833:

3866:

1404:

719:

41:

1076:

2610:

33:

1251:

land values for 46 U.S. metro areas. One of the fastest-growing regions in the United States for the last several decades was the

Atlanta, Georgia metro area, where land values are a small fraction of those in the high-priced markets. High land values contribute to high living costs in general and are part of the reason for the decline of the old industrial centers while new automobile plants, for example, were built throughout the South, which grew in population faster than the other regions.

1255:

health. Besides health issues, the unstable housing market has also been shown to increase instances of violence. They subsequently begin to fear that their own homes may be taken from them. Increases in anxiety have at the very least been commonly noted. There is a fear that foreclosures bring about these reactions in people who anticipate the same thing happening to them. An uptick on violent occurrences has also been shown to follow neighborhoods where such uncertainty exists.

1005:

slowing in the rate of price growth can be expected, but in many areas inventory shortages will persist and home prices are likely to continue to rise above historic norms". Following reports of rapid sales declines and price depreciation in August 2006, Lereah admitted that he expected "home prices to come down 5% nationally, more in some markets, less in others. And a few cities in

Florida and California, where home prices soared to nose-bleed heights, could have 'hard landings'."

2253:

7360:

3171:' ... If houses get too expensive, people will stop buying them, which will cause people to adjust their spending habits ... Let the market function properly. I guarantee that your kind of question has been asked throughout the history of homebuilding – you know, prices for my homes are getting bid up so high that I'm afraid I'm not going to have any consumers – or my kid – and yet, things cycle. That's just the way it works. Economies should cycle.'

49:

1150:

7386:

7373:

1304:

2928:] around–often from folks close to real estate interests–to minimize the importance of this housing bust, it is worth to point out a number of flawed arguments and misperception that are being peddled around. You will hear many of these arguments over and over again in the financial pages of the media, in sell-side research reports and in innumerous [

1386:

on mortgage payments fell from 2.2 to 1.9; homeowners who thought it was "very likely or somewhat likely" that they would fall behind on payments fell from 6% to 4.6% of families. On the other hand, family's financial liquidity has decreased: "As of 2009, 18.5% of families had no liquid assets, and by 2011 this had grown to 23.4% of families."

1571:" to inject U.S. $ 38 billion in temporary reserves into the system to help overcome the ill effects of a spreading credit crunch, on top of a similar move the previous day. In order to further ease the credit crunch in the U.S. credit market, at 8:15 a.m. on August 17, 2007, the chairman of the Federal Reserve Bank

1591:, held hearings in March 2007 in which he asked executives from the top five subprime mortgage companies to testify and explain their lending practices. Dodd said that "predatory lending practices" were endangering home ownership for millions of people. In addition, Democratic senators such as Senator

1529:

reported that it had made a quarterly loss of $ 677 million on discontinued operations, which included the subprime lender Option One, as well as writedowns, loss provisions for mortgage loans and the lower prices achievable for mortgages in the secondary market. The unit's net asset value had fallen

603:

Land prices contributed much more to the price increases than did structures. This can be seen in the building cost index in Fig. 1. An estimate of land value for a house can be derived by subtracting the replacement value of the structure, adjusted for depreciation, from the home price. Using this

4507:

In early 2004, he urged homeowners to shift from fixed to floating rate mortgages, and in early 2005, he extolled the virtues of subprime borrowing—the extension of credit to unworthy borrowers. Far from the heartless central banker that is supposed to 'take the punchbowl away just when the party is

1551:

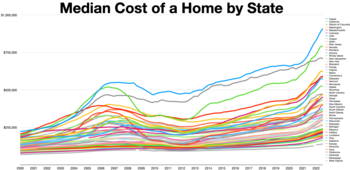

report connects the hedge fund crisis with lax lending standards: "The crisis this week from the near collapse of two hedge funds managed by Bear

Stearns stems directly from the slumping housing market and the fallout from loose lending practices that showered money on people with weak, or subprime,

1544:

funds were auctioned on the open market, much weaker values would be plainly revealed. Schiff added, "This would force other hedge funds to similarly mark down the value of their holdings. Is it any wonder that Wall street is pulling out the stops to avoid such a catastrophe? ... Their true weakness

1114:

However, housing bubbles did not manifest themselves in each of these areas at the same time. San Diego and Los

Angeles had maintained consistently high appreciation rates since late 1990s, whereas the Las Vegas and Phoenix bubbles did not develop until 2003 and 2004 respectively. It was in the East

3958:

Once a price history develops, and people hear that their neighbor made a lot of money on something, that impulse takes over, and we're seeing that in commodities and housing ... Orgies tend to be wildest toward the end. It's like being

Cinderella at the ball. You know that at midnight everything's

1614:

market in the 1970s, warned of the future impact of mortgage defaults: "This is the leading edge of the storm ... If you think this is bad, imagine what it's going to be like in the middle of the crisis." In his opinion, more than $ 100 billion of home loans were likely to default when the problems

1385:

analyzed data from the Panel Study of Income

Dynamics (PSID), which surveyed roughly 9,000 representative households in 2009 and 2011. The data seems to indicate that, while conditions are still difficult, in some ways the crisis is easing: Over the period studied, the percentage of families behind

1367:

Basing their statements on historic U.S. housing valuation trends, in 2005 and 2006 many economists and business writers predicted market corrections ranging from a few percentage points to 50% or more from peak values in some markets, and although this cooling had not yet affected all areas of the

1111:, six (Dallas, Cleveland, Detroit, Denver, Atlanta, and Charlotte) saw less than 10% price growth in inflation-adjusted terms in 2001–2006. During the same period, seven metropolitan areas (Tampa, Miami, San Diego, Los Angeles, Las Vegas, Phoenix, and Washington, D.C.) appreciated by more than 80%.

1004:

Among other statements, the reports stated that people "should be concerned that home prices are rising faster than family income", that "there is virtually no risk of a national housing price bubble based on the fundamental demand for housing and predictable economic factors", and that "a general

942:

magazine stated, "The worldwide rise in house prices is the biggest bubble in history", so any explanation needs to consider its global causes as well as those specific to the United States. The then

Federal Reserve Board Chairman Alan Greenspan said in mid-2005 that "at a minimum, there's a little

3291:

The headline hints of catastrophe: a dot-com repeat, a bubble bursting, an economic apocalypse. Cassandra, though, can stop wailing: the expected price corrections mark a slowing in the rate of increase—not a precipitous decline. This will not spark a chain reaction that will devastate homeowners,

1595:

of New York were already proposing a federal government bailout of subprime borrowers like the bailout made in the savings and loan crisis, in order to save homeowners from losing their residences. Opponents of such a proposal asserted that a government bailout of subprime borrowers was not in the

1254:

People who either experienced foreclosures or live near foreclosures have a higher probability of falling ill or at the very least dealing with increased anxiety. Overall, it is reported that homeowners who are unable to afford living in their desired locations experience higher instances of poor

1250:

Extreme regional differences in land prices. The differences in housing prices are mainly due to differences in land values, which reached 85% of the total value of houses in the highest priced markets at the peak. The

Wisconsin Business School publishes an on line database with building cost and

1023:

on June 14, 2007, on the linkage between increased foreclosures and localized housing price declines: "Living in an area with multiple foreclosures can result in a 10 percent to 20 percent decrease in property values". He went on to say, "In some cases that can wipe out the equity of homeowners or

920:

identified the housing bubble and foretold the difficulties it would cause: "Like all artificially-created bubbles, the boom in housing prices cannot last forever. When housing prices fall, homeowners will experience difficulty as their equity is wiped out. Furthermore, the holders of the mortgage

874:

e can profit from the collapse of the credit bubble and the subsequent stock market divestment . However, real estate has not yet joined in a decline of prices fed by selling (and foreclosing). Unless you have a very specific reason to believe that real estate will outperform all other investments

1618:

Former

Federal Reserve Chairman Alan Greenspan had praised the rise of the subprime mortgage industry and the tools which it uses to assess credit-worthiness in an April 2005 speech. Because of these remarks, as well as his encouragement of the use of adjustable-rate mortgages, Greenspan has been

1284:

plummeted in 2008 as investors worried that they lacked sufficient capital to cover the losses on their $ 5 (~$ 6.95 trillion in 2023) trillion portfolio of loans and loan guarantees. On June 16, 2010, it was announced that Fannie Mae and

