27:

131:

A study by two

European academics published in May, 2022 found the Buffett Indicator "explains a large fraction of ten-year return variation for the majority of countries outside the United States". The study examined 10-year periods in fourteen developed markets, in most cases with data starting in

199:

by large US technology and life sciences multinationals), or that the profitability of US companies has structurally increased (e.g. due to increased concentration of technology companies), thus justifying a higher ratio; although that may also revert over time. Other commentators have highlighted

208:

Buffett's original chart used US GNP as the divisor, which captures the domestic and international activity of all US resident entities even if based abroad, however, many modern

Buffett metrics use US GDP as the metric. US GDP has historically been within 1 percent of US GNP, and is more readily

112:

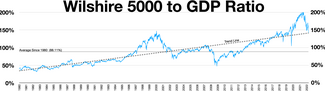

metric showed favorable or poor times to invest: "For me, the message of that chart is this: If the percentage relationship falls to the 70% or 80% area, buying stocks is likely to work very well for you. If the ratio approaches 200%–as it did in 1999 and a part of 2000–you are playing with fire".

190:

There is evidence that the

Buffett indicator has trended upwards over time, particularly post 1995, and the lows registered in 2009 would have registered as average readings from the 1950–1995 era. Reasons proposed include that GDP might not capture all the overseas profits of US multinationals

150:

The same studies show a poor annual correlation between US GDP growth and US equity returns, underlining

Buffett's belief that when equity prices get ahead of corporate profits (via the GNP/GDP proxy), poor returns will follow. The indicator has also been advocated for its ability to reduce the

111:

Buffett explained that for the annual return of US securities to materially exceed the annual growth of US GNP for a protracted period of time: "you need to have the line go straight off the top of the chart. That won't happen". Buffett finished the essay by outlining the levels he believed the

412:

828:

What's in the future for investors--another roaring bull market or more upset stomach? Amazingly, the answer may come down to three simple factors. Here, the world's most celebrated investor talks about what really makes the market tick--and whether that ticking should make you

132:

1973. The

Buffett Indicator forecasted an average of 83% of returns across all nations and periods, though the predictive value ranged from a low of 42% to as high as 93% depending on the specific nation. Accuracy was lower in nations with smaller stock markets.

108:". Buffett said of the metric: "Still, it is probably the best single measure of where valuations stand at any given moment. And as you can see, nearly two years ago the ratio rose to an unprecedented level. That should have been a very strong warning signal".

162:

The

Buffett indicator has been calculated for most international stock markets, however, caveats apply as other markets can have less stable compositions of listed corporations (e.g. the Saudi Arabia metric was materially impacted by the 2018 listing of

417:(E.g. if US GDP is USD 20 trillion and the market capitalization of the Wilshire 5000 is USD 40 trillion, then the Buffett indicator for the US is 200%; i.e. US public companies are twice as big as annual US economic output.)

585:

237:

520:

Or more technically, item NCBEILQ027S, from Line 62 in the F.103 balance sheet of Table S.5.q of the "Integrated

Macroeconomic Accounts for the United States" (Market Value of Equities Outstanding) file.

140:

Buffett acknowledged that his metric was a simple one and thus had "limitations", however the underlying theoretical basis for the indicator, particularly in the US, is considered reasonable.

147:

of 2007–2009. GDP captures effects where a given industry's margins increase materially for a period, but the effect of reduced wages and costs, dampening margins in other industries.

143:

For example, studies have shown a consistent and strong annual correlation between US GDP growth, and US corporate profit growth, and which has increased materially since the

466:

De-trended data of

Buffett's original calculation basis (see above) has had the following lows and highs from 1950 to February 2021 (expressed a % deviation from mean):

549:

1255:

764:

115:

Buffett's metric became known as the "Buffett

Indicator", and has continued to receive widespread attention in the financial media, and in modern finance textbooks.

1352:

455:

Using the more common modern

Buffett indicator with the Wilshire 5000 and US GDP, the metric has had the following lows and highs from 1970 to February 2021:

444:

Using Buffett's original calculation basis in his 2001 article, but with GDP, the metric has had the following lows and highs from 1950 to February 2021:

104:. In the essay, Buffett presented a chart going back 80 years that showed the value of all "publicly traded securities" in the US as a percentage of "US

1112:

723:

407:{\displaystyle \operatorname {Buffett\ indicator} ={\frac {\operatorname {Wilshire\ 5000\ capitalization} }{\operatorname {US\ GDP} }}\times 100}

624:

1288:

1144:

67:

in 2001, who called it "probably the best single measure of where valuations stand at any given moment", and its modern form compares the

2168:

2143:

1345:

63:

used to assess how expensive or cheap the aggregate stock market is at a given point in time. It was proposed as a metric by investor

692:

79:. It is widely followed by the financial media as a valuation measure for the US market in both its absolute, and de-trended forms.

167:), or a significantly higher/lower composition of private vs public firms (e.g. Germany vs. Switzerland), and therefore comparisons

1050:

870:

2248:

1338:

999:

Swinkels, Laurens and Umlauft, Thomas S., The Buffett Indicator: International Evidence (March 30, 2022). Available at SSRN:

550:"Warren Buffett's favorite market indicator soars to record high, signaling stocks are overvalued and a crash may be coming"

436:

peaks at 137% in Q1 2000, while the versions following Buffett's original technique, peak at very close to 160% in Q1 2000.

1583:

60:

2389:

977:

939:

910:

810:

220:

for "corporate equities", as it went back for over 80 years; however, many modern Buffett metrics simply use the main

1202:

429:

217:

1608:

2319:

451:

A high of 87.1% in 1968, a high of 159.2% in 2000, a high of c. 118% in 2007, and a high of 189.6% in (Feb) 2021.

462:

A high of 81.1% in 1972, a high of 136.9% in 2000, a high of 105.2% in 2007, and a high of 172.1% in (Feb) 2021.

2136:

159:

ratio metrics; and that it is not affected by share buybacks (which don't affect aggregate corporate profits).

86:", crossing the 200% level in February 2021; a level that Buffett warned if crossed, was "playing with fire".

1602:

842:

213:

151:

effects of "aggressive accounting" or "adjusted profits", that distort the value of corporate profits in the

1021:

473:

A high of +58% in 1968, a high of +96% in 2000, a high of c. +30% in 2007, and a high of +80% in (Feb) 2021.

2394:

2379:

2085:

2025:

1821:

1727:

1225:

178:

The Buffett indicator has also been calculated for industries (but also noting that it is not relevant for

1320:

1082:"One of Warren Buffett's Favorite Metrics Is Flashing Red—a Sign That Corporate Profits Are Due for a Hit"

1811:

1779:

1683:

1637:

1620:

1573:

1292:

1149:

2301:

1596:

1590:

448:

A low of 33.0% in 1953, a low of 32.2% in 1982, and a low of c. 79% in 2002, and a low of 66.7% in 2009

2374:

2313:

2129:

1265:

959:

662:

2384:

2260:

1985:

1660:

1081:

196:

152:

2347:

1939:

1800:

1695:

1578:

875:

470:

A low of -28% in 1953, a low of -51% in 1982, and a low of -5% in 2002, and a low of -27% in 2009

958:

Sanz, Jorge L.C (2016). "Chapter 26: Understanding Buffett Indicators in Different Industries".

1827:

511:

index, or using different definitions of GDP, and even using GNP (Buffett's original divisor).

128:, listed the Buffett indicator as one of his "Eight Best Predictors of the Long-Term Market".

2272:

2254:

2197:

1965:

1774:

68:

2336:

2289:

2186:

2100:

2020:

1785:

1769:

1732:

1614:

1557:

1525:

483:

8:

2226:

2174:

2030:

1975:

1899:

1759:

1689:

1518:

1491:

847:

590:

433:

124:

1310:

1282:

1172:

2070:

2045:

2005:

1990:

1909:

1879:

1848:

1806:

1550:

1460:

1450:

1198:"Wilshire 5000 Total Market Full Cap Index/Gross Domestic Product (GDP at 2007 prices)"

1086:

815:

96:

2325:

2295:

1934:

1919:

973:

935:

931:

906:

902:

629:

83:

209:

available (other international markets have greater variation between GNP and GDP).

2307:

2283:

2237:

2035:

1955:

1751:

1632:

1508:

1427:

1383:

1361:

965:

554:

231:

A common modern formula for the US market, which is expressed as a percentage, is:

2152:

2110:

2105:

2040:

2015:

1950:

1924:

1904:

1863:

1858:

1853:

1838:

1833:

1721:

1655:

1647:

1535:

1422:

507:

Note that slightly different Buffett indicators can be calculated when using the

144:

899:

The Conceptual Foundations of Investing: A Short Book of Need–to–Know Essentials

2202:

2192:

2065:

2060:

1960:

1945:

1706:

1701:

1666:

1465:

1432:

1378:

1370:

969:

802:

200:

that the omission by metric of corporate debt, could also be having an effect.

64:

26:

2368:

2353:

2342:

2278:

1929:

1914:

1889:

1843:

1795:

1498:

1455:

1442:

1393:

1117:

225:

72:

35:

2331:

2090:

2010:

1980:

1970:

1790:

1764:

1513:

1503:

1486:

1417:

1412:

1388:

1197:

806:

722:

Regan, Michael P.; Hajric, Vildana; Ballentine, Claire (12 February 2021).

581:

421:

119:

101:

20:

1004:

459:

A low of 34.6% in 1982, a low of 72.9% in 2002, and a low of 56.8% in 2009

2232:

2095:

2075:

2055:

2050:

1995:

1884:

1816:

2080:

2000:

1677:

1540:

765:"Market Cap to GDP: An Updated Look at the Buffett Valuation Indicator"

508:

221:

192:

2266:

2242:

2208:

1716:

1711:

1626:

1545:

1256:

Market Cap to GDP: An Updated Look at the Buffett Valuation Indicator

693:"The Buffett Indicator at All-Time Highs: Is This Cause for Concern?"

488:

156:

1330:

1000:

897:

Cornell, Shaun; Cornell, Bradford; Cornell, Andrew (December 2018).

2220:

2121:

1894:

1530:

1230:

1113:"The Buffett Indicator Revisited: Market Cap-to-GDP and Valuations"

428:

of the ratio; for example, the Buffett indicator calculated by the

1738:

724:"Warren Buffett's Favorite Valuation Metric Is Ringing an Alarm"

2214:

1481:

1298:

928:

Japanese Equities: A Practical Guide to Investing in the Nikkei

164:

2180:

1404:

1051:"What Is the Relationship Between Corporate Profits and GDP?"

1139:

1137:

1135:

1026:

432:

peaks at 118% in Q1 2000, while the version calculated by

1132:

105:

82:

The indicator set an all-time high during the so-called "

76:

39:

1022:"Is There a Link Between GDP Growth and Equity Returns?"

657:

655:

653:

651:

649:

647:

1311:

Buffett Indicator: Where Are We with Market Valuations?

94:

On 10 December 2001, Buffett proposed the metric in a

896:

758:

756:

754:

752:

750:

748:

746:

744:

721:

644:

240:

953:

951:

871:"Future Returns: The Value Gap Is Too Big to Ignore"

586:"The Eight Best Predictors of the Long-Term Market"

741:

686:

684:

406:

1145:"Market Cap to GDP Ratio (the Buffett Indicator)"

948:

543:

541:

539:

537:

2366:

1289:Market Cap to GDP Ratio (the Buffett Indicator)

1106:

1104:

681:

171:international markets using the indicator as a

534:

2137:

1346:

801:

576:

574:

572:

1101:

717:

715:

713:

1075:

1073:

1071:

2144:

2130:

1353:

1339:

569:

420:The choice of how GDP is calculated (e.g.

175:measure of valuation are not appropriate.

797:

795:

793:

791:

789:

787:

785:

710:

1321:Market Cap to GDP: The Buffett Indicator

1283:Stock Market Capitalization-to-GDP Ratio

1068:

622:

618:

616:

614:

612:

610:

608:

25:

1016:

1014:

1012:

840:

623:Ponciano, Jonathan (12 February 2021).

580:

547:

16:Aggregate stock market valuation metric

2367:

1223:

1048:

1005:http://dx.doi.org/10.2139/ssrn.4071039

782:

762:

2249:Present value of growth opportunities

2169:Cyclically adjusted price-to-earnings

2125:

1360:

1334:

1110:

1079:

925:

843:"MoneyBeat: Buffett Indicator Flares"

625:"Is The Stock Market About To Crash?"

605:

2215:Enterprise value/gross cash invested

2151:

1009:

957:

811:"Warren Buffett On The Stock Market"

548:Mohamed, Theron (10 February 2021).

868:

690:

13:

1249:

1226:"Are We in a Stock Market Bubble?"

1049:Hansen, Steven (15 October 2015).

392:

389:

386:

380:

377:

372:

369:

366:

363:

360:

357:

354:

351:

348:

345:

342:

339:

336:

333:

321:

318:

315:

312:

309:

306:

303:

300:

290:

287:

284:

281:

278:

275:

272:

269:

266:

260:

257:

254:

251:

248:

245:

242:

212:Buffett's original chart used the

100:essay co-authored with journalist

57:Market capitalization-to-GDP ratio

14:

2406:

1276:

1224:Richer, Felix (9 February 2021).

1203:Federal Reserve Bank of St. Louis

1001:https://ssrn.com/abstract=4071039

841:Scholer, Kristen (14 June 2015).

430:Federal Reserve Bank of St. Louis

218:Federal Reserve Bank of St. Louis

1609:Electronic communication network

1111:Vohra, Navin (29 January 2021).

763:Minski, Jill (4 February 2021).

691:Ang, Carmen (17 February 2021).

2320:Risk-adjusted return on capital

1217:

1190:

1165:

1042:

993:

926:Naito, Michiro (October 2019).

919:

890:

862:

834:

514:

869:Max, Sarah (2 February 2021).

501:

1:

1603:Multilateral trading facility

1080:Tully, Shawn (19 June 2019).

527:

424:), can materially affect the

214:Federal Reserve Economic Data

2181:Cash return on cash invested

2026:Returns-based style analysis

1822:Post-modern portfolio theory

1728:Security characteristic line

1285:(Investopedia, January 2021)

7:

1780:Efficient-market hypothesis

1684:Capital asset pricing model

1621:Straight-through processing

1293:Corporate Finance Institute

1150:Corporate Finance Institute

477:

185:

10:

2413:

2302:Return on capital employed

1597:Alternative Trading System

970:10.1142/9789813149311_0026

439:

203:

89:

18:

2390:2000s in economic history

2314:Return on tangible equity

2159:

1872:

1747:

1646:

1566:

1474:

1441:

1402:

1368:

1177:St. Louis Federal Reserve

216:(FRED) database from the

135:

2267:Price-earnings to growth

1661:Arbitrage pricing theory

494:

118:In 2018, finance author

19:Not to be confused with

2209:Enterprise value/EBITDA

1940:Initial public offering

1801:Modern portfolio theory

1696:Dividend discount model

1579:List of stock exchanges

663:"The Buffett Indicator"

182:valuation comparison).

2221:Enterprise value/sales

1828:Random walk hypothesis

1270:CurrentMarketValuation

667:CurrentMarketValuation

408:

224:index, or the broader

44:

1966:Market capitalization

1775:Dollar cost averaging

1266:The Buffett Indicator

409:

29:

2290:Return on net assets

1786:Fundamental analysis

1770:Contrarian investing

1733:Security market line

1638:Liquidity aggregator

1615:Direct market access

1526:Quantitative analyst

1303:BuffettIndicator.net

964:. pp. 685–710.

809:(10 December 2001).

484:Economy monetization

238:

153:price–earnings ratio

2395:Economic indicators

2380:Valuation (finance)

2175:Capitalization rate

2031:Reverse stock split

1976:Market manipulation

1900:Dual-listed company

1760:Algorithmic trading

1690:Capital market line

1492:Inter-dealer broker

1260:AdvisorPerspectives

1173:"US GDP vs. US GNP"

848:Wall Street Journal

769:AdvisorPerspectives

591:Wall Street Journal

434:Wilshire Associates

125:Wall Street Journal

2348:Sustainable growth

2071:Stock market index

1910:Efficient frontier

1849:Technical analysis

1807:Momentum investing

1629:(private exchange)

1519:Proprietary trader

1461:Shares outstanding

1451:Authorised capital

961:Business Analytics

669:. 11 February 2021

404:

61:valuation multiple

45:

2362:

2361:

2296:Return on capital

2164:Buffett indicator

2119:

2118:

1920:Flight-to-quality

1672:Buffett indicator

1362:Financial markets

1299:Buffett Indicator

584:(5 August 2018).

396:

385:

332:

326:

265:

84:everything bubble

49:Buffett indicator

2402:

2375:Financial ratios

2308:Return on equity

2284:Return on assets

2238:Operating margin

2153:Financial ratios

2146:

2139:

2132:

2123:

2122:

2036:Share repurchase

1748:Trading theories

1633:Crossing network

1591:Over-the-counter

1428:Restricted stock

1384:Secondary market

1355:

1348:

1341:

1332:

1331:

1272:, February 2021)

1262:, February 2021)

1243:

1242:

1240:

1238:

1221:

1215:

1214:

1212:

1210:

1194:

1188:

1187:

1185:

1183:

1169:

1163:

1162:

1160:

1158:

1141:

1130:

1129:

1127:

1125:

1108:

1099:

1098:

1096:

1094:

1077:

1066:

1065:

1063:

1061:

1046:

1040:

1039:

1037:

1035:

1018:

1007:

997:

991:

990:

988:

986:

955:

946:

945:

930:(1st ed.).

923:

917:

916:

901:(1st ed.).

894:

888:

887:

885:

883:

866:

860:

859:

857:

855:

838:

832:

831:

825:

823:

799:

780:

779:

777:

775:

760:

739:

738:

736:

734:

719:

708:

707:

705:

703:

697:VisualCapitalist

688:

679:

678:

676:

674:

659:

642:

641:

639:

637:

620:

603:

602:

600:

598:

578:

567:

566:

564:

562:

555:Business Insider

545:

521:

518:

512:

505:

413:

411:

410:

405:

397:

395:

383:

375:

330:

324:

298:

293:

263:

33:

2412:

2411:

2405:

2404:

2403:

2401:

2400:

2399:

2385:2000 neologisms

2365:

2364:

2363:

2358:

2255:Price/cash flow

2198:Dividend payout

2155:

2150:

2120:

2115:

2106:Voting interest

2016:Public offering

1951:Mandatory offer

1925:Government bond

1905:DuPont analysis

1868:

1864:Value investing

1859:Value averaging

1854:Trend following

1839:Style investing

1834:Sector rotation

1749:

1743:

1722:Net asset value

1648:Stock valuation

1642:

1562:

1470:

1437:

1423:Preferred stock

1398:

1364:

1359:

1279:

1252:

1250:Further reading

1247:

1246:

1236:

1234:

1222:

1218:

1208:

1206:

1196:

1195:

1191:

1181:

1179:

1171:

1170:

1166:

1156:

1154:

1143:

1142:

1133:

1123:

1121:

1109:

1102:

1092:

1090:

1078:

1069:

1059:

1057:

1047:

1043:

1033:

1031:

1020:

1019:

1010:

998:

994:

984:

982:

980:

956:

949:

942:

924:

920:

913:

895:

891:

881:

879:

867:

863:

853:

851:

839:

835:

821:

819:

803:Buffett, Warren

800:

783:

773:

771:

761:

742:

732:

730:

720:

711:

701:

699:

689:

682:

672:

670:

661:

660:

645:

635:

633:

621:

606:

596:

594:

579:

570:

560:

558:

546:

535:

530:

525:

524:

519:

515:

506:

502:

497:

480:

442:

376:

299:

297:

241:

239:

236:

235:

228:index instead.

206:

188:

145:Great Recession

138:

122:writing in the

92:

43:

31:

24:

17:

12:

11:

5:

2410:

2409:

2398:

2397:

2392:

2387:

2382:

2377:

2360:

2359:

2357:

2356:

2351:

2345:

2340:

2337:Short interest

2334:

2329:

2323:

2317:

2311:

2305:

2299:

2293:

2287:

2281:

2276:

2270:

2264:

2261:Price-earnings

2258:

2252:

2246:

2240:

2235:

2230:

2224:

2218:

2212:

2206:

2203:Earnings yield

2200:

2195:

2193:Dividend cover

2190:

2187:Debt-to-equity

2184:

2178:

2172:

2166:

2160:

2157:

2156:

2149:

2148:

2141:

2134:

2126:

2117:

2116:

2114:

2113:

2108:

2103:

2098:

2093:

2088:

2083:

2078:

2073:

2068:

2066:Stock exchange

2063:

2061:Stock dilution

2058:

2053:

2048:

2043:

2038:

2033:

2028:

2023:

2018:

2013:

2008:

2003:

1998:

1993:

1988:

1986:Mean reversion

1983:

1978:

1973:

1968:

1963:

1961:Market anomaly

1958:

1953:

1948:

1943:

1937:

1932:

1927:

1922:

1917:

1912:

1907:

1902:

1897:

1892:

1887:

1882:

1880:Bid–ask spread

1876:

1874:

1870:

1869:

1867:

1866:

1861:

1856:

1851:

1846:

1841:

1836:

1831:

1825:

1819:

1814:

1809:

1804:

1798:

1793:

1788:

1783:

1777:

1772:

1767:

1762:

1756:

1754:

1745:

1744:

1742:

1741:

1736:

1730:

1725:

1719:

1714:

1709:

1707:Earnings yield

1704:

1702:Dividend yield

1699:

1693:

1687:

1681:

1675:

1669:

1664:

1658:

1652:

1650:

1644:

1643:

1641:

1640:

1635:

1630:

1624:

1618:

1612:

1606:

1600:

1594:

1593:(off-exchange)

1588:

1587:

1586:

1581:

1570:

1568:

1567:Trading venues

1564:

1563:

1561:

1560:

1555:

1554:

1553:

1543:

1538:

1533:

1528:

1523:

1522:

1521:

1516:

1506:

1501:

1496:

1495:

1494:

1489:

1478:

1476:

1472:

1471:

1469:

1468:

1466:Treasury stock

1463:

1458:

1453:

1447:

1445:

1439:

1438:

1436:

1435:

1433:Tracking stock

1430:

1425:

1420:

1415:

1409:

1407:

1400:

1399:

1397:

1396:

1391:

1386:

1381:

1379:Primary market

1375:

1373:

1366:

1365:

1358:

1357:

1350:

1343:

1335:

1329:

1328:

1325:LongTermTrends

1318:

1308:

1306:

1296:

1286:

1278:

1277:External links

1275:

1274:

1273:

1263:

1251:

1248:

1245:

1244:

1216:

1189:

1164:

1131:

1100:

1067:

1041:

1008:

992:

979:978-9813149304

978:

947:

941:978-1119603665

940:

918:

912:978-1119516293

911:

889:

861:

833:

781:

740:

709:

680:

643:

604:

568:

532:

531:

529:

526:

523:

522:

513:

499:

498:

496:

493:

492:

491:

486:

479:

476:

475:

474:

471:

464:

463:

460:

453:

452:

449:

441:

438:

426:absolute value

415:

414:

403:

400:

394:

391:

388:

382:

379:

374:

371:

368:

365:

362:

359:

356:

353:

350:

347:

344:

341:

338:

335:

329:

323:

320:

317:

314:

311:

308:

305:

302:

296:

292:

289:

286:

283:

280:

277:

274:

271:

268:

262:

259:

256:

253:

250:

247:

244:

205:

202:

197:tax structures

187:

184:

180:cross industry

137:

134:

91:

88:

69:capitalization

65:Warren Buffett

53:Buffett metric

30:

15:

9:

6:

4:

3:

2:

2408:

2407:

2396:

2393:

2391:

2388:

2386:

2383:

2381:

2378:

2376:

2373:

2372:

2370:

2355:

2352:

2349:

2346:

2344:

2341:

2338:

2335:

2333:

2330:

2327:

2324:

2321:

2318:

2315:

2312:

2309:

2306:

2303:

2300:

2297:

2294:

2291:

2288:

2285:

2282:

2280:

2279:Profit margin

2277:

2274:

2271:

2268:

2265:

2262:

2259:

2256:

2253:

2250:

2247:

2244:

2243:Price-to-book

2241:

2239:

2236:

2234:

2231:

2228:

2227:Loan-to-value

2225:

2222:

2219:

2216:

2213:

2210:

2207:

2204:

2201:

2199:

2196:

2194:

2191:

2188:

2185:

2182:

2179:

2176:

2173:

2170:

2167:

2165:

2162:

2161:

2158:

2154:

2147:

2142:

2140:

2135:

2133:

2128:

2127:

2124:

2112:

2109:

2107:

2104:

2102:

2099:

2097:

2094:

2092:

2089:

2087:

2084:

2082:

2079:

2077:

2074:

2072:

2069:

2067:

2064:

2062:

2059:

2057:

2054:

2052:

2049:

2047:

2044:

2042:

2041:Short selling

2039:

2037:

2034:

2032:

2029:

2027:

2024:

2022:

2019:

2017:

2014:

2012:

2009:

2007:

2004:

2002:

1999:

1997:

1994:

1992:

1989:

1987:

1984:

1982:

1979:

1977:

1974:

1972:

1969:

1967:

1964:

1962:

1959:

1957:

1954:

1952:

1949:

1947:

1944:

1941:

1938:

1936:

1933:

1931:

1930:Greenspan put

1928:

1926:

1923:

1921:

1918:

1916:

1915:Financial law

1913:

1911:

1908:

1906:

1903:

1901:

1898:

1896:

1893:

1891:

1890:Cross listing

1888:

1886:

1883:

1881:

1878:

1877:

1875:

1873:Related terms

1871:

1865:

1862:

1860:

1857:

1855:

1852:

1850:

1847:

1845:

1844:Swing trading

1842:

1840:

1837:

1835:

1832:

1829:

1826:

1823:

1820:

1818:

1815:

1813:

1812:Mosaic theory

1810:

1808:

1805:

1802:

1799:

1797:

1796:Market timing

1794:

1792:

1789:

1787:

1784:

1781:

1778:

1776:

1773:

1771:

1768:

1766:

1763:

1761:

1758:

1757:

1755:

1753:

1746:

1740:

1737:

1734:

1731:

1729:

1726:

1723:

1720:

1718:

1715:

1713:

1710:

1708:

1705:

1703:

1700:

1697:

1694:

1691:

1688:

1685:

1682:

1679:

1676:

1673:

1670:

1668:

1665:

1662:

1659:

1657:

1654:

1653:

1651:

1649:

1645:

1639:

1636:

1634:

1631:

1628:

1625:

1622:

1619:

1616:

1613:

1610:

1607:

1604:

1601:

1598:

1595:

1592:

1589:

1585:

1584:Trading hours

1582:

1580:

1577:

1576:

1575:

1572:

1571:

1569:

1565:

1559:

1556:

1552:

1549:

1548:

1547:

1544:

1542:

1539:

1537:

1534:

1532:

1529:

1527:

1524:

1520:

1517:

1515:

1512:

1511:

1510:

1507:

1505:

1502:

1500:

1499:Broker-dealer

1497:

1493:

1490:

1488:

1485:

1484:

1483:

1480:

1479:

1477:

1473:

1467:

1464:

1462:

1459:

1457:

1456:Issued shares

1454:

1452:

1449:

1448:

1446:

1444:

1443:Share capital

1440:

1434:

1431:

1429:

1426:

1424:

1421:

1419:

1416:

1414:

1411:

1410:

1408:

1406:

1401:

1395:

1394:Fourth market

1392:

1390:

1387:

1385:

1382:

1380:

1377:

1376:

1374:

1372:

1367:

1363:

1356:

1351:

1349:

1344:

1342:

1337:

1336:

1333:

1326:

1322:

1319:

1316:

1312:

1309:

1307:

1304:

1300:

1297:

1294:

1290:

1287:

1284:

1281:

1280:

1271:

1267:

1264:

1261:

1257:

1254:

1253:

1233:

1232:

1227:

1220:

1205:

1204:

1199:

1193:

1178:

1174:

1168:

1152:

1151:

1146:

1140:

1138:

1136:

1120:

1119:

1118:CFA Institute

1114:

1107:

1105:

1089:

1088:

1083:

1076:

1074:

1072:

1056:

1052:

1045:

1029:

1028:

1023:

1017:

1015:

1013:

1006:

1002:

996:

981:

975:

971:

967:

963:

962:

954:

952:

943:

937:

933:

929:

922:

914:

908:

904:

900:

893:

878:

877:

872:

865:

850:

849:

844:

837:

830:

818:

817:

812:

808:

807:Loomis, Carol

804:

798:

796:

794:

792:

790:

788:

786:

770:

766:

759:

757:

755:

753:

751:

749:

747:

745:

729:

725:

718:

716:

714:

698:

694:

687:

685:

668:

664:

658:

656:

654:

652:

650:

648:

632:

631:

626:

619:

617:

615:

613:

611:

609:

593:

592:

587:

583:

582:Hulbert, Mark

577:

575:

573:

557:

556:

551:

544:

542:

540:

538:

533:

517:

510:

504:

500:

490:

487:

485:

482:

481:

472:

469:

468:

467:

461:

458:

457:

456:

450:

447:

446:

445:

437:

435:

431:

427:

423:

418:

401:

398:

327:

294:

234:

233:

232:

229:

227:

226:Wilshire 5000

223:

219:

215:

210:

201:

198:

194:

191:(e.g. use of

183:

181:

176:

174:

170:

166:

160:

158:

154:

148:

146:

141:

133:

129:

127:

126:

121:

116:

113:

109:

107:

103:

99:

98:

87:

85:

80:

78:

74:

73:Wilshire 5000

70:

66:

62:

58:

54:

50:

41:

37:

36:Wilshire 5000

28:

22:

2163:

2091:Tender offer

2011:Public float

1981:Market trend

1971:Market depth

1791:Growth stock

1765:Buy and hold

1674:(Cap-to-GDP)

1671:

1514:Floor trader

1504:Market maker

1487:Floor broker

1475:Participants

1418:Golden share

1413:Common stock

1389:Third market

1324:

1314:

1302:

1269:

1259:

1235:. Retrieved

1229:

1219:

1207:. Retrieved

1201:

1192:

1180:. Retrieved

1176:

1167:

1155:. Retrieved

1148:

1122:. Retrieved

1116:

1091:. Retrieved

1085:

1058:. Retrieved

1054:

1044:

1032:. Retrieved

1025:

995:

983:. Retrieved

960:

927:

921:

898:

892:

880:. Retrieved

874:

864:

852:. Retrieved

846:

836:

827:

820:. Retrieved

814:

772:. Retrieved

768:

731:. Retrieved

727:

700:. Retrieved

696:

671:. Retrieved

666:

634:. Retrieved

628:

595:. Retrieved

589:

559:. Retrieved

553:

516:

503:

465:

454:

443:

425:

419:

416:

230:

211:

207:

189:

179:

177:

172:

168:

161:

149:

142:

139:

130:

123:

120:Mark Hulbert

117:

114:

110:

102:Carol Loomis

95:

93:

81:

75:index to US

56:

52:

48:

46:

21:Buffett Rule

2326:Risk return

2273:Price-sales

2211:(EV/EBITDA)

2096:Uptick rule

2076:Stock split

2056:Squeeze-out

2051:Speculation

1996:Open outcry

1885:Block trade

1817:Pairs trade

1237:19 February

1209:19 February

1182:18 February

1157:18 February

1124:18 February

1093:18 February

1060:19 February

1034:19 February

985:19 February

882:18 February

854:18 February

822:18 February

774:18 February

733:13 February

702:18 February

673:18 February

636:14 February

597:21 February

561:18 February

509:S&P 500

222:S&P 500

173:comparative

2369:Categories

2223:(EV/Sales)

2177:(Cap Rate)

2101:Volatility

2081:Stock swap

2001:Order book

1752:strategies

1678:Book value

1546:Arbitrager

1541:Speculator

1030:. May 2010

528:References

193:tax havens

71:of the US

1717:Fed model

1712:EV/EBITDA

1627:Dark pool

1558:Regulator

1403:Types of

1369:Types of

1315:GuruFocus

728:Bloomberg

489:EV/Ebitda

399:×

157:EV/EBITDA

55:, or the

2217:(EV/GCI)

2046:Slippage

2006:Position

1991:Momentum

1895:Dividend

1574:Exchange

1531:Investor

1231:Statista

876:Barron's

829:nervous.

478:See also

422:deflator

186:Trending

51:(or the

2354:Treynor

2343:Sortino

2322:(RAROC)

2183:(CROCI)

1935:Haircut

1739:T-model

1551:Scalper

1371:markets

1327:, 2021)

1317:, 2021)

1305:, 2024)

1295:, 2021)

1087:Fortune

816:Fortune

440:Records

204:Formula

97:Fortune

90:History

59:) is a

2332:Sharpe

2316:(ROTE)

2304:(ROCE)

2292:(RONA)

2257:(P/CF)

2251:(PVGO)

2171:(CAPE)

1956:Margin

1824:(PMPT)

1686:(CAPM)

1536:Hedger

1509:Trader

1482:Broker

1405:stocks

1153:. 2021

1055:NASDAQ

976:

938:

909:

630:Forbes

384:

331:

325:

264:

169:across

165:Aramco

136:Theory

34:

32:

2350:(SGR)

2339:(SIR)

2328:(RRR)

2310:(ROE)

2298:(ROC)

2286:(ROA)

2275:(P/S)

2269:(PEG)

2263:(P/E)

2245:(P/B)

2233:Omega

2229:(LTV)

2205:(E/P)

2189:(D/E)

2111:Yield

2086:Trade

2021:Rally

1942:(IPO)

1830:(RMH)

1803:(MPT)

1782:(EMH)

1735:(SML)

1724:(NAV)

1698:(DDM)

1692:(CML)

1663:(APT)

1656:Alpha

1623:(STP)

1617:(DMA)

1611:(ECN)

1605:(MTF)

1599:(ATS)

932:Wiley

903:Wiley

495:Notes

42:ratio

1946:Long

1750:and

1680:(BV)

1667:Beta

1239:2021

1211:2021

1184:2021

1159:2021

1126:2021

1095:2021

1062:2021

1036:2021

1027:MSCI

987:2021

974:ISBN

936:ISBN

907:ISBN

884:2021

856:2021

824:2021

776:2021

735:2021

704:2021

675:2021

638:2021

599:2021

563:2021

328:5000

47:The

1003:or

966:doi

402:100

195:or

155:or

106:GNP

77:GDP

40:GDP

38:to

2371::

1228:.

1200:.

1175:.

1147:.

1134:^

1115:.

1103:^

1084:.

1070:^

1053:.

1024:.

1011:^

972:.

950:^

934:.

905:.

873:.

845:.

826:.

813:.

805:;

784:^

767:.

743:^

726:.

712:^

695:.

683:^

665:.

646:^

627:.

607:^

588:.

571:^

552:.

536:^

2145:e

2138:t

2131:v

1354:e

1347:t

1340:v

1323:(

1313:(

1301:(

1291:(

1268:(

1258:(

1241:.

1213:.

1186:.

1161:.

1128:.

1097:.

1064:.

1038:.

989:.

968::

944:.

915:.

886:.

858:.

778:.

737:.

706:.

677:.

640:.

601:.

565:.

393:P

390:D

387:G

381:S

378:U

373:n

370:o

367:i

364:t

361:a

358:z

355:i

352:l

349:a

346:t

343:i

340:p

337:a

334:c

322:e

319:r

316:i

313:h

310:s

307:l

304:i

301:W

295:=

291:r

288:o

285:t

282:a

279:c

276:i

273:d

270:n

267:i

261:t

258:t

255:e

252:f

249:f

246:u

243:B

23:.

Text is available under the Creative Commons Attribution-ShareAlike License. Additional terms may apply.