238:

140:

814:. For most governments, this is possible only through the issue of new bonds, as the governments have no possibility to create currency. (The issue of bonds which are then bought by the central bank with newly created currency in the process of "quantitative easing" may be regarded as de facto direct state financing from the central bank, which is outlawed officially for independent central banks.) There have been instances where a government has chosen to

1119:

950:

864:

43:

850:

similarly, a United States investor would consider German bonds to have more currency risk than United States bonds (since the euro may go down relative to the dollar). A bond paying in a currency that does not have a history of keeping its value may not be a good deal even if a high interest rate is offered. The currency risk is determined by the fluctuation of exchange rates.

185:

For example, a bondholder invests $ 20,000, called face value or principal, into a 10-year government bond with a 10% annual coupon; the government would pay the bondholder 10% interest ($ 2000 in this case) each year and repay the $ 20,000 original face value at the date of maturity (i.e. after 10

205:

provide ratings for each country's bonds. Bondholders generally demand higher yields from riskier bonds. For instance, on May 24, 2016, 10-year government bonds issued by the

Canadian government offered a yield of 1.34%, while 10-year government bonds issued by the Brazilian government offered a

849:

Currency risk is the risk that the value of the currency a bond pays out will decline compared to the holder's reference currency. For example, a German investor would consider United States bonds to have more currency risk than German bonds (since the dollar may go down relative to the euro);

1018:. Interest rate changes can affect the value of a bond. If the interest rates fall, then the bond prices rise and if the interest rates rise, bond prices fall. When interest rates rise, bonds are more attractive because investors can earn higher coupon rate, thereby

1253:

is the official website where investors can purchase treasury securities directly from the U.S. government. This online system allow investors to save money on commissions and fees taken with traditional channels. Investors can use banks or brokers to hold a bond.

1100:

A conventional UK gilt might look like this – "Treasury stock 3% 2020". On the 27 of April 2019 the United

Kingdom 10Y Government Bond had a 1.145% yield. Central Bank Rate is 0.10% and the United Kingdom rating is AA, according to

1053:

because a

Central Bank injects liquidity (cash) into the economy. Doing this lowers the government bond's yield. On the contrary, when a Central Bank is fighting against inflation then a Central Bank decreases the money supply.

932:, which protect investors against inflation risk by linking both interest payments and maturity payments to a consumer price index. In the UK these bonds are called Index-linked bonds. In the US these bonds are called

1583:

1022:

may occur. Interest rate and bond price have negative correlation. Lower fixed-rate bond coupon rates meaning higher interest rate risk and higher fixed-rate bond coupon rates meaning lower interest rate risk.

1096:

UK gilts have maturities stretching much further into the future than other

European government bonds, which has influenced the development of pension and life insurance markets in the respective countries.

1359:

1552:

782:(bonds with no maturity date) to fund wars and other government spending. The use of perpetual bonds ceased in the 20th century, and currently governments issue bonds of limited term to maturity.

1077:., which means the value of the gilt rises with inflation. They are fixed-interest securities issued by the British government in order to raise money. The issuance of gilts is managed by the

201:

risk; that is, the possibility that the government will be unable to pay bondholders. Bonds from countries with less stable economies are usually considered to be higher risk. International

789:, in order to raise money, the U.S. government started to issue bonds - called loan certificates. The total amount generated by bonds was $ 27 million and helped finance the war.

763:

in 1694 to raise money to fund a war against France. The form of these bonds was both lottery and annuity. The Bank of

England and government bonds were introduced in England by

193:

or the government's domestic currency. Countries with less stable economies tend to denominate their bonds in the currency of a country with a more stable economy (i.e. a

1027:

of a bond also has an impact on the interest rate risk. Indeed, longer maturity meaning higher interest rate risk and shorter maturity meaning lower interest rate risk.

1575:

924:

Inflation risk is the risk that the value of the currency a bond pays out will decline over time. Investors expect some amount of inflation, so the risk is that the

1416:

1363:

2486:

1544:

2049:

838:

1192:(T-notes): maturity of these bonds is two, three, five or 10 years, they provided fixed coupon payments every six months and have face value of $ 1,000.

767:(also called William of Orange), who financed England's war efforts by copying the approach of issuing bonds and raising government debt from the

1334:

1179:

The U.S. Treasury offered several types of bonds with various maturities. Certain bonds may pay interest, others not. These bonds could be:

1612:

735:

2479:

2037:

1493:

1446:

2043:

1468:

1073:. Older issues have names such as "Treasury Stock" and newer issues are called "Treasury Gilt". Inflation-indexed gilts are called

768:

1205:

1078:

834:

1198:(T-bonds or long bonds): are the treasury bonds with the longest maturity, from twenty years to thirty years. They also have a

1522:

107:

2472:

1650:

602:

17:

1220:

The principal argument for investors to hold U.S. government bonds is that the bonds are exempt from state and local taxes.

79:

2717:

1973:

1408:

1968:

1274:

1213:

86:

1166:

997:

911:

126:

1148:

979:

893:

2742:

1140:

971:

885:

60:

728:

93:

2233:

2083:

1963:

1839:

1144:

975:

889:

577:

64:

2736:

823:

704:

526:

75:

3219:

3159:

2955:

2861:

2945:

2913:

2817:

2771:

2754:

2707:

1779:

1183:

252:

2730:

2724:

2366:

1819:

721:

478:

3265:

1643:

752:

became the first state to finance its debt through bonds when it assumed bonds issued by the city of

587:

3119:

2794:

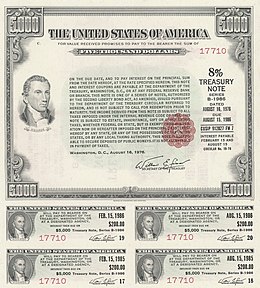

1978:

1338:

1284:

1129:

960:

874:

3073:

2934:

2829:

2712:

2402:

2313:

1133:

1102:

964:

878:

407:

53:

1438:

2961:

2217:

1912:

1814:

1209:

1057:

These actions of increasing or decreasing the amount of money in the banking system are called

929:

764:

552:

1604:

3099:

2908:

2407:

1958:

1922:

1759:

1718:

1070:

684:

597:

210:

100:

3234:

3154:

2919:

2903:

2866:

2748:

2691:

2659:

2228:

2208:

1636:

531:

434:

202:

1497:

1472:

8:

3164:

3109:

3033:

2893:

2823:

2652:

2625:

2341:

1728:

1036:

1019:

827:

786:

709:

164:

31:

3204:

3179:

3139:

3124:

3043:

3013:

2982:

2940:

2684:

2594:

2584:

2288:

2223:

2203:

2076:

1804:

1024:

811:

699:

657:

642:

612:

536:

464:

381:

259:

247:

179:

1216:. In other words, the principal increases with inflation and decreases with deflation.

3068:

3053:

2805:

2433:

2308:

2168:

2011:

1937:

1789:

1711:

815:

759:

The first official government bond issued by a national government was issued by the

632:

627:

617:

562:

388:

356:

198:

1384:

3169:

3089:

2885:

2766:

2642:

2561:

2517:

2495:

2001:

1872:

1844:

1784:

1769:

1518:

1314:

1299:

1244:

1240:

1228:

833:

Investors may use rating agencies to assess credit risk. In the United States, the

679:

674:

647:

517:

493:

488:

449:

429:

393:

341:

229:

172:

3244:

3239:

3174:

3149:

3084:

3038:

2997:

2992:

2987:

2972:

2967:

2855:

2789:

2781:

2669:

2556:

2453:

2371:

2346:

2278:

2273:

2248:

2016:

2006:

1809:

1799:

1794:

1279:

1086:

1058:

760:

637:

622:

582:

398:

336:

297:

139:

237:

3199:

3194:

3094:

3079:

2840:

2835:

2800:

2599:

2566:

2512:

2504:

2386:

2356:

2336:

2238:

2178:

2130:

2115:

2107:

1917:

1902:

1867:

1854:

1829:

1733:

1701:

1670:

1294:

1250:

1236:

1195:

1189:

933:

807:

803:

779:

749:

652:

557:

507:

469:

361:

308:

302:

282:

277:

156:

818:

on its domestic currency debt rather than create additional currency, such as

3259:

3063:

3048:

3023:

2977:

2929:

2632:

2589:

2576:

2527:

2448:

2416:

2412:

2331:

2148:

2069:

2021:

1996:

1907:

1892:

1882:

1834:

1774:

1764:

1269:

1232:

1212:

issued by the U.S. Treasury. The principal of these bonds is adjusted to the

1199:

1090:

1046:

592:

567:

419:

366:

194:

3224:

3144:

3114:

3104:

2924:

2898:

2647:

2637:

2620:

2551:

2546:

2522:

2381:

2376:

2361:

2351:

2303:

2283:

2255:

1932:

1877:

1824:

1754:

1680:

1050:

1042:

694:

669:

439:

331:

326:

317:

287:

30:"Government investment" redirects here. For investment by governments, see

3229:

3209:

3189:

3184:

3129:

3018:

2950:

2420:

2323:

2298:

2213:

2163:

1988:

1927:

1887:

1862:

1738:

1706:

1696:

1659:

1289:

1264:

1082:

1011:

772:

689:

502:

459:

454:

444:

351:

268:

3214:

3134:

2811:

2674:

2438:

2268:

2198:

2158:

1545:"Computershare to take over from Bank of England as UK gilts registrar"

1409:"Analysis: Counting the cost of currency risk in emerging bond markets"

756:

in 1517. The average interest rate at that time fluctuated around 20%.

209:

Governments close to a default are sometimes referred to as being in a

160:

2850:

2845:

2760:

2679:

2293:

2120:

1675:

1309:

1015:

925:

802:

A government bond in a country's own currency is strictly speaking a

778:

Later, governments in Europe started following the trend and issuing

753:

2464:

1118:

949:

863:

42:

3028:

2664:

2443:

2263:

1942:

1897:

1304:

414:

190:

168:

1227:

system by the government. The bonds are buying and selling on the

2872:

1224:

664:

607:

2615:

2153:

819:

1628:

1231:, the financial market in which financial instruments such as

2538:

2173:

346:

2140:

2092:

572:

928:

rate will be higher than expected. Many governments issue

2061:

839:

nationally recognized statistical rating organizations

2050:

Securities

Industry and Financial Markets Association

167:. It generally includes a commitment to pay periodic

1186:: they are considered one of the safest investments.

1045:purchases a government security, such as a bond or

67:. Unsourced material may be challenged and removed.

189:Government bonds can be denominated in a foreign

3257:

1605:"United Kingdom Government Bonds - Yields Curve"

1085:. Prior to April 1998, gilts were issued by the

2480:

2077:

1644:

1089:. Purchase and sales services are managed by

729:

837:(SEC) has designated ten rating agencies as

1496:. UK Debt Management Office. Archived from

1471:. UK Debt Management Office. Archived from

1147:. Unsourced material may be challenged and

978:. Unsourced material may be challenged and

892:. Unsourced material may be challenged and

143:U.S. government bond: 1976 8% Treasury Note

2487:

2473:

2084:

2070:

2038:Commercial Mortgage Securities Association

1651:

1637:

1521:. UK Debt Management Office. 17 May 2022.