Freddie Mac would be delisted from the New York Stock

1219:

to China. Analysts believed that with the downturn in the two sectors, the economy from the early 2000s to 2007 evaded what would have been stagnant growth with a booming housing market creating jobs, economic demand along with a consumer boom that came from home value withdraws until the housing

2238:

The home-price bubble feels like the stock-market mania in the fall of 1999, just before the stock bubble burst in early 2000, with all the hype, herd investing and absolute confidence in the inevitability of continuing price appreciation. My blood ran slightly cold at a cocktail party the other

1259:

These trends were reversed during the real estate market correction of 2006–2007. As of August 2007, D.R. Horton's and Pulte Corp's shares had fallen to 1/3 of their respective peak levels as new residential home sales fell. Some of the cities and regions that had experienced the fastest growth

2316:

Once stocks fell, real estate became the primary outlet for the speculative frenzy that the stock market had unleashed. Where else could plungers apply their newly acquired trading talents? The materialistic display of the big house also has become a salve to bruised egos of disappointed stock

1000:

magazine report on the US housing bubble states: "The great housing bubble has finally started to deflate ... In many once-sizzling markets around the country, accounts of dropping list prices have replaced tales of waiting lists for unbuilt condos and bidding wars over humdrum three-bedroom

3959:

going to turn back to pumpkins and mice. But you look around and say, 'one more dance,' and so does everyone else. The party does get to be more fun—and besides, there are no clocks on the wall. And then suddenly the clock strikes 12, and everything turns back to pumpkins and mice.

1208:– grew considerably since the early 1990s. According to US Federal Reserve estimates, in 2005 homeowners extracted $ 750 billion of equity from their homes (up from $ 106 billion in 1996), spending two thirds of it on personal consumption, home improvements, and credit card debt.

1264:

rates. It was suggested that the weakness of the housing industry and the loss of the consumption that had been driven by the withdrawal of mortgage equity could lead to a recession, but as of mid-2007 the existence of this recession had not yet been ascertained. In March 2008,

623:—a mortgage debt higher than the value of the property. The underlying causes of the housing bubble are complex. Factors include tax policy (exemption of housing from capital gains), historically low interest rates, lax lending standards, failure of regulators to intervene, and

1478:." Many of these good-looking girls are not high-class assets worth 100 cents on the dollar ... he point is that there are hundreds of billions of dollars of this toxic waste ... This problem resides in America's heartland, with millions and millions of overpriced homes.

1134:, where weak local economies had produced little house price appreciation early in the decade but still saw declining values and increased foreclosures in 2007. As of January 2009 California, Michigan, Ohio and Florida were the states with the highest foreclosure rates.

1051:

held hearings and asked executives from the top five subprime mortgage companies to testify and explain their lending practices. Dodd said that "predatory lending" had endangered home ownership for millions of people. In addition, Democratic senators such as Senator

1567:(ECB) immediately stepped in to ease market worries by opening lines of €96.8 billion (U.S. $ 130 billion) of low-interest credit. One day after the financial panic about a credit crunch had swept through Europe, the U.S. Federal Reserve Bank conducted an "

852:

identified the bubble in August 2002, thereafter repeatedly warning of its nature and depth, and the political reasons it was being ignored. Prior to that, Robert Prechter wrote about it extensively as did Professor Shiller in his original publication of

1137:

By July 2008, year-to-date prices had declined in 24 of 25 U.S. metropolitan areas, with California and the southwest experiencing the greatest price falls. According to the reports, only Milwaukee had seen an increase in house prices after July 2007.

1579:

rate, which is the lending rate between banks and the Federal Reserve Bank, by 50 basis points to 5.75% from 6.25%. The Federal Reserve Bank stated that the recent turmoil in the U.S. financial markets had raised the risk of an economic downturn.

62:, 2nd ed. Shiller shows that inflation-adjusted U.S. home prices increased 0.4% per year from 1890 to 2004 and 0.7% per year from 1940 to 2004, whereas U.S. census data from 1940 to 2004 shows that the self-assessed value increased 2% per year.

681:'s warning that home prices appear overvalued and that the correction could last years, with trillions of dollars of home value being lost. Greenspan warned of "large double digit declines" in home values "larger than most people expect".

3982:

A significant decline in prices is coming. A huge buildup of inventories is taking place, and then we're going to see a major in hot markets in California, Arizona, Florida and up the East Coast. These markets could fall 50% from their

3933:

Alan Greenspan, the United States's central banker, warned American homebuyers that they risk a crash if they continue to drive property prices higher ... On traditional tests, about a third of U.S. local homes markets are now markedly

1522:

sold off assets seized from the funds and three other banks closed out their positions with them. The Bear Stearns funds once had over $ 20 billion of assets, but lost billions of dollars on securities backed by subprime mortgages.

559:

hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President

7823:

1185:

One of the most direct effects was on the construction of new houses. In 2005, 1,283,000 new single-family houses were sold, compared with an average of 609,000 per year during 1990–1995. The largest home builders, such as

574:

In 2008 alone, the United States government allocated over $ 900 billion (~$ 1.25 trillion in 2023) to special loans and rescues related to the U.S. housing bubble. This was shared between the public sector and the

8679:

7816:

1034:

held hearings on the housing bubble and related loan practices in 2006, titled "The Housing Bubble and its Implications for the Economy" and "Calculated Risk: Assessing Non-Traditional Mortgage Products". Following the

1377:

warned, "The examples we have of past cycles indicate that major declines in real home prices—even 50 percent declines in some places—are entirely possible going forward from today or from the not-too-distant future."

8212:

1198:, improved operations significantly. D. R. Horton's stock went from $ 3 in early 1997 to all-time high of $ 42.82 on July 20, 2005. Pulte Corp's revenues grew from $ 2.33 billion in 1996 to $ 14.69 billion in 2005.

2118:

3836:

1103:

Despite greatly relaxed lending standards and low interest rates, many regions of the country saw very little price appreciation during the "bubble period". Out of 20 largest metropolitan areas tracked by the

897:, warning him that Freddie Mac was financing risk-laden loans that threatened Freddie Mac's financial stability. In his memo, Mr. Andrukonis wrote that these loans "would likely pose an enormous financial and

4137:

The examples we have of past cycles indicate that major declines in real home prices—even 50 per cent declines in some places—are entirely possible going forward from today or from the not-too-distant future.

1372:

Economy.com predicted a "crash" of double-digit depreciation in some U.S. cities by 2007–2009. In a paper he presented to a Federal Reserve Board economic symposium in August 2007, Yale University economist

1430:

rates (no verifying source), with more than 25 subprime lenders declaring bankruptcy, announcing significant losses, or putting themselves up for sale. The stock of the country's largest subprime lender,

704:

was fueled by the related refinancing boom, which allowed people to both reduce their monthly mortgage payments with lower interest rates and withdraw equity from their homes as their value increased.

1530:

21% to $ 1.1 billion as of April 30, 2007. The head of the mortgage industry consulting firm Wakefield Co. warned, "This is going to be a meltdown of unparalleled proportions. Billions will be lost."

4639:

2980:

1450:, warned in June 2007 that the subprime mortgage crisis was not an isolated event and would eventually take a toll on the economy and ultimately have an impact in the form of impaired home prices.

4253:

7414:

4087:

3404:

642:

While bubbles may be identifiable in progress, bubbles can be definitively measured only in hindsight after a market correction, which began in 2005–2006 for the U.S. housing market. Former U.S.

8078:

1778:

1146:

Prior to the real estate market correction of 2006–2007, the unprecedented increase in house prices starting in 1997 produced numerous wide-ranging effects in the economy of the United States.

1122:

rates, even though they did not see much house appreciation in the first place and therefore did not appear to be contributing to the national bubble. This was also true of some cities in the

4508:

getting good,' Alan Greenspan turned into an unabashed cheerleader for the excesses of an increasingly asset-dependent U.S. economy. I fear history will not judge the Maestro's legacy kindly.

1588:

1534:

pledged up to U.S. $ 3.2 billion (~$ 4.53 billion in 2023) in loans on June 22, 2007, to bail out one of its hedge funds that was collapsing because of bad bets on subprime mortgages.

1048:

1031:

595:, they received a substantial share of government support, even though their mortgages were more conservatively underwritten and actually performed better than those of the private sector.

2947:

8345:

4400:"BNP Paribas Investment Partners temporally suspends the calculation of the Net Asset Value of the following funds: Parvest Dynamic ABS, BNP Paribas ABS EURIBOR and BNP Paribas ABS EONIA"

4165:

2239:

night when a recent Yale Medical School graduate told me that she was buying a condo to live in Boston during her year-long internship, so that she could flip it for a profit next year.

7714:

8796:

7706:

966:(JCHS) disputed the existence of a national housing bubble and expressed doubt that any significant decline in home prices was possible, citing consistently rising prices since the

947:"was a euphemism for a bubble". In early 2006, President Bush said of the U.S. housing boom: "If houses get too expensive, people will stop buying them ... Economies should cycle".

4441:

688:, to warn that a recovery in the housing sector was not expected to occur at least until 2009 because home prices were falling "almost like never before, with the exception of the

4229:

8490:

7809:

5779:

5433:

2617:

from July 2005 through March 2006. As of March 10, 2006, well over 14,000 (nearly half) of these for-sale homes were vacant. (Source: Arizona Regional Multiple Listing Service.)

1223:

Rapidly growing house prices and increasing price gradients forced many residents to flee the expensive centers of many metropolitan areas, resulting in the explosive growth of

317:

8743:

8407:

4149:

3844:

1649:, that triggered the economic crisis of 2008. Concerning the subprime mortgage mess, Greenspan later admitted that "I really didn't get it until very late in 2005 and 2006."

1016:

data, sales were down 13% to 482,000 from the peak of 554,000 in March 2006, and the national median price fell nearly 6% to $ 217,000 from a peak of $ 230,200 in July 2006.

8773:

5774:

5299:

119:

1211:

It is widely believed that the increased degree of economic activity produced by the expanding housing bubble in 2001–2003 was partly responsible for averting a full-scale

5005:

7881:

5804:

5250:

2128:

268:

8729:

3113:

1024:

leave them owing more on their mortgage than the house is worth. The innocent houses that just happen to be sitting next to those properties are going to take a hit."

955:

Many contested any suggestion that there could be a housing bubble, particularly at its peak from 2004 to 2006, with some rejecting the "house bubble" label in 2008.

4133:"Two top US economists present scary scenarios for US economy; House prices in some areas may fall as much as 50% – Housing contraction threatens a broader recession"

870:

The burst of the housing bubble was predicted by a handful of political and economic analysts, such as Jeffery Robert Hunn in a March 3, 2003, editorial. Hunn wrote:

8524:

8446:

8391:

7549:

5741:

4968:

7665:

619:, and other economic indicators of affordability. This may be followed by decreases in home prices that result in many owners finding themselves in a position of

5824:

665:

was caused by the inability of a large number of home owners to pay their mortgages as their low introductory-rate mortgages reverted to regular interest rates.

4379:

8750:

8693:

8377:

8027:

7441:

5410:

3268:

283:

4097:

3414:

2575:

8531:

1832:

1389:

By mid-2016, the national housing price index was "about 1 percent shy of that 2006 bubble peak" in nominal terms but 20% below in inflation adjusted terms.

4478:"Remarks by Chairman Alan Greenspan, Consumer Finance At the Federal Reserve System's Fourth Annual Community Affairs Research Conference, Washington, D.C."

1925:

901:

to the company and the country". The article revealed that more than two-dozen high-ranking executives said that Mr. Syron had simply decided to ignore the

604:

methodology, Davis and Palumbo calculated land values for 46 U.S. metro areas, which can be found at the website for the Lincoln Institute for Land Policy.

8501:

8205:

8154:

8143:

5708:

3215:

2069:

982:(NAR), distributed "Anti-Bubble Reports" in August 2005 to "respond to the irresponsible bubble accusations made by your local media and local academics".

161:

3216:"Housing Bubble—or Bunk? Are home prices soaring unsustainably and due for plunge? A group of experts takes a look—and come to very different conclusions"

840:

During the run up in asset prices and before the Great Recession, various parties described the housing market as a bubble or contested that designation.

7793:

848:

Especially in late 2004 and early 2005, numerous economic and cultural factors led several economists to argue that a housing bubble existed in the U.S.

7902:

7586:

5646:

4063:

3469:

1368:

U.S., some warned that it still could, and that the correction would be "nasty" and "severe". Chief economist Mark Zandi of the economic research firm

1786:

1482:

Business Week has featured predictions by financial analysts that the subprime mortgage market meltdown would result in earnings reductions for large

7960:

7621:

5289:

201:

8296:

7916:

7909:

7853:

7542:

7535:

7528:

7521:

7514:

7507:

7500:

5794:

2272:

607:

Housing bubbles may occur in local or global real estate markets. In their late stages, they are typically characterized by rapid increases in the

453:

263:

151:

4588:

4325:

3359:

3239:

2984:

2957:

2727:

1315:

values with the peak values immediately prior to the first month of decline all the way through the downturn and the full recovery of home prices.

8064:

7874:

7558:

497:

reported the largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is an important cause of the

4172:

3751:

3719:

2889:

1056:

of New York were already proposing a federal government bailout of subprime borrowers in order to save homeowners from losing their residences.

994:

prices and increased foreclosure rates, some economists have concluded that the correction in the U.S. housing market began in 2006. A May 2006

8866:

8628:

8598:

8247:

7888:

7860:

5799:

5703:

5380:

5245:

963:

662:

655:

238:

156:

7658:

1895:

1645:, when the Commission sought to initiate the regulation of derivatives. Ultimately, it was the collapse of a specific kind of derivative, the

8289:

8020:

7953:

7832:

7344:

4000:

2863:

2580:

104:

8656:

8635:

8568:

8275:

8034:

7923:

7867:

6671:

5769:

5304:

5159:

713:

258:

17:

4451:

3305:

1995:

This is the biggest housing slump in the last four or five decades: every housing indicator is in free fall, including now housing prices.

8582:

8483:

8191:

7895:

7651:

5923:

5839:

5829:

5809:

5350:

5111:

288:

1118:

Somewhat paradoxically, as the housing bubble deflates some metropolitan areas (such as Denver and Atlanta) have been experiencing high

8621:

8163:

7434:

7299:

5849:

5395:

5319:

4854:

4239:

1065:

298:

3813:

943:'froth' (in the U.S. housing market) ... it's hard not to see that there are a lot of local bubbles"; Greenspan admitted in 2007 that

8711:

8575:

8198:

7630:

7493:

7472:

7459:

5764:

5736:

5663:

5575:

5405:

5033:

3051:

293:

278:

3140:"In come the waves: The worldwide rise in house prices is the biggest bubble in history. Prepare for the economic pain when it pops"

493:. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2011. On December 30, 2008, the

8099:

7976:

7672:

6405:

5235:

5088:

1984:

1693:

114:

4666:

Adelino, Manuel; Schoar, Antoinette; Severino, Felipe (2018). "The Role of Housing and Mortgage Markets in the Financial Crisis".

4273:

1619:

criticized for his role in the rise of the housing bubble and the subsequent problems in the mortgage industry that triggered the

8803:

8780:

8540:

7688:

7593:

7565:

6805:

6568:

6050:

6039:

5880:

5698:

5329:

5126:

4861:

4015:

2850:

This soft-landing scenario is a fantasy ... Anything housing-related is going to feel like a recession, almost like a depression.

1294:

545:

1100:, but a number of local bubbles. In 2007, however, Greenspan stated that "all the froth bubbles add up to an aggregate bubble".

832:

8700:

8453:

8310:

7679:

7607:

7600:

7314:

5819:

5671:

5639:

5116:

1809:

747:

584:

3117:

1664:

at Northern Rock branches across the UK by concerned customers who took out "an estimated £2bn withdrawn in just three days".

8881:

8851:

8672:

8240:

7999:

7614:

7486:

7427:

7409:

6704:

5585:

5314:

5284:

5205:

4626:

2911:"Eight Market Spins About Housing by Perma-Bull Spin-Doctors ... And the Reality of the Coming Ugliest Housing Bust Ever ..."

1744:

1678:

580:

243:

3487:

3182:

8048:

7479:

7304:

5345:

5200:

5066:

4524:

2910:

2400:

magazine's cover story for the article "After the fall", which illustrates a brick falling, with the label "House Prices".

