197:; the employer's old, new and foreign competitors; the changing demographics of the workforce; changes in the internal revenue code; changes in the attitude of the internal revenue service regarding the calculation of surpluses; and equally importantly, both the short and long term financial and economic trends. It is common with mergers and acquisitions that several pension plans have to be combined or at least administered on an equitable basis. When benefit changes occur, old and new benefit plans have to be blended, satisfying new social demands and various government discrimination test calculations, and providing employees and retirees with understandable choices and transition paths. Benefit plans liabilities have to be properly valued, reflecting both earned benefits for past service, and the benefits for future service. Finally, funding schemes have to be developed that are manageable and satisfy the standards board or regulators of the appropriate country, such as the

500:

precalculated columns of summations over time of discounted values of survival and death probabilities). Actuarial organizations were founded to support and further both actuaries and actuarial science, and to protect the public interest by promoting competency and ethical standards. However, calculations remained cumbersome, and actuarial shortcuts were commonplace. Non-life actuaries followed in the footsteps of their life insurance colleagues during the 20th century. The 1920 revision for the New-York based

National Council on Workmen's Compensation Insurance rates took over two months of around-the-clock work by day and night teams of actuaries. In the 1930s and 1940s, the mathematical foundations for

360:

models. Ideas from financial economics became increasingly influential in actuarial thinking, and actuarial science has started to embrace more sophisticated mathematical modelling of finance. Today, the profession, both in practice and in the educational syllabi of many actuarial organizations, is cognizant of the need to reflect the combined approach of tables, loss models, stochastic methods, and financial theory. However, assumption-dependent concepts are still widely used (such as the setting of the discount rate assumption as mentioned earlier), particularly in North

America.

5219:

33:

1380:

they now provided for the necessary funeral expenses by paying into the common fund weekly a small fixed sum, easily within the reach of the poorest of them. When a member died, a stated sum was drawn from the treasury for his funeral....If the purpose of the society was the building of a columbārium, the cost was first determined and the sum total divided into what we should call shares (sortēs virīlēs), each member taking as many as he could afford and paying their value into the treasury.

5205:

136:, and annuities. These long term coverages required that money be set aside to pay future benefits, such as annuity and death benefits many years into the future. This requires estimating future contingent events, such as the rates of mortality by age, as well as the development of mathematical techniques for discounting the value of funds set aside and invested. This led to the development of an important actuarial concept, referred to as the

5243:

5231:

279:

predict the chance of re-offending according to rating factors which include the type of crime, age, educational background and ethnicity of the offender. However, these models have been open to criticism as providing justification for discrimination against specific ethnic groups by law enforcement personnel. Whether this is statistically correct or a self-fulfilling correlation remains under debate.

222:(SSI) program, a general-revenue financed, means-tested program for low-income aged, blind and disabled people. The office provides technical and consultative services to the Commissioner, to the board of trustees of the Social Security Trust Funds, and its staff appears before Congressional Committees to provide expert testimony on the actuarial aspects of Social Security issues.

459:. One could now set up an insurance scheme to provide life insurance or pensions for a group of people, and to calculate with some degree of accuracy how much each person in the group should contribute to a common fund assumed to earn a fixed rate of interest. The first person to demonstrate publicly how this could be done was

1379:

Early in the Empire, associations were formed for the purpose of meeting the funeral expenses of their members, whether the remains were to be buried or cremated, or for the purpose of building columbāria, or for both....If the members had provided places for the disposal of their bodies after death,

363:

Product design adds another dimension to the debate. Financial economists argue that pension benefits are bond-like and should not be funded with equity investments without reflecting the risks of not achieving expected returns. But some pension products do reflect the risks of unexpected returns. In

262:

insurance. The insurance industry also provides coverage for exposures such as catastrophe, weather-related risks, earthquakes, patent infringement and other forms of corporate espionage, terrorism, and "one-of-a-kind" (e.g., satellite launch). Actuarial science provides data collection, measurement,

1768:

My task is now finished....those who are here interred have received part of their honours already, and for the rest, their children will be brought up till manhood at the public expense: the state thus offers a valuable prize, as the garland of victory in this race of valour, for the reward both of

359:

The potential of modern financial economics theory to complement existing actuarial science was recognized by actuaries in the mid-twentieth century. In the late 1980s and early 1990s, there was a distinct effort for actuaries to combine financial theory and stochastic methods into their established

263:

estimating, forecasting, and valuation tools to provide financial and underwriting data for management to assess marketing opportunities and the nature of the risks. Actuarial science often helps to assess the overall risk from catastrophic events in relation to its underwriting capacity or surplus.

257:

companies tend to specialize because of the complexity and diversity of risks. One division is to organize around personal and commercial lines of insurance. Personal lines of insurance are for individuals and include fire, auto, homeowners, theft and umbrella coverages. Commercial lines address the

508:

methods they had used in the past. The introduction and development of the computer further revolutionized the actuarial profession. From pencil-and-paper to punchcards to current high-speed devices, the modeling and forecasting ability of the actuary has rapidly improved, while still being heavily

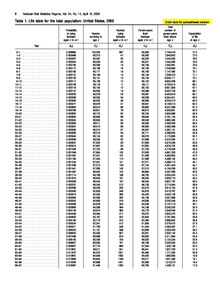

499:

In the 18th and 19th centuries, calculations were performed without computers. The computations of life insurance premiums and reserving requirements are rather complex, and actuaries developed techniques to make the calculations as easy as possible, for example "commutation functions" (essentially

490:

is often considered the father of modern actuarial science for his work in the field in the 1780s and 90s. Many other life insurance companies and pension funds were created over the following 200 years. Equitable Life was the first to use the word "actuary" for its chief executive officer in 1762.

332:

Historically, much of the foundation of actuarial theory predated modern financial theory. In the early twentieth century, actuaries were developing many techniques that can be found in modern financial theory, but for various historical reasons, these developments did not achieve much recognition.

1730:

The

Commutation Functions are a computational device to ensure that net single premiums...can all be obtained from a single table lookup. Historically, this idea has been very important in saving calculational labor when arriving at premium quotes. Even now...company employees without quantitative

282:

Another example is the use of actuarial models to assess the risk of sex offense recidivism. Actuarial models and associated tables, such as the MnSOST-R, Static-99, and SORAG, have been used since the late 1990s to determine the likelihood that a sex offender will re-offend and thus whether he or

217:

and the

Federal Disability Insurance Trust Fund, conducts studies of program financing, performs actuarial and demographic research on social insurance and related program issues involving mortality, morbidity, utilization, retirement, disability, survivorship, marriage, unemployment, poverty, old

343:

concepts used in modern finance. The divergence is not related to the use of historical data and statistical projections of liability cash flows, but is instead caused by the manner in which traditional actuarial methods apply market data with those numbers. For example, one traditional actuarial

278:

There is an increasing trend to recognize that actuarial skills can be applied to a range of applications outside the traditional fields of insurance, pensions, etc. One notable example is the use in some US states of actuarial models to set criminal sentencing guidelines. These models attempt to

192:

In the pension industry, actuarial methods are used to measure the costs of alternative strategies with regard to the design, funding, accounting, administration, and maintenance or redesign of pension plans. The strategies are greatly influenced by short-term and long-term bond rates, the funded

108:

Many universities have undergraduate and graduate degree programs in actuarial science. In 2010, a study published by job search website CareerCast ranked actuary as the #1 job in the United States. The study used five key criteria to rank jobs: environment, income, employment outlook, physical

421:

and assurance pacts can be traced back to various forms of fellowship within the Saxon clans of

England and their Germanic forebears, and to Celtic society. However, many of these earlier forms of surety and aid would often fail due to lack of understanding and knowledge.

491:

Previously, "actuary" meant an official who recorded the decisions, or "acts", of ecclesiastical courts. Other companies that did not use such mathematical and scientific methods most often failed or were forced to adopt the methods pioneered by

Equitable.