806:, because the government can if necessary

736:

722:

1167:Learn how and when to remove this message

998:Learn how and when to remove this message

912:Learn how and when to remove this message

127:Learn how and when to remove this message

2044:International Capital Market Association

138:

1206:Treasury Inflation-Protected Securities

1069:In the UK, government bonds are called

14:

3258:

1449:from the original on 20 September 2020

2494:

2468:

2065:

1632:

1576:"Gilts and corporate bonds explained"

1573:

939:

2234:Debtor-in-possession (DIP) financing

1145:adding citations to reliable sources

1112:

1014:, all bonds are subject to interest

976:adding citations to reliable sources

943:

890:adding citations to reliable sources

857:

65:adding citations to reliable sources

36:

1974:Commercial mortgage-backed security

178:and to repay the face value on the

24:

1969:Collateralized mortgage obligation

1275:Foreign-exchange reserves of China

835:Securities and Exchange Commission

25:

3277:

1525:from the original on 18 June 2022

1494:"Gilt Market: Index-linked gilts"

1419:from the original on 7 March 2016

1064:

853:

2743:Electronic communication network

1555:from the original on 1 July 2023

1360:"Portugal sovereign debt crisis"

1117:

1108:

948:

862:

844:

236:

41:

1658:

1615:from the original on 2022-01-25

1597:

1586:from the original on 2022-02-07

1567:

1030:

810:in order to redeem the bond at

479:Over-the-counter (off-exchange)

52:needs additional citations for

1964:Collateralized debt obligation

1840:Reverse convertible securities

1537:

1511:

1486:

1461:

1431:

1401:

1377:

1352:

1327:

1223:The bonds are sold through an

797:

13:

1:

2737:Multilateral trading facility

1549:Thomson Reuters Practical Law

1321:

705:Sustainable development goals

3160:Returns-based style analysis

2956:Post-modern portfolio theory

2862:Security characteristic line

7:

2914:Efficient-market hypothesis

2818:Capital asset pricing model

2755:Straight-through processing

1780:Contingent convertible bond

1257:

27:Bond issued by a government

10:

3282:

2731:Alternative Trading System

1820:Inverse floating rate note

1469:"Gilt Market: About gilts"

1034:

808:create additional currency

216:

29:

3006:

2881:

2780:

2700:

2608:

2575:

2536:

2502:

2429:

2395:

2322:

2247:

2191:

2139:

2106:

2099:

2030:

1987:

1951:

1853:

1747:

1689:

1666:

1574:Kaveh, Kim (2016-08-02).

1443:UK Debt Management Office

1439:"Daily Prices and Yields"

1081:, an executive agency of

1079:UK Debt Management Office

588:Diversification (finance)

2795:Arbitrage pricing theory

2091:

1979:Mortgage-backed security

1748:Types of bonds by payout

1690:Types of bonds by issuer

1335:"What is Sovereign Debt"

1285:List of government bonds

792:

3074:Initial public offering

2935:Modern portfolio theory

2830:Dividend discount model

2713:List of stock exchanges

2403:Consumer leverage ratio

2314:Tax refund interception

930:inflation-indexed bonds

2962:Random walk hypothesis

1913:Option-adjusted spread

1815:Inflation-indexed bond

1609:World Government Bonds

1210:inflation-indexed bond

771:, where he ruled as a

765:William III of England

553:Alternative investment

203:credit rating agencies

144:

3100:Market capitalization

2909:Dollar cost averaging

2408:Debt levels and flows

1959:Asset-backed security

1923:Weighted-average life

1760:Auction rate security

1103:Standard & Poor's

769:Seven Dutch Provinces

685:Investment management

598:Environmental finance

211:sovereign debt crisis

142:

18:Government investment

2920:Fundamental analysis

2904:Contrarian investing

2867:Security market line

2772:Liquidity aggregator

2749:Direct market access

2660:Quantitative analyst

2229:Debt snowball method

1952:Securitized products

1415:. 22 November 2013.

1214:Consumer Price Index

1141:improve this section

1010:Also referred to as

972:improve this section

886:improve this section

61:improve this article

3165:Reverse stock split

3110:Market manipulation

3034:Dual-listed company

2894:Algorithmic trading

2824:Capital market line

2626:Inter-dealer broker

1729:Infrastructure bond

1049:, it increases the

1037:Quantitative easing

1020:holding period risk

828:national bankruptcy

787:American Revolution

710:Sustainable finance

224:Part of a series on

197:). All bonds carry

32:Government spending

3205:Stock market index

3044:Efficient frontier

2983:Technical analysis

2941:Momentum investing

2763:(private exchange)

2653:Proprietary trader

2595:Shares outstanding

2585:Authorised capital

1805:Floating rate note

1385:"investopedia.com"

1075:Index-linked gilts

940:Interest rate risk

700:Speculative attack

465:Structured product

145:

3253:

3252:

3054:Flight-to-quality

2806:Buffett indicator

2496:Financial markets

2462:

2461:

2309:Strategic default

2274:Collection agency

2187:

2186:

2169:Predatory lending

2059:

2058:

2012:Exchangeable bond

1938:Yield to maturity

1790:Exchangeable bond

1712:Subordinated debt

1202:every six months.

1177:

1176:

1169:

1008:

1007:

1000:

922:

921:

914:

746:

745:

573:Banks and banking

563:Asset (economics)

389:Credit derivative

357:Stock certificate

230:Financial markets

206:yield of 12.84%.

137:

136:

129:

111:

76:"Government bond"

16:(Redirected from

3273:

3266:Government bonds

3170:Share repurchase

2882:Trading theories

2767:Crossing network

2725:Over-the-counter

2562:Restricted stock

2518:Secondary market

2489:

2482:

2475:

2466:

2465:

2154:Consumer lending

2104:

2103:

2086:

2079:

2072:

2063:

2062:

2002:Convertible bond

1845:Zero-coupon bond

1785:Convertible bond

1770:Commercial paper

1653:

1646:

1639:

1630:

1629:

1624:

1623:

1621:

1620:

1601:

1595:

1594:

1592:

1591:

1571:

1565:

1564:

1562:

1560:

1551:. 16 July 2004.

1541:

1535:

1534:

1532:

1530:

1515:

1509:

1508:

1506:

1505:

1490:

1484:

1483:

1481:

1480:

1465:

1459:

1458:

1456:

1454:

1435:

1429:

1428:

1426:

1424:

1405:

1399:

1398:

1396:

1395:

1389:investopedia.com

1381:

1375:

1374:

1372:

1371:

1362:. Archived from

1356:

1350:

1349:

1347:

1346:

1337:. Archived from

1331:

1315:Zero-coupon bond

1300:Secondary market

1229:secondary market

1208:(TIPS): are the

1172:

1165:

1161:

1158:

1152:

1121:

1113:

1003:

996:

992:

989:

983:

952:

944:

917:

910:

906:

903:

897:

866:

858:

738:

731:

724:

680:Impact investing

675:Growth investing

408:Foreign exchange

394:Futures exchange

342:Registered share

240:

221:

220:

132:

125:

121:

118:

112:

110:

69:

45:

37:

21:

3281:

3280:

3276:

3275:

3274:

3272:

3271:

3270:

3256:

3255:

3254:

3249:

3240:Voting interest

3150:Public offering

3085:Mandatory offer

3059:Government bond

3039:DuPont analysis

3002:

2998:Value investing

2993:Value averaging

2988:Trend following

2973:Style investing

2968:Sector rotation

2883:

2877:

2856:Net asset value

2782:Stock valuation

2776:

2696:

2604:

2571:

2557:Preferred stock

2532:

2498:

2493:

2463:

2458:

2454:Promissory note

2425:

2391:

2372:Deposit account

2318:

2289:Debtors' prison

2243:

2209:Management plan

2183:

2135:

2095:

2090:

2060:

2055:

2026:

2017:Extendible bond

2007:Embedded option

1983:

1947:

1849:

1810:High-yield debt

1800:Fixed rate bond

1795:Extendible bond

1743:

1724:Government bond

1719:Distressed debt

1685:

1662:

1657:

1627:

1618:

1616:

1603:

1602:

1598:

1589:

1587:

1572:

1568:

1558:

1556:

1543:

1542:

1538:

1528:

1526:

1517:

1516:

1512:

1503:

1501:

1492:

1491:

1487:

1478:

1476:

1467:

1466:

1462:

1452:

1450:

1437:

1436:

1432:

1422:

1420:

1407:

1406:

1402:

1393:

1391:

1383:

1382:

1378:

1369:

1367:

1358:

1357:

1353:

1344:

1342:

1333:

1332:

1328:

1324:

1319:

1280:Government debt

1260:

1173:

1162:

1156:

1153:

1138:

1122:

1111:

1087:Bank of England

1067:

1059:monetary policy

1039:

1033:

1004:

993:

987:

984:

969:

953:

942:

918:

907:

901:

898:

883:

867:

856:

847:

800:

795:

780:perpetual bonds

761:Bank of England

742:

583:Climate finance

512:

498:

426:

425:

405:

404:

399:Hybrid security

337:Preferred stock

307:

298:High-yield debt

293:Government bond

219:

173:coupon payments

165:public spending

149:government bond

133:

122:

116:

113:

70:

68:

58:

46:

35:

28:

23:

22:

15:

12:

11:

5:

3279:

3269:

3268:

3251:

3250:

3248:

3247:

3242:

3237:

3232:

3227:

3222:

3217:

3212:

3207:

3202:

3200:Stock exchange

3197:

3195:Stock dilution

3192:

3187:

3182:

3177:

3172:

3167:

3162:

3157:

3152:

3147:

3142:

3137:

3132:

3127:

3122:

3120:Mean reversion

3117:

3112:

3107:

3102:

3097:

3095:Market anomaly

3092:

3087:

3082:

3077:

3071:

3066:

3061:

3056:

3051:

3046:

3041:

3036:

3031:

3026:

3021:

3016:

3014:Bid–ask spread

3010:

3008:

3004:

3003:

3001:

3000:

2995:

2990:

2985:

2980:

2975:

2970:

2965:

2959:

2953:

2948:

2943:

2938:

2932:

2927:

2922:

2917:

2911:

2906:

2901:

2896:

2890:

2888:

2879:

2878:

2876:

2875:

2870:

2864:

2859:

2853:

2848:

2843:

2841:Earnings yield

2838:

2836:Dividend yield

2833:

2827:

2821:

2815:

2809:

2803:

2798:

2792:

2786:

2784:

2778:

2777:

2775:

2774:

2769:

2764:

2758:

2752:

2746:

2740:

2734:

2728:

2727:(off-exchange)

2722:

2721:

2720:

2715:

2704:

2702:

2701:Trading venues

2698:

2697:

2695:

2694:

2689:

2688:

2687:

2677:

2672:

2667:

2662:

2657:

2656:

2655:

2650:

2640:

2635:

2630:

2629:

2628:

2623:

2612:

2610:

2606:

2605:

2603:

2602:

2600:Treasury stock

2597:

2592:

2587:

2581:

2579:

2573:

2572:

2570:

2569:

2567:Tracking stock

2564:

2559:

2554:

2549:

2543:

2541:

2534:

2533:

2531:

2530:

2525:

2520:

2515:

2513:Primary market

2509:

2507:

2500:

2499:

2492:

2491:

2484:

2477:

2469:

2460:

2459:

2457:

2456:

2451:

2446:

2441:

2436:

2430:

2427:

2426:

2424:

2423:

2410:

2405:

2399:

2397:

2393:

2392:

2390:

2389:

2387:Securitization

2384:

2379:

2374:

2369:

2364:

2359:

2354:

2349:

2344:

2339:

2334:

2328:

2326:

2320:

2319:

2317:

2316:

2311:

2306:

2301:

2296:

2291:

2286:

2281:

2276:

2271:

2266:

2260:

2258:

2245:

2244:

2242:

2241:

2239:Loan guarantee

2236:

2231:

2226:

2221:

2211:

2206:

2201:

2195:

2193:

2189:

2188:

2185:

2184:

2182:

2181:

2179:Vendor finance

2176:

2171:

2166:

2161:

2156:

2151:

2145:

2143:

2137:

2136:

2134:

2133:

2128:

2123:

2118:

2112:

2110:

2101:

2097:

2096:

2089:

2088:

2081:

2074:

2066:

2057:

2056:

2054:

2053:

2047:

2041:

2034:

2032:

2028:

2027:

2025:

2024:

2019:

2014:

2009:

2004:

1999:

1993:

1991:

1985:

1984:

1982:

1981:

1976:

1971:

1966:

1961:

1955:

1953:

1949:

1948:

1946:

1945:

1940:

1935:

1930:

1925:

1920:

1918:Risk-free bond

1915:

1910:

1905:

1903:Mortgage yield

1900:

1895:

1890:

1885:

1880:

1875:

1870:

1865:

1859:

1857:

1855:Bond valuation

1851:

1850:

1848:

1847:

1842:

1837:

1832:

1830:Perpetual bond

1827:

1822:

1817:

1812:

1807:

1802:

1797:

1792:

1787:

1782:

1777:

1772:

1767:

1762:

1757:

1751:

1749:

1745:

1744:

1742:

1741:

1736:

1734:Municipal bond

1731:

1726:

1721:

1716:

1715:

1714:

1709:

1702:Corporate bond

1699:

1693:

1691:

1687:

1686:

1684:

1683:

1678:

1673:

1667:

1664:

1663:

1656:

1655:

1648:

1641:

1633:

1626:

1625:

1596:

1566:

1536:

1510:

1485:

1460:

1430:

1400:

1376:

1351:

1325:

1323:

1320:

1318:

1317:

1312:

1307:

1302:

1297:

1295:Municipal bond

1292:

1287:

1282:

1277:

1272:

1267:

1261:

1259:

1256:

1251:TreasuryDirect

1218:

1217:

1203:

1200:coupon payment

1196:Treasury bonds

1193:

1190:Treasury notes

1187:

1175:

1174:

1125:

1123:

1116:

1110:

1107:

1066:

1065:United Kingdom

1063:

1032:

1029:

1006:

1005:

956:

954:

947:

941:

938:

934:Series I bonds

920:

919:

870:

868:

861:

855:

854:Inflation risk

852:

846:

843:

824:"ruble crisis"

804:risk-free bond

799:

796:

794:

791:

750:Dutch Republic

744:

743:

741:

740:

733:

726:

718:

715:

714:

713:

712:

707:

702:

697:

692:

687:

682:

677:

672:

667:

662:

661:

660:

655:

650:

645:

640:

635:

630:

625:

620:

615:

605:

600:

595:

590:

585:

580:

575:

570:

565:

560:

558:Angel investor

555:

547:

546:

542:

541:

540:

539:

534:

529:

521:

520:

514:

513:

511:

510:

505:

499:

497:

496:

491:

485:

482:

481:

475:

474:

473:

472:

470:Swap (finance)

467:

462:

457:

452:

447:

442:

437:

432:

424:

423:

417:

410:

406:

403:

402:

396:

391:

384:

380:

377:

376:

372:

371:

370:

369:

364:

362:Stock exchange

359:

354:

349:

344:

339:

334:

329:

321:

320:

314:

313:

312:

311:

309:Securitization

305:

303:Municipal bond

300:

295:

290:

285:

283:Corporate bond

280:

278:Bond valuation

272:

271:

265:

264:

263:

262:

250:

242:

241:

233:

232:

226:

225:

218:

215:

153:sovereign bond

135:

134:

49:

47:

40:

26:

9:

6:

4:

3:

2:

3278:

3267:

3264:

3263:

3261:

3246:

3243:

3241:

3238:

3236:

3233:

3231:

3228:

3226:

3223:

3221:

3218:

3216:

3213:

3211:

3208:

3206:

3203:

3201:

3198:

3196:

3193:

3191:

3188:

3186:

3183:

3181:

3178:

3176:

3175:Short selling

3173:

3171:

3168:

3166:

3163:

3161:

3158:

3156:

3153:

3151:

3148:

3146:

3143:

3141:

3138:

3136:

3133:

3131:

3128:

3126:

3123:

3121:

3118:

3116:

3113:

3111:

3108:

3106:

3103:

3101:

3098:

3096:

3093:

3091:

3088:

3086:

3083:

3081:

3078:

3075:

3072:

3070:

3067:

3065:

3064:Greenspan put

3062:

3060:

3057:

3055:

3052:

3050:

3049:Financial law

3047:

3045:

3042:

3040:

3037:

3035:

3032:

3030:

3027:

3025:

3024:Cross listing

3022:

3020:

3017:

3015:

3012:

3011:

3009:

3007:Related terms

3005:

2999:

2996:

2994:

2991:

2989:

2986:

2984:

2981:

2979:

2978:Swing trading

2976:

2974:

2971:

2969:

2966:

2963:

2960:

2957:

2954:

2952:

2949:

2947:

2946:Mosaic theory

2944:

2942:

2939:

2936:

2933:

2931:

2930:Market timing

2928:

2926:

2923:

2921:

2918:

2915:

2912:

2910:

2907:

2905:

2902:

2900:

2897:

2895:

2892:

2891:

2889:

2887:

2880:

2874:

2871:

2868:

2865:

2863:

2860:

2857:

2854:

2852:

2849:

2847:

2844:

2842:

2839:

2837:

2834:

2831:

2828:

2825:

2822:

2819:

2816:

2813:

2810:

2807:

2804:

2802:

2799:

2796:

2793:

2791:

2788:

2787:

2785:

2783:

2779:

2773:

2770:

2768:

2765:

2762:

2759:

2756:

2753:

2750:

2747:

2744:

2741:

2738:

2735:

2732:

2729:

2726:

2723:

2719:

2718:Trading hours

2716:

2714:

2711:

2710:

2709:

2706:

2705:

2703:

2699:

2693:

2690:

2686:

2683:

2682:

2681:

2678:

2676:

2673:

2671:

2668:

2666:

2663:

2661:

2658:

2654:

2651:

2649:

2646:

2645:

2644:

2641:

2639:

2636:

2634:

2633:Broker-dealer

2631:

2627:

2624:

2622:

2619:

2618:

2617:

2614:

2613:

2611:

2607:

2601:

2598:

2596:

2593:

2591:

2590:Issued shares

2588:

2586:

2583:

2582:

2580:

2578:

2577:Share capital

2574:

2568:

2565:

2563:

2560:

2558:

2555:

2553:

2550:

2548:

2545:

2544:

2542:

2540:

2535:

2529:

2528:Fourth market

2526:

2524:

2521:

2519:

2516:

2514:

2511:

2510:

2508:

2506:

2501:

2497:

2490:

2485:

2483:

2478:

2476:

2471:

2470:

2467:

2455:

2452:

2450:

2449:Interest rate

2447:

2445:

2442:

2440:

2437:

2435:

2432:

2431:

2428:

2422:

2418:

2414:

2411:

2409:

2406:

2404:

2401:

2400:

2398:

2394:

2388:

2385:

2383:

2380:

2378:

2375:

2373:

2370:

2368:

2365:

2363:

2360:

2358:

2355:

2353:

2350:

2348:

2345:

2343:

2340:

2338:

2335:

2333:

2330:

2329:

2327:

2325:

2321:

2315:

2312:

2310:

2307:

2305:

2302:

2300:

2297:

2295:

2292:

2290:

2287:

2285:

2282:

2280:

2277:

2275:

2272:

2270:

2267:

2265:

2262:

2261:

2259:

2257:

2254:

2250:

2246:

2240:

2237:

2235:

2232:

2230:

2227:

2225:

2224:Restructuring

2222:

2219:

2215:

2212:

2210:

2207:

2205:

2204:Consolidation

2202:

2200:

2197:

2196:

2194:

2190:

2180:

2177:

2175:

2172:

2170:

2167:

2165:

2162:

2160:

2157:

2155:

2152:

2150:

2149:Business loan

2147:

2146:

2144:

2142:

2138:

2132:

2129:

2127:

2124:

2122:

2119:

2117:

2114:

2113:

2111:

2109:

2105:

2102:

2098:

2094:

2087:

2082:

2080:

2075:

2073:

2068:

2067:

2064:

2051:

2048:

2045:

2042:

2039:

2036:

2035:

2033:

2029:

2023:

2022:Puttable bond

2020:

2018:

2015:

2013:

2010:

2008:

2005:

2003:

2000:

1998:

1997:Callable bond

1995:

1994:

1992:

1990:

1986:

1980:

1977:

1975:

1972:

1970:

1967:

1965:

1962:

1960:

1957:

1956:

1954:

1950:

1944:

1941:

1939:

1936:

1934:

1931:

1929:

1926:

1924:

1921:

1919:

1916:

1914:

1911:

1909:

1908:Nominal yield

1906:

1904:

1901:

1899:

1896:

1894:

1891:

1889:

1886:

1884:

1883:Current yield

1881:

1879:

1878:Credit spread

1876:

1874:

1871:

1869:

1866:

1864:

1861:

1860:

1858:

1856:

1852:

1846:

1843:

1841:

1838:

1836:

1835:Puttable bond

1833:

1831:

1828:

1826:

1823:

1821:

1818:

1816:

1813:

1811:

1808:

1806:

1803:

1801:

1798:

1796:

1793:

1791:

1788:

1786:

1783:

1781:

1778:

1776:

1773:

1771:

1768:

1766:

1765:Callable bond

1763:

1761:

1758:

1756:

1753:

1752:

1750:

1746:

1740:

1737:

1735:

1732:

1730:

1727:

1725:

1722:

1720:

1717:

1713:

1710:

1708:

1705:

1704:

1703:

1700:

1698:

1695:

1694:

1692:

1688:

1682:

1679:

1677:

1674:

1672:

1669:

1668:

1665:

1661:

1654:

1649:

1647:

1642:

1640:

1635:

1634:

1631:

1614:

1610:

1606:

1600:

1585:

1581:

1577:

1570:

1554:

1550:

1546:

1540:

1524:

1520:

1519:"Gilt Market"

1514:

1500:on 2011-07-18

1499:

1495:

1489:

1475:on 2016-11-10

1474:

1470:

1464:

1448:

1444:

1440:

1434:

1418:

1414:

1410:

1404:

1390:

1386:

1380:

1366:on 2014-08-10

1365:

1361:

1355:

1341:on 2020-07-02

1340:

1336:

1330:

1326:

1316:

1313:

1311:

1308:

1306:

1303:

1301:

1298:

1296:

1293:

1291:

1288:

1286:

1283:

1281:

1278:

1276:

1273:

1271:

1268:

1266:

1263:

1262:

1255:

1252:

1248:

1246:

1242:

1238:

1234:

1230:

1226:

1221:

1215:

1211:

1207:

1204:

1201:

1197:

1194:

1191:

1188:

1185:

1184:Savings bonds

1182:

1181:

1180:

1171:

1168:

1160:

1150:

1146:

1142:

1136:

1135:

1131:

1126:This section

1124:

1120:

1115:

1114:

1109:United States

1106:

1104:

1098:

1094:

1092:

1091:Computershare

1088:

1084:

1080:

1076:

1072:

1062:

1060:

1055:

1052:

1048:

1047:treasury bill

1044:

1038:

1028:

1026:

1021:

1017:

1013:

1002:

999:

991:

981:

977:

973:

967:

966:

962:

957:This section

955:

951:

946:

945:

937:

935:

931:

927:

916:

913:

905:

895:

891:

887:

881:

880:

876:

871:This section

869:

865:

860:

859:

851:

845:Currency risk

842:

840:

836:

831:

829:

825:

822:in 1998 (the

821:

817:

813:

809:

805:

790:

788:

783:

781:

776:

774:

770:

766:

762:

757:

755:

751:

739:

734:

732:

727:

725:

720:

719:

717:

716:

711:

708:

706:

703:

701:

698:

696:

693:

691:

688:

686:

683:

681:

678:

676:

673:

671:

668:

666:

663:

659:

656:

654:

651:

649:

646:

644:

641:

639:

636:

634:

631:

629:

626:

624:

621:

619:

616:

614:

611:

610:

609:

606:

604:

601:

599:

596:

594:

593:Eco-investing

591:

589:

586:

584:

581:

579:

576:

574:

571:

569:

568:Asset pricing

566:

564:

561:

559:

556:

554:

551:

550:

549:

548:

545:Related areas

544:

543:

538:

535:

533:

530:

528:

525:

524:

523:

522:

519:

516:

515:

509:

506:

504:

501:

500:

495:

492:

490:

487:

486:

484:

483:

480:

477:

476:

471:

468:

466:

463:

461:

458:

456:

453:

451:

448:

446:

443:

441:

438:

436:

433:

431:

428:

427:

421:

420:Exchange rate

418:

416:

412:

411:

409:

400:

397:

395:

392:

390:

386:

385:

383:

379:

378:

375:Other markets

374:

373:

368:

367:Watered stock

365:

363:

360:

358:

355:

353:

350:

348:

345:

343:

340:

338:

335:

333:

330:

328:

325:

324:

323:

322:

319:

316:

315:

310:

306:

304:

301:

299:

296:

294:

291:

289:

286:

284:

281:

279:

276:

275:

274:

273:

270:

267:

266:

261:

258:

254:

251:

249:

248:Public market

246:

245:

244:

243:

239:

235:

234:

231:

228:

227:

223:

222:

214:

212:

207:

204:

200:

196:

195:hard currency

192:

187:

183:

181:

177:

174:

170:

166:

162:

158:

155:is a form of

154:

150:

141:

131:

128:

120:

109:

106:

102:

99:

95:

92:

88:

85:

81:

78: –

77:

73:

72:Find sources:

66:

62:

56:

55:

50:This article

48:

44:

39:

38:

33:

19:

3225:Tender offer

3145:Public float

3115:Market trend

3105:Market depth

3058:

2925:Growth stock

2899:Buy and hold

2808:(Cap-to-GDP)

2648:Floor trader

2638:Market maker

2621:Floor broker

2609:Participants

2552:Golden share

2547:Common stock

2523:Third market

2419: /

2415: /

2382:Money market

2377:Fixed income

2304:Phantom debt

2284:Debt bondage

2252:

2125:

2031:Institutions

1989:Bond options

1933:Yield spread

1825:Lottery bond

1755:Accrual bond

1723:

1681:Fixed income

1617:. Retrieved

1608:

1599:

1588:. Retrieved

1580:Which? Money

1579:

1569:

1557:. Retrieved

1548:

1539:

1527:. Retrieved

1513:

1502:. Retrieved

1498:the original

1488:

1477:. Retrieved

1473:the original

1463:

1451:. Retrieved

1442:

1433:

1421:. Retrieved

1412:

1403:

1392:. Retrieved

1388:

1379:

1368:. Retrieved

1364:the original

1354:

1343:. Retrieved

1339:the original

1329:

1249:

1247:are traded.

1222:

1219:

1178:

1163:

1154:

1139:Please help

1127:

1099:

1095:

1074:

1068:

1056:

1051:money supply

1043:central bank

1040:

1031:Money supply

1009:

994:

985:

970:Please help

958:

923:

908:

899:

884:Please help

872:

848:

832:

801:

784:

777:

758:

747:

695:Market trend

670:Greenwashing

527:Participants

332:Growth stock

327:Common stock

318:Stock market

292:

288:Fixed income

256:

208:

188:

184:

175:

159:issued by a

152:

148:

146:

123:

114:

104:

97:

90:

83:

71:

59:Please help

54:verification

51:

3230:Uptick rule

3210:Stock split

3190:Squeeze-out

3185:Speculation

3130:Open outcry

3019:Block trade

2951:Pairs trade

2421:Odious debt

2299:Garnishment

2164:Payday loan

2100:Instruments

1928:Yield curve

1888:Dirty price

1863:Clean price

1739:Global bond

1707:Senior debt

1697:Agency bond

1660:Bond market

1290:Market risk

1265:Bond market

1083:HM Treasury

1012:market risk

798:Credit risk

785:During the

773:stadtholder

690:Market risk

503:Spot market

460:Reinsurance

455:Real estate

445:Mutual fund

382:Derivatives

352:Stockbroker

269:Bond market

163:to support

3235:Volatility

3215:Stock swap

3135:Order book

2886:strategies

2812:Book value

2680:Arbitrager

2675:Speculator

2439:Insolvency

2347:Government

2279:Compliance

2269:Charge-off

2249:Collection

2199:Bankruptcy

2192:Management

2159:Loan shark

2126:Government

1619:2022-02-07

1590:2022-02-07

1504:2011-06-13

1479:2011-06-13

1394:2023-08-03

1370:2014-08-02

1345:2014-08-02

1322:References

1035:See also:

532:Regulation

260:Securities

161:government

87:newspapers

2851:Fed model

2846:EV/EBITDA

2761:Dark pool

2692:Regulator

2537:Types of

2503:Types of

2396:Economics

2357:Municipal

2342:Diplomacy

2337:Corporate

2294:Distraint

2131:Municipal

2121:Debenture

2116:Corporate

1868:Convexity

1676:Debenture

1453:19 August

1310:War Bonds

1128:does not

1016:rate risk

959:does not

926:inflation

873:does not

754:Amsterdam

633:corporate

608:Financial

430:Commodity

171:, called

117:July 2008

3260:Category

3180:Slippage

3140:Position

3125:Momentum

3029:Dividend

2708:Exchange

2665:Investor

2444:Interest

2417:Internal

2413:External

2332:Consumer

2264:Bad debt

1943:Z-spread

1898:I-spread

1893:Duration

1613:Archived

1584:Archived

1553:Archived

1523:Archived

1447:Archived

1417:Archived

1305:Treasury

1258:See also

1157:May 2023

1025:Maturity

988:May 2023

902:May 2023

812:maturity

658:services

648:personal

643:forecast

613:analysis

537:Clearing

489:Forwards

415:Currency

253:Exchange

191:currency

186:years).

180:maturity

169:interest

3069:Haircut

2873:T-model

2685:Scalper

2505:markets

2434:Default

2362:Venture

2352:Medical

2324:Markets

2256:Evasion

2218:history

2052:(SIFMA)

1413:Reuters

1245:futures

1225:auction

1149:removed

1134:sources

980:removed

965:sources

894:removed

879:sources

826:) (see

816:default

665:Fintech

628:betting

618:analyst

518:Trading

494:Options

217:History

199:default

101:scholar

3090:Margin

2958:(PMPT)

2820:(CAPM)

2670:Hedger

2643:Trader

2616:Broker

2539:stocks

2251:

2214:Relief

2046:(ICMA)

2040:(CMSA)

1873:Coupon

1775:Consol

1559:17 May

1529:16 May

1423:2 July

1270:Consol

1241:option

820:Russia

653:public

450:Option

255:

182:date.

103:

96:

89:

82:

74:

3245:Yield

3220:Trade

3155:Rally

3076:(IPO)

2964:(RMH)

2937:(MPT)

2916:(EMH)

2869:(SML)

2858:(NAV)

2832:(DDM)

2826:(CML)

2797:(APT)

2790:Alpha

2757:(STP)

2751:(DMA)

2745:(ECN)

2739:(MTF)

2733:(ATS)

2367:Buyer

2174:Usury

2141:Loans

2108:Bonds

1233:stock

1071:gilts

1041:If a

793:Risks

638:crime

623:asset

508:Swaps

440:Money

347:Stock

108:JSTOR

94:books

3080:Long

2884:and

2814:(BV)

2801:Beta

2093:Debt

1671:Bond

1561:2022

1531:2022

1455:2020

1425:2017

1243:and

1237:bond

1132:any

1130:cite

963:any

961:cite

877:any

875:cite

748:The

578:Bull

157:bond

80:news

1143:by

974:by

888:by

830:).

603:ESG

435:ETF

151:or

63:by

3262::

1611:.

1607:.

1582:.

1578:.

1547:.

1445:.

1441:.

1411:.

1387:.

1239:,

1235:,

1105:.

1093:.

1061:.

936:.

841:.

775:.

213:.

147:A

2488:e

2481:t

2474:v

2253:·

2220:)

2216:(

2085:e

2078:t

2071:v

1652:e

1645:t

1638:v

1622:.

1593:.

1563:.

1533:.

1507:.

1482:.

1457:.

1427:.

1397:.

1373:.

1348:.

1170:)

1164:(

1159:)

1155:(

1151:.

1137:.

1001:)

995:(

990:)

986:(

982:.

968:.

915:)

909:(

904:)

900:(

896:.

882:.

737:e

730:t

723:v

422:)

413:(

401:)

387:(

257:·

176:,

130:)

124:(

119:)

115:(

105:·

98:·

91:·

84:·

57:.

34:.

20:)

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.