2012:

1638:

990:

On the basis of 2006 market data that were indicating a marked decline, including lower sales, rising inventories, falling

726:

498:

446:

400:

7637:

8856:

8462:

8261:

7939:

4525:"Who is to Blame for the Mortgage Carnage and Coming Financial Disaster? Unregulated Free Market Fundamentalism Zealotry"

3995:

3626:

1629:

titled, "What Went Wrong". In their investigation, the authors claim that Greenspan vehemently opposed any regulation of

4955:

2661:

8861:

8614:

8510:

8071:

7572:

7329:

5490:

5375:

4882:

4542:

3564:

3429:

2154:

913:

233:

146:

3028:

8398:

8184:

7644:

7127:

6810:

5632:

5385:

5370:

5294:

4940:

4652:

875:

for several years, you may deem this prime time to liquidate investment property (for use in more lucrative markets).

571:

to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.

248:

228:

3278:

3202:

3162:

2753:

2141:

he American housing boom is now the mother of all bubbles—in sheer volume, if not in degrees of speculative madness.

684:

Problems for home owners with good credit surfaced in mid-2007, causing the United States' largest mortgage lender,

8233:

6144:

5613:

5240:

5071:

3870:

3865:

3840:

3309:

2585:

1327:

1013:

979:

616:

395:

3543:

1843:

8787:

8605:

8547:

8469:

7932:

7778:

7771:

7764:

7757:

7750:

7743:

7736:

7579:

6538:

5916:

5676:

5568:

5061:

3384:

1935:

1683:

1311:

for the housing corrections in the periods beginning in 2005 (red) and the 1980s–1990s (blue), comparing monthly

1090:

802:

588:

565:

439:

429:

390:

4414:

3225:

3150:

The worldwide rise in house prices is the biggest bubble in history. Prepare for the economic pain when it pops.

8759:

8642:

8476:

8439:

8361:

8268:

8177:

8092:

7284:

7264:

6729:

6359:

6242:

5834:

5726:

5608:

5485:

5220:

5215:

4836:

2077:

1459:

592:

521:

109:

4477:

4166:"Mortgage Distress and Financial Liquidity: How U.S. Families are Handling Savings, Mortgages and Other Debts"

4150:"Mortgage Distress and Financial Liquidity: How U.S. Families are Handling Savings, Mortgages and Other Debts"

4051:

he overall market value of housing has lost touch with economic reality. And there's a nasty correction ahead.

3449:

2355:

1833:"A Summary of the Primary Causes of the Housing Bubble and the Resulting Credit Crisis: A Non-Technical Paper"

1559:

announced that it could not fairly value the underlying assets in three funds because of its exposure to U.S.

8663:

8554:

8282:

7390:

5854:

5759:

5751:

5390:

5324:

5225:

5026:

4190:

4073:

3914:

3369:

2637:

2467:

This article classified several U.S. real-estate regions as "Dead Zones", "Danger Zones", and "Safe Havens".

303:

253:

138:

4132:

3947:

2185:

551:

A bubble had the potential to affect not only on home valuations, but also mortgage markets, home builders,

8871:

8370:

8324:

8122:

7967:

7450:

7294:

7238:

6843:

6582:

6520:

6203:

5718:

5694:

5309:

5121:

3890:

2776:

2693:

1730:

1270:

1228:

855:

722:

693:

325:

58:

5686:

3644:

3514:

2402:

8338:

8129:

7729:

7243:

7233:

6800:

6508:

6496:

6465:

4687:

4117:

4068:

3273:

2839:

2449:

1881:

1008:

National home sales and prices both fell dramatically in March 2007 — the steepest plunge since the 1989

355:

189:

4698:

4498:

4399:

4112:

2282:

8828:

8819:

8766:

8317:

6900:

6790:

6625:

6394:

6296:

6260:

6254:

6162:

6084:

5909:

5784:

5095:

4577:

4208:

3250:

2716:

2317:

investors. These days, the only thing that comes close to real estate as a national obsession is poker.

2031:

1736:

1201:

1083:

Economists have debated whether the early 2000s house price boom involved nationwide or local bubbles.

765:

417:

3869:

Condominium Price Appreciation (percentages) in the south and west United States, 2002–2006. (Source:

3765:

1660:

for emergency funds because of liquidity problems related to the subprime crisis. This precipitated a

8722:

8561:

8430:

6848:

6745:

6697:

6661:

6096:

5885:

5505:

5415:

5083:

5056:

4811:

4796:

4768:

4754:

4726:

4712:

4314:

3726:

3658:

3139:

1443:

bankruptcy on April 2, 2007, with liabilities exceeding $ 100 million (~$ 142 million in 2023).

1330:

chief economist David Lereah's explanation, "What Happened", from the 2006 NAR Leadership Conference

811:

774:

412:

385:

4740:

4040:

3292:

builders and communities. Contradicting another gloomy seer, Chicken Little, the sky is not falling.

2013:"When mainstream analysts compare CDOs to 'subslime', 'toxic waste' and 'six-inch hooker heels' ..."

1905:

1115:

Coast, the more populated part of the country where the economic real estate turmoil was the worst.

8423:

8136:

6760:

6562:

6550:

6180:

6114:

5789:

5655:

5500:

5255:

5131:

5019:

1646:

1611:

1487:

1436:

1423:

1398:

1240:

1036:

902:

783:

756:

509:

490:

89:

4986:

2871:

8876:

8736:

7376:

7042:

6931:

6780:

6613:

6574:

6502:

6284:

6272:

6108:

5210:

5078:

4841:

4619:

The Great American Housing Bubble: What Went Wrong and How We Can Protect Ourselves in the Future

3976:

2370:

2036:

1620:

1471:

1168:

1009:

407:

207:

3194:

1623:. On October 15, 2008, Anthony Faiola, Ellen Nakashima and Jill Drew wrote a lengthy article in

1563:

mortgage lending markets. Faced with potentially massive (though unquantifiable) exposure, the

836:

The median and average sales prices of new homes sold in the United States between 1963 and 2010

8686:

8226:

7142:

7102:

6868:

6607:

6587:

6556:

6532:

6448:

6218:

6102:

5230:

3313:

2076:. Wisconsin School of Business & The Lincoln Institute of Land Policy. 2015. Archived from

1873:

1673:

1568:

1382:

1087:

1086:

As early as 2005, because of non-uniform price appreciation, some economists, including former

738:

494:

2425:

2305:

2227:

1403:

8354:

8115:

8108:

7203:

7183:

7157:

7147:

7107:

6975:

6936:

6838:

6795:

6785:

6770:

6750:

6631:

6619:

6526:

6308:

6230:

6132:

6126:

6017:

6006:

5978:

5953:

5580:

5527:

5480:

4782:

4480:

4293:

3788:

3364:

3069:

2165:

America was awash in a stark, raving frenzy that looked every bit as crazy as dot-com stocks.

1630:

1564:

1432:

1231:

almost doubled from 1,170,413 in 1990 to 2,026,803 in 2006, due to its relative proximity to

685:

643:

608:

4865:

4679:

3821:

2576:"Adjustable-rate loans come home to roost: Some squeezed as interest rises, home values sag"

1414:

Bank by customers queuing to withdraw savings in a panic related to the U.S. subprime crisis

718:

481:

was a sharp run up and subsequent collapse of house asset prices affecting over half of the

8013:

7990:

7983:

7419:

7364:

7117:

7047:

6910:

6853:

6775:

6765:

6755:

6690:

6302:

6236:

6168:

6120:

6078:

5603:

3185:, July 16, 2008, by "Economics of Contempt", lists 25 sources rejecting the "bubble" label.

2823:

2430:

2310:

2232:

1900:

1634:

1205:

124:

4351:

3048:

1953:

8:

7274:

7097:

7092:

6926:

6831:

6826:

6421:

6383:

6365:

6338:

6320:

6090:

6055:

5994:

5968:

5890:

5563:

5495:

4979:

4960:

2666:

2123:

2098:

1930:

1625:

1596:

best interests of the U.S. economy because it would simply set a bad precedent, create a

1273:'s National Activity Index for February sent a signal that a recession probably begun".

628:

94:

3675:

912:

warned of the risks posed by subprime mortgages. In September 2003, at a hearing of the

8649:

7946:

7846:

7324:

7198:

7152:

7132:

6965:

6946:

6888:

6863:

6389:

6377:

6332:

6290:

6186:

6174:

6033:

5963:

5859:

5844:

5545:

5521:

5179:

5152:

4945:

4816:

4419:

4356:

4045:

4025:

3389:

3246:

2454:

2159:

2103:

1958:

1159:

996:

894:

881:

820:

636:

486:

3591:

2934:] TV programs. So, be prepared to understand this misinformation, myths and spins.

2246:

Plot of inflation-adjusted home price appreciation in several U.S. cities, 1990–2005:

2051:

1545:

will finally reveal the abyss into which the housing market is about to plummet." The

40:

8384:

8006:

7839:

7228:

7037:

7020:

6980:

6905:

6895:

6873:

6858:

6637:

6266:

6213:

6192:

6156:

6138:

6044:

6000:

5814:

5590:

4924:

4920:

4648:

4622:

3761:

3693:

3340:

2952:

2256:

Plot of inflation-adjusted home price appreciation in several U.S. cities, 1990–2005.

1740:

1703:

1642:

1312:

1308:

1266:

1177:

1108:

898:

730:

701:

624:

513:

4974:

3971:

3088:

2212:

7248:

7223:

7122:

7064:

7025:

6985:

6481:

6476:

6453:

6248:

5958:

4916:

4875:

4675:

4634:

4494:

2609:

2471:

1637:. They further claim that Greenspan actively sought to undermine the office of the

1607:

1560:

1451:

1419:

1040:

967:

930:

886:

689:

670:

4556:

1075:

8414:

8219:

7112:

7059:

6597:

6459:

6427:

6349:

6224:

6150:

5932:

5731:

5539:

5042:

4886:

4583:

4520:

4320:

4092:

3409:

3166:

3055:

2722:

1761:

1688:

1657:

1592:

1576:

1495:

1053:

909:

863:

also called the bubble early on and was vocal about it on television and wrote a

674:

651:

620:

548:, called the bursting housing bubble "the most significant risk to our economy".

175:

74:

5624:

4528:

2917:

2016:

1454:, a "most reputable financial guru", sarcastically and ominously criticized the

1381:

To better understand how the mortgage crisis played out, a 2012 report from the

8589:

7339:

7319:

7279:

7218:

7000:

6970:

6666:

6514:

6491:

6415:

6371:

6326:

6314:

5454:

5400:

5184:

4502:

4473:

3608:

3569:

3434:

2894:

2781:

1779:"S&P CoreLogic Case-Shiller Home Price Indices - S&P Dow Jones Indices"

1547:

1507:

1374:

1244:

1105:

1093:

1020:

678:

647:

632:

576:

561:

350:

273:

195:

183:

56:'s plot of U.S. home prices, population, building costs, and bond yields, from

53:

3630:

3007:

2796:

2688:

1874:"In Washington, big business and big money are writing the rules on trade ..."

8845:

8517:

8057:

7802:

7404:

7137:

7069:

7054:

6883:

6651:

6072:

5875:

5169:

5164:

5147:

4832:

4801:

4787:

4773:

4759:

4745:

4731:

4717:

4703:

3344:

3220:

3144:

2407:

2396:

1760:

Chodorow-Reich, Gabriel; Guren, Adam M.; McQuade, Timothy J. (October 2022).

1698:

1653:

1519:

1503:

1499:

1411:

1096:, argued that United States was not experiencing a nationwide housing bubble

938:

926:

908:

Other cautions came as early as 2001, when the late Federal Reserve governor

792:

612:

541:

525:

360:

4879:

3609:"D.R. Horton, Inc. (DHI) Stock Historical Prices & Data - Yahoo Finance"

32:

8041:

7722:

7309:

7208:

7193:

7167:

6990:

6956:

6656:

6278:

5948:

5943:

4936:

4928:

4278:

4234:

3952:

3895:

3492:

3198:

3183:

The Unofficial List of Pundits/Experts Who Were Wrong on the Housing Bubble

2638:"Existing home sales drop 4.1% in July, median prices drop in most regions"

2277:

1597:

1572:

1541:

1537:

1531:

1526:

1515:

1491:

1187:

975:

860:

568:

537:

529:

1079:

Inflation-adjusted housing prices in the United States by state, 1998–2006

639:

of the United Kingdom, Hong Kong, Spain, Poland, Hungary and South Korea.

8331:

8303:

8254:

8170:

7334:

7188:

7010:

7005:

6878:

6713:

6438:

6027:

5988:

5533:

5174:

4897:

4644:

4640:

The Two-Income Trap: Why Middle-Class Mothers and Fathers Are Going Broke

4384:

4258:

2599:

2329:

2252:

1989:

1762:"The 2000s Housing Cycle With 2020 Hindsight: A Neo-Kindlebergerian View"

1615:

seen in the subprime industry also emerge in the prime mortgage markets.

1603:

1556:

1483:

1475:

1427:

1281:

1261:

1236:

1119:

959:

890:

864:

666:

556:

552:

505:

345:

3328:

2390:

A prediction of a correction in the housing market, possibly after the "

7289:

7162:

4901:

4850:

3012:

2240:

1584:

1511:

1467:

1455:

1440:

1369:

1277:

1216:

1191:

1044:

849:

533:

482:

340:

3205:, by Alex Tabarrok, February 13, 2008 as rejecting the label "bubble".

3163:"President Highlights Importance of Small Business in Economic Growth"

929:

analyst too had warned in 2006 that companies could suffer from their

700:

was an important factor in the recovery, because a large component of

48:

4446:

3919:

3548:

3454:

2876:

No question about it, the housing downturn is here now, and it's big.

2844:

2642:

1540:, president of Euro Pacific Capital, argued that if the bonds in the

1232:

1212:

1131:

1123:

1028:

971:

697:

658:

in 2007, "I really didn't get it until very late in 2005 and 2006.".

335:

5901:

2797:"Median and Average Sales Prices of New Homes Sold in United States"

827:

8085:

7269:

7213:

7015:

6941:

6724:

5449:

4991:

4561:

4020:

2064:

2062:

2060:

1661:

1407:

917:

330:

8797:

Small Business Liability Relief and Brownfields Revitalization Act

5011:

1149:

4969:"America's Rental Housing: The Key to a Balanced National Policy"

4298:

3519:

3470:"S&P/Case-Shiller Home Price Indices-historical spreadsheets"

2758:

2614:

2190:

1896:"Housing woes take bigger toll on economy than expected: Paulson"

1552:

credit, leaving many of them struggling to stay in their homes."

1127:

922:

2981:"The Run-Up in Home Prices: Is it Real or Is it Another Bubble?"

2681:

2356:"From the subprime to the terrigenous: Recession begins at home"

2213:"Intended federal funds rate, Change and level, 1990 to present"

2110:

2057:

8491:

White House Office of Faith-Based and Neighborhood Partnerships

7074:

5434:

List of banks acquired or bankrupted during the Great Recession

3756:

3405:"Housing market may be on ice, but the blame market is red hot"

2391:

2052:

FACTBOX – U.S. government bailout tally tops 504 billion pounds

1926:"Housing Bubble Trouble: Have we been living beyond our means?"

1224:

1195:

991:

8744:

Committee on Climate Change Science and Technology Integration

6682:

4191:"We're in a new housing bubble: Why it's less scary this time"

2747:

2745:

893:, received a memo from David Andrukonis, the company's former

7030:

5780:

Acquired or bankrupt banks in the late 2000s financial crisis

5008:– CEPR regularly releases reports on the U.S. Housing Bubble.

2710:

2708:

2706:

2704:

1810:"Home prices off record 18% in past year, Case-Schiller says"

1447:

1303:

517:

7449:

5269:

4971:, Joint Center for Housing Studies, Harvard University, 2007

2386:

2384:

1600:, and worsen the speculation problem in the housing market.

615:

until unsustainable levels are reached relative to incomes,

6995:

2831:

2742:

1285:

Exchange; shares now trade on the over-the-counter market.

269:

Government intervention during the subprime mortgage crisis

3915:"US heading for house price crash, Greenspan tells buyers"

3752:"Chicago Fed index indicates recession has probably begun"

2701:

1759:

8525:

Economic Growth and Tax Relief Reconciliation Act of 2001

5775:

Dodd–Frank Wall Street Reform and Consumer Protection Act

5300:

Dodd–Frank Wall Street Reform and Consumer Protection Act

4125:

3049:

Why are my investments diving…and what can I do about it?

3033:

2999:

2983:. Center for Economic and Policy Research. Archived from

2930:

2924:

2381:

2205:

1019:

John A. Kilpatrick from Greenfield Advisors was cited by

365:

120:

Dodd–Frank Wall Street Reform and Consumer Protection Act

4113:"Moody's predicts big drop in Washington housing prices"

3789:"Woes at Loan Agencies and Oil-Price Spike Roil Markets"

3249:, Joint Center for Housing Studies. 2006. Archived from

1919:

1917:

1915:

4569:

4434:

4380:"Bear Stearns Hedge Fund Woes Stir Worry In CDO Market"

4254:"New Century Financial files for Chapter 11 bankruptcy"

4224:

4222:

3901:

There has never been a run up in home prices like this.

3814:"Fannie, Freddie Delisting Signals Firms Have No Value"

2821:

Hudson, Michael (May 2006). "The New Road to Serfdom".

1583:

In the wake of the mortgage industry meltdown, Senator

8694:

Tax Increase Prevention and Reconciliation Act of 2005

8447:

President's Council on Service and Civic Participation

8378:

Higher Education Relief Opportunities For Students Act

5411:

National fiscal policy response to the Great Recession

4902:"The baby boom, the baby bust, and the housing market"

4266:

2771:

2769:

2631:

2629:

2420:

2418:

2330:"DETECCIÓN DE BURBUJAS INMOBILIARIAS: EL CASO ESPAÑOL"

1392:

635:

of the 1990s. This bubble roughly coincides with the

284:

National fiscal policy response to the Great Recession

8532:

Jobs and Growth Tax Relief Reconciliation Act of 2003

4665:

4164:

Stafford, Frank; Chen, Bing; Schoeni, Robert (2012).

1912:

1474:, by the makeup, those six-inch hooker heels, and a "

8144:

Foreign Investment and National Security Act of 2007

4345:

4343:

4219:

3565:"Metro U.S. Home Prices Fall on Higher Foreclosures"

3450:"Greenspan: 'Local bubbles' build in housing sector"

2939:

2297:

2186:"Top five US subprime lenders asked to testify-Dodd"

1978:

1976:

585:

Federal Home Loan Mortgage Corporation (Freddie Mac)

162:

Government policies and the subprime mortgage crisis

7402:

5825:

Public–Private Investment Program for Legacy Assets

4953:

4686:

Glaeser, Edward L.; Nathanson, Charles G. (2015). "

4352:"$ 3.2 Billion Move by Bear Stearns to Rescue Fund"

4163:

3720:"Bureau of Economic Analysis GDP estimate, Q2 2007"

3376:

2766:

2626:

2443:

2441:

2415:

1215:in the U.S. economy following the dot-com bust and

5530:(Europe, Middle East and North Africa, Asia; 2009)

4576:

4549:

4545:. October 15, 2008 – via washingtonpost.com.

4413:Kanter, James; Werdigier, Julia (August 9, 2007).

4313:

4008:

3329:"Foreclosures, House Prices, and the Real Economy"

3327:Mian, Atif; Sufi, Amir; Trebbi, Francesco (2015).

3114:"Fannie Mae and Freddie Mac Subsidies Distort the"

2922:A lot of spin is being furiously spinned [

2754:"Greenspan says didn't see subprime storm brewing"

2715:

2007:

2005:

2003:

1985:"Recession will be nasty and deep, economist says"

1868:

1866:

1864:

1247:, saw its population triple between 1990 and 2006.

581:Federal National Mortgage Association (Fannie Mae)

508:rates in 2006–2007 among U.S. homeowners led to a

5654:

4880:The Business Cycle: A Georgist-Austrian Synthesis

4340:

3694:"LOUDOUN COUNTY POPULATION: 2017 ESTIMATE SERIES"

3659:"Sources and Uses of Equity Extracted from Homes"

3592:"Number of Stories in New One-Family Houses Sold"

3515:"Home prices tumble as consumer confidence sinks"

3430:"U.S. Mortgages Enter Foreclosure at Record Pace"

3232:

3208:

2881:

2855:

2219:

1973:

1888:

1842:. The Journal of Business Inquiry. Archived from

828:Contemporary discussion of the housing price boom

673:concluded, "We had a bubble", and concurred with

44:Median cost to purchase a home by U.S. metro area

8843:

8297:National Security Entry-Exit Registration System

7715:Joint session of Congress (September 11 attacks)

5338:

4837:"Is the Party Really Over For the Housing Boom?"

4294:"Merrill sells off assets from Bear hedge funds"

4154:JournalistsResource.org, retrieved June 18, 2012

3488:"California cities fill top 10 foreclosure list"

2592:

2438:

692:". The impact of booming home valuations on the

264:Federal Reserve responses to the subprime crisis

152:Causes of the 2000s United States housing bubble

4519:

4412:

4350:Creswell, Julie; Bajaj, Vikas (June 23, 2007).

4171:. Institute for Social Research. Archived from

3397:

3070:"At Freddie Mac, Chief Discarded Warning Signs"

2948:"Risky Lending Trends could Bust Mortgage Boom"

2827:. Vol. 312, no. 1872. pp. 39–46.

2814:

2179:

2177:

2175:

2173:

2116:

2000:

1861:

1153:Housing starts in the United States, 1959–2021

8629:Job Creation and Worker Assistance Act of 2002

8599:Farm Security and Rural Investment Act of 2002

5800:Federal takeover of Fannie Mae and Freddie Mac

5381:American Recovery and Reinvestment Act of 2009

5246:Office of Federal Housing Enterprise Oversight

4472:

3725:(Press release). July 27, 2007. Archived from

3481:

3479:

3326:

3020:

2146:

2099:Tax Break May Have Helped Cause Housing Bubble

1446:The manager of the world's largest bond fund,

974:generation, and healthy levels of employment.

654:in housing", and also said in the wake of the

239:American Recovery and Reinvestment Act of 2009

157:Credit rating agencies and the subprime crisis

7435:

7345:List of housing markets by real estate prices

6698:

5917:

5640:

5027:

4831:

4493:

4349:

3837:"Real Estate Reality Check (Powerpoint talk)"

3029:"The Man Who Predicted The Economic Meltdown"

1947:

1945:

1439:investigations, before ultimately filing for

447:

105:2000s United States housing market correction

8657:Emergency Economic Stabilization Act of 2008

8636:Mortgage Forgiveness Debt Relief Act of 2007

8569:Energy Independence and Security Act of 2007

5770:Emergency Economic Stabilization Act of 2008

5305:Emergency Economic Stabilization Act of 2008

4935:

4617:Levitin, Adam J.; Wachter, Susan M. (2020).

3645:"Pulte Corp. 1996 Form 10-K – Annual report"

2902:

2659:

2655:

2653:

2353:

2170:

1954:"Lender Sees Mortgage Woes for 'Good' Risks"

1288:

714:Timeline of the United States housing bubble

259:Emergency Economic Stabilization Act of 2008

36:Median cost to purchase a home by U.S. state

8583:Financial Literacy and Education Commission

8206:Government response to September 11 attacks

8192:Emmett Till Unsolved Civil Rights Crime Act

5840:2009 Supervisory Capital Assessment Program

5810:Homeowners Affordability and Stability Plan

4891:American Journal of Economics and Sociology

4188:

4080:

4064:"Housing bubble correction could be severe"

3476:

3385:"Getting real about the real estate bubble"

2600:"Over 14,000 Phoenix For-Sale Homes Vacant"

2117:Evans-Pritchard, Ambrose (March 23, 2006).

1307:Comparison of the percentage change in the

970:, an anticipated increased demand from the

950:

289:Regulatory responses to the subprime crisis

8622:Food, Conservation, and Energy Act of 2008

8164:Adam Walsh Child Protection and Safety Act

7442:

7428:

7385:

6705:

6691:

5924:

5910:

5850:Term Asset-Backed Securities Loan Facility

5647:

5633:

5442:

5396:Fraud Enforcement and Recovery Act of 2009

5320:Term Asset-Backed Securities Loan Facility

5034:

5020:

4896:

4849:

3026:

2751:

2689:"Alan Greenspan Interview with Jim Lehrer"

2602:. The Housing Bubble Blog. March 10, 2006.

2369:Guide, Global Property (August 25, 2008).

2155:"Lowering the Boom? Speculators Gone Mild"

2015:RGE Monitor. June 27, 2007. Archived from

1942:

1923:

1260:during 2000–2005 began to experience high

1066:Causes of the United States housing bubble

867:detailing his predictions of the fallout.

843:

454:

440:

299:Term Asset-Backed Securities Loan Facility

8576:Fair and Accurate Credit Transactions Act

8199:Genetic Information Nondiscrimination Act

7833:Jordan–United States Free Trade Agreement

5765:Housing and Economic Recovery Act of 2008

5576:Effects of the Great Recession on museums

5406:Housing and Economic Recovery Act of 2008

5290:China–Japan–South Korea trilateral summit

4769:"The American economy: A phoney recovery"

4694:, Elsevier, vol. 5, pp. 701–751

3912:

3544:"Cleveland: Foreclosures weigh on market"

2972:

2650:

1043:mortgage industry in March 2007, Senator

294:Subprime mortgage crisis solutions debate

279:Housing and Economic Recovery Act of 2008

202:China–Japan–South Korea trilateral summit

7413:) is being considered for deletion. See

5270:Government policy and spending responses

5236:Government National Mortgage Association

4954:Robert J. Samuelson (October 11, 2006).

4692:Handbook of Regional and Urban Economics

4110:

4088:"Study sees '07 'crash' in some housing"

3864:

3786:

3485:

3267:Retsinas, Nicolas (September 26, 2006).

3266:

3240:"The State of the Nation's Housing 2006"

2861:

2608:

2265:

2251:

2152:

1694:Mortgage Electronic Registration Systems

1652:On September 13, 2007, the British bank

1402:

1302:

1148:

1074:

831:

717:

579:. Because of the large market share of

222:Government response and policy proposals

47:

39:

31:

8804:Water Resources Development Act of 2007

8541:Consumer Product Safety Improvement Act

7566:Dismissal of U.S. attorneys controversy

5881:Financial position of the United States

5330:2008 United Kingdom bank rescue package

5006:Center for Economic and Policy Research

4977:, Steven Gjerstad and Vernon L. Smith,

4862:Center for Economic and Policy Research

4809:

4680:10.1146/annurev-financial-110217-023036

4315:"H&R Block struck by subprime loss"

4135:. Finfacts Ireland. September 3, 2007.

4038:

2945:

2908:

2890:"Bloomberg Interview of Robert Shiller"

2887:

2752:Felsenthal, Mark (September 14, 2007).

2303:

2225:

2183:

2029:

2023:

1982:

1728:

1641:, specifically under the leadership of

1295:United States housing market correction

14:

8844:

8701:Tax Relief and Health Care Act of 2006

8311:Secondary Security Screening Selection

4591:from the original on December 11, 2022

4328:from the original on December 11, 2022

3834:

3787:Grynbaum, Michael M. (July 12, 2008).

3427:

3303:

3067:

3027:Folkenflik, David (December 4, 2008).

2946:Smalkin, Frederic N.C. (May 9, 2005).

2840:"Is economy headed to a soft landing?"

2837:

2820:

2730:from the original on December 11, 2022

2635:

2568:

2371:"The end of Poland's house price boom"

1355:First-time buyers priced out of market

8867:Economic history of the United States

8241:National Construction Safety Team Act

8000:Strategic Offensive Reductions Treaty

7423:

6686:

5931:

5905:

5628:

5315:Temporary Liquidity Guarantee Program

5285:Banking (Special Provisions) Act 2008

5268:

5206:Federal Deposit Insurance Corporation

5015:

4810:Fackler, Martin (December 25, 2005).

4442:"Next: The real estate market freeze"

4377:

4209:"American house prices: realty check"

3948:"Buffett: Real estate slowdown ahead"

3945:

3913:Searjeant, Graham (August 27, 2005).

3888:

3562:

3382:

3357:

3089:"Did Greenspan Add to Subprime Woes?"

3005:

2978:

2475:magazine Housing Bubble "Dead Zones"

2447:

2368:

2273:"Is A Housing Bubble About To Burst?"

1951:

1924:Laperriere, Andrew (April 10, 2006).

1724:

1722:

1720:

1718:

1679:2010 United States foreclosure crisis

1340:Affordability conditions deteriorated

244:Banking (Special Provisions) Act 2008

8774:Magnuson–Stevens Reauthorization Act

8673:Renovation, Repair and Painting Rule

8290:U.S. Department of Homeland Security

7372:

5201:Consumer Financial Protection Bureau

4909:Regional Science and Urban Economics

4668:Annual Review of Financial Economics

3806:

3541:

3413:. September 10, 2006. Archived from

2909:Roubini, Nouriel (August 26, 2006).

2717:"Greenspan alert on US house prices"

2524:Washington D.C. / Northern Virginia

2153:Levenson, Eugenia (March 15, 2006).

2030:Solomon, Deborah (August 31, 2007).

1983:Roubini, Nouriel (August 23, 2006).

1639:Commodity Futures Trading Commission

1337:Mortgage rates rose almost one point

1070:

627:. This bubble may be related to the

499:Great Recession in the United States

115:2008–2010 automotive industry crisis

8463:Prison Rape Elimination Act of 2003

7940:Darfur Peace and Accountability Act

5491:Collateralized mortgage obligations

5041:

4741:"Will the walls come falling down?"

4578:"Banks remain under fire in London"

2888:Shiller, Robert (August 20, 2006).

1824:

1807:

1393:Subprime mortgage industry collapse

1227:in some regions. The population of

985:

656:subprime mortgage and credit crisis

24:

8615:Flood Insurance Reform Act of 2004

8511:American Jobs Creation Act of 2004

7882:Dominican Republic–Central America

7330:Undergraduate real estate programs

4812:"Take It From Japan: Bubbles Hurt"

4606:

4557:"Northern Rock asks for Bank help"

4111:Clabaugh, Jeff (October 2, 2006).

3972:"Surviving a Real-Estate Slowdown"

3542:Knox, Noelle (November 21, 2006).

3428:Howley, Kathleen (June 14, 2007).

3086:

3068:Duhigg, Charles (August 5, 2008).

2662:"Existing-Home Sales Fall Steeply"

1904:. October 17, 2007. Archived from

1715:

1418:In March 2007, the United States'

1204:– primarily home equity loans and

914:House Financial Services Committee

468:2000s United States housing bubble

147:Causes of the European debt crisis

100:2000s United States housing bubble

25:

8893:

8185:Born-Alive Infants Protection Act

7417:to help reach a consensus. ›

7128:Investment rating for real estate

5586:2007–2008 world food price crisis

5386:Chinese economic stimulus program

5371:2008 European Union stimulus plan

5295:Commercial Paper Funding Facility

4999:

4096:. October 5, 2006. Archived from

4039:Krugman, Paul (January 2, 2006).

3843:Leadership Summit. Archived from

3835:Lereah, David (August 17, 2006).

3563:Lynch, Sharon (October 2, 2008).

3486:Christie, Les (August 14, 2007).

2864:"New home sales continue to fall"

2862:Hamilton, Jim (August 25, 2006).

2636:Lereah, David (August 24, 2005).

2304:Shiller, Robert (June 20, 2005).

2226:Shiller, Robert (June 20, 2005).

2119:"No mercy now, no bail-out later"

1518:was imperiled in June 2007 after

1426:due to higher-than-expected home

1352:Trade-up buyers went to sidelines

249:Chinese economic stimulus program

229:2008 European Union stimulus plan

8392:Criticism of government response

8371:Higher Education Opportunity Act

8262:President's Surveillance Program

7384:

7371:

7359:

7358:

6051:1830s Chicago real estate bubble

6040:1810s Alabama real estate bubble

5614:List of countries by public debt

5241:National Asset Management Agency

4983:, April 6, 2009, includes charts

4637:and Amelia Warren Tyagi (2003).

4535:

4513:

4487:

4466:

4450:. March 12, 2007. Archived from

4415:"Big French Bank Suspends Funds"

4406:

4402:(Press release). August 9, 2007.

4392:

4371:

4306:

4286:

4024:. August 8, 2006. Archived from

3996:"Surviving Real Estate Slowdown"

3841:National Association of Realtors

3764:. March 24, 2008. Archived from

3627:"Pulte Corp. 2006 Annual Report"

3383:Tully, Shawn (August 25, 2005).

3310:National Association of Realtors

2184:Poirier, John (March 19, 2007).

2070:"Land Prices for 46 Metro Areas"

1830:

1343:Speculative investors pulled out

980:National Association of Realtors

978:, former chief economist of the

964:Joint Center for Housing Studies

925:reported in October 2007 that a

589:government-sponsored enterprises

8788:Renewable Identification Number

8606:Forest Land Enhancement Program

8548:Credit Rating Agency Reform Act

8470:Public Service Loan Forgiveness

8248:NIST WTC Disaster Investigation

6712:

5569:2008 Central Asia energy crisis

5486:Collateralized debt obligations

4855:"The Housing Bubble Fact Sheet"

4378:Wines, Leslie (June 21, 2007).

4246:

4238:. March 7, 2007. Archived from

4201:

4189:Diana Olick (August 29, 2016).

4182:

4157:

4142:

4104:

4072:. June 13, 2006. Archived from

4056:

4032:

3988:

3964:

3939:

3906:

3882:

3828:

3820:. June 16, 2010. Archived from

3780:

3744:

3712:

3686:

3668:

3651:

3637:

3619:

3601:

3584:

3556:

3535:

3507:

3462:

3442:

3421:

3351:

3320:

3297:

3260:

3224:. June 22, 2005. Archived from

3188:

3176:

3155:

3132:

3106:

3080:

3061:

3041:

2789:

2660:Nancy Trejos (April 24, 2007).

2362:

2347:

2322:

2281:. July 19, 2004. Archived from

2092:

2044:

1510:. The solvency of two troubled

1349:Resort buyers went to sidelines

1141:

566:Chairman of the Federal Reserve

8760:Diesel Emissions Reduction Act

8680:SAFE Transportation Equity Act

8643:Pension Protection Act of 2006

8477:Unborn Victims of Violence Act

8440:Partial-Birth Abortion Ban Act

8362:Election Assistance Commission

8269:Terrorist Surveillance Program

8178:Bipartisan Campaign Reform Act

7673:State funeral of Ronald Reagan

7285:Graduate real estate education

6730:Tertiary sector of the economy

6243:Western Australian gold rushes

5835:Primary Dealer Credit Facility

5704:Role of credit rating agencies

5664:Background / timeline

5376:2008–2009 Keynesian resurgence

5221:Federal Housing Finance Agency

5216:Federal Housing Administration

3676:"America's Unsustainable Boom"

3358:Baker, Dean (August 2, 2006).

3006:Baker, Dean (August 9, 2004).

2838:Leamer, Ed (August 23, 2006).

2615:houses for sale in Phoenix, AZ

2584:. June 2, 2014. Archived from

2032:"Bush Moves to Aid Homeowners"

1952:Bajaj, Vikas (July 25, 2007).

1801:

1771:

1753:

593:Federal Housing Administration

555:, home supply retail outlets,

546:U.S. Secretary of the Treasury

522:collateralized debt obligation

234:2008–2009 Keynesian resurgence

13:

1:

8664:Troubled Asset Relief Program

8555:Economic Stimulus Act of 2008

8283:Homeland Security Act of 2002

5855:Troubled Asset Relief Program

5760:Economic Stimulus Act of 2008

5656:U.S. subprime mortgage crisis

5391:Economic Stimulus Act of 2008

5325:Troubled Asset Relief Program

5251:Office of Financial Stability

5226:Federal Housing Finance Board

5160:Société Générale trading loss

4527:. RGE Monitor. Archived from

3889:Baker, Dean (July 27, 2004).

3360:"The Slow Motion Train Wreck"

3304:Lereah, David (August 2005).

2358:. Land Values Research Group.

2354:G.R. Putland (June 1, 2009).

1309:Case-Shiller Home Price Index

921:debt will also have a loss."

598:

495:Case–Shiller home price index

489:, it was the impetus for the

304:Troubled Asset Relief Program

254:Economic Stimulus Act of 2008

8882:Presidency of George W. Bush

8852:United States housing bubble

8325:Terrorist Screening Database

8276:NSA warrantless surveillance

8123:H-1B Visa Reform Act of 2004

7968:Vision for Space Exploration

7680:State funeral of Gerald Ford

7451:Presidency of George W. Bush

7410:Presidency of George W. Bush

7239:Real estate investment trust

6844:Extraterrestrial real estate

6672:U.S. higher education bubble

6583:Chinese stock bubble of 2007

6545:United States housing bubble

6539:2000s Danish property bubble

6521:Baltic states housing bubble

6297:Second Nova Scotia Gold Rush

5695:United States housing bubble

5310:Irish emergency budget, 2009

4975:"From Bubble to Depression?"

4956:"Home Is Where the Worry Is"

4921:10.1016/0166-0462(89)90005-7

4688:Chapter 11 - Housing Bubbles

4621:. Harvard University Press.

4069:U.S. News & World Report

3946:Zweig, Jason (May 8, 2006).

2694:The NewsHour with Jim Lehrer

2448:Tully, Shawn (May 5, 2006).

2426:"The No-Money-Down Disaster"

1486:investment banks trading in

1346:Homebuyer confidence plunged

1271:Chicago Federal Reserve Bank

1229:Riverside County, California

361:Royal Bank of Scotland Group

326:American International Group

18:United States housing bubble

7:

8346:FISA Amendments Act of 2008

8339:Protect America Act of 2007

8130:L-1 Visa Reform Act of 2004

7244:Real property administrator

7234:Real estate investment club

6509:Japanese asset price bubble

6497:New Zealand property bubble

6466:New Zealand property bubble

6395:Third Nova Scotia Gold Rush

6163:First Nova Scotia Gold Rush

4659:

4230:"The Mortgage Mess Spreads"

4118:Washington Business Journal

3274:Scripps Howard News Service

3203:Was there a Housing Bubble?

2979:Baker, Dean (August 2002).

1684:Financial crisis of 2007–08

1667:

1202:Mortgage equity withdrawals

707:

10:

8898:

8857:2000s in the United States

8767:Healthy Forests Initiative

8408:Medicare Modernization Act

8318:Terrorist Screening Center

8213:Rescue and recovery effort

8049:August 2001 daily briefing

7666:Presidential proclamations

6901:Private equity real estate

6626:Australian property bubble

6261:Tierra del Fuego gold rush

6145:Colorado River mining boom

6085:Queen Charlottes Gold Rush

5785:Capital Assistance Program

5727:2007–2008 financial crisis

5609:2007–2008 financial crisis

5501:Mortgage-backed securities

5112:Automotive industry crisis

4699:"Hear that hissing sound?"

2450:"Welcome to the Dead Zone"

1737:Princeton University Press

1612:mortgage-backed securities

1488:mortgage-backed securities

1396:

1292:

1220:market began a correction.

1063:

879:An August 2008 article in

711:

663:mortgage and credit crisis

540:markets. In October 2007,

110:2007–2008 financial crisis

8862:2000s in economic history

8813:

8723:Clean Boating Act of 2008

8710:

8562:Energy Policy Act of 2005

8500:

8431:Highly qualified teachers

8153:

7847:Trade promotion authority

7792:

7707:Joint session of Congress

7698:

7467:

7458:

7353:

7257:

7176:

7083:

6955:

6919:

6849:International real estate

6819:

6738:

6720:

6662:Social media stock bubble

6647:

6596:

6475:

6437:

6404:

6348:

6204:2nd Industrial Revolution

6202:

6097:New South Wales gold rush

6065:

6018:1st Industrial Revolution

6016:

5977:

5939:

5886:Foreclosure rescue scheme

5868:

5795:Federal Reserve responses

5750:

5742:Indirect economic effects

5717:

5699:housing market correction

5685:

5662:

5599:

5556:

5514:

5506:Secondary mortgage market

5471:

5427:rescues, and acquisitions

5425:Government interventions,

5424:

5416:Zero interest-rate policy

5363:

5275:

5264:

5193:

5140:

5127:Housing market correction

5104:

5049:

4987:"Mired in Disequilibrium"

4900:; Weil, David N. (1989).

3087:Ip, Greg (June 9, 2007).

2394:" of 2005, is implied by

1466:AAA? You were wooed, Mr.

1334:Boom ended in August 2005

1289:Housing market correction

1059:

885:eported that in mid-2004

8820:← Clinton administration

8424:No Child Left Behind Act

8137:Secure Fence Act of 2006

7594:Supreme Court candidates

7559:Legislation and programs

7415:templates for discussion

6563:Canadian property bubble