1097:

Bloomberg

Business Week 2010-07-29). Bloomberg's Terhune (2010) explained how investors seeking high-margin returns use Credit Default Swaps (CDS) to bet against financial instruments owned by other companies and countries. Intercontinental's clearing houses guarantee every transaction between buyer and seller providing a much-needed safety net reducing the impact of a default by spreading the risk. ICE collects on every trade.(Terhune Bloomberg Business Week 2010-07-29). Brookings senior research fellow, Robert E. Litan, cautioned however, "valuable pricing data will not be fully reported, leaving ICE's institutional partners with a huge informational advantage over other traders. He calls ICE Trust "a derivatives dealers' club" in which members make money at the expense of nonmembers (Terhune citing Litan in Bloomberg Business Week 2010-07-29). (Litan Derivatives Dealers’ Club 2010)." Actually, Litan conceded that "some limited progress toward central clearing of CDS has been made in recent months, with CDS contracts between dealers now being cleared centrally primarily through one clearinghouse (ICE Trust) in which the dealers have a significant financial interest (Litan 2010:6)." However, "as long as ICE Trust has a monopoly in clearing, watch for the dealers to limit the expansion of the products that are centrally cleared, and to create barriers to electronic trading and smaller dealers making competitive markets in cleared products (Litan 2010:8)."

1011:

1071:) required an $ 85 billion federal loan because it had been excessively selling CDS protection without hedging against the possibility that the reference entities might decline in value, which exposed the insurance giant to potential losses over $ 100 billion. The CDS on Lehman were settled smoothly, as was largely the case for the other 11 credit events occurring in 2008 that triggered payouts. And while it is arguable that other incidents would have been as bad or worse if less efficient instruments than CDS had been used for speculation and insurance purposes, the closing months of 2008 saw regulators working hard to reduce the risk involved in CDS transactions.

1431:

owning any debt that they wanted to insure against default. See "naked" CDS) For example, at the time it filed for bankruptcy on

September 14, 2008, Lehman Brothers had approximately $ 155 billion of outstanding debt but around $ 400 billion notional value of CDS contracts had been written that referenced this debt. Clearly not all of these contracts could be physically settled, since there was not enough outstanding Lehman Brothers debt to fulfill all of the contracts, demonstrating the necessity for cash settled CDS trades. The trade confirmation produced when a CDS is traded states whether the contract is to be physically or cash settled.

1384:, one important issue was whether the restructuring would trigger Credit default swap (CDS) payments. European Central Bank and the International Monetary Fund negotiators avoided these triggers as they could have jeopardized the stability of major European banks who had been protection writers. An alternative could have been to create new CDS which clearly would pay in the event of debt restructuring. The market would have paid the spread between these and old (potentially more ambiguous) CDS. This practice is far more typical in jurisdictions that do not provide protective status to insolvent debtors similar to that provided by

1020:

213:

167:

5929:

of May 22, 2007, for the most widely traded LCDS form, which governs North

American single name and index trades, the default settlement method for LCDS shifted to auction settlement rather than physical settlement. The auction method is essentially the same that has been used in the various ISDA cash settlement auction protocols, but does not require parties to take any additional steps following a credit event (i.e., adherence to a protocol) to elect cash settlement. On October 23, 2007, the first ever LCDS auction was held for

5789:'s annual report to shareholders in 2002, he said, "Unless derivatives contracts are collateralized or guaranteed, their ultimate value also depends on the creditworthiness of the counterparties to them. In the meantime, though, before a contract is settled, the counterparties record profits and losses—often huge in amount—in their current earnings statements without so much as a penny changing hands. The range of derivatives contracts is limited only by the imagination of man (or sometimes, so it seems, madmen)."

664:

705:, critics say you should not be able to buy a CDS—insurance against default—when you do not own the bond. Short selling is also viewed as gambling and the CDS market as a casino. Another concern is the size of the CDS market. Because naked credit default swaps are synthetic, there is no limit to how many can be sold. The gross amount of CDSs far exceeds all "real" corporate bonds and loans outstanding. As a result, the risk of default is magnified leading to concerns about systemic risk.

3121:

249:, although CDSs are not subject to regulations governing traditional insurance. Also, investors can buy and sell protection without owning debt of the reference entity. These "naked credit default swaps" allow traders to speculate on the creditworthiness of reference entities. CDSs can be used to create synthetic long and short positions in the reference entity. Naked CDS constitute most of the market in CDS. In addition, CDSs can also be used in capital structure

1272:(for example necessary if the original reference obligation was a loan that is repaid before the expiry of the contract), and for performing various calculation and administrative functions in connection with the transaction. By market convention, in contracts between CDS dealers and end-users, the dealer is generally the calculation agent, and in contracts between CDS dealers, the protection seller is generally the calculation agent.

5859:" of losses. For example, if company A fails, company B will default on its CDS contract to company C, possibly resulting in bankruptcy, and company C will potentially experience a large loss due to the failure to receive compensation for the bad debt it held from the reference company. Even worse, because CDS contracts are private, company C will not know that its fate is tied to company A; it is only doing business with company B.

506:& Clearing Corporation (DTCC), through its global repository Trade Information Warehouse (TIW), provides weekly data but publicly available information goes back only one year. The numbers provided by each source do not always match because each provider uses different sampling methods. Daily, intraday and real time data is available from S&P Capital IQ through their acquisition of Credit Market Analysis in 2012.

10886:

1217:, $ 2 billion (~$ 2.62 billion in 2023), were reported by the firm in May 2012 in relationship to these trades. The disclosure, which resulted in headlines in the media, did not disclose the exact nature of the trading involved, which remains in progress. The item traded, possibly related to CDX IG 9, an index based on the default risk of major U.S. corporations, has been described as a "derivative of a derivative".

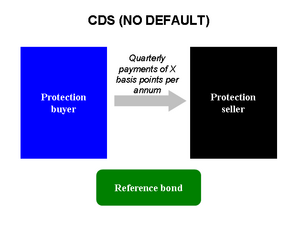

22:

5852:, say 2%. If the condition of the reference company worsens, the risk premium rises, so company B can sell a CDS to company C with a premium of say, 5%, and pocket the 3% difference. However, if the reference company defaults, company B might not have the assets on hand to make good on the contract. It depends on its contract with company A to provide a large payout, which it then passes along to company C.

625:$ 10 million worth of protection for 1 year to AAA-Bank at this lower spread. Therefore, over the two years the hedge fund pays the bank 2 * 5% * $ 10 million = $ 1 million, but receives 1 * 2.5% * $ 10 million = $ 250,000, giving a total loss of $ 750,000. This loss is smaller than the $ 1 million loss that would have occurred if the second transaction had not been entered into.

30:

1426:

defaulted, and its senior bonds are now trading at 25 (i.e., 25 cents on the dollar) since the market believes that senior bondholders will receive 25% of the money they are owed once the company is wound up (all the defaulting company's liquidable assets are sold off). Therefore, the bank must pay the hedge fund $ 5 million × (100% − 25%) = $ 3.75 million.

9582:

5903:

evidenced by the fact that

Congress confirmed that certain derivatives, including CDS, do constitute gambling when, in 2000, to allay industry fears that they were illegal gambling, it exempted them from "any State or local law that prohibits or regulates gaming." While this decriminalized Naked CDS, it did not grant them relief under the federal gambling tax provisions.

5801:

dealings because

Berkshire require counterparties to make payments when contracts are initiated, so that Berkshire always holds the money. Berkshire Hathaway was a large owner of Moody's stock during the period that it was one of two primary rating agencies for subprime CDOs, a form of mortgage security derivative dependent on the use of credit default swaps.

5797:, the clearinghouse for the majority of trades in the US over-the-counter market, stated in October 2008 that once offsetting trades were considered, only an estimated $ 6 billion would change hands on October 21, during the settlement of the CDS contracts issued on Lehman Brothers' debt, which amounted to somewhere between $ 150 and $ 360 billion.

759:

may not want to sell or share the potential profits from the loan. By buying a credit default swap, the bank can lay off default risk while still keeping the loan in its portfolio. The downside to this hedge is that without default risk, a bank may have no motivation to actively monitor the loan and the counterparty has no relationship to the borrower.

287:. But investors can also buy CDS contracts referencing Risky Corp debt without actually owning any Risky Corp debt. This may be done for speculative purposes, to bet against the solvency of Risky Corp in a gamble to make money, or to hedge investments in other companies whose fortunes are expected to be similar to those of Risky Corp (see

1345:

5758:, because certain bondholders might benefit from the credit event of a GM bankruptcy due to their holding of CDSs. Critics speculate that these creditors had an incentive to push for the company to enter bankruptcy protection. Due to a lack of transparency, there was no way to identify the protection buyers and protection writers.

5893:

If a CDS is a notional principal contract, pre-default periodic and nonperiodic payments on the swap are deductible and included in ordinary income. If a payment is a termination payment, or a payment received on a sale of the swap to a third party, however, its tax treatment is an open question. In

5800:

Despite

Buffett's criticism on derivatives, in October 2008 Berkshire Hathaway revealed to regulators that it has entered into at least $ 4.85 billion in derivative transactions. Buffett stated in his 2008 letter to shareholders that Berkshire Hathaway has no counterparty risk in its derivative

5705:

as the risk free rate. Both analyses make simplifying assumptions (such as the assumption that there is zero cost of unwinding the fixed leg of the swap on default), which may invalidate the no-arbitrage assumption. However the Duffie approach is frequently used by the market to determine theoretical

1421:

Physical settlement: The protection seller pays the buyer par value, and in return takes delivery of a debt obligation of the reference entity. For example, a hedge fund has bought $ 5 million worth of protection from a bank on the senior debt of a company. In the event of a default, the bank

1104:

to begin guaranteeing credit-default swaps. The SEC exemption represented the last regulatory approval needed by

Atlanta-based Intercontinental. A derivatives analyst at Morgan Stanley, one of the backers for IntercontinentalExchange's subsidiary, ICE Trust in New York, launched in 2008, claimed that

1063:

caused a total close to $ 400 billion to become payable to the buyers of CDS protection referenced against the insolvent bank. However the net amount that changed hands was around $ 7.2 billion. This difference is due to the process of 'netting'. Market participants co-operated so that CDS

1043:

In the days and weeks leading up to Bear's collapse, the bank's CDS spread widened dramatically, indicating a surge of buyers taking out protection on the bank. It has been suggested that this widening was responsible for the perception that Bear

Stearns was vulnerable, and therefore restricted its

747:

Credit default swaps are often used to manage the risk of default that arises from holding debt. A bank, for example, may hedge its risk that a borrower may default on a loan by entering into a CDS contract as the buyer of protection. If the loan goes into default, the proceeds from the CDS contract

9438:

See

Hearing to Review the Role of Credit Derivatives in the U.S. Economy, Before H. Comm. on Agriculture, at 4 (Nov. 20, 2008) (statement of Eric Dinallo, Superintendent of New York State Ins. Dept.) (declaring that "ith the proliferation of various kinds of derivatives in the late 20th Century came

5898:

announced that it was studying the characterization of CDS in response to taxpayer confusion. As the outcome of its study, the IRS issued proposed regulations in 2011 specifically classifying CDS as notional principal contracts, and thereby qualifying such termination and sale payments for favorable

5889:

for tax purposes,(Peaslee & Nirenberg 2008-07-21:129). but this is not certain. There is a risk of having CDS recharacterized as different types of financial instruments because they resemble put options and credit guarantees. In particular, the degree of risk depends on the type of settlement

5766:

settled at a final price of 8.625%) and that these large payouts could lead to further bankruptcies of firms without enough cash to settle their contracts. However, industry estimates after the auction suggest that net cashflows were only in the region of $ 7 billion. because many parties held

1375:

The definition of restructuring is quite technical but is essentially intended to respond to circumstances where a reference entity, as a result of the deterioration of its credit, negotiates changes in the terms in its debt with its creditors as an alternative to formal insolvency proceedings (i.e.

1369:; fiscal policy choices related to government revenues and expenses; and approaches used by nations to bail out troubled banking industries and private bondholders, assuming private debt burdens or socialising losses. The Credit default swap market also reveals the beginning of the sovereign crisis.

1318:

that limit the range of obligations that a protection buyer may deliver upon a credit event. Trading conventions for deliverable obligation characteristics vary for different markets and CDS contract types. Typical limitations include that deliverable debt be a bond or loan, that it have a maximum

1001:

Explosive growth was not without operational headaches. On

September 15, 2005, the New York Fed summoned 14 banks to its offices. Billions of dollars of CDS were traded daily but the record keeping was more than two weeks behind. This created severe risk management issues, as counterparties were in

985:

The high market share enjoyed by the banks was soon eroded as more and more asset managers and hedge funds saw trading opportunities in credit default swaps. By 2002, investors as speculators, rather than banks as hedgers, dominated the market. National banks in the USA used credit default swaps as

850:

For example, if a company has announced some bad news and its share price has dropped by 25%, but its CDS spread has remained unchanged, then an investor might expect the CDS spread to increase relative to the share price. Therefore, a basic strategy would be to go long on the CDS spread (by buying

803:

If Risky Corporation defaults on its debt three years into the CDS contract, the pension fund would stop paying the quarterly premium, and Derivative Bank would ensure that the pension fund is refunded for its loss of $ 10 million minus recovery (either by physical or cash settlement — see

774:

with a particular borrower or industry. The bank can lay off some of this risk by buying a CDS. Because the borrower—the reference entity—is not a party to a credit default swap, entering into a CDS allows the bank to achieve its diversity objectives without impacting its loan portfolio or customer

728:

Proponents of naked credit default swaps say that short selling in various forms, whether credit default swaps, options or futures, has the beneficial effect of increasing liquidity in the marketplace. That benefits hedging activities. Without speculators buying and selling naked CDSs, banks wanting

584:

If Risky Corp does indeed default after, say, one year, then the hedge fund will have paid $ 500,000 to AAA-Bank, but then receives $ 10 million (assuming zero recovery rate, and that AAA-Bank has the liquidity to cover the loss), thereby making a profit. AAA-Bank, and its investors, will incur

496:

Another kind of risk for the seller of credit default swaps is jump risk or jump-to-default risk ("JTD risk"). A seller of a CDS could be collecting monthly premiums with little expectation that the reference entity may default. A default creates a sudden obligation on the protection sellers to pay

348:

to default by the market, since a higher fee is being charged to protect against this happening. However, factors such as liquidity and estimated loss given default can affect the comparison. Credit spread rates and credit ratings of the underlying or reference obligations are considered among money

5945:

During the rapid growth of the credit derivatives market the 1999 ISDA Credit Derivatives Definitions were introduced to standardize the legal documentation of CDS. Subsequently, replaced with the 2003 ISDA Credit Derivatives Definitions, and later the 2014 ISDA Credit Derivatives Definitions, each

5928:

A new type of default swap is the "loan only" credit default swap (LCDS). This is conceptually very similar to a standard CDS, but unlike "vanilla" CDS, the underlying protection is sold on syndicated secured loans of the Reference Entity rather than the broader category of "Bond or Loan". Also, as

5919:

as the CDS changes value over its life due to market conditions and due to the tendency for shorter dated CDS to sell at lower prices than longer dated CDS. One can try to account for the CDS as a hedge under FASB 133 but in practice that can prove very difficult unless the risky asset owned by the

5844:

corporate bonds in 2005 and decided to hedge their exposure by buying CDS protection from Lehman Brothers. After Lehman's default, this protection was no longer active, and Washington Mutual's sudden default only days later would have led to a massive loss on the bonds, a loss that should have been

5792:

To hedge the counterparty risk of entering a CDS transaction, one practice is to buy CDS protection on one's counterparty. The positions are marked-to-market daily and collateral pass from buyer to seller or vice versa to protect both parties against counterparty default, but money does not always

1191:

Members of the Intercontinental clearinghouse ICE Trust (now ICE Clear Credit) in March 2009 would have to have a net worth of at least $ 5 billion (~$ 6.9 billion in 2023) and a credit rating of A or better to clear their credit-default swap trades. Intercontinental said in the statement

1165:

The SEC's approval for ICE Futures' request to be exempted from rules that would prevent it clearing CDSs was the third government action granted to Intercontinental in one week. On March 3, its proposed acquisition of Clearing Corp., a Chicago clearinghouse owned by eight of the largest dealers in

1121:

managing director Athanassios Diplas "the industry pushed through 10 years worth of changes in just a few months". By late 2008 processes had been introduced allowing CDSs that offset each other to be cancelled. Along with termination of contracts that have recently paid out such as those based on

758:

If both the borrower and lender are well-known and the market (or even worse, the news media) learns that the bank is selling the loan, then the sale may be viewed as signaling a lack of trust in the borrower, which could severely damage the banker-client relationship. In addition, the bank simply

556:

Finally, an investor might speculate on an entity's credit quality, since generally CDS spreads increase as credit-worthiness declines, and decline as credit-worthiness increases. The investor might therefore buy CDS protection on a company to speculate that it is about to default. Alternatively,

1212:

Chief Investment Office (CIO), referred to as "the London whale" in reference to the huge positions he was taking. Heavy opposing bets to his positions are known to have been made by traders, including another branch of J.P. Morgan, who purchased the derivatives offered by J.P. Morgan in such high

1195:

A clearinghouse acts as the buyer to every seller and seller to every buyer, reducing the risk of counterparty defaulting on a transaction. In the over-the-counter market, where credit- default swaps are currently traded, participants are exposed to each other in case of a default. A clearinghouse

981:

At first, banks were the dominant players in the market, as CDS were primarily used to hedge risk in connection with their lending activities. Banks also saw an opportunity to free up regulatory capital. By March 1998, the global market for CDS was estimated at $ 300 billion, with JP Morgan alone

641:

gets credit exposure to a portfolio of fixed income assets without owning those assets through the use of CDS. CDOs are viewed as complex and opaque financial instruments. An example of a synthetic CDO is Abacus 2007-AC1, which is the subject of the civil suit for fraud brought by the SEC against

629:

Transactions such as these do not even have to be entered into over the long-term. If Risky Corp's CDS spread had widened by just a couple of basis points over the course of one day, the hedge fund could have entered into an offsetting contract immediately and made a small profit over the life of

544:

Credit default swaps allow investors to speculate on changes in CDS spreads of single names or of market indices such as the North American CDX index or the European iTraxx index. An investor might believe that an entity's CDS spreads are too high or too low, relative to the entity's bond yields,

465:

The seller takes the risk that the buyer may default on the contract, depriving the seller of the expected revenue stream. More importantly, a seller normally limits its risk by buying offsetting protection from another party — that is, it hedges its exposure. If the original buyer drops out,

85:

Credit default swaps in their current form have existed since the early 1990s and increased in use in the early 2000s. By the end of 2007, the outstanding CDS amount was $ 62.2 trillion, falling to $ 26.3 trillion by mid-year 2010 and reportedly $ 25.5 trillion in early 2012. CDSs

5902:

The thrust of this criticism is that Naked CDS are indistinguishable from gambling wagers, and thus give rise in all instances to ordinary income, including to hedge fund managers on their so-called carried interests, and that the IRS exceeded its authority with the proposed regulations. This is

2743:

There are two competing theories usually advanced for the pricing of credit default swaps. The first, referred to herein as the 'probability model', takes the present value of a series of cashflows weighted by their probability of non-default. This method suggests that credit default swaps should

1027:

Since default is a relatively rare occurrence (historically around 0.2% of investment grade companies default in any one year), in most CDS contracts the only payments are the premium payments from buyer to seller. Thus, although the above figures for outstanding notionals are very large, in the

799:

If Risky Corporation does not default on its bond payments, the pension fund makes quarterly payments to Derivative Bank for 5 years and receives its $ 10 million back after five years from Risky Corp. Though the protection payments totaling $ 1 million reduce investment returns for the

1430:

The development and growth of the CDS market has meant that on many companies there is now a much larger outstanding notional of CDS contracts than the outstanding notional value of its debt obligations. (This is because many parties made CDS contracts for speculative purposes, without actually

1425:

Cash settlement: The protection seller pays the buyer the difference between par value and the market price of a debt obligation of the reference entity. For example, a hedge fund has bought $ 5 million worth of protection from a bank on the senior debt of a company. This company has now

1182:

Other proposals to clear credit-default swaps have been made by NYSE Euronext, Eurex AG and LCH.Clearnet Ltd. Only the NYSE effort is available now for clearing after starting on Dec. 22. As of Jan. 30, no swaps had been cleared by the NYSE’s London- based derivatives exchange, according to NYSE

1169:

Clearing Corp. shareholders including JPMorgan Chase & Co., Goldman Sachs Group Inc. and UBS AG, received $ 39 million in cash from Intercontinental in the acquisition, as well as the Clearing Corp.’s cash on hand and a 50–50 profit-sharing agreement with Intercontinental on the revenue

505:

Data about the credit default swaps market is available from three main sources. Data on an annual and semiannual basis is available from the International Swaps and Derivatives Association (ISDA) since 2001 and from the Bank for International Settlements (BIS) since 2004. The Depository Trust

229:

A CDS is linked to a "reference entity" or "reference obligor", usually a corporation or government. The reference entity is not a party to the contract. The buyer makes regular premium payments to the seller, the premium amounts constituting the "spread" charged in basis points by the seller to

1451:

is held following the publication of the initial midpoint of the dealer markets and what is the net open interest to deliver or be delivered actual bonds or loans. The final clearing point of this auction sets the final price for cash settlement of all CDS contracts and all physical settlement

834:

strategy that uses CDS transactions. This technique relies on the fact that a company's stock price and its CDS spread should exhibit negative correlation; i.e., if the outlook for a company improves then its share price should go up and its CDS spread should tighten, since it is less likely to

786:

Hedging risk is not limited to banks as lenders. Holders of corporate bonds, such as banks, pension funds or insurance companies, may buy a CDS as a hedge for similar reasons. Pension fund example: A pension fund owns five-year bonds issued by Risky Corp with par value of $ 10 million. To

5750:

In the case of Lehman Brothers, it is claimed that the widening of the bank's CDS spread reduced confidence in the bank and ultimately gave it further problems that it was not able to overcome. However, proponents of the CDS market argue that this confuses cause and effect; CDS spreads simply

997:

The market size for Credit Default Swaps more than doubled in size each year from $ 3.7 trillion in 2003. By the end of 2007, the CDS market had a notional value of $ 62.2 trillion. But notional amount fell during 2008 as a result of dealer "portfolio compression" efforts (replacing

1141:

A clearinghouse, and changes to the contracts to standardize them, will probably boost activity. ... Trading will be much easier.... We'll see new players come to the market because they’ll like the idea of this being a better and more traded product. We also feel like over time we'll see the

1096:

By 2010, Intercontinental Exchange, through its subsidiaries, ICE Trust in New York, launched in 2008, and ICE Clear Europe Limited in London, UK, launched in July 2009, clearing entities for credit default swaps (CDS) had cleared more than $ 10 trillion in credit default swaps (CDS) (Terhune

945:

In 1997, JPMorgan developed a proprietary product called BISTRO (Broad Index Securitized Trust Offering) that used CDS to clean up a bank's balance sheet. The advantage of BISTRO was that it used securitization to split up the credit risk into little pieces that smaller investors found more

1177:

For several months the SEC and our fellow regulators have worked closely with all of the firms wishing to establish central counterparties.... We believe that CME should be in a position soon to provide us with the information necessary to allow the commission to take action on its exemptive

6795:

If the fund manager acts as the protection seller under a CDS, there is some risk of breach of insurance regulations for the manager.... There is no Netherlands Antilles case law or literature available which makes clear whether a CDS constitutes the 'conducting of insurance business' under

1125:

The Bank for International Settlements estimates that outstanding derivatives total $ 708 trillion. U.S. and European regulators are developing separate plans to stabilize the derivatives market. Additionally there are some globally agreed standards falling into place in March 2009,

729:

to hedge might not find a ready seller of protection. Speculators also create a more competitive marketplace, keeping prices down for hedgers. A robust market in credit default swaps can also serve as a barometer to regulators and investors about the credit health of a company or country.

1149:

In Europe, CDS Index clearing was launched by IntercontinentalExchange's European subsidiary ICE Clear Europe on July 31, 2009. It launched Single Name clearing in Dec 2009. By the end of 2009, it had cleared CDS contracts worth EUR 885 billion reducing the open interest down to EUR

610:$ 10 million worth of protection for 1 year to AAA-Bank at this higher rate. Therefore, over the two years the hedge fund pays the bank 2 * 5% * $ 10 million = $ 1 million, but receives 1 * 15% * $ 10 million = $ 1.5 million, giving a total profit of $ 500,000.

244:

An investor or speculator may "buy protection" to hedge the risk of default on a bond or other debt instrument, regardless of whether such investor or speculator holds an interest in or bears any risk of loss relating to such bond or debt instrument. In this way, a CDS is similar to

5738:

Critics of the huge credit default swap market have claimed that it has been allowed to become too large without proper regulation and that, because all contracts are privately negotiated, the market has no transparency. Furthermore, there have been claims that CDSs exacerbated the

5936:

Because LCDS trades are linked to secured obligations with much higher recovery values than the unsecured bond obligations that are typically assumed the cheapest to deliver in respect of vanilla CDS, LCDS spreads are generally much tighter than CDS trades on the same name.

2804:

premium payments. So CDS pricing models have to take into account the possibility of a default occurring some time between the effective date and maturity date of the CDS contract. For the purpose of explanation we can imagine the case of a one-year CDS with effective date

5899:

capital gains tax treatment. These proposed regulations, which are yet to be finalized, have already been subject to criticism at a public hearing held by the IRS in January 2012, as well as in the academic press, insofar as that classification would apply to Naked CDS.

386:

Insurance requires the buyer to disclose all known risks, while CDSs do not (the CDS seller can in many cases still determine potential risk, as the debt instrument being "insured" is a market commodity available for inspection, but in the case of certain instruments like

698:, estimated to be up to 80% of the credit default swap market. There is currently a debate in the United States and Europe about whether speculative uses of credit default swaps should be banned. Legislation is under consideration by Congress as part of financial reform.

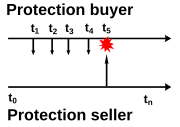

572:. Shorting a bond faced difficult practical problems, such that shorting was often not feasible; CDS made shorting credit possible and popular. Because the speculator in either case does not own the bond, its position is said to be a synthetic long or short position.

9801:

851:

CDS protection) while simultaneously hedging oneself by buying the underlying stock. This technique would benefit in the event of the CDS spread widening relative to the equity price, but would lose money if the company's CDS spread tightened relative to its equity.

1284:. Typical CDS contracts do not provide an internal mechanism for challenging the occurrence or non-occurrence of a credit event and rather leave the matter to the courts if necessary, though actual instances of specific events being disputed are relatively rare.

1093:(DTCC), which runs a warehouse for CDS trade confirmations accounting for around 90% of the total market, announced that it will release market data on the outstanding notional of CDS trades on a weekly basis. The data can be accessed on the DTCC's website here:

6796:

Netherlands Antilles law. However, if certain requirements are met, credit derivatives do not qualify as an agreement of (non-life) insurance because such an arrangement would in those circumstances not contain all the elements necessary to qualify it as such.

986:

early as 1996. In that year, the Office of the Comptroller of the Currency measured the size of the market as tens of billions of dollars. Six years later, by year-end 2002, the outstanding amount was over $ 2 trillion (~$ 3.24 trillion in 2023).

865:

Another common arbitrage strategy aims to exploit the fact that the swap-adjusted spread of a CDS should trade closely with that of the underlying cash bond issued by the reference entity. Misalignment in spreads may occur due to technical reasons such as:

588:

However, if Risky Corp does not default, then the CDS contract runs for two years, and the hedge fund ends up paying $ 1 million, without any return, thereby making a loss. AAA-Bank, by selling protection, has made $ 1 million without any upfront

5910:

basis. In contrast, assets that are held for investment, such as a commercial loan or bonds, are reported at cost, unless a probable and significant loss is expected. Thus, hedging a commercial loan using a CDS can induce considerable volatility into the

941:

where he and his team created bundles of swaps and sold them to investors. The investors would get the streams of revenue, according to the risk-and-reward level they chose; the bank would get insurance against its loans, and fees for setting up the deal.

241:. CDS contracts on sovereign obligations also usually include as credit events repudiation, moratorium, and acceleration. Most CDSs are in the $ 10–$ 20 million range with maturities between one and 10 years. Five years is the most typical maturity.

5761:

It was also feared at the time of Lehman's bankruptcy that the $ 400 billion notional of CDS protection which had been written on the bank could lead to a net payout of $ 366 billion from protection sellers to buyers (given the cash-settlement

57:. That is, the seller of the CDS insures the buyer against some reference asset defaulting. The buyer of the CDS makes a series of payments (the CDS "fee" or "spread") to the seller and, in exchange, may expect to receive a payoff if the asset defaults.

382:

The seller is not required to maintain reserves to cover the protection sold (this was a principal cause of AIG's financial distress in 2008; it had insufficient reserves to meet the "run" of expected payouts caused by the collapse of the housing

466:

the seller squares its position by either unwinding the hedge transaction or by selling a new CDS to a third party. Depending on market conditions, that may be at a lower price than the original CDS and may therefore involve a loss to the seller.

5210:

1129:

1. The introduction of central clearing houses, one for the US and one for Europe. A clearing house acts as the central counterparty to both sides of a CDS transaction, thereby reducing the counterparty risk that both buyer and seller face.

9439:

legal uncertainty as to whether certain derivatives, including credit default swaps, violated state bucket shop and gambling laws. created a ‘safe harbor’ by . . . preempting state and local gaming and bucket shop laws . . .") available at

778:

A bank buying protection can also use a CDS to free regulatory capital. By offloading a particular credit risk, a bank is not required to hold as much capital in reserve against the risk of default (traditionally 8% of the total loan under

1422:

pays the hedge fund $ 5 million cash, and the hedge fund must deliver $ 5 million face value of senior debt of the company (typically bonds or loans, which are typically worth very little given that the company is in default).

579:

believes that Risky Corp will soon default on its debt. Therefore, it buys $ 10 million worth of CDS protection for two years from AAA-Bank, with Risky Corp as the reference entity, at a spread of 500 basis points (=5%) per annum.

712:

called for an outright ban on naked credit default swaps, viewing them as "toxic" and allowing speculators to bet against and "bear raid" companies or countries. His concerns were echoed by several European politicians who, during the

936:

Despite early successes, credit default swaps could not be profitable until an industrialized and streamlined process was created to issue them. This changed when CDS's began to be traded as securities from JPMorgan, an effort led by

1348:

Sovereign credit default swap prices of selected European countries (2010-2011). The left axis is basis points, or 100ths of a percent; a level of 1,000 means it costs $ 1 million per year to protect $ 10 million of debt for five

1166:

the credit-default swap market, was approved by the Federal Trade Commission and the Justice Department. On March 5, 2009, the Federal Reserve Board, which oversees the clearinghouse, granted a request for ICE to begin clearing.

5880:

The U.S federal income tax treatment of CDS is uncertain (Nirenberg and Kopp 1997:1, Peaslee & Nirenberg 2008-07-21:129 and Brandes 2008). Commentators have suggested that, depending on how they are drafted, they are either

5866:, the establishment of a central exchange or clearing house for CDS trades would help to solve the "domino effect" problem, since it would mean that all trades faced a central counterparty guaranteed by a consortium of dealers.

5751:

reflected the reality that the company was in serious trouble. Furthermore, they claim that the CDS market allowed investors who had counterparty risk with Lehman Brothers to reduce their exposure in the case of their default.

5808:

insurance companies got involved with writing credit default swaps on mortgage-backed CDOs. Some media reports have claimed this was a contributing factor to the downfall of some of the monolines. In 2009 one of the monolines,

1064:

sellers were allowed to deduct from their payouts the inbound funds due to them from their hedging positions. Dealers generally attempt to remain risk-neutral, so that their losses and gains after big events offset each other.

3115:

is made, shown in blue. At either side of the diagram are the cashflows up to that point in time with premium payments in blue and default payments in red. If the contract is terminated the square is shown with solid shading.

4155:

891:

and should theoretically be close to zero. Basis trades attempt to exploit this difference to make a profit, however hedging a bond with a CDS does have irreducible risks which should be considered when making basis trades.

724:

Chairman Gensler are not in favor of an outright ban on naked credit default swaps. They prefer greater transparency and better capitalization requirements. These officials think that naked CDSs have a place in the market.

5845:

insured by the CDS. There was also fear that Lehman Brothers and AIG's inability to pay out on CDS contracts would lead to the unraveling of complex interlinked chain of CDS transactions between financial institutions.

152:

Some claim that derivatives such as CDS are potentially dangerous in that they combine priority in bankruptcy with a lack of transparency. A CDS can be unsecured (without collateral) and be at higher risk for a default.

1014:

Composition of the United States 15.5 trillion US dollar CDS market at the end of 2008 Q2. Green tints show Prime asset CDSs, reddish tints show sub-prime asset CDSs. Numbers followed by "Y" indicate years until

64:

of the loan), and the seller of the CDS takes possession of the defaulted loan or its market value in cash. However, anyone can purchase a CDS, even buyers who do not hold the loan instrument and who have no direct

842:

arbitrage because they exploit market inefficiencies between different parts of the same company's capital structure; i.e., mis-pricings between a company's debt and equity. An arbitrageur attempts to exploit the

1136:

Speaking before the changes went live, Sivan Mahadevan, a derivatives analyst at Morgan Stanley, one of the backers for IntercontinentalExchange's subsidiary, ICE Trust in New York, launched in 2008, claimed that

3941:

989:

Although speculators fueled the exponential growth, other factors also played a part. An extended market could not emerge until 1999, when ISDA standardized the documentation for credit default swaps. Also, the

275:

As an example, imagine that an investor buys a CDS from AAA-Bank, where the reference entity is Risky Corp. The investor—the buyer of protection—will make regular payments to AAA-Bank—the seller of protection.

7892:"Remarks by Chairman Alan Greenspan Risk Transfer and Financial Stability To the Federal Reserve Bank of Chicago's Forty-first Annual Conference on Bank Structure, Chicago, Illinois (via satellite) May 5, 2005"

6028:

Intercontinental Exchange's closest rival as credit default swaps (CDS) clearing houses, CME Group (CME) cleared $ 192 million in comparison to ICE's $ 10 trillion (Terhune Bloomberg Business Week 2010-07-29).

1275:

It is not the responsibility of the calculation agent to determine whether or not a credit event has occurred but rather a matter of fact that, pursuant to the terms of typical contracts, must be supported by

593:

Note that there is a third possibility in the above scenario; the hedge fund could decide to liquidate its position after a certain period of time in an attempt to realise its gains or losses. For example:

7661:

3724:

795:(200 basis points = 2.00 percent). In return for this credit protection, the pension fund pays 2% of $ 10 million ($ 200,000) per annum in quarterly installments of $ 50,000 to Derivative Bank.

8219:"Testimony Concerning Turmoil in U.S. Credit Markets: Recent Actions Regarding Government Sponsored Entities, Investment Banks and Other Financial Institutions (Christopher Cox, September 23, 2008)"

568:

Credit default swaps opened up important new avenues to speculators. Investors could go long on a bond without any upfront cost of buying a bond; all the investor need do was promise to pay in the

3022:

To price the CDS we now need to assign probabilities to the five possible outcomes, then calculate the present value of the payoff for each outcome. The present value of the CDS is then simply the

812:

In addition to financial institutions, large suppliers can use a credit default swap on a public bond issue or a basket of similar risks as a proxy for its own credit risk exposure on receivables.

736:

found that naked CDS did not worsen the Greek credit crisis. Without credit default swaps, Greece's borrowing costs would be higher. As of November 2011, the Greek bonds have a bond yield of 28%.

6745:

like insurance insofar as the buyer collects when an underlying security defaults ... unlike insurance, however, in that the buyer need not have an "insurable interest" in the underlying security

5890:(physical/cash and binary/FMV) and trigger (default only/any credit event) (Nirenberg & Kopp 1997:8). And, as noted below, the appropriate treatment for Naked CDS may be entirely different.

1326:

The premium payments are generally quarterly, with maturity dates (and likewise premium payment dates) falling on March 20, June 20, September 20, and December 20. Due to the proximity to the

8354:

462:"), the buyer loses its protection against default by the reference entity. If AAA-Bank defaults but Risky Corp. does not, the buyer might need to replace the defaulted CDS at a higher cost.

333:, or 0.5% (1 basis point = 0.01%), then an investor buying $ 10 million worth of protection from AAA-Bank must pay the bank $ 50,000. Payments are usually made on a quarterly basis, in

8749:

1146:

In the U.S., central clearing operations began in March 2009, operated by InterContinental Exchange (ICE). A key competitor also interested in entering the CDS clearing sector is CME Group.

9604:

7000:"The Trade Information Warehouse (Warehouse) is the market's first and only centralized global repository for trade reporting and post-trade processing of OTC credit derivatives contracts"

4637:

1117:

The early months of 2009 saw several fundamental changes to the way CDSs operate, resulting from concerns over the instruments' safety after the events of the previous year. According to

701:

Critics assert that naked CDSs should be banned, comparing them to buying fire insurance on your neighbor's house, which creates a huge incentive for arson. Analogizing to the concept of

6596:

4480:

3530:

4059:

755:. However, these options may not meet the bank's needs. Consent of the corporate borrower is often required. The bank may not want to incur the time and cost to find loan participants.

6977:

5906:

The accounting treatment of CDS used for hedging may not parallel the economic effects and instead, increase volatility. For example, GAAP generally require that CDS be reported on a

5075:

946:

digestible, since most investors lacked EBRD's capability to accept $ 4.8 billion in credit risk all at once. BISTRO was the first example of what later became known as synthetic

9260:

7117:

3832:

5829:, counterparties became subject to a risk of default, amplified with the involvement of Lehman Brothers and AIG in a very large number of CDS transactions. This is an example of

4904:

4235:

3988:

3771:

3577:

3418:

1443:) may be held to facilitate settlement of a large number of contracts at once, at a fixed cash settlement price. During the auction process participating dealers (e.g., the big

7591:. Amherst, MA: Center for International Securities and Derivatives Markets, Isenberg School of Management, University of Massachusetts, Amherst, 2004. Retrieved March 17, 2009.

5778:; that CDS contracts have been acting to distribute risk just as was intended; and that it is not CDSs themselves that need further regulation but the parties who trade them.

5681:

3628:

6857:

4756:

6827:

1192:

today that all market participants such as hedge funds, banks or other institutions are open to become members of the clearinghouse as long as they meet these requirements.

9486:

8290:

5085:

1105:

the "clearinghouse, and changes to the contracts to standardize them, will probably boost activity". IntercontinentalExchange's subsidiary, ICE Trust's larger competitor,

9644:

3302:

3275:

4401:

808:). The pension fund still loses the $ 600,000 it has paid over three years, but without the CDS contract it would have lost the entire $ 10 million minus recovery.

3453:

1153:

By the end of 2009, banks had reclaimed much of their market share; hedge funds had largely retreated from the market after the crises. According to an estimate by the

9784:

7551:

7539:

the use of an exotic credit default swap (called a Net Lease CDS), which effectively hedges tenant credit risk but at a substantially higher price than a vanilla swap.

1456:(ISDA), who organised them, auctions have recently proved an effective way of settling the very large volume of outstanding CDS contracts written on companies such as

1447:) submit prices at which they would buy and sell the reference entity's debt obligations, as well as net requests for physical settlement against par. A second stage

313:

AAA-Bank pays the investor the difference between the par value and the market price of a specified debt obligation (even if Risky Corp defaults there is usually some

3244:

3157:

357:

CDS contracts have obvious similarities with insurance contracts because the buyer pays a premium and, in return, receives a sum of money if an adverse event occurs.

9779:

7694:

5486:

3062:

5247:

4568:

4348:

4321:

4294:

4267:

3863:

3659:

3484:

3349:

3211:

3184:

2938:

2911:

2884:

2857:

2830:

739:

A bill in the U.S. Congress proposed giving a public authority the power to limit the use of CDSs other than for hedging purposes, but the bill did not become law.

4509:

3113:

3009:

1028:

absence of default the net cash flows are only a small fraction of this total: for a 100 bp = 1% spread, the annual cash flows are only 1% of the notional amount.

509:

According to DTCC, the Trade Information Warehouse maintains the only "global electronic database for virtually all CDS contracts outstanding in the marketplace."

5771:

frequently. This would have led to margin calls from buyers to sellers as Lehman's CDS spread widened, reducing the net cashflows on the days after the auction.

4177:

3371:

9663:

957:, regulators initially found CDS's ability to disperse default risk attractive. In 2000, credit default swaps became largely exempt from regulation by both the

325:

The "spread" of a CDS is the annual amount the protection buyer must pay the protection seller over the length of the contract, expressed as a percentage of the

6720:"Testimony Concerning Turmoil in U.S. Credit Markets: Recent Actions Regarding Government Sponsored Entities, Investment Banks and Other Financial Institutions"

4533:

4372:

3082:

2978:

2958:

10723:

368:. By contrast, a CDS provides an equal payout to all holders, calculated using an agreed, market-wide method. The holder does not need to own the underlying

3029:

This is illustrated in the following tree diagram where at each payment date either the contract has a default event, in which case it ends with a payment of

237:

A default is often referred to as a "credit event" and includes such events as failure to pay, restructuring and bankruptcy, or even a drop in the borrower's

775:

relations. Similarly, a bank selling a CDS can diversify its portfolio by gaining exposure to an industry in which the selling bank has no customer base.

1023:

Proportion of CDSs nominals (lower left) held by United States banks compared to all derivatives, in 2008Q2. The black disc represents the 2008 public debt.

10635:

9748:

9934:

7359:

33:

If the reference bond defaults, the protection seller pays par value of the bond to the buyer, and the buyer transfers ownership of the bond to the seller

9057:

5833:, risk which threatens an entire market, and a number of commentators have argued that size and deregulation of the CDS market have increased this risk.

1468:, however, has questioned in advance ISDA's ability to structure an auction, as defined to date, to set compensation associated with a 2012 bond swap in

917:

are widely credited with creating the modern credit default swap in 1994. In that instance, J.P. Morgan had extended a $ 4.8 billion credit line to

9417:

Diane Freda, I.R.S. Proposed Rules Mistakenly Classify Section 1256 Contracts, I.R.S. Witnesses Say, DAILY TAX REP. (BNA) No. 12 at G-4 (Jan. 20, 2012).

694:

In the examples above, the hedge fund did not own any debt of Risky Corp. A CDS in which the buyer does not own the underlying debt is referred to as a

9301:

Nirenberg, David Z.; Steven L. Kopp. (August 1997). "Credit Derivatives: Tax Treatment of Total Return Swaps, Default Swaps, and Credit-Linked Notes".

4070:

474:, such as ICE TCC, there will no longer be "counterparty risk", as the risk of the counterparty will be held with the central exchange/clearing house.

8463:

1036:

The market for Credit Default Swaps attracted considerable concern from regulators after a number of large scale incidents in 2008, starting with the

8953:

8754:

1291:

that will give rise to payment obligations by the protection seller and delivery obligations by the protection buyer. Typical credit events include

557:

the investor might sell protection if it thinks that the company's creditworthiness might improve. The investor selling the CDS is viewed as being "

8709:

8365:

6770:

If a default occurs, the party providing the credit protection — the seller — must make the buyer whole on the amount of insurance bought.

6522:

1056:

of Bear's collapse; i.e., investors saw that Bear was in trouble, and sought to hedge any naked exposure to the bank, or speculate on its collapse.

751:

There are other ways to eliminate or reduce the risk of default. The bank could sell (that is, assign) the loan outright or bring in other banks as

9945:

9894:

8322:

7914:

7477:

6889:

6337:

6113:

1469:

858:(LBO). Frequently this leads to the company's CDS spread widening due to the extra debt that will soon be put on the company's books, but also an

9775:

8854:

6396:

481:. If one or both parties to a CDS contract must post collateral (which is common), there can be margin calls requiring the posting of additional

340:

All things being equal, at any given time, if the maturity of two credit default swaps is the same, then the CDS associated with a company with a

9658:

9189:

6120:

1453:

1230:

1133:

2. The international standardization of CDS contracts, to prevent legal disputes in ambiguous cases where what the payout should be is unclear.

930:

115:

9029:

8661:

8402:

8164:

7181:

493:

of one of the parties changes. Many CDS contracts even require payment of an upfront fee (composed of "reset to par" and an "initial coupon.").

8532:

7216:

The Looting of America: How Wall Street's Game of Fantasy Finance Destroyed Our Jobs, Our Pensions, and Prosperity, and What We Can Do About It

6608:

126:), as well as loan-only credit default swaps (LCDS). Further, in addition to corporations and governments, the reference entity can include a

9862:

9823:

8080:

6783:

5848:

Chains of CDS transactions can arise from a practice known as "netting". Here, company B may buy a CDS from company A with a certain annual

9203:

10429:

10004:

3869:

1339:

9264:

8040:

7124:

5693:

In the "no-arbitrage" model proposed by both Duffie, and Hull-White, it is assumed that there is no risk free arbitrage. Duffie uses the

1204:

In April 2012, hedge fund insiders became aware that the market in credit default swaps was possibly being affected by the activities of

994:

spurred a market for CDS in emerging market sovereign debt. In addition, in 2004, index trading began on a large scale and grew rapidly.

966:

9817:

3011:. If we assume for simplicity that defaults can only occur on one of the payment dates then there are five ways the contract could end:

10434:

9112:

7582:

6999:

6058:

5794:

3015:

either it does not have any default at all, so the four premium payments are made and the contract survives until the maturity date, or

1090:

360:

However, there are also many differences, the most important being that an insurance contract provides an indemnity against the losses

95:

5817:, claiming that Merrill had misrepresented some of its CDOs to MBIA in order to persuade MBIA to write CDS protection for those CDOs.

7508:

513:

9855:

9654:

9440:

8807:

6951:

5755:

4538:

To get the total present value of the credit default swap we multiply the probability of each outcome by its present value to give

998:

offsetting redundant contracts), and by the end of 2008 notional amount outstanding had fallen 38 percent to $ 38.6 trillion.

431:

8636:

6864:

933:

in order to cut the reserves that J.P. Morgan was required to hold against Exxon's default, thus improving its own balance sheet.

10769:

8558:

8294:

7951:

6168:

958:

854:

An interesting situation in which the inverse correlation between a company's stock price and CDS spread breaks down is during a

8355:"The Derivatives Dealers' Club and Derivatives Markets Reform: A Guide for Policy Makers, Citizens and Other Interested Parties"

7847:

7118:"The Derivatives Dealers' Club and Derivatives Markets Reform: A Guide for Policy Makers, Citizens and Other Interested Parties"

10459:

8938:

8513:

5946:

definition update seeks to ensure the CDS payoffs closely mimic the economics of the underlying reference obligations (bonds).

3665:

441:

To cancel the insurance contract, the buyer can typically stop paying premiums, while for CDS the contract needs to be unwound.

9969:

8978:

10926:

7748:

7442:

7224:

7063:

5960:

1372:

Since December 1, 2011 the European Parliament has banned naked Credit default swap (CDS) on the debt for sovereign nations.

280:

Risky Corp defaults on its debt, the investor receives a one-time payment from AAA-Bank, and the CDS contract is terminated.

7558:

6672:

497:

millions, if not billions, of dollars to protection buyers. This risk is not present in other over-the-counter derivatives.

372:

and does not even have to suffer a loss from the default event. The CDS can therefore be used to speculate on debt objects.

9702:

9461:

8727:

7669:

7079:

6858:"Keynote Address of Chairman Gary Gensler, OTC Derivatives Reform, Markit's Outlook for OTC Derivatives Markets Conference"

962:

721:

435:

9645:

Barroso considers ban on speculation with banning purely speculative naked sales on credit default swaps of sovereign debt

5726:

change in its swap premium. CS01 may also be defined as the change in value for a one basis point parallel shift in the

4535:. The riskier the reference entity the greater the spread and the more rapidly the survival probability decays with time.

2767:

Under the probability model, a credit default swap is priced using a model that takes four inputs; this is similar to the

787:

manage the risk of losing money if Risky Corp defaults on its debt, the pension fund buys a CDS from Derivative Bank in a

264:. The buyer makes periodic payments to the seller, and in return receives a payoff if an underlying financial instrument

10591:

9285:

8387:

8268:

6365:

5730:. "CS01 Risk", in turn, refers to any unfavorable change in value, in response to changes in underlying credit spreads.

5722:- the credit spread dollar value of one basis point - reflects the change in market value of a CDS in response to a one

272:. The CDS may refer to a specified loan or bond obligation of a "reference entity", usually a corporation or government.

25:

If the reference bond performs without default, the protection buyer pays quarterly payments to the seller until maturity

7601:

Freeman, Jake; Kapoor, Vivek (June 17, 2019). "Irreducible Risks of Hedging a Bond with a Default Swap". Rochester, NY.

7155:

6423:

6151:

1109:, hasn't received an SEC exemption, and agency spokesman John Nester said he didn't know when a decision would be made.

9673:

8490:

7332:

1439:

When a credit event occurs on a major company on which a lot of CDS contracts are written, an auction (also known as a

835:

default on its debt. However, if its outlook worsens then its CDS spread should widen and its stock price should fall.

7829:

7025:

102:) announced it would give regulators greater access to its credit default swaps database. There is "$ 8 trillion

10327:

9630:

8832:

7801:

6706:

973:, specifically stated that CDSs are neither futures nor securities and so are outside the remit of the SEC and CFTC.

406:. Dealers in CDSs manage risk primarily by means of hedging with other CDS deals and in the underlying bond markets;

9764:

9004:

8780:

8609:

5754:

Credit default swaps have also faced criticism that they contributed to a breakdown in negotiations during the 2009

1357:; easy credit conditions during the 2002–2008 period that encouraged high-risk lending and borrowing practices; the

905:

Forms of credit default swaps had been in existence from at least the early 1990s, with early trades carried out by

561:" on the CDS and the credit, as if the investor owned the bond. In contrast, the investor who bought protection is "

86:

are not traded on an exchange and there is no required reporting of transactions to a government agency. During the

10829:

9997:

9679:

9429:

James Blakey, Tax Naked Credit Default Swaps for What They Are: Legalized Gambling, 8 U. Mass. L. Rev. 136 (2013).

7307:

6434:

1330:, which fall on the third Wednesday of these months, these CDS maturity dates are also referred to as "IMM dates".

1214:

6808:

6559:

4574:

470:

In the future, in the event that regulatory reforms require that CDS be traded and settled via a central exchange/

7935:

The lack of standardized documentation for credit swaps, in fact, could become a major brake on market expansion.

5920:

bank or corporation is exactly the same as the Reference Obligation used for the particular CDS that was bought.

4409:

3490:

1010:

349:

managers to be the best indicators of the likelihood of sellers of CDSs having to perform under these contracts.

7509:"Using Letters Of Credit, Credit Default Swaps And Other Forms of Credit Enhancements in Net Lease Transactions"

3994:

10764:

10409:

9938:

8867:

8584:

8081:"The level of outstanding credit-derivative trade confirmations presents operational and legal risks for firms"

7370:

5988:

5826:

5775:

5740:

4914:

1358:

1319:

maturity of 30 years, that it not be subordinated, that it not be subject to transfer restrictions (other than

947:

816:

634:

388:

234:

of the bond in exchange for physical delivery of the bond, although settlement may also be by cash or auction.

87:

9061:

8388:"IntercontinentalExchange gets SEC exemption: The exchange will begin clearing credit-default swaps next week"

8241:

8193:

7891:

783:). This frees resources the bank can use to make other loans to the same key customer or to other borrowers.

6903:

3120:

3026:

of the five payoffs multiplied by their probability of occurring. For a simplified numeric example, see and

1389:

1060:

767:

9549:

7987:

1452:

requests as well as matched limit offers resulting from the auction are actually settled. According to the

585:

a $ 9.5 million loss minus recovery unless the bank has somehow offset the position before the default.

458:

The buyer takes the risk that the seller may default. If AAA-Bank and Risky Corp. default simultaneously ("

192:. If the associated credit instrument suffers no credit event, then the buyer continues paying premiums at t

9130:

8467:

7735:

Fool's Gold: How Unrestrained Greed Corrupted a Dream, Shattered Global Markets and Unleashed a Catastrophe

7279:

6114:"Chart; ISDA Market Survey; Notional amounts outstanding at year-end, all surveyed contracts, 1987–present"

5744:

3777:

3084:

is the recovery rate, or it survives without a default being triggered, in which case a premium payment of

1381:

950:(CDOs). There were two Bistros in 1997 for approximately $ 10 billion (~$ 17.6 billion in 2023) each.

714:

489:

amount may vary over the life of the CDS contract, if the market price of the CDS contract changes, or the

4766:

4183:

1303:

corporate reference entities, European corporate reference entities and sovereigns generally also include

230:

insure against a credit event. If the reference entity defaults, the protection seller pays the buyer the

10804:

10342:

10196:

9990:

8713:

5882:

3947:

3730:

3536:

3377:

1323:), that it be of a standard currency and that it not be subject to some contingency before becoming due.

1122:

Lehmans, this had by March reduced the face value of the market down to an estimated $ 30 trillion.

1075:

991:

9953:

9912:

9883:

9177:

8326:

7922:

7485:

6722:. Senate Committee on Banking, Housing, and Urban Affairs. September 23, 2008. Retrieved March 17, 2009.

6634:

6124:

283:

If the investor actually owns Risky Corp's debt (i.e., is owed money by Risky Corp), a CDS can act as a

10660:

10601:

10423:

9844:

9034:

8411:

8169:

7190:

6400:

6081:

5955:

1083:

222:, then the seller pays the buyer for the loss, and the buyer would cease paying premiums to the seller.

9769:

9649:

9524:

9499:

8610:"Crony Capitalism: After Lobbying Against New Financial Regulations, JPMorgan Loses $ 2B in Risky Bet"

8142:

6317:"Testimony Concerning Credit Default Swaps Before the House Committee on Agriculture October 15, 2008"

5793:

change hands due to the offset of gains and losses by those who had both bought and sold protection.

5496:

3583:

646:

in April 2010. Abacus is a synthetic CDO consisting of credit default swaps referencing a variety of

10705:

10516:

9685:

8665:

7866:

7662:"The Promise of Credit Derivatives in Nonfinancial Corporations (and Why It's Failed to Materialize)"

6576:

ISDA is the trade group that represents participants in the privately negotiated derivatives industry

6009:

5970:

5205:{\displaystyle -p_{1}p_{2}p_{3}p_{4}(\delta _{1}+\delta _{2}+\delta _{3}+\delta _{4}){\frac {Nc}{4}}}

4647:

1990:

1976:

1101:

929:. A team of J.P. Morgan bankers led by Masters then sold the credit risk from the credit line to the

819:, most observers conclude that using credit default swaps as a hedging device has a useful purpose.

138:

9733:

9711:

9349:

7643:

1126:

administered by International Swaps and Derivatives Association (ISDA). Two of the key changes are:

10916:

10824:

10819:

9740:

9612:

9608:

9592:

6374:

5895:

5785:

famously described derivatives bought speculatively as "financial weapons of mass destruction." In

2752:

1582:

1086:(OTC). This led to recent calls for the market to open up in terms of transparency and regulation.

1079:

1037:

1019:

647:

516:

publishes quarterly credit derivative data about insured U.S commercial banks and trust companies.

471:

9818:

New ways to dice up debt - Suddenly, credit derivatives-deals that spread credit risk--are surging

8091:

7443:"OCC 96-43; OCC Bulletin; Subject: Credit Derivatives; Description: Guidelines for National Banks"

1476:

for Greek bondholders, issued an opinion that the bond swap would not constitute a default event.

1396:'s restructuring in 2000 led to the credit event's removal from North American high yield trades.

90:, the lack of transparency in this large market became a concern to regulators as it could pose a

10774:

10474:

10444:

10419:

10302:

10143:

10075:

9976:

9210:

8014:

7253:

3280:

3253:

1609:

1595:

1353:

The European sovereign debt crisis resulted from a combination of complex factors, including the

954:

763:

391:

made up of "slices" of debt packages, it can be difficult to tell exactly what is being insured);

127:

60:

In the event of default, the buyer of the credit default swap receives compensation (usually the

6315:

Sirri, Erik, Director, Division of Trading and Markets U.S. Securities and Exchange Commission.

6201:

Kiff, John; Jennifer Elliott; Elias Kazarian; Jodi Scarlata; Carolyne Spackman (November 2009).

5774:

Senior bankers have argued that not only did the CDS market function remarkably well during the

4377:

10921:

10571:

10556:

10521:

10464:

9788:

9744:

9706:

8055:

6758:

5981:

5870:

3424:

2756:

926:

9372:

8116:

7622:

7214:

6488:

1409:

As described in an earlier section, if a credit event occurs then CDS contracts can either be

1237:, a corporation or sovereign that generally, although not always, has debt outstanding, and a

69:

in the loan (these are called "naked" CDSs). If there are more CDS contracts outstanding than

10784:

10551:

10449:

10128:

9923:

9752:

9720:

9600:

9336:

8895:

8361:

7740:

7630:

6553:

6551:

6382:

5975:

5965:

3216:

3129:

131:

118:, although there are many variants. In addition to the basic, single-name swaps, there are

9770:

Warren Buffett on Derivatives - Excerpts from the Berkshire Hathaway annual report for 2002.

8907:

8687:

6461:

5253:

3032:

379:

The seller might in principle not be a regulated entity (though in practice most are banks);

10911:

10738:

10695:

10685:

10675:

10670:

10396:

10337:

10272:

10226:

10221:

10095:

10055:

10022:

8850:

5225:

4546:

4512:

4326:

4299:

4272:

4245:

3841:

3637:

3462:

3327:

3189:

3162:

2916:

2889:

2862:

2835:

2808:

2801:

1299:

with respect to its direct or guaranteed bond or loan debt. CDS written on North American

1209:

910:

482:

421:

399:

146:

9905:

7523:

7417:

6548:

6316:

6202:

4485:

3087:

2983:

212:

8:

10743:

10454:

10277:

9876:

8218:

6809:"Understanding Derivatives: Markets and Infrastructure - Federal Reserve Bank of Chicago"

6719:

5781:

Some general criticism of financial derivatives is also relevant to credit derivatives.

5727:

4351:

4161:

3355:

1569:

1516:

1502:

485:. The required collateral is agreed on by the parties when the CDS is first issued. This

337:. These payments continue until either the CDS contract expires or Risky Corp defaults.

145:

of any entity on which a CDS is available, which can be compared to that provided by the

9759:

Hull, J. C. and A. White, Valuing Credit Default Swaps II: Modeling Default Correlations

9246:

7003:

6955:

6557:

677:

Please help update this article to reflect recent events or newly available information.

10794:

10779:

10748:

10733:

10700:

10566:

10357:

10322:

10085:

10050:

10013:

9153:

9091:

7686:

7610:

6225:

5786:

4518:

4357:

3067:

2963:

2943:

1556:

1530:

1362:

771:

752:

702:

550:

369:

365:

123:

66:

9758:

8891:

7962:

6278:

6172:

800:

pension fund, its risk of loss due to Risky Corp defaulting on the bond is eliminated.

166:

49:

agreement that the seller of the CDS will compensate the buyer in the event of a debt

10799:

10789:

10728:

10715:

10690:

10576:

10362:

10158:

9368:

9084:

8911:

7744:

7733:

7690:

7682:

7618:

7614:

7576:

7220:

7059:

6883:

6702:

6484:

6378:

6331:

6229:

5841:

4403:

2797:

1731:

1473:

1461:

1157:, by late 2009 the bank JP Morgan alone now had about 30% of the global CDS market.

839:

451:

403:

265:

257:

246:

50:

9833:

9234:

8965:

7248:

6733:

720:

Despite these concerns, former United States Secretary of the Treasury Geithner and

671:

Parts of this article (those related to legality of naked CDS in Europe) need to be

77:. The payment received is often substantially less than the face value of the loan.

10680:

10619:

10614:

10596:

10526:

10292:

10287:

10259:

10211:

10090:

10030:

9363:

Ari J. Brandes (July 21, 2008). "A Better Way to Understand Credit Default Swaps".

7678:

7602:

6480:

6476:

6460:

Koresh, Galil; Shapir, Offer Moshe; Amiram, Dan; Ben-Zion, Uri (November 1, 2018).

6217:

5912:

5886:

2772:

1444:

1354:

1300:

1154:

922:

855:

569:

486:

427:

414:

119:

7446:

10890:

10860:

10855:

10809:

10645:

10640:

10586:

10496:

10404:

10377:

10317:

10312:

10282:

10231:

10216:

10133:

10113:

9690:

6155:

4150:{\displaystyle -{\frac {Nc}{4}}(\delta _{1}+\delta _{2}+\delta _{3}+\delta _{4})}

3247:

1870:

1856:

1842:

1718:

1543:

1457:

1366:

1344:

1308:

1246:

1196:

also provides one location for regulators to view traders’ positions and prices.

1048:

in March. An alternative view is that this surge in CDS protection buyers was a

788:

562:

529:

450:

When entering into a CDS, both the buyer and seller of credit protection take on

326:

284:

9465:

9451:

Commodity Futures Modernization Act of 2000, H.R. 5660, 106th Cong. § 117(e)(2).

815:

Although credit default swaps have been highly criticized for their role in the

10865:

10850:

10650:

10561:

10511:

10488:

10469:

10297:

10239:

10206:

10201:

10181:

10105:

9698:

8926:

7395:

6200:

6004:

5907:

5782:

5768:

5698:

2748:

1922:

1908:

1786:

1772:

1636:

1242:

1045:

970:

914:

862:

in its share price, since buyers of a company usually end up paying a premium.

558:

478:

477:

As is true with other forms of over-the-counter derivatives, CDS might involve

459:

410:

395:

103:

70:

46:

6856:

Gensler, Gary, Chairman Commodity Futures Trading Commission (March 9, 2010).

6363:; Skeel, David A. Jr. (2007). "The Promise And Perils of Credit Derivatives".

6221:

1249:. The period over which default protection extends is defined by the contract

1160:

10905:

10845:

10814:

10655:

10581:

10541:

10536:

10372:

10244:

10191:

10186:

10168:

10065:

10045: