684:. The price of oil stayed near $ 100 throughout January because of concerns over supplies, and the European debt situation. The average price of gas was $ 3.38 on January 20, up 17 cents from a month earlier. By early February, the national average for gasoline was $ 3.48, though oil prices were at $ 98, the lowest in six weeks, and U.S. demand was the lowest since September 2001. On February 20, benchmark March crude oil reached $ 105.21, the highest in nine months. This came one day after Iran's oil ministry announced an end to sales to British and French companies; though this would have little actual impact on supplies, fears resulted in higher prices. Also, approval of the

367:

1075:

cuts. OPEC agreed to production cuts on April 12; these would be greater in 2020 than in future years. U.S. crude supplies had risen for 12 weeks, including the largest increase for a week as of April 10. On April 14, the difference between the front month contract and contracts for later delivery were the most since 2009 for WTI, which traded $ 14.45 below the

September contract. On April 20, the front month contract for WTI fell below zero, an unprecedented event. With the contract for May delivery expiring on April 21, the contract for June delivery became the new front month contract; on April 22 after settling at $ 13.78, WTI was the lowest since the 1990s.

790:

production cuts. Brent plunged to US$ 71.25, a four-year low. Al-Naimi argued that the market would be left to correct itself, this will put pressure on companies in the US to reduce shale fracturing operations. OPEC had a "long-standing policy of defending prices". OPEC was ready to let the Brent oil price drop to $ 60 to slow down US tight oil (shale oil) production. In spite of a troubled economy in member countries, al-Naimi repeated his statement on Saudi inaction on 10 December 2014. By the end of 2014, as the demand for global oil consumption continued to decline, the remarkably rapid oil output growth in ‘light, tight’ oil production in the North Dakota

924:. U.S. oil inventories were down 15% since March and lower than in 2016 due to higher exports resulting from WTI being significantly lower than Brent. In November, WTI reached $ 57.92, highest since July 2015, and Brent crude $ 64.65, highest since June 2015. Demand was high, and OPEC cuts and "rising political tensions" were other reasons. During the last week of 2017, WTI went over $ 60 for the first time since June 2015 before falling back to $ 59.69, while Brent crude passed $ 67 for the first time since May 2015 before falling to $ 66.50. Pipeline problems in Libya and the North Sea added to production cuts by OPEC and Russia.

1114:, easing of restrictions related to the pandemic, and production cuts by OPEC and allies were factors. As of September 10, Brent was up 41 percent for the year due to OPEC supply cuts and increased demand after the worst of the pandemic seemed to be over. A month later both WTI and Brent were 60 percent higher than at the start of the year. OPEC and other nations were limiting production increases as increased COVID-19 infections still showed the potential to hurt demand. By October 19 WTI had increased 21 percent and Brent 19 percent just since the start of September.

235:

246:

478:. Oil prices surged above $ 110 to a new inflation-adjusted record on March 12, 2008, before settling at $ 109.92. On April 18, 2008, the price of oil broke $ 117 per barrel after a Nigerian militant group claimed an attack on an oil pipeline. Oil prices rose to a new high of $ 119.90 a barrel on April 22, 2008, before dipping and then rising $ 3 on April 25, 2008, to $ 119.10 on the New York Mercantile Exchange after a news report that a ship contracted by the U.S. Military Sealift Command fired at an Iranian boat.

1174:

WTI peaked at $ 93.68 on

September 27 before falling 8.8 percent during the first full week of October. The gain for the year was 3.15 percent. The first full week of December was the seventh week of declines, the longest streak since 2018, with Brent finishing at $ 75.18 and WTI at $ 71.23. Both dropped nearly 4 percent for the week and reaching their lowest point since June on December 7. Oil ended the year down 10 percent, finishing at the lowest year-end level since 2020. Brent was at $ 77.04 and WTI at $ 71.65.

284:

16.37. Electronic crude oil trading was temporarily halted by NYMEX when the daily price rise limit of $ 10 was reached, but the limit was reset seconds later and trading resumed. By

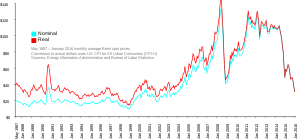

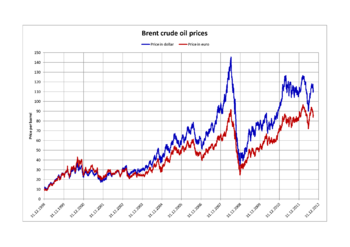

October 16, prices had fallen again to below $ 70, and on November 6 oil closed below $ 60. Then in 2009, prices went slightly higher, although not to the extent of the 2005–2007 crisis, exceeding $ 100 in 2011 and most of 2012. Since late 2013 the oil price has fallen below the $ 100 mark, plummeting below the $ 50 mark one year later.

1170:, both indexes reached their lowest point since 2021. The first quarter ended with Brent at $ 79.89, down 5 percent for the month and for the first time since 2015, down for the third straight quarter. WTI finished down 2 percent for the month, at $ 75.67. Because of negative economic news worldwide and the prospect of lower demand, oil finished down for the fourth straight quarter, with Brent ending second quarter 2023 at $ 74.90, down 6 percent, and WTI at $ 70.64, down 6.5 percent.

147:

1132:, Brent was up about 25 percent to more than $ 110. It eventually peaked at $ 139.13, highest since 2008. As of March 7, Brent was at $ 125, up 35 percent in a month and 60 percent for the year, and gas was $ 4 per gallon for the first time since 2008. Just over a week later Brent was down nearly 30 percent, settling below $ 100 for the first time in March, with expected production increases by some OPEC nations and COVID-19 restrictions in China. Gas was still $ 4.32.

507:

1147:

fell below $ 80 for the first time all year. Interest rate increases also contributed to oil's decline. For the third quarter, Brent fell 23 percent, ending at $ 87.96, and WTI fell 25 percent, finishing at $ 79.49. In the last three weeks of 2022, Brent and WTI jumped 13 percent. For the year, Brent climbed 10 percent, finishing at $ 85.91, and WTI climbed 7 percent to $ 80.26. Though the gains were much smaller, 2022 was the second year of increases for both.

223:

822:, combined with the US$ 12 million upfront well drilling and construction costs, provided incentives to oil producers to continue to flood the already glutted market with under-priced oil in spite of crude oil storage limitations. Many less efficient and less productive older wells were shut down but these tight oil (shale oil) wells continue to increase production while making a profit in a market where crude oil is priced as low as US$ 50 a barrel.

47:

1079:

that given the chances of more COVID-19 related lockdowns or problems with the world economy. Bad news about U.S. unemployment, a strong dollar, lower expected demand, and higher U.S. crude supplies contributed to the second down week for WTI, which fell 6.1 percent to $ 37.33. Brent fell 6.6 percent for the week to $ 39.83. This was the first time oil fell for two straight weeks since April.

486:. The mid-July decision of Saudi Arabia to increase oil output caused little significant influence on prices. According to the oil minister of the Islamic Republic of Iran, Gholam-Hossein Nozari, the world markets were saturated and a Saudi promise of increased production would not lower prices. Several Asian refineries were refusing Saudi petroleum in late June because they were over priced

88:

1071:, on March 8 oil fell over 30 percent. WTI reached $ 31.13, down 24.6 percent, with Brent $ 34.36, down 24.1 percent. Both were the lowest since 2016 and the one-day decline was the largest since 1991. On a week when oil fell the most since 2014, Russia rejected plans by OPEC and others to help calm the oil market, and Saudi Arabia was expected to increase production.

605:

reacted. The average price of gasoline in the United States increased 6 cents to $ 3.17. On March 1, 2011, a significant drop in Libyan production and fears of more instability in other countries pushed the price of oil over $ 100 a barrel in New York trading, while the average price of gas reached $ 3.37. Despite Saudi promises, the

1139:

Arabia lowered the price of its Arab Light crude grade to Europe for the month of June. The price of the Arab Light benchmark sold in the US in June remained the same, at $ 5.65 per barrel above the Argus Sour Crude Index. Meanwhile, Kuwait became the second-largest OPEC member to cut its prices for Asia, after Saudi Arabia.

354:, which maintained production for a few years until it eventually declined. Pumping oil out of Iraq may reduce petroleum prices in the short term, but will be unable to perpetually lower the price. From Simmons' point of view, the invasion of Iraq is associated with the start of long-term increase in oil prices, but it may

916:

lower production. In June OPEC production actually went up and with high worldwide supplies and high U.S. production, oil reached its lowest level in six months in June. With higher U.S. demand and lower inventories, oil finally turned around and reached its highest level in two and a half months on August 9.

525:. By the end of the week, crude oil fell 11% to $ 128, also affected by easing of tensions between the US and Iran. By August 13, prices had fallen to $ 113 a barrel. By the middle of September, oil price fell below $ 100 for the first time in over six months, falling below $ 92 in the aftermath of the

1086:, WTI fell 4.3 percent on October 2 to finish the week down 8 percent at $ 37.05, the lowest since September 8. Brent dropped 4.1 percent and 7.4 percent for the week to $ 39.27, the lowest since June 12. Continued concerns about the pandemic reducing demand also contributed even as U.S. supplies fell.

1146:

outweighed concerns over Russia, and by the time OPEC and other nations decided on a small cut in production on

September 5, Brent was $ 96.50 and WTI $ 89.79. Gas was $ 3.82. Just over a week later both indexes were down 20 percent for the quarter, the most since the pandemic began in 2020. Then WTI

1063:

a major reason. WTI fell 1.5 percent to $ 49.57, the lowest since

January 2019, and Brent dropped 2.2 percent to $ 53.27, the lowest since December 2018. Russia had not agreed to further production cuts, though OPEC had a plan. WTI ended February 28 down more than 16 percent for the week, the most in

1029:

WTI fell 7.9 percent on August 1, the most in one day in four years, to $ 53.95, the lowest since June 19. The next day WTI finished the week down, in response to Trump's plans for more tariffs. Brent fell 7 percent on August 1 and also ended the week lower. Later in the month, Tom Kloza, global head

915:

Crude inventories set a record so oil continued to fall through March, with WTI reaching just above $ 47 and Brent falling below $ 50. After Saudi Arabia announced plans to continue lower production beyond the first half of 2017, oil went higher in April before falling again despite plans to continue

891:

Brent reached $ 57.89 and U.S. crude reached $ 54.51 on

December 12, both the highest since July 2015, after Russia and other countries not part of OPEC also agreed to limit production. On December 27, with the output reduction to start January 1, Brent crude hit $ 56.09 and U.S. crude CLc1 reached $

722:

all contributed to a 20% jump in oil prices in six weeks. The price of gas reached $ 3.63 but was not expected to go much higher. Good economic news in the United States contributed to oil reaching its highest price since May on August 17, with

Benchmark Crude reaching $ 96.01, while Brent crude fell

652:

During

October, the price of oil rose 22%, the fastest pace since February, as worries over the U.S. economy decreased, leading to predictions of $ 4 by early 2012. As of November 8, the price reached $ 96.80. Gas prices were not following the increase, due to lower demand resulting from the economy,

392:

From 2005 onwards, the price elasticity of the crude oil market changed significantly. Before 2005 a small increase in oil price lead to an noticeable expansion of the production volume. Later price rises let the production grow only by small numbers. This was the reason to call 2005 a tipping point.

283:

summer. The highest recorded price per barrel maximum of $ 147.02 was reached on July 11, 2008. After falling below $ 100 in the late summer of 2008, prices rose again in late

September. On September 22, oil rose over $ 25 to $ 130 before settling again to $ 120.92, marking a record one-day gain of $

1138:

On May 8, Saudi Arabia cut oil prices for buyers in Asia, countering uncertainty around Russia's supplies. The state-controlled company dropped its key Arab Light crude grade for the next month's shipments to Asia to $ 4.40 a barrel above the benchmark it uses, from $ 9.35 in May. Also in May, Saudi

979:

Oil finished

January up 18.5 percent (the best ever with records going back as far as 1984) with WTI at $ 53.79 one day after its highest finish since November, and Brent up 15 percent for the month to $ 61.89; both gains were the most for a month since April 2016. A major factor was an announcement

872:

On January 6, 2016, the price of WTI crude hit another eleven-year low, as it dropped to $ 32.53 a barrel for the first time since 2009. On January 12, in its seventh losing day, crude oil dropped below $ 30 for the first time since December 2003. OPEC encouraged production cuts, which helped prices

640:

fell 81 cents to $ 113.21. On June 15 the Energy Information Association said oil consumption was down 3.5% from a year earlier, but wholesale gasoline demand was up for the first time in several weeks. The price of gas on June 17 was $ 3.67.5 a gallon, 25.1 cents lower than a month earlier but 96.8

616:

The weakened U.S. Dollar resulted in a spike to $ 112/barrel with the national average of $ 3.74/gallon – with expectations of damaging the U.S. economy suggestive of a long-term recession. As of April 26, the national average was $ 3.87 – with a fear of $ 4/gallon as the nationwide average prior to

1173:

After six weeks of gains, WTI was up 20 percent to $ 82.82 on August 4, and Brent finished at $ 86.24, up 17 percent. Saudi Arabia agreed to continue production cuts, while Russia was reducing exports, while demand was expected to increase. Gas peaked at $ 3.88 in the United States on September 18.

963:

In November oil fell the most for any month in ten years. WTI finished at $ 50.93, up 1% for the week but down 22% for the month, while Brent was $ 58.71, down 12% for the year. Higher production in the U.S., Russia and some OPEC countries meant too much supply. Losses would have been higher except

805:

By December 12, both Brent and WTI reached their lowest prices since 2009; Brent dropped to $ 62.75 a barrel and WTI slid to $ 58.80 . Later in the month the price of oil was down 50% since April. Economic problems in Europe and Asia, high gas mileage, a strong dollar, higher U.S. production and no

774:

Cold weather led to the price of oil staying above $ 100 for most of February, but lower prices were expected. With United States fourth quarter economic growth expected to be lower than an early estimate, Benchmark crude fell slightly on February 27 to $ 102.40, with Brent crude reaching $ 108.61.

734:

On January 17, with good economic news in the United States, Benchmark oil reached its highest level since September, going over $ 95. Brent rose above $ 110. On February 25, with European stock markets doing well, Benchmark crude for April rose above $ 94 after a significant drop the previous week

699:

On April 24, gasoline was $ 3.85 compared to $ 3.86 a year earlier; it had been two years since gas prices were lower than the previous year. Crude oil prices were down; West Texas Intermediate was $ 103.55 a barrel, down from over $ 107 late in March, and Brent Crude $ 118.16 after peaking above $

497:

crude contract for August delivery rose to $ US145.01 a barrel" in Asian trade. London Brent crude reached a record of $ 145.75 a barrel, and Brent crude for August delivery peaked to a record $ 145.11 a barrel on London's ICE Futures Europe exchange, and to $ 144.44 a barrel on the NYMExchange. By

265:

was generally under $ 25/barrel. Then, during 2004, the price rose above $ 40, and then $ 60. A series of events led the price to exceed $ 60 by August 11, 2005, leading to a record-speed hike that reached $ 75 by the middle of 2006. Prices then dropped back to $ 60/barrel by the early part of 2007

1100:

WTI ended 2020 at $ 48.52, down 20.5 percent in its second down year in three years but up 7 percent for the month and more than 20 percent for the quarter. Brent finished at $ 51.80, down 21.5 percent for the year but up 8.9 percent for December and 26.5 percent for the quarter. A weak dollar and

1078:

On July 15, after the largest drop in U.S. crude supplies of the year, WTI reached $ 41.20 and Brent $ 43.79, the highest since March 6 for both. That same day, OPEC and others said they planned to decrease production cuts in August but FXTM analyst Lukman Otunuga said it might not be the time for

967:

For the week ending December 21, WTI fell 11.4% to $ 45.59, the lowest since July 2017, and Brent crude fell 10.7% to $ 53.82, the lowest since September 2017. Higher U.S. interest rates, more active U.S. oil rigs, higher U.S. crude production and lower expected worldwide demand did not cancel out

919:

Brent rose 40% from June to October as oil producers were expected to continue lower production, with an increase of 20% in the third quarter, the most for the quarter since 2004, and reaching $ 59.49 during the final week of September. The increase would have been more but Turkey did not act on a

911:

Despite the promises of lower output from other countries, no evidence of changes was seen. U.S. output was higher and oil continued to fall. With U.S. production and inventories up, even a lower dollar and decreased production by OPEC nations did not cause oil prices to rise as much as they could

887:

Saudi Arabia began attempting to persuade other OPEC countries to participate in its plan. OPEC countries met November 30 and agreed to limit output for the first time since 2008. As a result, Brent crude went over $ 50, the highest in a month, while West Texas intermediate stopped just short of $

879:

Early in August, WTI fell to $ 41.52; oil prices had fallen more than 20% since June and were rising earlier in the week. U.S. crude fell to $ 43.16 on September 1, its lowest level in 3 weeks, after oil had gone up 11% for the month of August with the expectation that OPEC would limit production.

1074:

In the first quarter, the percentage loss was the worst ever, 66.5 percent for WTI and 65.6 percent for Brent. Then on April 2, WTI jumped 24.7 percent to $ 25.32 and Brent rose 21 percent to $ 29.94, the biggest percentage increase in a single day ever, in anticipation of significant production

883:

A September 26 OPEC meeting led to a decision to decrease production resulting in the biggest gains in oil prices since April. On October 10, with Russia planning to join OPEC and Algeria saying others should, Brent crude reached its highest point in a year at $ 53.73, while WTI hit $ 51.60, the

604:

Oil supplies remained high, and Saudi Arabia assured an increase in production to counteract shutdowns. Still, the Mideast and North African crisis led to a rise in oil prices to the highest level in two years, with gasoline prices following. Though most Libyan oil went to Europe, all oil prices

1013:

contributed as WTI fell for three weeks straight. On May 23 when oil fell the most in a day since December (also falling below the 200-day moving average), WTI finished at $ 57.21, lowest since March 12, in a week when WTI lost nearly 7 percent; Brent finished the week at $ 68.69 for a nearly 5

987:

WTI rose 6.4 percent in February while Brent crude went up 6.7 percent. On March 1, WTI fell 2.5 percent to end the week at $ 55.80 while Brent crude fell 1.9 percent to $ 65.07. This was true even though OPEC output reached its lowest level in four years. U.S. economic reports indicated slower

573:

Prices rose back to $ 90/barrel in December 2010. The US average for a gallon of 87 octane regular unleaded averaged $ 3.00/gallon on December 23, sparking fear of a second recession if prices reached $ 100/barrel and $ 4.00/gallon gasoline, as forecasted for spring 2011. The price increases in

952:, WTI ended the day at $ 66.82, with Brent at $ 72.04, both the highest since December 2014. In May WTI reached its highest level in three and half years twice. Brent rose for the sixth week in a row, the most since 2011, going over $ 80 for the first time since November 2014 the previous day.

851:

After an International Energy Agency prediction of high supplies for the next year, U.S. crude fell the most in a week in more than two months, ending October 15 below $ 47, and Brent crude had its biggest loss for a week in nearly two months, just under $ 50 on October 16. With Middle Eastern

789:

U.S. tight oil (shale oil) production increased and China and Europe's demand for oil decreased. In spite of huge global oversupply, on 27 November 2014 in Vienna, Saudi Oil Minister Ali al-Naimi blocked the appeals from the poorer OPEC member states, such as Venezuela, Iran and Algeria, for

940:

WTI ended March at $ 64.94, up 5.6% for the month and 7.7% for the first quarter. Brent finished at $ 70.27 for an increase of 8.6% for the month and 6.3% for the quarter. Possible sanctions on Iran, OPEC's desire for higher prices, and lower production in Venezuela were reasons.

959:

WTI ended the first half of 2018 up about 23% to $ 74.15, the highest since November 2014, up 14% for the second quarter and 11% for the month. Brent crude was $ 79.44. Factors included threats to supplies from Libya and proposed sanctions on countries importing oil from Iran.

936:

decreasing U.S. production, oil reached its highest price since December 2014 in mid-January. On January 15, Brent crude reached $ 70.37, and the next day, WTI hit $ 64.89. U.S. production increased and demand was predicted to go down when winter was over, so prices went down.

466:

bought 1,000 barrels (160 m), the smallest amount permitted, and immediately sold it for $ 99.40 at a $ 600 loss. Oil fell back later in the week to $ 97.91 at the close of trading on Friday, January 4, in part due to a weak jobs report that showed unemployment had risen.

843:

Oil fell by about $ 10 in July as the U.S. dollar was strong, supplies were high, and the Chinese stock market was down. Near the end of the month, Brent crude reached $ 53.31, close to the lowest in six months, while U.S. crude, at $ 48.52, was close to a four-month low.

1109:

WTI rose over 50 percent during the first half of 2021 and Brent jumped 45 percent, reaching their highest levels in two and a half years. In June alone WTI jumped more than 10 percent, with Brent up 8 percent. On July 2, WTI was at $ 74.28 and Brent was at $ 75.76.

532:

A stronger US dollar and a likely decline in European demand were suggested to be among the causes of the decline. By October 24, the price of crude dropped to $ 64.15, and closed at $ 60.77 on November 6. By the end of December, 2008, oil had bottomed out at $ 32.

2942:

832:

After oil reached a six-year low in March, Brent crude rose 16% in April, reaching $ 64.95, its highest price for 2015, on April 16. U.S. crude was $ 56.62 on April 17. Reasons were a drop in expected tight oil (shale oil) production in the United States and the

596:

in Egypt, Libya, Yemen, and Bahrain drove oil prices to $ 95/barrel in late February 2011. A few days prior, oil prices on the NYMEX closed at $ 86. Oil prices topped at $ 103 on February 24 where oil production is curtailed to the political upheaval in

991:

The third week of April ended with WTI at $ 64 for its seventh gain for the first time since February 2014. Brent rose for the fourth week, ending at $ 71.97. On April 22, WTI rose to $ 66.30, with the highest settlement since October resulting from the

553:

On May 21, 2010, the price of oil had dropped in two weeks from $ 88 to $ 70 mainly due to concerns over how European countries would reduce budget deficits; if the European economy slowed down, this would mean less demand for crude oil. Also, if the

781:

pushed Benchmark crude above $ 100 and Brent crude over $ 108 on May 12, and further problems in Libya helped push Benchmark crude over $ 102 and Brent crude over $ 110 by May 15. Continued concerns over Ukraine and Libya pushed oil above $ 104.

863:

On December 21, Brent fell as low as $ 36.35 a barrel; this was the lowest price since July 2004. On December 30 with U.S. supplies still high, light sweet crude fell to $ 36.60, while Brent crude reached $ 36.46. Oil ended the year down 30%.

742:. In the past week, Brent had climbed 7% to $ 108.51. Because too much oil was being produced for the infrastructure to handle it, West Texas Intermediate was lower than Brent for several years; it returned to being consistent with Brent.

1064:

11 years, falling 5 percent to $ 44.76 on February 28. Brent closed at $ 50.52. Both were the lowest since December 2018. Warmer than usual weather was one reason but the major factor was concerns about economic slowdown due to COVID-19.

735:

due to news the Federal Reserve might end its stimulus efforts, making the dollar stronger. Brent was over $ 115. By mid-April, with low demand expected due to negative economic news, Brent fell to $ 103.04, its lowest price since July.

2685:

955:

With OPEC's announcement that it would keep production low through the rest of 2018, WTI finished May 30 at $ 68.21. Brent finished at $ 77.50. The difference between WTI and Brent was increasing, possibly due to tight oil (shale oil).

2984:

624:

crude fell 9 percent, ending the day below $ 100 a barrel, the lowest since March 16, after the most dramatic single-day drop in over two years. Gas prices fell slightly on May 6, and experts predicted $ 3.50 a gallon by summer.

4758:

859:

On the first week of December Brent fell to $ 42.43 and U.S. crude slipped below $ 40 after OPEC first said it would increase production and then decided not to make changes. Other factors were a weak dollar and a strong Euro.

315:– totaled $ 494.8 billion. Likewise, major oil-dependent countries such as Saudi Arabia, the United Arab Emirates, Canada, Russia, Venezuela and Nigeria have benefited economically from surging oil prices during the 2000s.

2952:

648:

In August, the same pessimistic economic news that caused stock prices to fall also decreased expected energy demand. On August 8, oil fell over 6%, in its largest drop since May, to $ 81, its lowest price of the year.

1017:

WTI rose almost 9 percent for the week ending June 21, the most since December 2016, to $ 57.43, the highest finish for the month. Brent was up 5 percent to $ 65.20. Reasons for the jump included expectations of the

481:

On June 6, prices rose $ 11 in 24 hours, the largest gain in history due to the possibility of an Israeli attack on Iran. The combination of two major oil suppliers reducing supply generated fears of a repeat of the

270:

on November 21, 2007. Throughout the first half of 2008, oil regularly reached record high prices. Prices on June 27, 2008, touched $ 141.71/barrel, for August delivery in the New York Mercantile Exchange, amid

400:

in the United States, gasoline prices reached a record high during the first week of September 2005. The average retail price was, on average, US$ 3.04 per U.S. gallon. The average retail price of a liter of

847:

During August, Brent reached a low of $ 42.23 and U.S. crude was as low as $ 37.75. Then U.S. crude jumped 28% in 3 days, the most since 1990. Brent crude also climbed 28% above $ 54, the highest in a month.

1006:

that other countries would make up the difference. Though WTI fell due to higher U.S. crude supplies, Brent reached the highest close since October on April 24 before falling to $ 74.35 the next day.

688:

was expected, and China's action to raise the money supply was likely to stimulate the economy. Brent crude was up 11% for the year to $ 119.58 on February 17, with cold weather in Europe and higher

287:

As the price of producing petroleum did not rise significantly, the price increases have coincided with a period of record profits for the oil industry. Between 2004 and 2007, the profits of the six

1117:

Brent reached $ 86.70, the highest since 2018, during October. WTI reached $ 85.41 on October 25, the highest in seven years, and fell 11.5 percent by November 19, still up 55 percent for the year.

334:. The conflict coincided with an increase in global demand for petroleum, but it also reduced Iraq's current oil production and has been blamed for increasing oil prices. However, oil company CEO

3265:

620:

Crude oil reached $ 114.83 on May 2, the highest since September 2008., The national average for gasoline rose on May 5, 2011, for the 44th straight day, reaching $ 3.98. However, that same day,

521:

On July 15, 2008, a bubble-bursting sell-off began after remarks by President Bush the previous day that the ban on oil drilling would be lifted. This precipitated an $ 8 drop, the biggest since

4834:

2699:

755:

On December 27, due to a better economy in the United States leading to higher demand, oil closed about $ 100 for the first time since October. Gas was $ 3.27, two cents below a year earlier.

802:

Basins in Texas, while rejuvenating economic growth in "U.S. refining, petrochemical and associated transportation industries, rail & pipelines, destabilized international oil markets."

2430:

745:

On August 28 West Texas Intermediate reached $ 110.10, the highest since May 2011, and Brent reached $ 116.61, its highest point since February 19, due to concern about U.S. involvement in

358:

in oil production by retaining a partial amount of Iraq's oil reserves. As a direct consequence, the oil production capacity was diminished to 2 million barrels (320,000 m) per day.

2992:

4815:

318:

The difference between West Texas Intermediate (WTI) crude and Brent crude is greater if the amount of U.S. oil is high, so prices will go down in order to get the oil off the market.

4948:

840:

On June 10, West Texas Intermediate reached $ 61.43, the highest price since December. Demand was expected to stay high, but OPEC production was also staying high. Brent was $ 65.70.

752:

On November 13, Brent reached $ 107.12 and was $ 13.24 higher than West Texas Intermediate, the largest difference since April, due to trouble in Libya and sanctions against Iran.

1033:

On August 19, the difference between WTI and Brent was $ 3.53, the lowest since July 2018. At the start of the year it was twice that. More pipeline capacity was a reason. The

980:

of expected production cuts by Saudi Arabia, though higher U.S. gasoline stocks kept oil from going even higher. U.S. crude supplies were lower than expected and sanctions on

892:

53.90. though oil fell slightly at the end of the week, with WTI ending the year at $ 53.72 for a 45% gain, and Brent at $ 56.82, up 52%. Both gains were the most since 2009.

3398:"Oil Prices Hit a 2015 High on Hopes U.S. Production Will EaseLight, sweet crude for May delivery settled up 32 cents to $ 56.71 a barrel on the New York Mercantile Exchange"

703:

After falling to its lowest price since October 2011, Benchmark crude rose 5.8% to $ 82.18 on June 29, with Brent crude up 4.5% to $ 95.51. European bailout efforts included

102:

2656:

1142:

In June, Brent peaked at $ 123 and gas was over $ 5 because of fears Russian oil would no longer be sold, but Russia continued to sell oil in Asia at low prices. Fear of a

4853:

4739:

4720:

4422:

326:

United States crude oil prices averaged $ 30 a barrel in 2003 due to political instability within various oil producing nations. It rose 19% from the average in 2002. The

4796:

884:

highest since June 9. But after an October 29 meeting by both OPEC members and nonmembers resulted only in an agreement to meet again on November 30, oil went back down.

1582:

1461:

government, Robert Longley Robert Longley is a U. S.; since 1997, history expert with over 30 years of experience in municipal government He has written for ThoughtCo.

4324:

1014:

percent loss. The declines for the week were the most all year. The trade war with China caused concerns, though possible actions by Trump helped slightly on May 24.

4610:

2912:

2106:

3547:

1933:

1089:

WTI and Brent both reached their highest settlements since September on November 18, with WTI at $ 41.82 and Brent at $ 44.34. One major factor was good news about

1186:

resulted in WTI rising 19 percent for the year as of April 11 when it finished at $ 85.66. The next day Brent was up 18 percent for the year, finishing over $ 91.

498:

midday in Europe, crude rose to $ 145.85 a barrel on the NYME while Brent crude futures rose to a trading record of $ 146.69 a barrel on the ICE Futures exchange.

4519:

2611:

1182:

Brent, finishing the quarter at $ 87.48, and WTI, which settled at $ 83.17, rose for each of the first three months of the year. High demand, supply problems and

5216:

2162:

1128:

As of February 3, WTI traded over $ 90 for the first time since October 2014, a week after Brent did the same. WTI was up 20 percent for the year. A week after

3322:

429:

60:

4967:

4701:

4777:

4663:

1428:

4910:

4572:

2535:

704:

661:

The CIBC reported that the global oil industry continued to produce massive amounts of oil in spite of a stagnant crude oil market. Oil production from the

4500:

4400:

2872:

1907:

474:

accused the United States of economic "mismanagement" that was pushing oil prices to record highs, rebuffing calls to boost output and laying blame at the

5505:

5052:

1093:. U.S. crude inventories rose more than expected, and uncertainty about OPEC and COVID-19 lockdowns contributed to lower prices the next day. Just before

653:

the normal decrease in travel, lower oil prices in other countries, and production of winter blends which cost less. The average rose slightly to $ 3.41.

346:. According to Simmons, isolated events, such as the Iraq war, affect short-term prices but do not determine a long-term trend. Simmons cites the use of

5543:

5155:

2571:

2487:

2458:

1526:

5014:

4286:

4174:

3773:

3186:

707:, decreasing likelihood of failures. Also, European countries decided not to buy Iranian oil. The price of gas was $ 3.35, the lowest since January 6.

1978:

829:

reported that oil production in the United States had peaked and would start to decline in the third quarter thereby easing the global glut of crude.

4481:

4441:

4362:

826:

5524:

5446:

5408:

4381:

4036:

3479:

628:

In mid-June, West Texas Intermediate crude for July delivery fell nearly $ 2 to $ 93.01, the lowest price since February. The dollar was up and the

5234:

4891:

2091:

1786:

685:

4629:

4591:

3397:

2440:

1996:

443:. Prices fell briefly on the expectation of increased U.S. crude oil stocks, however they quickly rose to a peak of $ 92.22 on October 26, 2007.

405:

in the United Kingdom was 86.4p on October 19, 2006, or $ 6.13 per gallon. Oil production in Iraq continued to decline as result of the nation's

5486:

5427:

3237:

1480:

1120:

WTI ended 2021 at $ 75.21, up 55.5 percent, while Brent finished at $ 77.78, up 50.5 percent. This was the biggest gain for the year since 2016.

795:

5284:

1956:

4682:

4553:

3083:

157:

17:

4644:

4343:

4248:

2201:

4534:

778:

4986:

4192:

4211:

4073:

3102:

921:

432:. After news of North Korea's successful nuclear test on October 9, 2006, oil prices rose past $ 60 a barrel, but fell back the next day.

5370:

2780:

710:

On August 7, a California refinery fire contributed to a jump in oil futures. Other refinery problems, a pipeline leak, fears about Iran,

5309:

5131:

3289:

642:

389:

has been above US$ 50 per barrel since March 5, 2005. In June 2005, crude oil prices broke the psychological barrier of $ 60 per barrel.

106:

5389:

4872:

5563:

Donato Paolo Mancini, Jennifer Jacobs and Alex Wickham (April 13, 2024). "Israel prepares for Iran to act on threat of direct attack".

4267:

2242:

2227:

1068:

932:

Both WTI and Brent crude began the year above $ 60 for the first time since 2014. With U.S. inventories the lowest in three years, and

416:, setting an all-time record. The run-up is attributed to a 1.9 increase in gasoline consumption, geopolitical tensions resulting from

169:

66:

4230:

4140:

4125:

1844:

5618:

4759:"Oil plunges 25% and investors brace for a race to the bottom, as an all-out OPEC 'price war' erupts between Saudi Arabia and Russia"

1156:

1049:

1023:

901:

819:

764:

583:

30:

This article is about a chronology of events affecting the oil market. For a discussion of the energy crisis of the same period, see

5074:

3700:

3667:

873:

go up before U.S. crude fell to $ 26.05, its lowest price since May 2003. Prices started rising when OPEC was "ready to cooperate".

5112:

3907:

406:

5033:

4929:

4305:

3461:

3142:

2966:

2664:

2036:

786:

666:

1495:

1167:

563:

542:

3615:

3207:

1870:

1030:

of energy analysis at the Oil Price Information Service, said this was proof a presidential tweet could affect world markets.

856:, as well as slow growth in China, U.S. crude fell below $ 46 on October 19 and Brent crude reached $ 48.51 early October 20.

641:

cents above a year earlier. On June 24, the price of gas was $ 3.62.8 and expected to go much lower due to the opening of the

1589:

677:

35:

3630:

2073:

1272:

3371:

2755:

933:

3759:

2920:

5330:

3555:

2354:

1322:

834:

558:

caused the American economy to have problems, demand for oil would be reduced further. Other factors included the strong

555:

3172:

2114:

1654:

2549:

1941:

1808:

1613:

1336:

853:

439:

rose to $ 90.02 per barrel due to a combination of ongoing tensions in eastern Turkey and the reducing strength of the

5093:

3121:

3007:

2632:

613:. On March 7, 2011, the average price of gas having reached $ 3.57, individuals were making changes in their driving.

3026:

2374:

2166:

1034:

1010:

209:

191:

128:

74:

3157:

2808:

1445:

458:

report from the following day stated a single trader bid up the price; Stephen Schork, a former floor trader on the

3686:

2734:

2586:

2501:

2472:

2312:

1129:

1037:

was not a factor. As of September 5 WTI was up 24 percent to $ 56.30 while Brent increased 13 percent to $ 60.95.

3788:

5613:

110:

4835:"Oil prices at 4-month high as U.S. crude supply posts biggest decline of the year and OPEC+ tapers output cuts"

3730:

3533:

1911:

1389:

739:

5195:

5174:

3715:

997:

633:

165:

3649:

1558:

5603:

4816:"About 150-years of oil-price history in one chart illustrates crude's spectacular plunge below $ 0 a barrel"

1703:

1533:

1083:

5588:

5465:

3222:

2333:

1982:

726:

In mid-December, gas prices reached $ 3.25, the lowest for 2012. Oil was trading for between $ 84 and $ 90.

5608:

4460:

2893:

2263:

1769:

1094:

475:

459:

386:

262:

238:

3423:

4949:"Thanksgiving could see almost half as many travelers, despite the lowest seasonal gas prices in 4 years"

3491:

2205:

567:

4778:"Oil rallies, with U.S. prices up nearly 25% as Trump expects Saudi Arabia and Russia to cut production"

3348:

2004:

1794:

3809:

3514:

3442:

266:

before rising steeply again to $ 92/barrel by October 2007, and $ 99.29/barrel for December futures in

5094:"Oil prices fall 4% to six-week low on lockdown worries, but don't expect much relief at the pump yet"

4854:"Oil settles lower, posting modest change for week as rise in coronavirus cases stokes demand worries"

3597:

3578:

3243:

1964:

366:

1097:, gas was $ 2.11, the lowest at that time of year since 2016 and 49 cents lower than a year earlier.

371:

241:

prices for West Texas Intermediate since 2000, monthly overlaid on daily prices to show the variation

4968:"Oil prices end 2020 on a positive note, but suffer 20% annual fall as pandemic took toll on demand"

3889:

3849:

3064:

2851:

3030:

2516:

719:

173:

3870:

2018:

1462:

1135:

WTI ended the quarter up 34 percent with Brent up 38 percent, the most since second quarter 2020.

3814:

2399:

693:

681:

621:

428:

substantially cut growth of world oil demand in 2006, including a reduction in oil demand of the

4987:"$ 100 oil? Analysts share their price forecasts after a strong rally in the first half of 2021"

454:, and on suspicion that U.S. crude stocks will have dropped for the seventh consecutive week. A

97:

may contain an excessive amount of intricate detail that may interest only a particular audience

5565:

2943:"Oil rises on new hope of 'fiscal cliff' resolution; pump prices hit $ 3.25 a gallon, 2012 low"

2637:

2435:

852:

countries producing more oil than needed and Iran expected to add even more as a result of the

574:

December were based on global demand and the Arctic blasts affecting North America and Europe.

355:

5349:

4797:"Oil market in 'super contango' underlines storage fears as coronavirus destroys crude demand"

4107:

3979:

3960:

3922:

3830:

3298:

1371:

738:

On July 10, oil prices were the highest in more than a year as a result of lower supplies and

4892:"Oil sells off after Trump's coronavirus diagnosis, sending U.S. prices down 8% for the week"

2247:

1583:"James Murray, David King: Oil's tipping point has passed, Nature, Vol 481, 2012, p. 433-435"

1250:

945:

598:

487:

347:

327:

3908:"US crude posts best settle since July 2015, up 2.6% at $ 52.83 on oil producer output cuts"

3045:

1848:

4155:

4141:"US crude falls 1.1%, settling at $ 49.03, amid concerns about oil cartel's growing output"

4126:"US crude falls 1.1%, settling at $ 49.03, amid concerns about oil cartel's growing output"

4088:

4055:

4017:

3998:

3941:

3191:

2985:"Oil prices rise above $ 95 on strong US housing data and encouraging signs for job market"

1183:

993:

799:

566:, gas prices nationwide averaged $ 2.91 on May 10, dropping to $ 2.79 two weeks later. The

511:

440:

4461:"US crude surges 5.2%, settling at $ 52.36, on Saudi output cuts and US-China trade talks"

4423:"Oil gains, holds near 2-month high as looming OPEC meeting expected to yield deeper cuts"

4363:"Oil marks a fourth climb, with U.S. prices tallying a year-to-date gain of more than 20%"

1410:

330:

marked a significant event for oil markets because Iraq contains a large amount of global

8:

4611:"Oil logs 9% weekly rise — biggest since late 2016; refinery fire jolts gasoline futures"

3487:

2947:

2616:

2289:

2137:

1889:

749:. Meanwhile, inventories in the United States had their biggest increase in four months.

450:

surpassed $ 100 per barrel before falling to $ 99.69 due to tensions on New Years Day in

308:

280:

31:

4740:"Why an 'oil shock' sent the Dow down 2,000 points and upended global financial markets"

4721:"Oil finishes at lowest in over 13 months as coronavirus keeps market in 'stranglehold'"

5583:

5354:

4501:"U.S. oil futures notch a seventh straight weekly climb, the longest streak in 5 years"

3126:

2359:

2338:

2317:

815:

227:

5562:

1826:

1738:

1720:

245:

4573:"Oil ends up as concerns over U.S.-China trade talks ease, Middle East tensions rise"

4554:"Oil ends up as concerns over U.S.-China trade talks ease, Middle East tensions rise"

2085:

1474:

1060:

397:

300:

234:

2826:

1678:

968:

proposed production cuts by OPEC nations, including definite plans by Saudi Arabia.

5314:

4911:"Oil prices tally highest finish since early September on latest vaccine prospects"

3854:

2790:

2785:

2765:

2713:

2695:

2642:

2596:

2545:

2497:

2468:

1111:

1090:

949:

791:

746:

711:

673:

662:

421:

342:

of oil-exporting in Mexico, Indonesia and the United Kingdom is the reason for the

4535:"U.S. oil prices fall, Brent turns lower in pullback from recent multimonth highs"

4303:

3744:

Marley Jay (June 8, 2016). "Late sell-off leaves stocks barely higher/oil rises".

1756:

1350:

1297:

1224:

1203:

409:

causing a decrease in production to 1 million barrels per day (160,000 m/d).

4664:"Why U.S. crude has outpaced gains for the international oil benchmark this year"

4037:"Oil ends lower, as drop in gasoline stocks softens blow of record U.S. supplies"

2690:

1522:

1429:"Why U.S. crude has outpaced gains for the international oil benchmark this year"

1276:

1019:

665:

was forecast in 2012 to grow by 600,000 barrels every year through 2016. By 2012

610:

526:

483:

447:

436:

351:

335:

4074:"US crude plunges 4.8% to $ 45.52, posting worst close in more than five months"

645:. U.S. oil prices fell below $ 90 before rising again, and Brent crude fell 2%.

5548:

5544:"Oil price news: oil rises on prospect of Iran attack widening Middle East war"

4325:"Oil falls for the session, but U.S. benchmark logs third weekly gain in a row"

3106:

3087:

2686:"Retail gasoline prices stay high on concerns about the Middle East and Europe"

1812:

1773:

606:

312:

4683:"Oil drops back to 1-year low as coronavirus takes toll on China crude demand"

876:

On June 7, Benchmark crude closed over $ 50 for the first time since July 21.

5597:

3887:

2830:

343:

267:

258:

4056:"Oil prices rise on prospect that Saudi Arabia seeking output cut extension"

109:

any relevant information, and removing excessive detail that may be against

5200:

5179:

3793:

3551:

3483:

2970:

2877:

2760:

2591:

2540:

2492:

2463:

1000:

506:

463:

425:

331:

254:

3980:"Oil falls on China concerns, down 3 percent for the week on China doubts"

3789:"Third time's the charm? Opec members meet again to tackle low oil prices"

2563:

413:

4702:"U.S. oil futures suffer largest weekly percentage loss in over a decade"

4344:"Oil prices rally, with U.S. crude notching the first gain in 6 sessions"

3465:

2180:

1496:"Iraq invasion may be remembered as the start of the age of oil scarcity"

689:

637:

593:

494:

417:

4930:"Oil posts a loss as rising COVID cases feed prospects for lower demand"

2055:"Yahoo Finance - Stock Market Live, Quotes, Business & Finance News"

501:

4608:

4589:

4532:

4520:"Oil adds to multimonth high as supply uncertainty drives crude prices"

4517:

4498:

4482:"Oil prices decline on demand concerns to lose roughly 3% for the week"

4479:

4439:

4398:

4379:

4018:"Oil prices rise on weakening dollar, but plentiful supplies cap gains"

3065:"Update 9-U.S. crude soars to 16-mth high; discount to Brent under $ 2"

2812:

515:

375:

296:

292:

288:

4630:"Oil resumes steep drop as U.S.-China trade row raises demand worries"

4401:"U.S. oil prices end at 17-month low, down more than 11% for the week"

4382:"Oil prices drop 22% in November for biggest monthly loss in a decade"

4322:

1059:

On February 10, oil reached its lowest level in over a year, with the

5470:

4775:

4551:

4304:

Myra P. Saefong, Mark Decambre and Sarah McFarlane (April 11, 2018).

2739:

2612:"Gas prices fall to lowest price all year after stock values plummet"

1143:

981:

715:

382:

222:

5409:"Oil settles 1% higher on tightening supplies, cooling US inflation"

4284:

4089:"Oil prices fall on OPEC output increase, rising U.S. crude stocks"

3459:

3352:

3323:"WTI Oil extends drop below $ 60 as IEA cuts forecast; Brent falls"

3236:

Lawler, Alex; Sheppard, David; El Gamal, Rania (27 November 2014),

3049:

2897:

2718:

2520:

1725:

696:

crude was up 19% to $ 103.24. The average price of gas was $ 3.53.

545:. From mid January to February 13, oil fell to near $ 35 a barrel.

522:

402:

339:

5260:"Saudi Aramco lowers Arab Light oil price to Asia, Europe in June"

5156:"Oil ends year of wild price swings with 2nd straight annual gain"

4889:

3942:"Oil prices edge up despite unexpected U.S. crude inventory build"

3888:

Devika Krishna Kumar and Jessica Resnick-Ault (December 1, 2016).

3774:"US crude closes 3.45 pct lower, at $ 43.16, marking a 3-week low"

1827:"BBC NEWS | Business | Oil reaches $ 117 for first time"

1809:"Oil Rises Above $ 110 to Record as the Dollar Falls Against Euro"

1739:"BBC NEWS | Business | Supply fears push oil above $ 92"

676:, through which one-fifth of exported oil travels, as a result of

5371:"Oil falls but notches weekly gain as OPEC+ considers output cut"

5113:"U.S. oil prices top $ 90 a barrel for the first time since 2014"

5034:"U.S. crude oil price tops $ 80 a barrel, the highest since 2014"

4851:

4832:

4718:

4699:

4680:

4645:"Gasoline prices may drop by another 10% before the year is done"

4570:

4360:

4341:

4034:

3701:"Oil rises, pares losses in January on hopes for production deal"

2856:

2107:"Crude Oil Tumbles as Wall Street Turmoil Adds to Demand Concern"

1934:"Crude Oil Rises to Record Above $ 144 After U.S. Stockpile Drop"

1770:"Oil Falls More Than $ 1 as U.S. Jobs Data Signal Lower Fuel Use"

1323:"Oil Is Little Changed After Falling as Investors Sell Contracts"

1003:

912:

have. WTI reached $ 53.07 and Brent crude $ 55.44 on January 26.

451:

381:

After retreating for several months in late 2004 and early 2005,

5428:"Oil settles higher but posts fourth straight quarterly decline"

5132:"Oil slides from decade-highs as Iran talks kindle supply hopes"

4306:"Oil settles at a more than 3-year high on Middle East tensions"

3807:

2431:"Oil Jumps to 31-Month High on Concern About Al-Qaeda Reprisals"

818:, the efficiency of newer tight oil (shale oil) wells that use

570:

was not a factor in gas prices since the well had not produced.

3999:"U.S. oil prices rise on weaker dollar, U.S. drilling in focus"

3579:"Oil inches higher in volatile trade after week's sharp losses"

2310:

1871:"Oil jumps over $ 3 after report on U.S. shot toward Iran boat"

944:

On April 11, with the United States planning a response to the

559:

5506:"Oil prices shed 10% in 2023 as supply, demand concerns weigh"

5235:"Saudis Cut Oil Prices from Record Highs Amid China Lockdowns"

4927:

4908:

4870:

3850:"Crude oil is getting slammed after another OPEC meeting flop"

3267:

Oil crashes 5%, nears $ 60 on weak U.S. demand, Saudi inaction

1633:

1337:"Oil Rises to Record Above $ 141 as Investors Buy Commodities"

669:

Canadian tight oil and oil sands production was also surging.

5541:

5466:"Gas prices keep falling and it's a trend that should spread"

5310:"OPEC+ makes small trim to world oil supplies as prices fall"

5068:

5066:

5053:"Oil remains near multi-year highs as energy crunch persists"

4399:

Myra P. Saefong and Rachel Koning Beals (December 21, 2018).

4380:

Myra P. Saefong and Rachel Koning Beals (November 30, 2018).

3871:"Oil jumps, at three-week high ahead of OPEC output decision"

2567:

2054:

272:

253:

From the mid-1980s to September 2003, the inflation adjusted

156:

deal primarily with the United States and do not represent a

5525:"Oil rises more than $ 1 a barrel on tighter supply outlook"

5447:"Oil rises for 6th straight week as global supplies tighten"

5390:"Oil settles flat, with weekly decline on recession worries"

5015:"Oil rallies to $ 73 on tight U.S. supplies, Biden-Xi call'"

4442:"Oil gains, with U.S. prices up more than 20% for the month"

4440:

Myra P. Saefong and Rachel Koning Beals (January 31, 2019).

3831:"Oil hits one-year high as Russia ready to join output caps"

3731:"Crazily volatile oil spikes 12% in biggest gain since 2009"

3668:"Oil price posts two-year highs - but how long can it last?"

4991:

4465:

4175:"Oil prices dip on profit-taking and U.S. production fears"

4108:"Oil prices edge up; still near 2017 lows on stubborn glut"

2228:"Gas Prices Headed Lower as Summer Driving Season Heats Up"

629:

471:

276:

5259:

5217:"Oil slumps 7% as U.S. plans record crude reserve release"

5063:

4873:"Oil prices suffer a second weekly fall on demand worries"

4533:

Myra P. Saefong and Rachel Koning Beals (April 25, 2019).

4518:

Myra P. Saefong and Rachel Koning Beals (April 23, 2019).

4499:

Myra P. Saefong and Rachel Koning Beals (April 18, 2019).

2331:

785:

In June 2014 crude oil prices dropped by about a third as

609:

the country exported could not replace the more desirable

5331:"Oil prices up after Basra spill, but log weekly decline"

4609:

Myra P. Saefong and Rachel Koning Beals (June 21, 2019).

4592:"Oil futures suffer worst weekly performance of the year"

4480:

Myra P. Saefong and Rachel Koning Beals (March 1, 2019).

3890:"After OPEC deal, oil expected to rally – for the moment"

2657:"Why price discounts for Canadian crude are here to stay"

1790:

1527:"Another Nail in the Coffin of the Case Against Peak Oil"

1084:

U.S. President Donald Trump being diagnosed with COVID-19

1040:

As of November 25, Brent was up 19 percent for the year.

455:

4590:

Myra P. Saefong and Rachel Koning Beals (May 24, 2019).

4287:"Oil ends higher, notches third straight quarterly rise"

3239:

Saudis block OPEC output cut, sending oil price plunging

3084:"WTI Oil Falls From 2-Year High as Syria Strike Debated"

2485:

672:

Shortages of oil could have resulted if Iran closed the

541:

In January 2009, oil prices rose temporarily because of

5350:"Oil Prices Tumble to Their Lowest Level Since January"

5285:"Kuwait Follows Saudis In Slashing Oil Prices For Asia"

4776:

Myra P. Saefong and Barbara Kollmeyer (April 2, 2020).

4719:

Myra P. Saefong and William Watts (February 27, 2020).

4700:

Myra P. Saefong and William Watts (February 28, 2020).

4681:

Myra P. Saefong and William Watts (February 10, 2020).

4323:

Myra P. Saefong and Christopher Alessi (May 18, 2018).

3808:

Alison Sider and Sarah McFarlane (September 29, 2016).

3366:

3364:

3362:

2352:

2311:

Clifford Krauss; Christine Hauser (February 22, 2011).

1517:

1515:

304:

5487:"Oil gains over 2% but records seventh weekly decline"

4890:

Myra Saefong and Barbara Kollmeyer (October 2, 2020).

4285:

Myra P. Saefong and Sarah McFarlane (March 29, 2018).

3961:"Oil down, but ends year with biggest gain since 2009"

3531:

3235:

2714:"Iran: EU oil sanctions 'unfair' and 'doomed to fail'"

2355:"U.S. Economy Is Better Prepared for Rising Gas Costs"

1997:"This story is no longer available - Washington Times"

1931:

502:

2008: oil prices peak at $ 145.85 then bottom at $ 32

412:

In mid-2006, crude oil was traded for over US$ 79 per

4871:

Myra Saefong and William Watts (September 11, 2020).

4552:

Myra P. Saefong and Barbara Kollmeyer (May 6, 2019).

3460:

Myra P. Saefong and Georgi Kantchev (June 11, 2015).

3443:"Brent rises above $ 64 after Yemen oilfield retreat"

3103:"Crude Rises as Fuel-Price Gain Spurs Demand for Oil"

2967:"Oil Prices Lifted by Progress on Fiscal Cliff Talks"

2951:. Associated Press. December 17, 2012. Archived from

2852:"UPDATE 9-US crude jumps, Brent lags, spread narrows"

2827:"2012 West Texas Intermediate Crude Oil (WTI) Prices"

1704:"Finfacts: Irish business, finance news on economics"

1372:"Oil spikes $ 25 a barrel on anxiety over US bailout"

462:

and the editor of an oil market newsletter, said one

385:

prices rose to new highs in March 2005. The price on

279:'s president predicted prices may reach $ 170 by the

5072:

5012:

4928:

Myra Saefong and William Watts (November 19, 2020).

4909:

Myra Saefong and William Watts (November 18, 2020).

4249:"Oil marks highest January opening price since 2014"

4035:

Myra Saefong and Victor Reklaitis (March 22, 2017).

3977:

3631:"OPEC Report Suggests Oil-Price Rebound, Supply Cut"

3359:

3223:"Oil higher above $ 104 on crises in Ukraine, Libya"

3046:"Oil prices surge above $ 105, gasoline tops $ 3.50"

2991:. Associated Press. January 17, 2013. Archived from

2204:. Associated Press. January 16, 2009. Archived from

2074:"Oil tumbles more than 5%, but natural gas rebounds"

1512:

1101:

lower than expected U.S. inventories kept oil high.

996:

ending waivers for Iranian oil exports, even though

420:'s missile launch. The ongoing Iraq war, as well as

361:

5075:"Oil posts biggest annual gain since at least 2016"

4852:Myra P. Saefong and William Watts (July 17, 2020).

4833:Myra P. Saefong and William Watts (July 15, 2020).

4627:

4420:

4361:Myra P. Saefong and Mark DeCambre (June 29, 2018).

3684:

3616:"Oil below $ 40 a barrel as OPEC rolls over policy"

3595:

3424:"Oil Prices Near Six-Year Lows on Oversupply Fears"

2781:"Gas prices are highest ever for this time of year"

2564:"Price of gas drops 11 cents in the last two weeks"

2019:"Bush lifts executive ban on offshore oil drilling"

1614:"Weekly U.S. Retail Gasoline Prices, Regular Grade"

5175:"Oil is up 60% this year. How high can prices go?"

4571:Myra P. Saefong and Mark DeCambre (May 10, 2019).

4342:Myra P. Saefong and Mark DeCambre (May 30, 2018).

4193:"Oil prices edge up on signs of tightening market"

3534:"US oil surges 5.7% to settle at $ 47.15 a barrel"

3515:"Oil dips as robust dollar offsets stock drawdown"

3315:

3143:"Oil Down Ahead of Expected Trimming in US Growth"

3062:

3027:"Oil Falls 2 Percent, Gas Prices to Keep Dropping"

2756:"Oil jumps to 9-month high after Iran cuts supply"

1890:"Oil Prices Take a Nerve-Rattling Jump Past $ 138"

1556:

249:Oil prices for Brent in US$ (blue) and Euro (red)

5368:

5214:

4458:

4265:

4228:

4086:

4053:

4015:

3923:"Oil rallies in thin trade, adds to year's gains"

3760:"Oil prices fall as dollar jumps on US jobs data"

3548:"Global Oil Prices Jump as Equitiy Markets Rally"

3462:"Oil retreats from year's high, settles 1% lower"

3158:"Oil up Above $ 101 on Renewed Unrest in Ukraine"

2913:"Oil rises; U.S. considers release from reserves"

1463:"How Oil Influenced the 2003 US Invasion of Iraq"

827:Organization of the Petroleum Exporting Countries

5595:

5542:Alex Longley and Jack Wittels (April 11, 2024).

3208:"Oil Steady Above $ 102 as Libya Tensions Flare"

3043:

3008:"Oil price gains to above $ 94 on weaker dollar"

2910:

2891:

2809:"US gasoline prices now cheaper than a year ago"

2609:

1460:

1383:

1381:

5347:

5196:"Oil prices dropped 30% in a week. What gives?"

5050:

4794:

4661:

4642:

4212:"Oil prices slide after U.S. drillers add rigs"

4156:"Oil prices flat as oversupply concerns linger"

3828:

3647:

3598:"Oil steadies under $ 50 but outlook uncertain"

3576:

3512:

3421:

2163:"Crude oil prices skid despite OPEC output cut"

1967:on January 25, 2016 – via uk.reuters.com.

1757:http://news.bbc.co.uk/1/hi/business/7169543.stm

1446:Oil prices in 2003 averaged highest in 20 years

1426:

1251:"Oil crosses record $ 110, despite supply rise"

5463:

5425:

5387:

5193:

5172:

4268:"Oil prices drop on uptick in U.S. production"

4209:

4138:

3996:

3786:

3024:

2849:

2649:

2332:Clifford Krauss; Jad Mouawad (March 1, 2011).

2240:

2225:

920:threat to close a pipeline as a result of the

5522:

5328:

5153:

5129:

5110:

5091:

5031:

4965:

4813:

4756:

4737:

3713:

3628:

3532:Christopher S. Rugaber (September 16, 2015).

3440:

3346:

3220:

3205:

3170:

3155:

3140:

3119:

3005:

2753:

2428:

2202:"Oil languishes near $ 35 on weak US economy"

1378:

1248:

825:The publication of the monthly review by the

154:The examples and perspective in this article

27:Chronology of events affecting the oil market

5307:

5149:

5147:

5145:

4946:

4231:"Oil prices near 2015 highs on tight market"

3920:

3868:

3847:

3554:. Reuters. September 3, 2015. Archived from

3257:

3173:"Ukraine Jitters Push Crude Oil Above $ 100"

2873:"Oil soars as Europe moves to bolster banks"

2732:

2633:"Oil soars, but don't worry yet at the pump"

2424:

2422:

2420:

2243:"Summer shocker: Gasoline prices going down"

2090:: CS1 maint: multiple names: authors list (

1011:plans to raise tariffs of imports from China

350:techniques in large fields such as Mexico's

5584:U.S. DOE EIA energy chronology and analysis

5484:

5444:

5406:

5013:Jessica Resnick-Ault (September 10, 2021).

4172:

4105:

3081:

2802:

2800:

2514:

2353:Jad Mouawad; Nick Bunkley (March 8, 2011).

2290:"Oil prices spike to $ 103, then drop back"

2037:"Oil sags to 6-week low as war worries ebb"

1847:. CNN Money. April 22, 2008. Archived from

1479:: CS1 maint: numeric names: authors list (

75:Learn how and when to remove these messages

5503:

5073:Jessica Resnick-ault (December 31, 2021).

4959:

4153:

3743:

3187:"Oil below $ 102 on weak US economic data"

3100:

2870:

2806:

2778:

2630:

2584:

2533:

2486:Jonathan Fahey; Chris Kahn (May 7, 2011).

2456:

2313:"Oil Soars as Libyan Furor Shakes Markets"

1270:

5142:

4636:

4421:Rachel Koning Beals (November 25, 2019).

4416:

4414:

3978:Devika Krishna Kumar (January 13, 2017).

3958:

3728:

3525:

3389:

3372:"Why Cheap Oil Doesn't Stop the Drilling"

3281:

2973:. Dow Jones Newswires. December 17, 2012.

2417:

2375:"Oil settles above $ 112 as dollar falls"

820:hydraulic fracturing in the United States

210:Learn how and when to remove this message

192:Learn how and when to remove this message

129:Learn how and when to remove this message

5369:Arathy Somasekhar (September 30, 2022).

4984:

3939:

3716:"Oil crash taking stocks down ... again"

3685:Christopher Johnson (January 12, 2016).

3596:Christopher Johnson (October 20, 2015).

3395:

3263:

2797:

1273:"Gas Prices Near Records, Following Oil"

505:

365:

244:

233:

221:

4511:

4229:Henning Gloystein (December 28, 2017).

3650:"Oil Prices Fall on Oversupply Anxiety"

3113:

2536:"Oil falls 2 percent, to $ 93 a barrel"

2488:"Gas price to drop as oil joins plunge"

2452:

2450:

2138:"Oil tumbles to 8-month low below $ 88"

1932:Christian Schmollinger (July 2, 2008).

1908:"Oil prices hit new peak above US$ 145"

1887:

1655:"Iraq Oil Output Lowest Since Invasion"

1550:

1521:

1493:

1487:

562:and high inventories. According to the

424:are also causative factors. The higher

14:

5596:

5348:Clifford Krauss (September 22, 2022).

4628:Rachel Koning Beals (August 7, 2019).

4411:

4266:Henning Gloystein (January 19, 2018).

4016:Henning Gloystein (January 26, 2017).

3349:"89 straight days of lower gas prices"

2287:

2135:

1979:"ap.google.com, Oil prices near $ 146"

1957:"Oil tops $ 145 ahead of U.S. holiday"

1954:

1387:

1168:March 2023 United States bank failures

1069:2020 Russia–Saudi Arabia oil price war

564:U.S. Energy Information Administration

4662:Myra P. Saefong (September 6, 2019).

4459:Tom DiChristopher (January 9, 2019).

3787:Debbie Carlson (September 24, 2016).

3693:

3648:Nicole Friedman (December 30, 2015).

3264:Krishnan, Barani (10 December 2014),

2400:"Gasoline rises to $ 3.87 per gallon"

2261:

2104:

1767:

1652:

1646:

1427:Myra P. Saefong (September 6, 2019).

1157:2023–2025 world oil market chronology

1050:2020–2022 world oil market chronology

971:Brent finished 2018 down 20 percent.

902:2017–2019 world oil market chronology

765:2014–2016 world oil market chronology

584:2011–2013 world oil market chronology

36:Gasoline and diesel usage and pricing

5329:Laila Kearney (September 16, 2022).

5215:Arathy Somasekhar (March 31, 2022).

5051:Stephanie Kelly (October 19, 2021).

4210:Scott DiSavino (November 10, 2017).

4054:Henning Gloystein (April 12, 2017).

3829:Barani Krishnan (October 10, 2016).

3577:Koustav Samanta (October 16, 2015).

3287:

3270:, London: Globe and Mail via Reuters

3063:Anna Louie Sussman (July 10, 2013).

2894:"Gas prices climb 30 cents a gallon"

2447:

2262:Riley, Charles (December 23, 2010).

140:

81:

40:

5154:Laila Kearney (December 30, 2022).

5092:Pippa Stevens (November 19, 2021).

4966:William Watts (December 31, 2020).

4643:Myra P. Saefong (August 24, 2019).

4087:Henning Gloystein (June 14, 2017).

3997:Naveen Thukral (January 24, 2017).

3910:. CNBC. Reuters. December 12, 2016.

3776:. CNBC. Reuters. September 1, 2016.

3714:Charles Riley (February 11, 2016).

3629:Benoit Faucon (December 23, 2015).

3480:"Oil Prices Rise on Inventory Data"

3347:Chris Isidore (December 23, 2014).

3288:Mohr, Patricia (28 November 2014),

3141:Pablo Gorondi (February 27, 2014).

3006:Pablo Gorondi (February 25, 2013).

2977:

2911:Samantha Bomkamp (August 7, 2012).

2892:Steve Hargreaves (August 7, 2012).

2754:Pablo Gorondi (February 20, 2012).

2610:Robert Dominguez (August 9, 2011).

2574:from the original on June 29, 2011.

2105:Smith, Grant (September 16, 2008).

1298:"Oil sets fresh record above $ 109"

1204:"Oil reaches new record above $ 99"

806:action by OPEC have been credited.

632:and other currencies down, and the

24:

5464:Charley Blaine (October 8, 2023).

5388:Scott Disavino (January 6, 2023).

5308:David McHugh (September 5, 2022).

5111:Pippa Stevens (February 3, 2022).

4947:Myra Saefong (November 21, 2020).

4795:Myra P. Saefong (April 18, 2020).

3921:David Gaffen (December 27, 2016).

3869:David Gaffen (November 21, 2016).

3810:"Oil Prices Climb After OPEC Deal"

3703:. CNBC. Reuters. January 29, 2016.

3618:. CNBC. Reuters. December 4, 2015.

3422:Nicole Friedman (August 6, 2015).

3396:Friedman, Nicole (16 April 2015),

3044:Steve Hargreaves (July 10, 2013).

2919:. Associated Press. Archived from

2698:. January 20, 2012. Archived from

2663:, 1 September 2012, archived from

2459:"Oil drops below $ 100 per barrel"

2334:"Uncertainty Drives Up Oil Prices"

2181:"Oil price rises on Gaza conflict"

2071:

1755:Single trader behind oil record –

1275:. Associated Press. Archived from

25:

5630:

5577:

5194:Julia Horowitz (March 15, 2022).

5032:Pippa Stevens (October 8, 2021).

4139:Scott DiSavino (August 4, 2017).

3848:Akin Oyedele (October 31, 2016).

3513:Barani Krishnan (July 30, 2015).

3242:, Vienna: Reuters, archived from

3195:. Associated Press. May 15, 2014.

3120:Pablo Gorondi (January 2, 2014).

3025:Jonathan Fahey (April 13, 2013).

2850:Robert Gibbons (April 17, 2012).

2733:Gary Strauss (February 6, 2012).

2288:Rooney, Ben (February 24, 2011).

1787:"OPEC accuses U.S. on oil prices"

1721:Oil prices touch above $ 90 level

1557:Youssef M. Ibrahim (2004-05-10).

1351:"Oil hits new high on Iran fears"

1225:"Oil prices pushed to fresh high"

964:for speculation about OPEC cuts.

636:made investors concerned. London

362:2004 to 2008: rising costs of oil

56:This article has multiple issues.

5619:Economic history of the Iraq War

5556:

5535:

5523:Laila Kearney (March 28, 2024).

5516:

5504:Nicole Jao (December 29, 2023).

5497:

5485:Shariq Khan (December 8, 2023).

5478:

5457:

5438:

5426:Laura Sanicola (June 30, 2023).

5419:

5400:

5381:

5362:

5341:

5322:

5301:

5277:

5252:

5227:

5208:

5187:

5173:Julia Horowitz (March 7, 2022).

5166:

5123:

5104:

5085:

5044:

5025:

5006:

4978:

4940:

4921:

4902:

4883:

4864:

4845:

4826:

4814:Mark DeCambre (April 22, 2020).

4807:

4788:

4769:

4750:

4731:

4712:

4693:

4674:

4655:

4621:

4602:

4583:

4564:

4545:

4526:

4492:

4473:

4452:

4433:

4392:

4373:

4354:

4335:

4316:

4297:

4278:

4259:

4241:

4222:

4203:

4185:

4166:

4147:

4132:

4128:. CNBC. Reuters. August 3, 2017.

4118:

4099:

4080:

4066:

4047:

4028:

4009:

3990:

3971:

3952:

3933:

3914:

3900:

3881:

3862:

3841:

3822:

3801:

3780:

3766:

3762:. CNBC. Reuters. August 5, 2016.

3752:

3737:

3722:

3707:

3678:

3660:

3641:

3622:

3608:

3589:

3570:

3540:

3506:

3472:

3453:

3441:Himanshu Ojha (April 17, 2015).

3434:

3415:

3291:Scotiabank Commodity Price Index

3101:Mark Shenk (November 13, 2013).

2779:Chris Kahn (February 20, 2012).

2072:Lesova, Myra P. Saefong, Polya.

1955:Kebede, Rebekah (July 3, 2008).

1868:

1388:Rooney, Ben (November 7, 2008).

1249:David Goldman (March 12, 2008).

145:

86:

45:

5130:Marcy de Luna (March 3, 2022).

4757:Mark DeCambre (March 8, 2020).

4738:William Watts (March 9, 2020).

4173:Julia Simon (October 3, 2017).

3959:Ethan Lou (December 30, 2016).

3748:. Associated Press. p. 2A.

3729:Matt Egan (February 12, 2016).

3490:. June 10, 2015. Archived from

3340:

3229:

3214:

3199:

3179:

3164:

3156:Pablo Gorondi (April 8, 2014).

3149:

3134:

3094:

3082:Grant Smith (August 29, 2013).

3075:

3056:

3037:

3018:

2999:

2959:

2935:

2904:

2885:

2864:

2843:

2819:

2772:

2747:

2726:

2706:

2678:

2631:Chris Kahn (November 9, 2011).

2624:

2603:

2578:

2556:

2527:

2508:

2479:

2392:

2367:

2346:

2325:

2304:

2281:

2255:

2241:Andrew Maykuth (May 27, 2010).

2234:

2226:Joseph Lazzaro (May 21, 2010).

2219:

2194:

2173:

2155:

2136:Rooney, Ben (October 6, 2008).

2129:

2098:

2065:

2047:

2029:

2011:

1989:

1971:

1948:

1925:

1900:

1881:

1862:

1837:

1819:

1801:

1793:. March 5, 2008. Archived from

1779:

1768:Shenk, Mark (January 4, 2008).

1761:

1749:

1731:

1714:

1696:

1671:

1626:

1606:

1575:

1559:"The world has lost Iraq's oil"

1454:

1439:

1420:

1404:

1339:. Bloomberg.com. June 27, 2008.

1325:. Bloomberg.com. June 27, 2008.

922:Kurdistan vote for independence

422:Israel and Lebanon going to war

64:or discuss these issues on the

5589:Oil Price History and Analysis

5445:Shariq Khan (August 4, 2023).

5407:Shariq Khan (March 31, 2023).

4985:Meredith, Sam (July 2, 2021).

4154:Jane Chung (August 11, 2017).

3940:Mark Tay (December 30, 2016).

3687:"Oil crashes to $ 30 a barrel"

3221:Pablo Gorondi (May 28, 2014).

3206:Pablo Gorondi (May 20, 2014).

3171:Pablo Gorondi (May 12, 2014).

1494:Collier, Robert (2005-03-20).

1417:website, accessed August 2008.

1364:

1343:

1329:

1315:

1290:

1264:

1242:

1217:

1196:

18:Oil price increases since 2003

13:

1:

4106:Julia Simon (June 16, 2017).

4076:. CNBC. Reuters. May 4, 2017.

3210:. ABC News. Associated Press.

3175:. ABC News. Associated Press.

3160:. ABC News. Associated Press.

3145:. ABC News. Associated Press.

2807:Chris Kahn (April 24, 2012).

2587:"Gas prices expected to fall"

2585:Chris Kahn (August 6, 2011).

2429:Margot Habiby (May 2, 2011).

2264:"Gas prices top $ 3 a gallon"

1888:Mouawad, Jad (June 7, 2008).

1271:John Wilen (March 10, 2008).

1189:

1035:China–United States trade war

476:George W. Bush administration

275:'s threat to cut output, and

3122:"Oil price falls below $ 96"

2871:Chris Kahn (June 29, 2012).

2534:Chris Kahn (June 18, 2011).

1150:

1043:

1022:lowering interest rates and

895:

758:

577:

460:New York Mercantile Exchange

239:New York Mercantile Exchange

111:Knowledge's inclusion policy

7:

2515:Blake Ellis (May 6, 2011).