430:

The 17th century was a period of advances in mathematics in

Germany, France and England. At the same time there was a rapidly growing desire and need to place the valuation of personal risk on a more scientific basis. Independently of each other,

101:. Historically, actuarial science used deterministic models in the construction of tables and premiums. The science has gone through revolutionary changes since the 1980s due to the proliferation of high speed computers and the union of

179:

In health insurance, including insurance provided directly by employers, and social insurance, actuarial science focuses on the analysis of rates of disability, morbidity, mortality, fertility and other contingencies. The effects of

81:

are professionals trained in this discipline. In many countries, actuaries must demonstrate their competence by passing a series of rigorous professional examinations focused in fields such as probability and predictive analysis.

212:

plans and directs a program of actuarial estimates and analyses relating to SSA-administered retirement, survivors and disability insurance programs and to proposed changes in those programs. It evaluates operations of the

482:'s pioneering work on the long term insurance contracts under which the same premium is charged each year led to the formation of the Society for Equitable Assurances on Lives and Survivorship (now commonly known as

189:(RBRVS) at Harvard in a multi-disciplined study. Actuarial science also aids in the design of benefit structures, reimbursement standards, and the effects of proposed government standards on the cost of healthcare.

184:

and the geographical distribution of the utilization of medical services and procedures, and the utilization of drugs and therapies, is also of great importance. These factors underlay the development of the

409:. A small sum was paid into a communal fund on a weekly basis, and upon the death of a member, the fund would cover the expenses of rites and burial. These societies sometimes sold shares in the building of

1140:"An Estimate of the Degrees of the Mortality of Mankind, Drawn from Curious Tables of the Births and Funerals at the City of Breslaw; with an Attempt to Ascertain the Price of Annuities Upon Lives"

307:

270:

fields, actuarial science can be used to design and price reinsurance and retrocession arrangements, and to establish reserve funds for known claims and future claims and catastrophes.

299:

1915:

1402:

247:. In these forms of insurance, coverage is generally provided on a renewable period, (such as a yearly). Coverage can be cancelled at the end of the period by either party.

258:

insurance needs of businesses and include property, business continuation, product liability, fleet/commercial vehicle, workers compensation, fidelity and surety, and

164:

to produce life insurance, annuities and endowment policies. Contemporary life insurance programs have been extended to include credit and mortgage insurance,

132:

Actuarial science became a formal mathematical discipline in the late 17th century with the increased demand for long-term insurance coverage such as burial,

1082:

1667:

Silver, Eric; Chow-Martin, Lynette (October 2002). "A Multiple Models

Approach To Assessing Recidivism Risk: Implications for Judicial Decision Making".

364:

some cases, the pension beneficiary assumes the risk, or the employer assumes the risk. The current debate now seems to be focusing on four principles:

1455:

295:

in the US have different practices, which is caused by different ways of calculating funding and investment strategies, and by different regulations.

2730:

1594:

218:

age, families with children, etc., and projects future workloads. In addition, the Office is charged with conducting cost analyses relating to the

385:

Essentially, financial economics state that pension assets should not be invested in equities for a variety of theoretical and practical reasons.

1516:

1147:

311:

75:

and other industries and professions. More generally, actuaries apply rigorous mathematics to model matters of uncertainty and life expectancy.

4340:

2745:

2010:

1782:

455:, of people of the same age, despite the uncertainty of the date of death of any one individual. This study became the basis for the original

4845:

1872:

1990:

4995:

2740:

4619:

3260:

2116:

1410:

259:

1102:

976:

4393:

1326:

4832:

2750:

2735:

1834:

1564:

1352:

3255:

2955:

2005:

483:

315:

198:

1246:

3859:

3007:

1951:

336:

As a result, actuarial science developed along a different path, becoming more reliant on assumptions, as opposed to the

186:

2146:

1406:

1490:"The Technique of Rate Making as Illustrated by the 1920 National Revision of Workmen's Compensations Insurance Rates"

4642:

4534:

2075:

1649:

1427:

1064:

504:

processes were developed. Actuaries could now begin to estimate losses using models of random events, instead of the

5247:

4820:

4694:

2141:

1565:"The Impact of Residency Restrictions on Sex Offenders and Correctional Management Practices: A Literature Review"

1276:

4878:

4539:

4284:

3655:

3245:

2720:

2111:

2101:

544:

214:

1086:

4929:

4141:

3948:

3837:

3795:

2725:

303:

209:

3869:

5172:

4131:

3034:

1920:

1393:

559:

4723:

4672:

4657:

4647:

4516:

4388:

4355:

4181:

4136:

3966:

2883:

2131:

2032:

1543:

1470:

479:

439:

emerged as a well-understood mathematical discipline. Another important advance came in 1662 from a London

219:

1617:

1277:"Commentary: Behind the Ideology and Theory: What Is the Empirical Evidence for Medical Savings Accounts?"

340:

5289:

5235:

5067:

4868:

4792:

4093:

3847:

3516:

2980:

2700:

2397:

2343:

2182:

2017:

1817:

205:

111:

1197:"The Shaping of Chance: Actuarial Models and Criminal Profiling at the Turn of the Twenty-First Century"

982:. Revised November 19, 2004. California Health Benefits Review Program. February 9, 2004. Archived from

5269:

4952:

4924:

4919:

4667:

4426:

4332:

4312:

4220:

3931:

3749:

3232:

3104:

2348:

2212:

2106:

1056:

1052:

509:

dependent on the assumptions input into the models, and actuaries needed to adjust to this new world .

1524:

4684:

4452:

4173:

4098:

4027:

3956:

3876:

3864:

3734:

3722:

3715:

3423:

3144:

2427:

2316:

2126:

2027:

1348:

1028:

394:

17:

5284:

5167:

4934:

4797:

4482:

4447:

4411:

4196:

3638:

3547:

3506:

3418:

3109:

2948:

2800:

2552:

2457:

2422:

2402:

2070:

2022:

1571:

554:

487:

169:

1879:

401:, associations were formed to meet the expenses of burial, cremation, and monuments—precursors to

371:

assets and liabilities with identical cash flows should have the same price. This is at odds with

5076:

4689:

4629:

4566:

4204:

4188:

3926:

3788:

3778:

3628:

3542:

2921:

2603:

2392:

2260:

2207:

2065:

2055:

1944:

1548:

534:

519:

173:

5114:

5044:

4837:

4774:

4529:

4416:

3413:

3310:

3217:

3096:

2995:

2695:

2328:

2156:

1361:. Revised by Mary Johnston. Chicago, Atlanta: Scott, Foresman and Company. pp. §475–§476.

467:

fame). Halley constructed his own life table, and showed how it could be used to calculate the

5139:

5081:

5024:

4850:

4743:

4652:

4378:

4262:

4121:

4113:

4003:

3995:

3810:

3706:

3684:

3643:

3608:

3575:

3521:

3496:

3451:

3390:

3350:

3152:

2975:

2710:

2596:

2525:

2380:

2265:

2227:

569:

194:

1742:

5062:

4637:

4586:

4562:

4524:

4442:

4421:

4373:

4252:

4230:

4199:

4108:

3985:

3936:

3854:

3827:

3783:

3739:

3501:

3277:

3157:

2819:

2762:

2385:

2365:

2192:

2080:

2000:

1196:

1117:

349:

165:

94:

1791:

1712:

1489:

1002:

8:

5279:

5209:

5134:

5057:

4738:

4502:

4495:

4457:

4365:

4345:

4317:

4050:

3916:

3911:

3901:

3893:

3711:

3672:

3562:

3552:

3461:

3240:

3196:

3114:

3039:

2941:

2878:

2873:

2868:

2853:

2715:

2675:

2437:

2407:

2275:

2136:

2060:

2050:

1029:"When the Spinning Stops: Can Actuaries Help to Sort out the Mess in Corporate Pensions?"

983:

452:

353:

292:

240:

145:

2333:

1705:

1330:

1139:

933:

451:, who showed that there were predictable patterns of longevity and death in a group, or

5274:

5223:

5034:

4888:

4784:

4733:

4609:

4506:

4490:

4467:

4244:

3978:

3961:

3921:

3832:

3727:

3689:

3660:

3620:

3580:

3526:

3443:

3129:

3124:

2914:

2826:

2705:

2630:

2447:

2412:

2323:

2280:

2250:

2222:

2217:

2187:

2161:

1985:

1937:

1776:

1731:

training could calculate premiums in a spreadsheet format with the aid of a life table.

1692:

1387:

1307:

1227:

1174:

529:

436:

254:

250:

236:

232:

115:

ranked actuary as the third-best job in the business sector and the eighth-best job in

86:

5218:

5129:

5091:

4911:

4902:

4827:

4758:

4614:

4599:

4574:

4462:

4403:

4269:

4257:

3883:

3800:

3744:

3667:

3511:

3433:

3212:

3086:

2775:

2645:

2537:

2501:

2452:

2442:

2370:

2360:

2290:

1812:

1796:

1696:

1684:

1655:

1645:

1517:"The Actuary's New Clothes, A Canadian Perspective on the Financial Economics Debate"

1362:

1299:

1219:

1178:

1166:

1070:

1060:

958:

539:

464:

432:

244:

85:

Actuarial science includes a number of interrelated subjects, including mathematics,

1311:

934:"The Actuary: the Role and Limitations of the Profession Since the Mid-19th Century"

5154:

5109:

4873:

4860:

4753:

4728:

4662:

4594:

4472:

4080:

3973:

3906:

3819:

3766:

3585:

3456:

3250:

3134:

3049:

3016:

2888:

2843:

2788:

2780:

2770:

2547:

2471:

2311:

2285:

2270:

2177:

1995:

1977:

1746:

1676:

1609:

1291:

1211:

1192:

1156:

948:

414:

406:

348:

mix of investments can change the value of liabilities and assets (by changing the

345:

98:

1845:

5071:

4815:

4677:

4604:

4279:

4153:

4126:

4103:

4072:

3699:

3694:

3648:

3378:

3029:

2900:

2863:

2839:

2640:

2635:

2615:

2574:

2569:

2516:

2511:

2375:

2355:

2232:

2197:

1910:

1752:

1575:

1356:

803:

801:

181:

56:

4561:

1638:

The

Suffering Self; Pain and Narrative Representation in the Early Christian Era

318:, (FASB) in the US and Canada, which regulates pensions valuations and funding.

32:

5020:

5015:

3478:

3408:

3054:

2806:

2655:

2338:

2202:

2096:

2042:

1257:

524:

402:

337:

153:

133:

1613:

1295:

798:

5263:

5177:

5144:

5007:

4968:

4779:

4748:

4212:

4166:

3771:

3473:

3300:

3064:

3059:

2609:

2530:

2478:

2417:

2255:

2121:

1905:

1688:

1223:

1170:

1135:

962:

505:

460:

141:

137:

1680:

953:

152:

In traditional life insurance, actuarial science focuses on the analysis of

5119:

5052:

5029:

4944:

4274:

3570:

3468:

3403:

3345:

3330:

3267:

3222:

2858:

2670:

2665:

2625:

2586:

1303:

1161:

398:

1439:

286:

140:

of a future sum. Certain aspects of the actuarial methods for discounting

5162:

5124:

4807:

4708:

4570:

4383:

4350:

3842:

3759:

3754:

3398:

3355:

3335:

3315:

3305:

3074:

2893:

2848:

2521:

2306:

564:

549:

448:

410:

327:

267:

48:

1878:. Revised Edition. Actuarial Education and Research Fund. Archived from

4008:

3488:

3188:

3119:

3069:

3044:

2964:

2792:

2784:

2660:

2581:

2542:

2486:

1738:

1231:

606:

501:

456:

444:

157:

102:

72:

52:

37:

1210:(105). The University of Chicago Law Review, Vol. 70, No. 1: 105–128.

4161:

4013:

3633:

3428:

3340:

3325:

3320:

3285:

2834:

2650:

2620:

2591:

1960:

1641:

471:

amount someone of a given age should pay to purchase a life annuity.

468:

90:

60:

1428:"Institutional Bases of the Spontaneous Order: Surety and Assurance"

1215:

27:

Statistics applied to risk in insurance and other financial products

3677:

3295:

3172:

3167:

3162:

2558:

1047:

Feldblum, Sholom (2001) . "Introduction". In Robert F. Lowe (ed.).

161:

1081:

1074:

807:

5182:

4883:

2496:

2432:

78:

68:

64:

1659:

1366:

1085:. Faculty and Institute of Actuaries. 2004-01-13. Archived from

885:

5104:

4085:

4059:

4039:

3290:

3081:

2151:

1924:

1756:

440:

418:

1844:. Staple Inn Actuarial Society. pp. 34–35. Archived from

1456:"The Actuary and his Profession: Growth, Development, Promise"

2933:

2811:

774:

1929:

1811:

1103:"Stochastic Life Contingencies with Solvency Considerations"

909:

654:

612:

3024:

2506:

1706:"6: Commutation Functions, Reserves & Select Mortality"

702:

372:

226:

116:

127:

1148:

678:

397:

agreements and pensions arose in antiquity. Early in the

977:"Analysis of Senate Bill 174: Hearing Aids for Children"

1256:. John Wiley & Sons, Ltd. p. 4. Archived from

897:

849:

738:

413:, or burial vaults, owned by the fund—the precursor to

287:

Actuarial science related to modern financial economics

714:

378:

the value of an asset is independent of its financing.

837:

726:

4846:

Autoregressive conditional heteroskedasticity (ARCH)

1521:

American Academy of Actuaries, Contingencies Jul/Aug

873:

750:

594:

825:

666:

4308:

1608:(2). Faculty and Institute of Actuaries: 233–246.

813:

762:

690:

215:Federal Old-Age and Survivors Insurance Trust Fund

1835:"Actuaries' contributions to financial economics"

1666:

660:

5261:

861:

786:

642:

630:

618:

582:

273:

193:status of the pension and benefit arrangements,

4394:Multivariate adaptive regression splines (MARS)

1714:Actuarial Mathematics and Life-Table Statistics

352:assumption). This concept is inconsistent with

314:, which cushioned market fluctuations, and the

312:National Association of Insurance Commissioners

105:actuarial models with modern financial theory.

1369:. Archived from the original on April 14, 2003

2949:

1945:

1792:"Americans' donations to charity near record"

1497:Proceedings of the Casualty Actuarial Society

1463:Proceedings of the Casualty Actuarial Society

1010:Proceedings of the Casualty Actuarial Society

368:financial models should be free of arbitrage.

283:she should be institutionalized or set free.

1487:

891:

1873:"Fundamental Concepts of Actuarial Science"

1453:

915:

2994:

2956:

2942:

1952:

1938:

1781:: CS1 maint: location missing publisher (

1769:those who have fallen and their survivors.

1563:Nieto, Marcus; David, Jung (August 2006).

1284:Journal of Health Politics, Policy and Law

1003:"On Becoming An Actuary of the Third Kind"

1000:

720:

3607:

1562:

1541:

1160:

1049:Foundations of Casualty Actuarial Science

1027:

952:

732:

684:

600:

494:

291:Traditional actuarial science and modern

1914:) is being considered for deletion. See

1514:

1347:

1191:

1110:Transactions of the Society of Actuaries

1046:

931:

903:

855:

780:

756:

744:

708:

672:

227:Applications to other forms of insurance

31:

1743:"VI – Funeral Oration of Pericles"

1542:Needleman, Sarah E. (January 5, 2010).

