1225:

1222:

1220:

1217:

1213:

1210:

1209:

1208:

1205:

1204:

1202:

1198:

1194:

1190:

1183:

1178:

1176:

1171:

1169:

1164:

1163:

1160:

1153:

1150:

1147:

1144:

1141:

1138:

1135:

1132:

1129:

1126:

1124:

1121:

1118:

1115:

1114:

1105:

1101:

1098:

1094:

1090:

1089:

1081:

1077:

1074:

1073:

1068:

1064:

1063:Joshua Rosner

1060:

1056:

1052:

1048:

1045:

1044:

1032:

1026:

1022:

1021:

1013:

1007:

1003:

999:

998:

991:

983:

977:

973:

972:

964:

956:

950:

946:

945:

938:

930:

924:

920:

919:

911:

903:

897:

893:

892:

884:

876:

870:

866:

865:

857:

849:

843:

839:

838:

830:

822:

816:

812:

811:

803:

795:

789:

785:

784:

776:

774:

765:

764:

756:

748:

742:

738:

737:

729:

721:

715:

711:

710:

702:

694:

688:

684:

683:

675:

673:

664:

660:

656:

652:

648:

641:

633:

629:

625:

621:

616:

611:

607:

603:

596:

588:

582:

578:

577:

569:

562:

558:

554:

551:

546:

544:

535:

529:

525:

524:

516:

508:

502:

498:

497:

489:

487:

477:

468:

459:

457:

452:

443:

440:

438:

435:

433:

430:

428:

425:

423:

420:

418:

415:

413:

410:

409:

403:

396:

393:

390:

386:

382:

378:

374:

371:

367:

364:

361:

357:

354:

351:

347:

344:

341:

338:

337:

336:

328:

325:

323:

318:

314:

306:

300:

298:

288:

284:

282:

277:

275:

260:

257:

256:

253:

250:

249:

246:

243:

242:

239:

236:

235:

232:

229:

228:

225:

222:

221:

218:

215:

207:

203:

199:

196:

193:

192:

189:

182:

179:

175:

172:

169:

165:

161:

159:

156:

153:

151:

148:

145:

142:

141:

140:

137:

128:

119:

116:

112:

107:

105:

100:

96:

92:

88:

84:

80:

69:

66:

58:

48:

44:

38:

37:

32:This article

30:

21:

20:

2544:Robo-advisor

2489:Fixed income

2420: /

2376: /

2296:Pension fund

2120:Total return

2080:Pension fund

2064:

1842:Vulture fund

1828:

1657:Vintage year

1582:Capital call

1554:Crowdfunding

1489:Corporations

1416:

1392:Venture debt

1086:

1070:

1066:

1054:

1019:

1012:

995:

990:

970:

963:

943:

937:

917:

910:

890:

883:

863:

856:

836:

829:

809:

802:

782:

762:

755:

735:

728:

708:

701:

681:

663:the original

650:

640:

605:

601:

595:

575:

568:

522:

515:

495:

476:

467:

400:

394:High returns

349:

334:

326:

312:

310:

304:

294:

285:

278:

270:

187:

184:investments.

133:

108:

82:

78:

76:

61:

55:October 2015

52:

33:

2518:Yield curve

2431:Terminology

2383:Hedge Funds

2276:Mutual fund

2216:Investment

2022:Mutual fund

1975:130–30 fund

1958:Alternative

1937:Traditional

1903:Sector fund

1898:Income fund

1888:Growth fund

1817:Alternative

1791:Traditional

1519:Foundations

1442:Pledge fund

1234:Secondaries

2612:Investment

2596:Categories

2353:Unit trust

2261:Hedge fund

2251:Index fund

2220:structures

2060:Hedge fund

1893:Value fund

1878:Index fund

1849:Hedge fund

1798:Stock fund

1607:Envy ratio

1514:Endowments

1377:Seed money

1291:Terms and

448:References

391:companies.

104:asymmetric

47:footnoting

2497:Convexity

1803:Bond fund

1577:Cap table

1482:Investors

1406:Structure

1224:Mezzanine

1212:Leveraged

659:2329-9134

632:0893-9454

610:CiteSeerX

322:secondary

2575:Category

2493:Duration

1871:By style

1627:Leverage

1563:Related

1293:concepts

553:Archived

406:See also

381:leverage

177:manager.

43:citation

2308:(QIAIF)

1637:M&A

1344:Venture

1249:History

1219:Venture

561:CalPERS

85:) is a

83:PE fund

2472:Theory

2374:Active

2314:(REIT)

2015:Public

1602:EBITDA

1301:Buyout

1229:Growth

1207:Buyout

1027:

1004:

978:

951:

925:

898:

871:

844:

817:

790:

743:

716:

689:

657:

630:

612:

583:

530:

503:

2559:UCITS

2418:Value

2328:SICAV

2242:(FCP)

2236:(ETF)

2230:(CCF)

1417:funds

1282:2020s

1277:2010s

1272:2000s

1267:1990s

1262:1980s

1083:(PDF)

305:exits

272:with

113:(the

2583:List

2218:fund

1469:SPAC

1415:and

1372:SAFE

1191:and

1061:and

1025:ISBN

1002:ISBN

976:ISBN

949:ISBN

923:ISBN

896:ISBN

869:ISBN

842:ISBN

815:ISBN

788:ISBN

741:ISBN

714:ISBN

687:ISBN

655:ISSN

628:ISSN

581:ISBN

528:ISBN

501:ISBN

313:exit

45:and

1927:By

1642:PME

1622:IRR

1617:IPO

1572:AUM

1088:PwC

620:doi

2598::

2495:,

1840:,

1836:,

1085:.

1065:,

1053:,

772:^

671:^

653:.

649:.

626:.

618:.

606:23

604:.

559:.

542:^

485:^

455:^

77:A

2499:)

2491:(

2200:e

2193:t

2186:v

2029:)

2025:(

1844:)

1832:(

1769:e

1762:t

1755:v

1181:e

1174:t

1167:v

1033:.

984:.

957:.

931:.

904:.

877:.

850:.

823:.

796:.

749:.

722:.

695:.

634:.

622::

589:.

536:.

509:.

307:)

68:)

62:(

57:)

53:(

49:.

39:.

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.