1244:

879:

808:Faculty and Institute of Actuaries 2004

128:Life insurance, pensions and healthcare

14:

5262:

4920:Kaplan–Meier estimator (product limit)

1832:

1737:

1592:

1353:"Burial Places and Funeral Ceremonies"

1134:

843:

819:

768:

696:

425:

144:have come under criticism from modern

4993:

4560:

4307:

3606:

3376:

2993:

2937:

1933:

1602:Journal of the Institute of Actuaries

1400:

1324:

1274:

1100:

1083:"History of the actuarial profession"

975:

831:

648:

636:

624:

588:

381:how pension assets should be invested

231:Actuarial science is also applied to

5230:

4930:Accelerated failure time (AFT) model

1703:

1454:MacGinnitie, James (November 1980).

1425:

867:

792:

388:

316:Financial Accounting Standards Board

308:Mandatory Security Valuation Reserve

199:Financial Accounting Standards Board

5242:

4525:Analysis of variance (ANOVA, anova)

3377:

1636:Perkins, Judith (August 25, 1995).

24:

4620:Cochran–Mantel–Haenszel statistics

3246:Pearson product-moment correlation

1991:Accidental death and dismemberment

1595:"The Professional Name of Actuary"

1407:Institute and Faculty of Actuaries

474:

344:method suggests that changing the

187:Resource-Base Relative Value Scale

25:

5301:

1918:to help reach a consensus. ›

1897:

1327:"Harvard School of Public Health"

1275:Hsiao, William C. (August 2001).

1254:Encyclopedia of Actuarial Science

1247:"History of Actuarial Profession"

1101:Frees, Edward W. (January 1990).

613:U.S. News & World Report 2024

417:. Other early examples of mutual

5241:

5229:

5217:

5204:

5203:

4994:

2117:Directors and officers liability

1748:History of the Peloponnesian War

1488:Michelbacher, Gustav F. (1920).

1204:University of Chicago Law Review

932:Bühlmann, Hans (November 1997).

204:In social welfare programs, the

4879:Least-squares spectral analysis

1864:

1833:Whelan, Shane (December 2002).

1001:D'Arcy, Stephen P. (May 1989).

545:Category:Actuarial associations

300:Armstrong investigation of 1905

47:is the discipline that applies

3860:Mean-unbiased minimum-variance

2963:

1871:Charles L. Trowbridge (1989).

1790:Tong, Vinnee (June 19, 2006).

1593:Ogborn, M.E. (December 1956).

1570:. California Research Bureau,

1401:Lewin, Chris (June 14, 2007).

1358:The Private Life of the Romans

924:

210:Social Security Administration

109:demands, and stress. In 2024,

13:

1:

5173:Geographic information system

4389:Simultaneous equations models

1959:

1903:

1669:Criminal Justice and Behavior

661:Silver & Chow-Martin 2002

576:

560:Reinsurance Actuarial Premium

274:Actuaries in criminal justice

4356:Coefficient of determination

3967:Uniformly most powerful test

2884:Savings and loan association

1818:U.S. News & World Report

1469:(127): 49–56. Archived from

1426:Loan, Albert (Winter 1992).

220:Supplemental Security Income

122:

112:U.S. News & World Report

7:

4925:Proportional hazards models

4869:Spectral density estimation

4851:Vector autoregression (VAR)

4285:Maximum posterior estimator

3517:Randomized controlled trial

2317:Insurance-linked securities

1515:Moriarty, Charlene (2006).

512:

206:Office of the Chief Actuary

10:

5306:

4685:Multivariate distributions

3105:Average absolute deviation

2006:Total permanent disability

1349:Johnston, Harold Whetstone

1057:Casualty Actuarial Society

1053:Arlington County, Virginia

415:mutual insurance companies

325:

321:

304:Glass–Steagall Act of 1932

5199:

5153:

5090:

5043:

5006:

5002:

4989:

4961:

4943:

4910:

4901:

4859:

4806:

4767:

4716:

4707:

4673:Structural equation model

4628:

4585:

4581:

4556:

4515:

4481:

4435:

4402:

4364:

4331:

4327:

4303:

4243:

4152:

4071:

4035:

4026:

4009:Score/Lagrange multiplier

3994:

3947:

3892:

3818:

3809:

3619:

3615:

3602:

3561:

3535:

3487:

3442:

3424:Sample size determination

3389:

3385:

3372:

3276:

3231:

3205:

3187:

3143:

3095:

3015:

3006:

3002:

2989:

2971:

2909:

2761:

2746:Health insurance coverage

2686:

2470:

2299:

2241:

2170:

2089:

2041:

2011:Business overhead expense

1976:

1967:

1614:10.1017/S0020268100046424

1544:"The Best and Worst Jobs"

1392:: CS1 maint: unfit URL (

1325:Hsiao, William C (2004).

1296:10.1215/03616878-26-4-733

298:Regulations are from the

160:, and the application of

5168:Environmental statistics

4690:Elliptical distributions

4483:Generalized linear model

4412:Simple linear regression

4182:Hodges–Lehmann estimator

3639:Probability distribution

3548:Stochastic approximation

3110:Coefficient of variation

2147:Protection and indemnity

1916:templates for discussion

1572:California State Library

1438:(1): 538. Archived from

1116:: 91–148. Archived from

555:List of actuarial topics

170:long term care insurance

40:) table, Table 1, Page 1

4828:Cross-correlation (XCF)

4436:Non-standard predictors

3870:Lehmann–Scheffé theorem

3543:Adaptive clinical trial

2604:Explanation of benefits

2076:Variable universal life

1704:Slud, Eric V. (2006) .

1681:10.1177/009385402236732

1549:The Wall Street Journal

1245:Hickman, James (2004).

954:10.2143/ast.27.2.542046

535:Actuarial present value

520:Actuarial control cycle

174:health savings accounts

89:, statistics, finance,

5224:Mathematics portal

5045:Engineering statistics

4953:Nelson–Aalen estimator

4530:Analysis of covariance

4417:Ordinary least squares

4341:Pearson product-moment

3745:Statistical functional

3656:Empirical distribution

3489:Controlled experiments

3218:Frequency distribution

2996:Descriptive statistics

2741:Health insurance costs

2142:Professional liability

1162:10.1098/rstl.1693.0007

495:Technological advances

341:risk-neutral valuation

328:Actuary § History

306:, the adoption of the

168:for small businesses,

41:

5140:Population statistics

5082:System identification

4816:Autocorrelation (ACF)

4744:Exponential smoothing

4658:Discriminant analysis

4653:Canonical correlation

4517:Partition of variance

4379:Regression validation

4223:(Jonckheere–Terpstra)

4122:Likelihood-ratio test

3811:Frequentist inference

3723:Location–scale family

3644:Sampling distribution

3609:Statistical inference

3576:Cross-sectional study

3563:Observational studies

3522:Randomized experiment

3351:Stem-and-leaf display

3153:Central limit theorem

2597:Out-of-pocket expense

2458:Workers' compensation

2112:Collateral protection

2102:Business interruption

1800:. Digital Chicago Inc

1432:Humane Studies Review

685:Nieto & Jung 2006

570:Scenario optimization

486:) in London in 1762.

201:in the United States.

195:collective bargaining

35:

5063:Probabilistic design

4648:Principal components

4491:Exponential families

4443:Nonlinear regression

4422:General linear model

4384:Mixed effects models

4374:Errors and residuals

4351:Confounding variable

4253:Bayesian probability

4231:Van der Waerden test

4221:Ordered alternative

3986:Multiple comparisons

3865:Rao–Blackwellization

3828:Estimating equations

3784:Statistical distance

3502:Factorial experiment

3035:Arithmetic-Geometric

2820:Corpus Juris Civilis

1193:Harcourt, Bernard E.

1155:(192–206): 596–610.

894:, pp. 224, 230.

166:key person insurance

156:, the production of

95:financial accounting

5135:Official statistics

5058:Methods engineering

4739:Seasonal adjustment

4507:Poisson regressions

4427:Bayesian regression

4366:Regression analysis

4346:Partial correlation

4318:Regression analysis

3917:Prediction interval

3912:Likelihood interval

3902:Confidence interval

3894:Interval estimation

3855:Unbiased estimators

3673:Model specification

3553:Up-and-down designs

3241:Partial correlation

3197:Index of dispersion

3115:Interquartile range

2879:Rochdale Principles

2874:Mutual savings bank

2869:Mutual organization

2854:Cooperative banking

2771:Mesopotamian banker

2051:Longevity insurance

1413:on October 20, 2011

1403:"Actuarial History"

989:on February 4, 2006

711:, pp. 169–171.

426:Initial development

354:financial economics

293:financial economics

146:financial economics

36:2003 US mortality (

5290:Applied statistics

5155:Spatial statistics

5035:Medical statistics

4935:First hitting time

4889:Whittle likelihood

4540:Degrees of freedom

4535:Multivariate ANOVA

4468:Heteroscedasticity

4280:Bayesian estimator

4245:Bayesian inference

4094:Kolmogorov–Smirnov

3979:Randomization test

3949:Testing hypotheses

3922:Tolerance interval

3833:Maximum likelihood

3728:Exponential family

3661:Density estimation

3621:Statistical theory

3581:Natural experiment

3527:Scientific control

3444:Survey methodology

3130:Standard deviation

2631:Insurable interest

2132:Payment protection

2033:Payment protection

1813:"Actuary Overview"

1720:. pp. 149–150

530:Actuarial notation

437:probability theory

407:friendly societies

255:casualty insurance

87:probability theory

42:

5270:Actuarial science

5257:

5256:

5195:

5194:

5191:

5190:

5130:National accounts

5100:Actuarial science

5092:Social statistics

4985:

4984:

4981:

4980:

4977:

4976:

4912:Survival function

4897:

4896:

4759:Granger causality

4600:Contingency table

4575:Survival analysis

4552:

4551:

4548:

4547:

4404:Linear regression

4299:

4298:

4295:

4294:

4270:Credible interval

4239:

4238:

4022:

4021:

3838:Method of moments

3707:Parametric family

3668:Statistical model

3598:

3597:

3594:

3593:

3512:Random assignment

3434:Statistical power

3368:

3367:

3364:

3363:

3213:Contingency table

3183:

3182:

3050:Generalized/power

2931:

2930:

2776:Code of Hammurabi

2751:Vehicle insurance

2646:Replacement value

2538:Actual cash value

2502:Adverse selection

2492:Actuarial science

2466:

2465:

2398:Kidnap and ransom

2371:Extended warranty

2018:Income protection

1921:Actuarial science

1797:Chicago Sun-Times

1770:

1732:

1623:on March 20, 2012

1381:

918:, pp. 50–51.

892:Michelbacher 1920

687:, pp. 28–33.

540:Black swan theory

433:compound interest

389:Pre-formalisation

245:general insurance

162:compound interest

45:Actuarial science

16:(Redirected from

5297:

5245:

5244:

5233:

5232:

5222:

5221:

5207:

5206:

5110:Crime statistics

5004:

5003:

4991:

4990:

4908:

4907:

4874:Fourier analysis

4861:Frequency domain

4841:

4788:

4754:Structural break

4714:

4713:

4663:Cluster analysis

4610:Log-linear model

4583:

4582:

4558:

4557:

4499:

4473:Homoscedasticity

4329:

4328:

4305:

4304:

4224:

4216:

4208:

4207:(Kruskal–Wallis)

4192:

4177:

4132:Cross validation

4117:

4099:Anderson–Darling

4046:

4033:

4032:

4004:Likelihood-ratio

3996:Parametric tests

3974:Permutation test

3957:1- & 2-tails

3848:Minimum distance

3820:Point estimation

3816:

3815:

3767:Optimal decision

3718:

3617:

3616:

3604:

3603:

3586:Quasi-experiment

3536:Adaptive designs

3387:

3386:

3374:

3373:

3251:Rank correlation

3013:

3012:

3004:

3003:

2991:

2990:

2958:

2951:

2944:

2935:

2934:

2889:Social insurance

2844:Friendly society

2736:Health insurance

2564:Short rate table

2312:Catastrophe bond

2213:Lenders mortgage

1974:

1973:

1954:

1947:

1940:

1931:

1930:

1893:

1891:

1890:

1884:

1877:

1859:

1857:

1856:

1850:

1839:

1829:

1827:

1826:

1808:

1806:

1805:

1786:

1780:

1772:

1767:

1764:

1763:

1751:. Translated by

1734:

1729:

1726:

1725:

1719:

1710:

1700:

1663:

1632:

1630:

1628:

1622:

1616:. Archived from

1599:

1589:

1587:

1586:

1580:

1574:. Archived from

1569:

1559:

1557:

1556:

1538:

1536:

1535:

1529:

1523:. Archived from

1511:

1509:

1508:

1494:

1484:

1482:

1481:

1475:

1460:

1450:

1448:

1447:

1422:

1420:

1418:

1409:. Archived from

1397:

1391:

1383:

1378:

1375:

1374:

1344:

1342:

1341:

1335:

1329:. Archived from

1321:

1319:

1318:

1281:

1271:

1269:

1268:

1262:

1251:

1241:

1239:

1238:

1201:

1188:

1186:

1185:

1164:

1144:

1131:

1129:

1128:

1122:

1107:

1097:

1095:

1094:

1078:

1051:(4th ed.).

1043:

1041:

1040:

1024:

1022:

1021:

1007:

997:

995:

994:

988:

981:

972:

970:

969:

956:

938:

919:

916:MacGinnitie 1980

913:

907:

901:

895:

889:

883:

877:

871:

865:

859:

853:

847:

841:

835:

829:

823:

817:

811:

805:

796:

790:

784:

778:

772:

766:

760:

754:

748:

742:

736:

730:

724:

718:

712:

706:

700:

694:

688:

682:

676:

670:

664:

658:

652:

646:

640:

634:

628:

622:

616:

610:

604:

598:

592:

586:

443:, the father of

435:was studied and

403:burial insurance

346:asset allocation

99:computer science

21:

5305:

5304:

5300:

5299:

5298:

5296:

5295:

5294:

5285:Formal sciences

5260:

5259:

5258:

5253:

5216:

5187:

5149:

5086:

5072:quality control

5039:

5021:Clinical trials

4998:

4973:

4957:

4945:Hazard function

4939:

4893:

4855:

4839:

4802:

4798:Breusch–Godfrey

4786:

4763:

4703:

4678:Factor analysis

4624:

4605:Graphical model

4577:

4544:

4511:

4497:

4477:

4431:

4398:

4360:

4323:

4322:

4291:

4235:

4222:

4214:

4206:

4190:

4175:

4154:Rank statistics

4148:

4127:Model selection

4115:

4073:Goodness of fit

4067:

4044:

4018:

3990:

3943:

3888:

3877:Median unbiased

3805:

3716:

3649:Order statistic

3611:

3590:

3557:

3531:

3483:

3438:

3381:

3379:Data collection

3360:

3272:

3227:

3201:

3179:

3139:

3091:

3008:Continuous data

2998:

2985:

2967:

2962:

2932:

2927:

2905:

2901:Insurance cycle

2864:Fraternal order

2757:

2688:

2682:

2641:Proximate cause

2636:Insurance fraud

2616:General average

2575:Claims adjuster

2517:Risk management

2512:Risk assessment

2476:

2473:

2462:

2428:Prize indemnity

2295:

2243:

2237:

2166:

2127:Over-redemption

2085:

2037:

2028:National health

1969:

1963:

1958:

1919:

1900:

1888:

1886:

1882:

1875:

1870:

1867:

1862:

1854:

1852:

1848:

1837:

1824:

1822:

1803:

1801:

1789:

1774:

1773:

1761:

1759:

1753:Richard Crawley

1723:

1721:

1717:

1708:

1652:

1635:

1626:

1624:

1620:

1597:

1584:

1582:

1578:

1567:

1554:

1552:

1533:

1531:

1527:

1506:

1504:

1492:

1479:

1477:

1473:

1458:

1445:

1443:

1416:

1414:

1385:

1384:

1372:

1370:

1339:

1337:

1333:

1316:

1314:

1279:

1266:

1264:

1260:

1249:

1236:

1234:

1216:10.2307/1600548

1199:

1183:

1181:

1142:

1126:

1124:

1120:

1105:

1092:

1090:

1067:

1038:

1036:

1019:

1017:

1005:

992:

990:

986:

979:

967:

965:

936:

927:

922:

914:

910:

902:

898:

890:

886:

878:

874:

866:

862:

854:

850:

842:

838:

830:

826:

818:

814:

806:

799:

791:

787:

779:

775:

767:

763:

755:

751:

747:, pp. 8–9.

743:

739:

731:

727:

719:

715:

707:

703:

695:

691:

683:

679:

671:

667:

659:

655:

647:

643:

635:

631:

623:

619:

611:

607:

599:

595:

587:

583:

579:

574:

515:

497:

477:

475:Early actuaries

428:

391:

330:

324:

289:

276:

229:

182:consumer choice

130:

125:

28:

23:

22:

15:

12:

11:

5:

5303:

5293:

5292:

5287:

5282:

5277:

5272:

5255:

5254:

5252:

5251:

5239:

5227:

5213:

5200:

5197:

5196:

5193:

5192:

5189:

5188:

5186:

5185:

5180:

5175:

5170:

5165:

5159:

5157:

5151:

5150:

5148:

5147:

5142:

5137:

5132:

5127:

5122:

5117:

5112:

5107:

5102:

5096:

5094:

5088:

5087:

5085:

5084:

5079:

5074:

5065:

5060:

5055:

5049:

5047:

5041:

5040:

5038:

5037:

5032:

5027:

5018:

5016:Bioinformatics

5012:

5010:

5000:

4999:

4987:

4986:

4983:

4982:

4979:

4978:

4975:

4974:

4972:

4971:

4965:

4963:

4959:

4958:

4956:

4955:

4949:

4947:

4941:

4940:

4938:

4937:

4932:

4927:

4922:

4916:

4914:

4905:

4899:

4898:

4895:

4894:

4892:

4891:

4886:

4881:

4876:

4871:

4865:

4863:

4857:

4856:

4854:

4853:

4848:

4843:

4835:

4830:

4825:

4824:

4823:

4821:partial (PACF)

4812:

4810:

4804:

4803:

4801:

4800:

4795:

4790:

4782:

4777:

4771:

4769:

4768:Specific tests

4765:

4764:

4762:

4761:

4756:

4751:

4746:

4741:

4736:

4731:

4726:

4720:

4718:

4711:

4705:

4704:

4702:

4701:

4700:

4699:

4698:

4697:

4682:

4681:

4680:

4670:

4668:Classification

4665:

4660:

4655:

4650:

4645:

4640:

4634:

4632:

4626:

4625:

4623:

4622:

4617:

4615:McNemar's test

4612:

4607:

4602:

4597:

4591:

4589:

4579:

4578:

4554:

4553:

4550:

4549:

4546:

4545:

4543:

4542:

4537:

4532:

4527:

4521:

4519:

4513:

4512:

4510:

4509:

4493:

4487:

4485:

4479:

4478:

4476:

4475:

4470:

4465:

4460:

4455:

4453:Semiparametric

4450:

4445:

4439:

4437:

4433:

4432:

4430:

4429:

4424:

4419:

4414:

4408:

4406:

4400:

4399:

4397:

4396:

4391:

4386:

4381:

4376:

4370:

4368:

4362:

4361:

4359:

4358:

4353:

4348:

4343:

4337:

4335:

4325:

4324:

4321:

4320:

4315:

4309:

4301:

4300:

4297:

4296:

4293:

4292:

4290:

4289:

4288:

4287:

4277:

4272:

4267:

4266:

4265:

4260:

4249:

4247:

4241:

4240:

4237:

4236:

4234:

4233:

4228:

4227:

4226:

4218:

4210:

4194:

4191:(Mann–Whitney)

4186:

4185:

4184:

4171:

4170:

4169:

4158:

4156:

4150:

4149:

4147:

4146:

4145:

4144:

4139:

4134:

4124:

4119:

4116:(Shapiro–Wilk)

4111:

4106:

4101:

4096:

4091:

4083:

4077:

4075:

4069:

4068:

4066:

4065:

4057:

4048:

4036:

4030:

4028:Specific tests

4024:

4023:

4020:

4019:

4017:

4016:

4011:

4006:

4000:

3998:

3992:

3991:

3989:

3988:

3983:

3982:

3981:

3971:

3970:

3969:

3959:

3953:

3951:

3945:

3944:

3942:

3941:

3940:

3939:

3934:

3924:

3919:

3914:

3909:

3904:

3898:

3896:

3890:

3889:

3887:

3886:

3881:

3880:

3879:

3874:

3873:

3872:

3867:

3852:

3851:

3850:

3845:

3840:

3835:

3824:

3822:

3813:

3807:

3806:

3804:

3803:

3798:

3793:

3792:

3791:

3781:

3776:

3775:

3774:

3764:

3763:

3762:

3757:

3752:

3742:

3737:

3732:

3731:

3730:

3725:

3720:

3704:

3703:

3702:

3697:

3692:

3682:

3681:

3680:

3675:

3665:

3664:

3663:

3653:

3652:

3651:

3641:

3636:

3631:

3625:

3623:

3613:

3612:

3600:

3599:

3596:

3595:

3592:

3591:

3589:

3588:

3583:

3578:

3573:

3567:

3565:

3559:

3558:

3556:

3555:

3550:

3545:

3539:

3537:

3533:

3532:

3530:

3529:

3524:

3519:

3514:

3509:

3504:

3499:

3493:

3491:

3485:

3484:

3482:

3481:

3479:Standard error

3476:

3471:

3466:

3465:

3464:

3459:

3448:

3446:

3440:

3439:

3437:

3436:

3431:

3426:

3421:

3416:

3411:

3409:Optimal design

3406:

3401:

3395:

3393:

3383:

3382:

3370:

3369:

3366:

3365:

3362:

3361:

3359:

3358:

3353:

3348:

3343:

3338:

3333:

3328:

3323:

3318:

3313:

3308:

3303:

3298:

3293:

3288:

3282:

3280:

3274:

3273:

3271:

3270:

3265:

3264:

3263:

3258:

3248:

3243:

3237:

3235:

3229:

3228:

3226:

3225:

3220:

3215:

3209:

3207:

3206:Summary tables

3203:

3202:

3200:

3199:

3193:

3191:

3185:

3184:

3181:

3180:

3178:

3177:

3176:

3175:

3170:

3165:

3155:

3149:

3147:

3141:

3140:

3138:

3137:

3132:

3127:

3122:

3117:

3112:

3107:

3101:

3099:

3093:

3092:

3090:

3089:

3084:

3079:

3078:

3077:

3072:

3067:

3062:

3057:

3052:

3047:

3042:

3040:Contraharmonic

3037:

3032:

3021:

3019:

3010:

3000:

2999:

2987:

2986:

2984:

2983:

2978:

2972:

2969:

2968:

2961:

2960:

2953:

2946:

2938:

2929:

2928:

2926:

2925:

2922:List of topics

2918:

2910:

2907:

2906:

2904:

2903:

2898:

2897:

2896:

2891:

2886:

2881:

2876:

2871:

2866:

2861:

2856:

2851:

2837:

2832:

2831:

2830:

2816:

2815:

2814:

2809:

2807:Burial society

2797:

2796:

2795:

2789:§235–238; §240

2781:§100–105; §126

2773:

2767:

2765:

2759:

2758:

2756:

2755:

2754:

2753:

2748:

2743:

2738:

2733:

2731:Climate change

2723:

2721:United Kingdom

2718:

2713:

2708:

2703:

2698:

2692:

2690:

2684:

2683:

2681:

2680:

2679:

2678:

2668:

2666:Underinsurance

2663:

2658:

2656:Self-insurance

2653:

2648:

2643:

2638:

2633:

2628:

2623:

2618:

2613:

2606:

2601:

2600:

2599:

2594:

2589:

2579:

2578:

2577:

2567:

2566:

2565:

2562:

2550:

2545:

2540:

2535:

2534:

2533:

2528:

2519:

2514:

2509:

2504:

2499:

2489:

2483:

2481:

2468:

2467:

2464:

2463:

2461:

2460:

2455:

2450:

2445:

2440:

2435:

2430:

2425:

2423:Political risk

2420:

2415:

2410:

2405:

2403:Legal expenses

2400:

2395:

2390:

2389:

2388:

2378:

2373:

2368:

2363:

2358:

2353:

2352:

2351:

2346:

2336:

2331:

2326:

2321:

2320:

2319:

2314:

2303:

2301:

2297:

2296:

2294:

2293:

2288:

2283:

2278:

2273:

2268:

2263:

2258:

2253:

2247:

2245:

2239:

2238:

2236:

2235:

2230:

2225:

2220:

2215:

2210:

2205:

2200:

2195:

2190:

2185:

2183:Builder's risk

2180:

2174:

2172:

2168:

2167:

2165:

2164:

2159:

2154:

2149:

2144:

2139:

2134:

2129:

2124:

2119:

2114:

2109:

2107:Business owner

2104:

2099:

2093:

2091:

2087:

2086:

2084:

2083:

2078:

2073:

2071:Universal life

2068:

2063:

2058:

2053:

2047:

2045:

2039:

2038:

2036:

2035:

2030:

2025:

2023:Long-term care

2020:

2015:

2014:

2013:

2008:

1998:

1993:

1988:

1982:

1980:

1971:

1965:

1964:

1957:

1956:

1949:

1942:

1934:

1928:

1927:

1899:

1898:External links

1896:

1895:

1894:

1866:

1863:

1861:

1860:

1830:

1809:

1787:

1741:(1994–2009) .

1735:

1701:

1675:(5): 538–568.

1664:

1650:

1633:

1590:

1560:

1539:

1512:

1485:

1451:

1423:

1398:

1345:

1322:

1290:(4): 733–737.

1272:

1242:

1189:

1136:Halley, Edmond

1132:

1098:

1079:

1065:

1044:

1025:

998:

973:

947:(2): 165–171.

941:ASTIN Bulletin

928:

926:

923:

921:

920:

908:

906:, p. 168.

896:

884:

872:

860:

858:, p. 166.

848:

846:, p. 235.

836:

824:

812:

797:

785:

773:

761:

749:

737:

733:Economist 2006

725:

713:

701:

689:

677:

665:

653:

641:

629:

617:

605:

601:Needleman 2010

593:

580:

578:

575:

573:

572:

567:

562:

557:

552:

547:

542:

537:

532:

527:

525:Actuarial exam

522:

516:

514:

511:

496:

493:

488:William Morgan

484:Equitable Life

476:

473:

465:Halley's comet

427:

424:

390:

387:

383:

382:

379:

376:

369:

338:arbitrage-free

323:

320:

288:

285:

275:

272:

228:

225:

224:

223:

202:

190:

177:

134:life insurance

129:

126:

124:

121:

26:

9:

6:

4:

3:

2:

5302:

5291:

5288:

5286:

5283:

5281:

5278:

5276:

5273:

5271:

5268:

5267:

5265:

5250:

5249:

5240:

5238:

5237:

5228:

5226:

5225:

5220:

5214:

5212:

5211:

5202:

5201:

5198:

5184:

5181:

5179:

5178:Geostatistics

5176:

5174:

5171:

5169:

5166:

5164:

5161:

5160:

5158:

5156:

5152:

5146:

5145:Psychometrics

5143:

5141:

5138:

5136:

5133:

5131:

5128:

5126:

5123:

5121:

5118:

5116:

5113:

5111:

5108:

5106:

5103:

5101:

5098:

5097:

5095:

5093:

5089:

5083:

5080:

5078:

5075:

5073:

5069:

5066:

5064:

5061:

5059:

5056:

5054:

5051:

5050:

5048:

5046:

5042:

5036:

5033:

5031:

5028:

5026:

5022:

5019:

5017:

5014:

5013:

5011:

5009:

5008:Biostatistics

5005:

5001:

4997:

4992:

4988:

4970:

4969:Log-rank test

4967:

4966:

4964:

4960:

4954:

4951:

4950:

4948:

4946:

4942:

4936:

4933:

4931:

4928:

4926:

4923:

4921:

4918:

4917:

4915:

4913:

4909:

4906:

4904:

4900:

4890:

4887:

4885:

4882:

4880:

4877:

4875:

4872:

4870:

4867:

4866:

4864:

4862:

4858:

4852:

4849:

4847:

4844:

4842:

4840:(Box–Jenkins)

4836:

4834:

4831:

4829:

4826:

4822:

4819:

4818:

4817:

4814:

4813:

4811:

4809:

4805:

4799:

4796:

4794:

4793:Durbin–Watson

4791:

4789:

4783:

4781:

4778:

4776:

4775:Dickey–Fuller

4773:

4772:

4770:

4766:

4760:

4757:

4755:

4752:

4750:

4749:Cointegration

4747:

4745:

4742:

4740:

4737:

4735:

4732:

4730:

4727:

4725:

4724:Decomposition

4722:

4721:

4719:

4715:

4712:

4710:

4706:

4696:

4693:

4692:

4691:

4688:

4687:

4686:

4683:

4679:

4676:

4675:

4674:

4671:

4669:

4666:

4664:

4661:

4659:

4656:

4654:

4651:

4649:

4646:

4644:

4641:

4639:

4636:

4635:

4633:

4631:

4627:

4621:

4618:

4616:

4613:

4611:

4608:

4606:

4603:

4601:

4598:

4596:

4595:Cohen's kappa

4593:

4592:

4590:

4588:

4584:

4580:

4576:

4572:

4568:

4564:

4559:

4555:

4541:

4538:

4536:

4533:

4531:

4528:

4526:

4523:

4522:

4520:

4518:

4514:

4508:

4504:

4500:

4494:

4492:

4489:

4488:

4486:

4484:

4480:

4474:

4471:

4469:

4466:

4464:

4461:

4459:

4456:

4454:

4451:

4449:

4448:Nonparametric

4446:

4444:

4441:

4440:

4438:

4434:

4428:

4425:

4423:

4420:

4418:

4415:

4413:

4410:

4409:

4407:

4405:

4401:

4395:

4392:

4390:

4387:

4385:

4382:

4380:

4377:

4375:

4372:

4371:

4369:

4367:

4363:

4357:

4354:

4352:

4349:

4347:

4344:

4342:

4339:

4338:

4336:

4334:

4330:

4326:

4319:

4316:

4314:

4311:

4310:

4306:

4302:

4286:

4283:

4282:

4281:

4278:

4276:

4273:

4271:

4268:

4264:

4261:

4259:

4256:

4255:

4254:

4251:

4250:

4248:

4246:

4242:

4232:

4229:

4225:

4219:

4217:

4211:

4209:

4203:

4202:

4201:

4198:

4197:Nonparametric

4195:

4193:

4187:

4183:

4180:

4179:

4178:

4172:

4168:

4167:Sample median

4165:

4164:

4163:

4160:

4159:

4157:

4155:

4151:

4143:

4140:

4138:

4135:

4133:

4130:

4129:

4128:

4125:

4123:

4120:

4118:

4112:

4110:

4107:

4105:

4102:

4100:

4097:

4095:

4092:

4090:

4088:

4084:

4082:

4079:

4078:

4076:

4074:

4070:

4064:

4062:

4058:

4056:

4054:

4049:

4047:

4042:

4038:

4037:

4034:

4031:

4029:

4025:

4015:

4012:

4010:

4007:

4005:

4002:

4001:

3999:

3997:

3993:

3987:

3984:

3980:

3977:

3976:

3975:

3972:

3968:

3965:

3964:

3963:

3960:

3958:

3955:

3954:

3952:

3950:

3946:

3938:

3935:

3933:

3930:

3929:

3928:

3925:

3923:

3920:

3918:

3915:

3913:

3910:

3908:

3905:

3903:

3900:

3899:

3897:

3895:

3891:

3885:

3882:

3878:

3875:

3871:

3868:

3866:

3863:

3862:

3861:

3858:

3857:

3856:

3853:

3849:

3846:

3844:

3841:

3839:

3836:

3834:

3831:

3830:

3829:

3826:

3825:

3823:

3821:

3817:

3814:

3812:

3808:

3802:

3799:

3797:

3794:

3790:

3787:

3786:

3785:

3782:

3780:

3777:

3773:

3772:loss function

3770:

3769:

3768:

3765:

3761:

3758:

3756:

3753:

3751:

3748:

3747:

3746:

3743:

3741:

3738:

3736:

3733:

3729:

3726:

3724:

3721:

3719:

3713:

3710:

3709:

3708:

3705:

3701:

3698:

3696:

3693:

3691:

3688:

3687:

3686:

3683:

3679:

3676:

3674:

3671:

3670:

3669:

3666:

3662:

3659:

3658:

3657:

3654:

3650:

3647:

3646:

3645:

3642:

3640:

3637:

3635:

3632:

3630:

3627:

3626:

3624:

3622:

3618:

3614:

3610:

3605:

3601:

3587:

3584:

3582:

3579:

3577:

3574:

3572:

3569:

3568:

3566:

3564:

3560:

3554:

3551:

3549:

3546:

3544:

3541:

3540:

3538:

3534:

3528:

3525:

3523:

3520:

3518:

3515:

3513:

3510:

3508:

3505:

3503:

3500:

3498:

3495:

3494:

3492:

3490:

3486:

3480:

3477:

3475:

3474:Questionnaire

3472:

3470:

3467:

3463:

3460:

3458:

3455:

3454:

3453:

3450:

3449:

3447:

3445:

3441:

3435:

3432:

3430:

3427:

3425:

3422:

3420:

3417:

3415:

3412:

3410:

3407:

3405:

3402:

3400:

3397:

3396:

3394:

3392:

3388:

3384:

3380:

3375:

3371:

3357:

3354:

3352:

3349:

3347:

3344:

3342:

3339:

3337:

3334:

3332:

3329:

3327:

3324:

3322:

3319:

3317:

3314:

3312:

3309:

3307:

3304:

3302:

3301:Control chart

3299:

3297:

3294:

3292:

3289:

3287:

3284:

3283:

3281:

3279:

3275:

3269:

3266:

3262:

3259:

3257:

3254:

3253:

3252:

3249:

3247:

3244:

3242:

3239:

3238:

3236:

3234:

3230:

3224:

3221:

3219:

3216:

3214:

3211:

3210:

3208:

3204:

3198:

3195:

3194:

3192:

3190:

3186:

3174:

3171:

3169:

3166:

3164:

3161:

3160:

3159:

3156:

3154:

3151:

3150:

3148:

3146:

3142:

3136:

3133:

3131:

3128:

3126:

3123:

3121:

3118:

3116:

3113:

3111:

3108:

3106:

3103:

3102:

3100:

3098:

3094:

3088:

3085:

3083:

3080:

3076:

3073:

3071:

3068:

3066:

3063:

3061:

3058:

3056:

3053:

3051:

3048:

3046:

3043:

3041:

3038:

3036:

3033:

3031:

3028:

3027:

3026:

3023:

3022:

3020:

3018:

3014:

3011:

3009:

3005:

3001:

2997:

2992:

2988:

2982:

2979:

2977:

2974:

2973:

2970:

2966:

2959:

2954:

2952:

2947:

2945:

2940:

2939:

2936:

2924:

2923:

2919:

2917:

2916:

2912:

2911:

2908:

2902:

2899:

2895:

2892:

2890:

2887:

2885:

2882:

2880:

2877:

2875:

2872:

2870:

2867:

2865:

2862:

2860:

2857:

2855:

2852:

2850:

2847:

2846:

2845:

2841:

2838:

2836:

2833:

2829:

2828:

2824:

2823:

2822:

2821:

2817:

2813:

2810:

2808:

2805:

2804:

2803:

2802:

2798:

2794:

2790:

2786:

2782:

2779:

2778:

2777:

2774:

2772:

2769:

2768:

2766:

2764:

2760:

2752:

2749:

2747:

2744:

2742:

2739:

2737:

2734:

2732:

2729:

2728:

2727:

2726:United States

2724:

2722:

2719:

2717:

2714:

2712:

2709:

2707:

2704:

2702:

2699:

2697:

2694:

2693:

2691:

2685:

2677:

2674:

2673:

2672:

2669:

2667:

2664:

2662:

2659:

2657:

2654:

2652:

2649:

2647:

2644:

2642:

2639:

2637:

2634:

2632:

2629:

2627:

2624:

2622:

2619:

2617:

2614:

2612:

2611:

2610:Force majeure

2607:

2605:

2602:

2598:

2595:

2593:

2590:

2588:

2585:

2584:

2583:

2580:

2576:

2573:

2572:

2571:

2568:

2563:

2561:

2560:

2556:

2555:

2554:

2551:

2549:

2546:

2544:

2541:

2539:

2536:

2532:

2531:Value of life

2529:

2527:

2523:

2520:

2518:

2515:

2513:

2510:

2508:

2505:

2503:

2500:

2498:

2495:

2494:

2493:

2490:

2488:

2485:

2484:

2482:

2480:

2475:

2469:

2459:

2456:

2454:

2451:

2449:

2446:

2444:

2441:

2439:

2436:

2434:

2431:

2429:

2426:

2424:

2421:

2419:

2416:

2414:

2411:

2409:

2406:

2404:

2401:

2399:

2396:

2394:

2393:Interest rate

2391:

2387:

2384:

2383:

2382:

2379:

2377:

2374:

2372:

2369:

2367:

2364:

2362:

2359:

2357:

2354:

2350:

2347:

2345:

2342:

2341:

2340:

2337:

2335:

2332:

2330:

2327:

2325:

2322:

2318:

2315:

2313:

2310:

2309:

2308:

2305:

2304:

2302:

2298:

2292:

2289:

2287:

2284:

2282:

2279:

2277:

2274:

2272:

2269:

2267:

2264:

2262:

2261:Inland marine

2259:

2257:

2256:GAP insurance

2254:

2252:

2249:

2248:

2246:

2244:Communication

2240:

2234:

2231:

2229:

2226:

2224:

2221:

2219:

2216:

2214:

2211:

2209:

2206:

2204:

2201:

2199:

2196:

2194:

2191:

2189:

2186:

2184:

2181:

2179:

2176:

2175:

2173:

2169:

2163:

2160:

2158:

2155:

2153:

2150:

2148:

2145:

2143:

2140:

2138:

2135:

2133:

2130:

2128:

2125:

2123:

2120:

2118:

2115:

2113:

2110:

2108:

2105:

2103: